As reported by U.Today, Microsoft shareholders are gearing up for a big December vote on a proposal to diversify the company’s balance sheet, by including major cryptocurrency Bitcoin (BTC). This development is generating interest in the space as crypto enthusiasts consider the implications of such a decision.

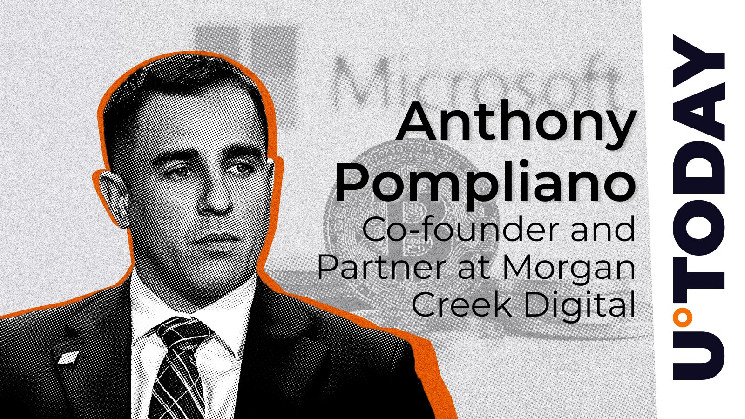

Anthony Pompliano has reacted to the news, indicating that Microsoft’s consideration of Bitcoin comes from a broader recognition that holding cash in dollars may not be sustainable long term. The cryptocurrency is becoming more and more attractive as a digital store of value, says the entrepreneur, as more entities look for ways to save the value of their assets amid uncertain inflationary conjecture.

Earlier, Pompliano expressed belief that as awareness of Bitcoin’s potential continues to grow, Wall Street will eventually acknowledge the opportunity cryptocurrency presents. This would all result in a significant influx of capital into Bitcoin, driving the price of Bitcoin even higher, he assured.

Microsoft is interested in storing a portion of their balance sheet in bitcoin because they are realizing they can’t store it in dollars over the long term.

The digital store-of-value will continue gaining adoption by those looking to preserve their hard-earned economic value.

— Anthony Pompliano 🌪 (@APompliano) October 25, 2024

The potential for Microsoft, currently the third-largest company globally, to follow in the footsteps of industry players like MicroStrategy is still up for debate as the decision to adopt a Bitcoin strategy remains uncertain.

Stick in wheel

While interest from within the company is evident, the board has officially recommended voting against this initiative.

The proposal, brought forth by the National Center for Public Policy Research (NCPPR), asserts that corporations have a fiduciary duty to protect shareholder value from economic debasement. This raises questions about the company’s stance on integrating Bitcoin into its current vision.