[ad_1]

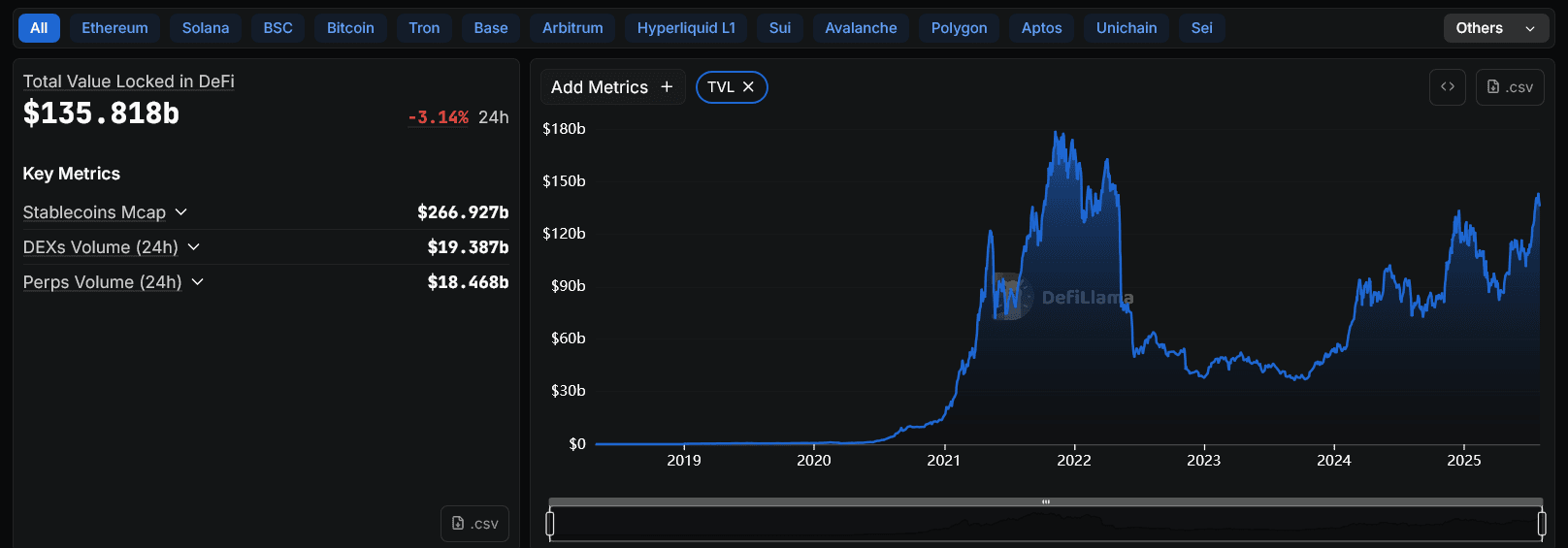

The decentralized finance (DeFi) market just shed over $4 billion in Total Value Locked (TVL) within a single day. That kind of drop usually spooks people. But zoom out, and something more strategic comes into focus. The data from DeFiLlama reveals not a collapse, but a recalibration across protocols, categories, and capital flows. Let’s unpack what’s really happening, what matters in these charts, and where things may be heading next in the crypto market.

Total Value Locked Takes a Hit, but Momentum Remains Intact

TVL: Image Source: DefiLlama

According to DefiLlama, TVL across all DeFi protocols now stands at $135.81 billion, down 3.14 percent over the past 24 hours. This marks a noticeable dip in an otherwise upward trend that’s been building since late 2023. The historical TVL chart shows a clear recovery from the brutal drawdowns of 2022 and the stagnation through much of 2023. While we’re not at the highs of the 2021-2022 DeFi summer, we are seeing a much healthier and more distributed recovery.

A one-day decline doesn’t change the larger structure. TVL is still up significantly year-to-date, and the composition of where the value is moving tells a more useful story than the headline number.

