[ad_1]

As Bitcoin prices soar, the wealthiest investors are holding onto their assets. What’s driving this choice, and how does it affect the market?

In recent years, the number of large Bitcoin (BTC) holders, called “whales”, has increased significantly.

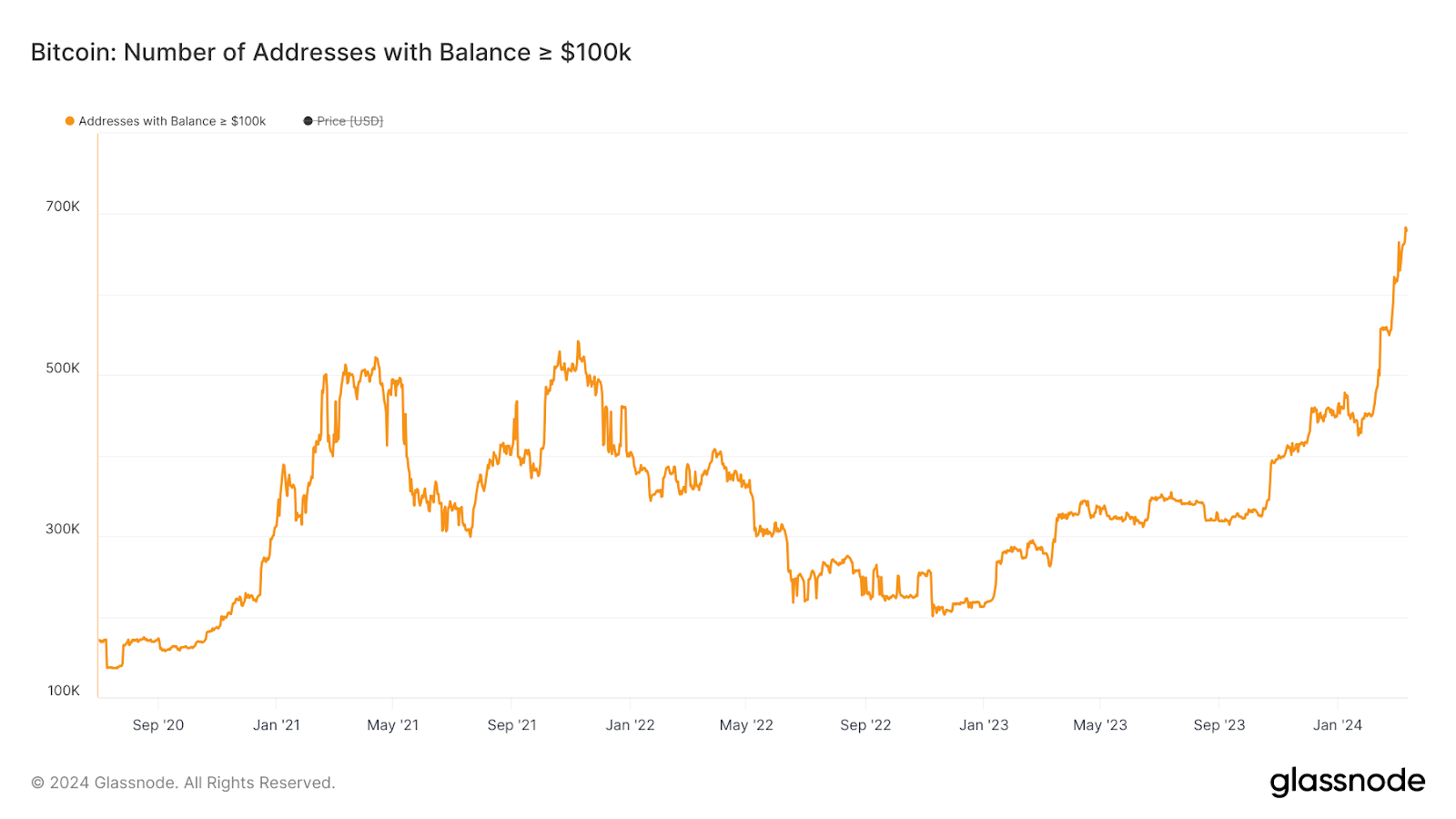

Data from Glassnode reveals a striking uptrend in the number of Bitcoin addresses holding over $100,000, escalating from less than 140,000 in July 2020 to nearly 680,000 by Mar. 12.