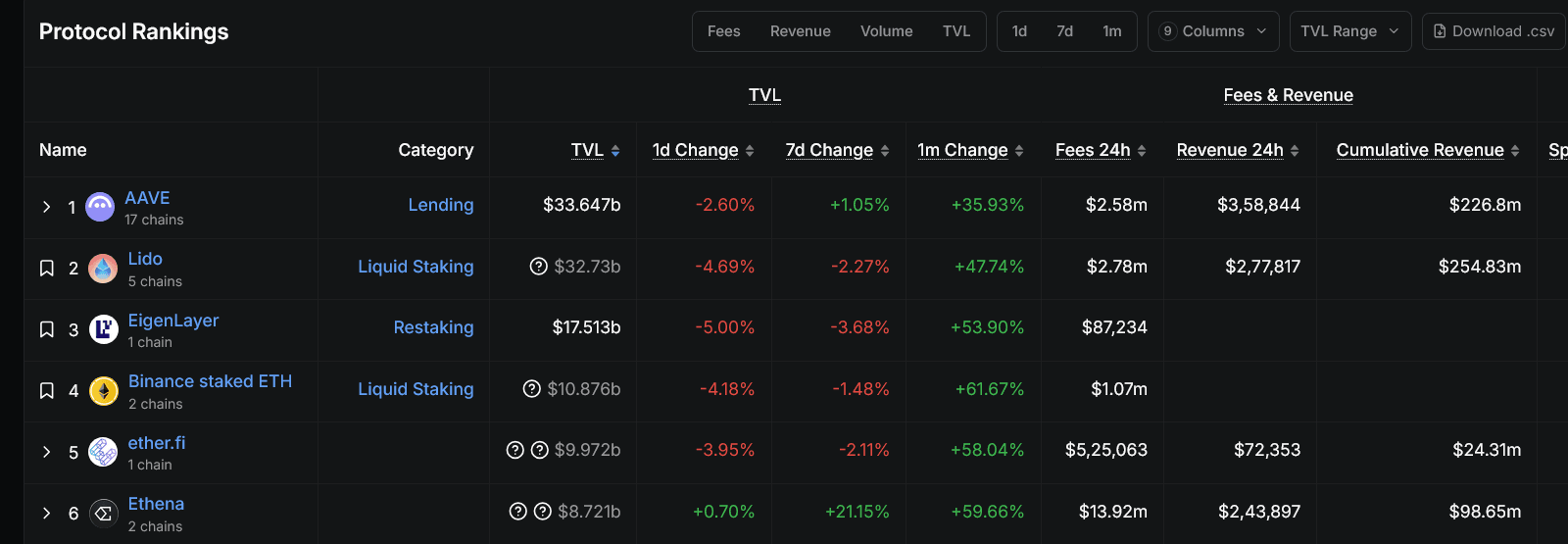

AAVE, Lido, and EigenLayer Dominate TVL, but Not the Growth

Protocol Rankings : Image Source: DefiLlama

AAVE leads with $33.64 billion in TVL across 17 chains. That’s nearly one-fourth of the entire DeFi TVL in one protocol. Over the past 24 hours, AAVE saw a 2.6 percent drop in locked value, though it posted a modest 1.05 percent gain over the week and nearly 36 percent growth over the month.

Lido, the liquid staking heavyweight, follows closely with $32.73 billion. Its 7-day change is negative 2.27 percent, but like AAVE, it gained over 47 percent in the past month. These are big protocols with huge liquidity. They often act as liquidity sources or sinks during macro DeFi movements.

Then there’s EigenLayer, sitting at $17.51 billion. Despite a 5 percent daily TVL drop, it’s up almost 54 percent this month. That level of volatility on the upside and downside suggests hot capital flow, likely tied to yield-chasing restaking dynamics.

ether.fi and Ethena: The Outliers Everyone Should Be Watching

Where things get interesting is outside the traditional top three.

ether.fi, with just under $10 billion in TVL, is down nearly 4 percent on the day. Still, it has grown over 58 percent this past month. That is massive relative expansion. Even more impressive is its daily fee generation. It clocked in over $5.25 million in fees in the last 24 hours, which dwarfs even AAVE and Lido. However, its revenue remains low, just $72,353, implying high operational cost or aggressive reward emission strategies.

Ethena is the wild card. It’s the only protocol in the top six with positive daily and weekly TVL changes, up 0.7 percent and 21.15 percent respectively. Over the month, it has grown 59.66 percent. Even more impressive is its 24-hour fee haul: $13.92 million. That puts it at the top of the revenue leaderboard, well ahead of Lido and AAVE. Its revenue for the day, $2.43 million, reflects strong actual economic activity and suggests that it’s not just emitting tokens to attract liquidity. Ethena appears to be monetizing real usage.

In short, the data shows that while traditional protocols are stabilizing or declining slightly, newer or more agile players like ether.fi and Ethena are gaining attention and traction quickly.

Fee Generation and Real Yield: A New Set of Winners

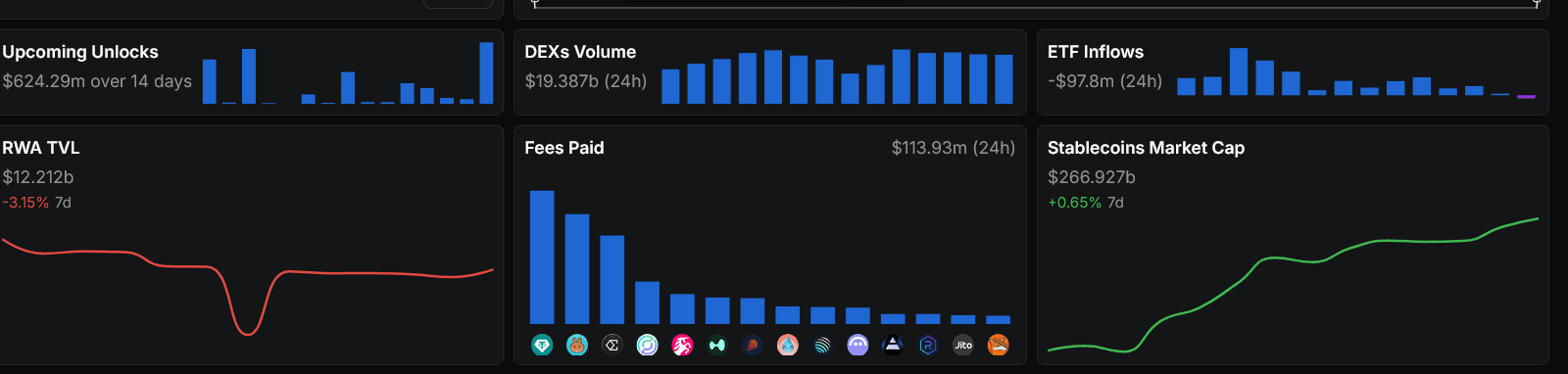

Fees Paid: Image Source: DefiLlama

Across DeFi, total fees paid in the last 24 hours came in at $113.93 million. That number should not be underestimated. It reflects that usage is active, even when TVL dips. In fact, comparing this figure to DEX volumes ($19.38 billion in 24h) and perp volumes ($18.46 billion in 24h) highlights a healthy rotation across DeFi’s verticals.

Notably, many users are not simply holding liquidity in vaults or LPs. They are actively trading, bridging, restaking, and using leverage. This explains why protocols with lower TVLs (like Ethena) can outperform high-TVL incumbents in revenue. Capital is becoming more efficient.

ETF Outflows Reveal Institutional Hesitation or Strategic Rotation

One detail that should not be ignored: ETF inflows were negative $97.8 million over 24 hours. That is not just noise. It shows traditional finance pulling back slightly from crypto wrappers. Whether this capital is moving into stablecoins, DeFi protocols, or sitting idle is unclear, but the juxtaposition with the increase in DeFi protocol fees suggests that some of it may be rotating into on-chain opportunities.

In other words, while institutional products are bleeding capital, native DeFi protocols may be catching the upside from those flows.

Stablecoin Liquidity Continues Quiet Expansion

Stablecoins represent dry powder. Their market cap has now reached $266.92 billion, up 0.65 percent over the past week. That’s a key metric. While TVL in DeFi protocols has dropped, stablecoin supply is growing. That suggests capital is not leaving the ecosystem but sitting on the sidelines, likely waiting for reentry.

This further supports the idea that the 3 percent TVL drop is less about exit and more about reallocation.

RWA TVL Declines, but Still Significant

Real World Assets (RWA) represent $12.2 billion of TVL and have declined 3.15 percent over the week. This is in line with broader TVL decline but signals something worth watching. If stablecoin capital starts rotating into yield-generating RWAs, we could see protocols like Centrifuge or Maple Finance start outperforming again.

So far, most of the growth this month has been in staking, restaking, and synthetic dollar protocols.

Over $624 million in token unlocks are expected in the next 14 days. While that doesn’t always correlate to selling pressure, it often creates volatility. Projects undergoing large unlocks may see temporary price weakness, potentially creating entry points for long-term accumulation.

What This All Means for the Crypto Market?

- The short-term TVL drop is not a sign of collapse. It’s a reaction to market rotations, unlocks, and strategic reshuffling across protocols.

- Protocols like Ethena and ether.fi are gaining real traction. Their growth in both usage and revenue suggests sustainable momentum rather than fleeting hype.

- Legacy leaders like AAVE and Lido are still strong, but slowing. These giants may become stability anchors while newer protocols chase growth.

- Stablecoin growth and ETF outflows hint at capital movement. Liquidity isn’t vanishing. It’s waiting for the next wave or entering more agile strategies.

- The broader trend is still intact. Zoom out on the TVL chart and you’ll see a recovery trend from early 2023 lows. The current dip fits within that structure.

The market is not breaking. It’s breathing. The next few weeks will likely determine which protocols can convert short-term momentum into long-term dominance. For now, DeFi looks alive, active, and preparing for its next move.

$Crypto, $CryptoMarket, $BTC, $AAVE, $LDO, $ENA, $DeFi, $ETHFI

[ad_2]