Bitcoin addresses with a balance of more than $100,000 | Source: Glassnode

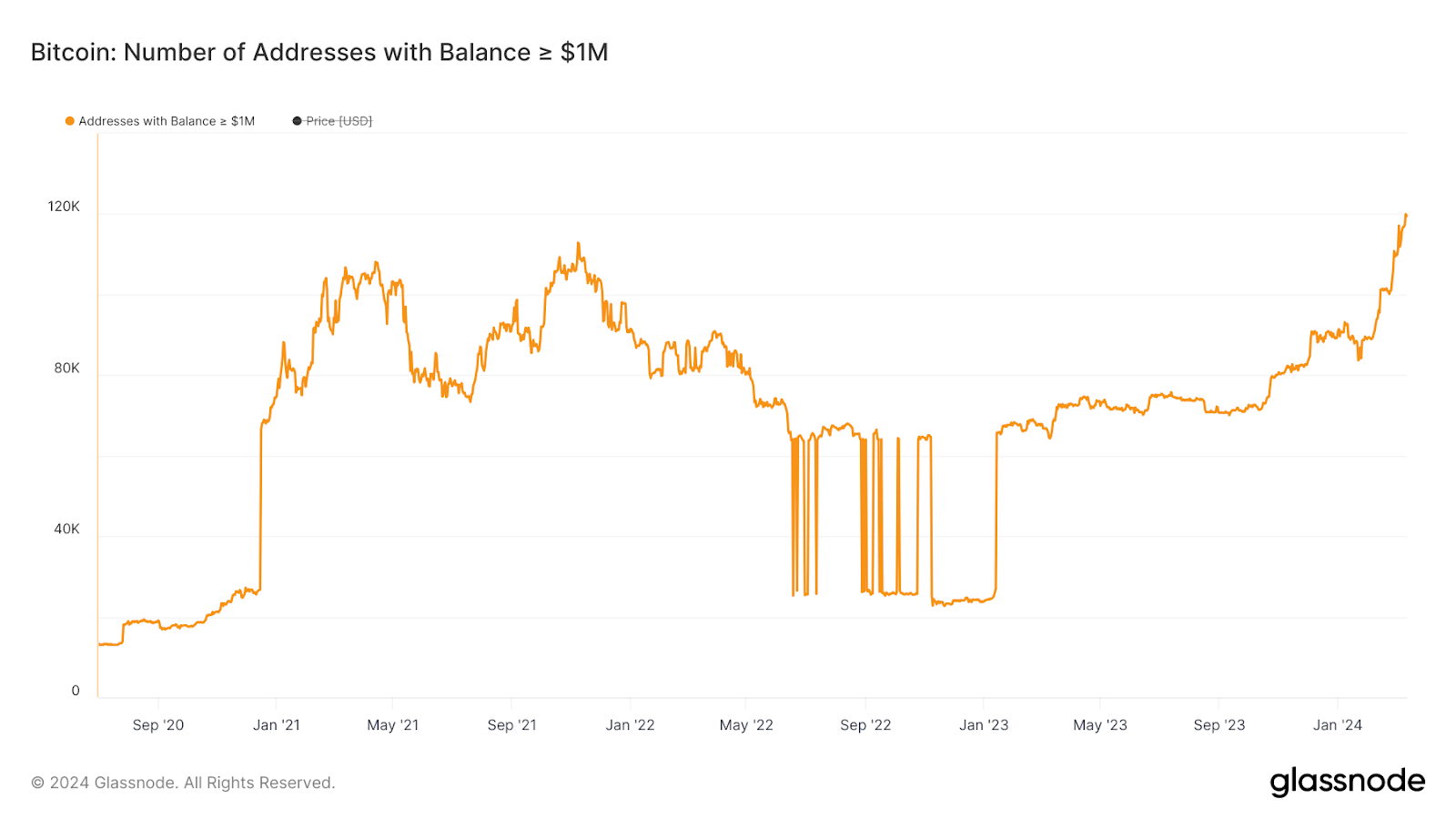

Similarly, addresses possessing more than $1 million in Bitcoin surged from 13,000 in July 2020 to close to 120,000 on the same date.

Bitcoin addresses with a balance of more than $1 million | Source: Glassnode

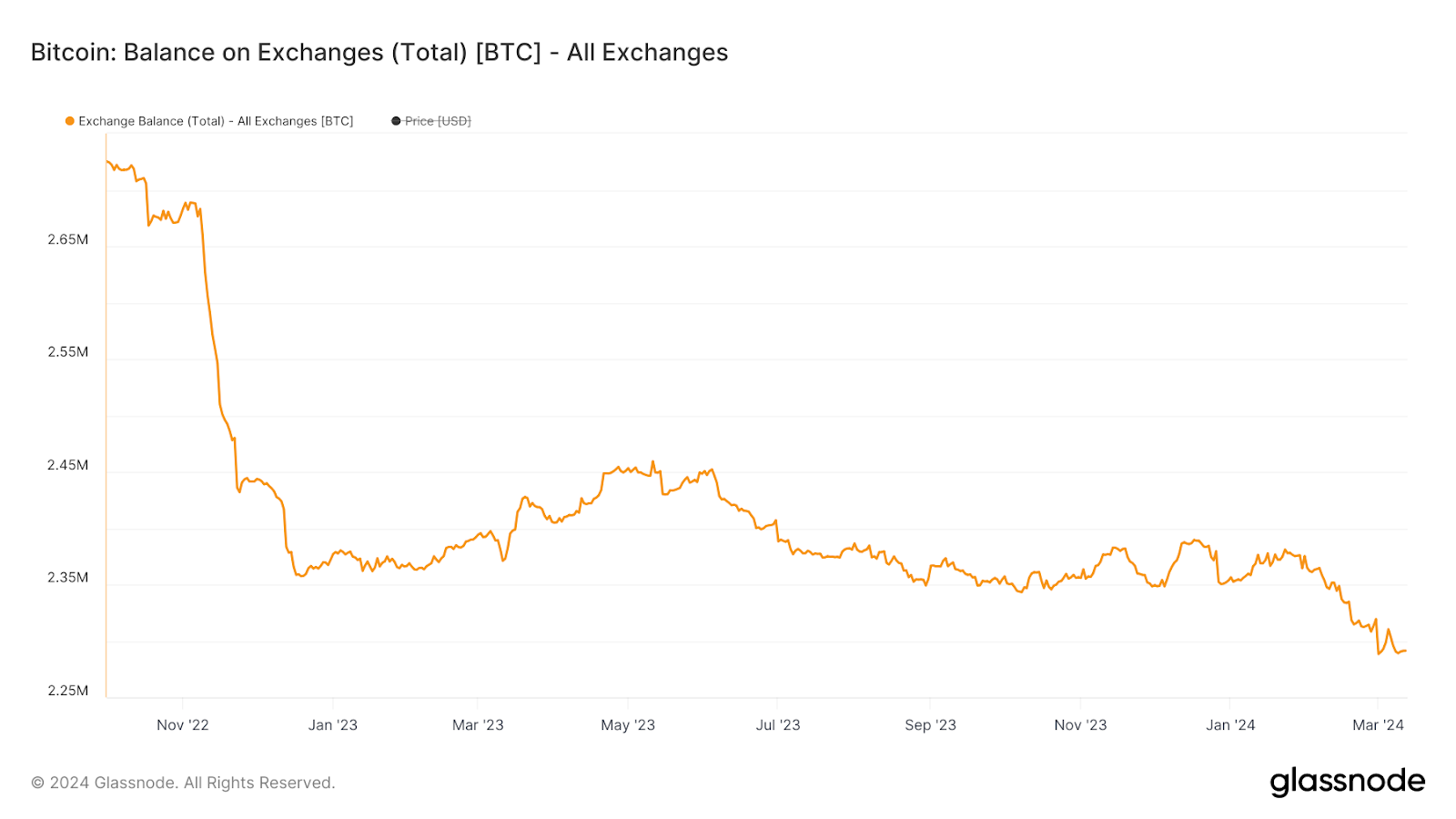

A deep dive into this uncovers a blend of accumulation and bullish market sentiment. Bitcoin’s exchange reserves hit a six-year low of 2.34 million in February 2024, just before Bitcoin’s value surged past $73,000 on March 13.

The amount of #Bitcoin held in known #crypto exchange wallets has dropped to its lowest level in six years, now totaling just 2.34 million $BTC!

This significant decrease suggests a growing trend of investors moving their #BTC off exchanges, potentially indicating a shift toward… pic.twitter.com/Y9zhRCOaWP

— Ali (@ali_charts) February 14, 2024

As of this writing, the three largest BTC wallets control almost 3% of all Bitcoin in circulation, while the top 110 wallets hold nearly 15% of all Bitcoin.

This concentration of wealth means that the actions of these whales, whether buying, selling, or merely moving assets, can have ripple effects across the market.

Let’s uncover what happens with large-scale BTC holders and why they choose to hold onto their assets amid such high prices.

Total exchange balance and number of whales

The exchange balance of Bitcoin refers to the amount of BTC held in wallets on trading platforms. Since Oct. 2022, there has been a significant decrease in BTC held on exchanges, dropping from 2.71 million BTC to 2.29 million by Mar. 12.

BTC balance on all exchanges | Source: Glassnode

This decline suggests a large-scale migration of Bitcoin from exchanges to personal or institutional wallets, indicating investors prefer to hold rather than sell their assets.

A lower exchange balance typically signifies a reduction in the immediate supply of Bitcoin available for trading. This can stabilize prices or increase if demand remains constant or grows.

Concurrently, the number of Bitcoin whales (having 1000 BTC or more) has risen from 1500 in Oct. 2022 to 1600 by Mar. 12. This increase in large-scale holders can influence the market in several ways.

Bitcoin addresses with a balance of more than 1000 BTC | Source: Glassnode

It may reduce price volatility, as these whales are less likely to sell their holdings impulsively, creating a more stable market environment.

Additionally, the accumulation of Bitcoin by whales often reflects a bullish outlook on the currency’s value, suggesting an anticipation of higher prices in the future.

The fact that the total balance on exchanges is decreasing while the number of these large investors is increasing suggests a shift from short-term trading to long-term investing. This trend reinforces the belief among major investors in Bitcoin’s future value.

Moving beyond a speculative asset?

Coindesk reported that in a 2023 report, Morgan Stanley pointed out that Bitcoin does not operate in isolation from the traditional banking system.

They reported that despite its decentralized nature, the liquidity necessary for Bitcoin trading heavily relies on U.S. dollar liquidity. This integration led Bitcoin to behave more like a speculative risk asset rather than a currency.

However, the narrative surrounding Bitcoin has shifted in 2024, primarily catalyzed by the approval of spot Bitcoin ETFs. The approval of ETFs has significantly changed how people view Bitcoin as an asset class.

Moreover, Bitcoin has demonstrated signs of maturing as an asset class, characterized by increased liquidity and the potential development of more sophisticated trading instruments.

For instance, Grayscale Investments, the manager of the largest spot BTC ETF by market cap, has advocated for the approval of options trading on its ETF.

This move would make the product more accessible to a wider range of investors, further expanding Bitcoin’s position in traditional financial markets.

These developments, along with others, have the potential to dampen Bitcoin’s volatility, a common criticism of its speculative nature, and enhance its role as a store of value or “digital gold.”

Consequently, the prevailing sentiment is shifting towards viewing Bitcoin as more than just a speculative asset, signaling growing confidence in its long-term value proposition.

Why are whales holding BTC despite all-time high prices?

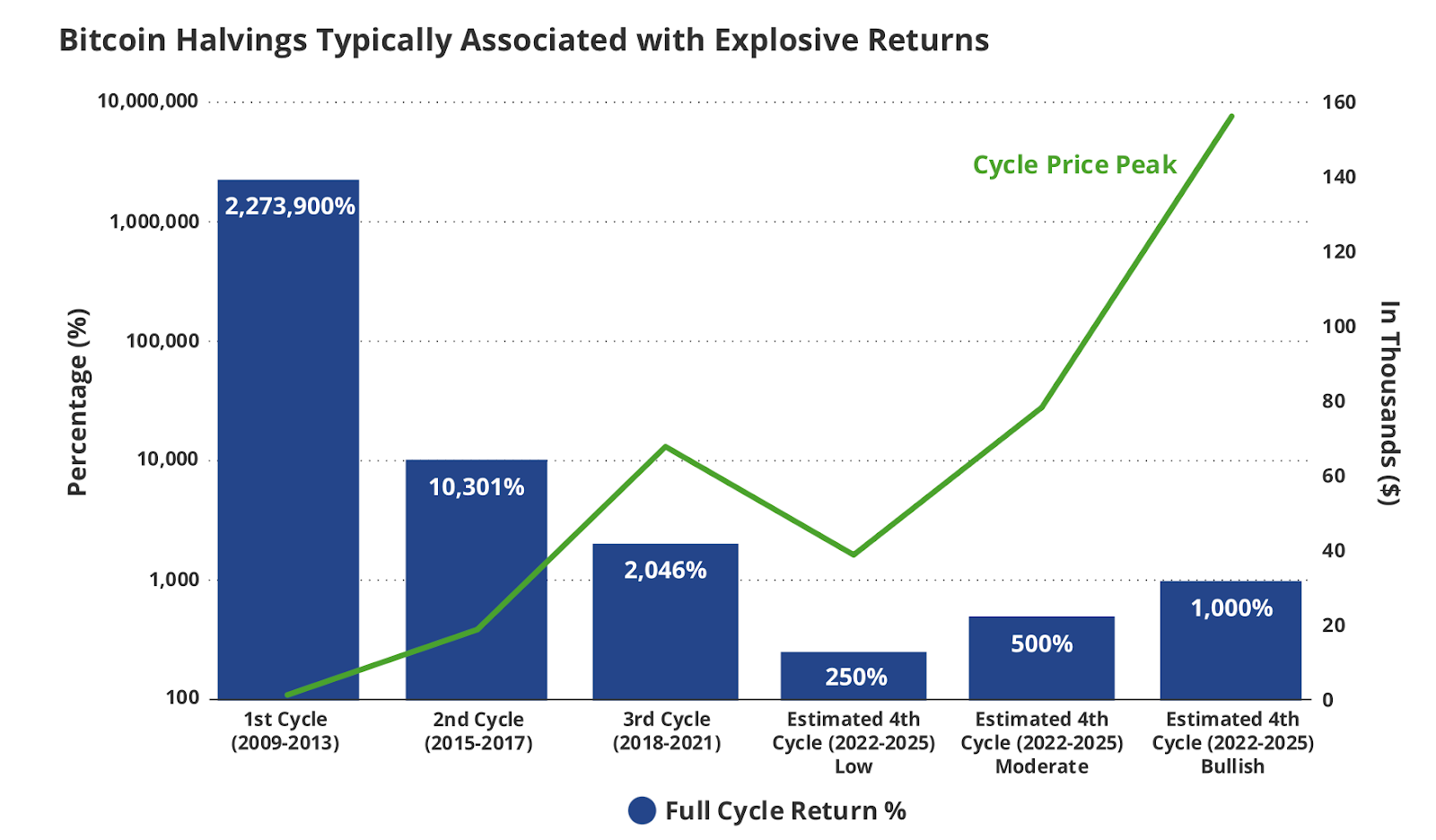

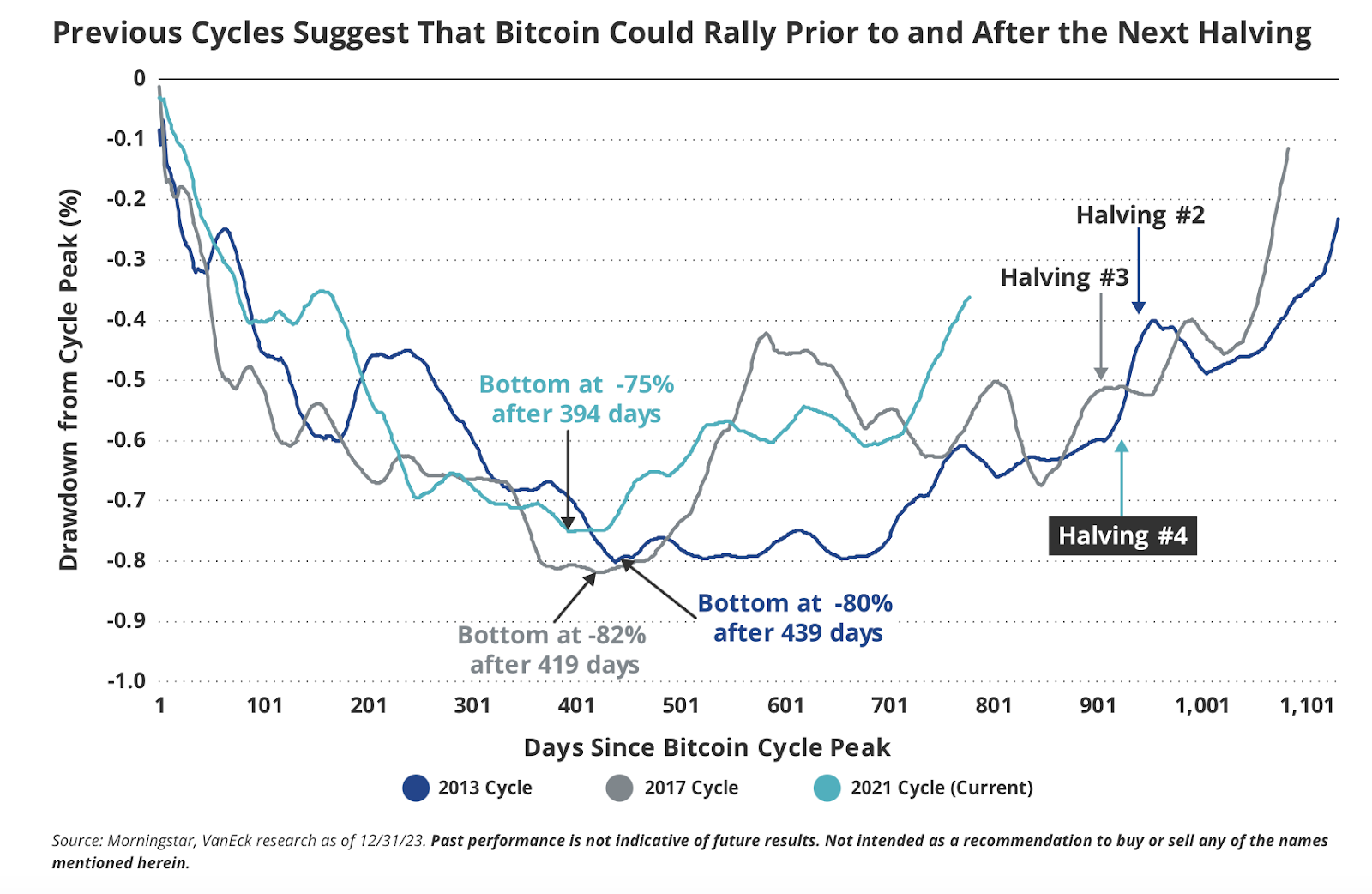

Whales, despite witnessing record-breaking prices in Bitcoin, continue to hold onto their assets, largely driven by the anticipation of significant rallies expected following the upcoming halving event, scheduled for April 2024. Historical data from previous cycles strongly supports this expectation.

Bitcoin’s halving events, occurring approximately every four years, have historically been crucial turning points for its price trajectory.

These events involve a 50% reduction in the rate of new Bitcoins being introduced into circulation. The resultant scarcity and increasing demand have consistently led to notable price surges.

For instance, during the 2013 cycle, Bitcoin witnessed an extraordinary increase in value, yielding returns of 22,73,900%, according to Vaneck.

BTC returns in each halving cycle | Source: Vaneck

Similarly, the 2017 cycle saw a remarkable 10,301% surge in value. Even the most recent cycle, spanning from 2018 to 2021, delivered returns of 2046%.

The ongoing cycle, expected to last until 2025, appears to be following a comparable trajectory. Despite already achieving impressive returns, with Bitcoin reaching new all-time highs, Vaneck forecasts gains ranging from at least 250% to as high as 1000% in this current cycle.

BTC past cycles | Source: Vaneck

Moreover, improvements in Bitcoin’s technology play a big role in boosting investor confidence for its future.

Layer 2 solutions, like the Lightning Network and the RGB protocol, have expanded rapidly, offering scalability, more customization, and the ability to create and handle digital assets on the Bitcoin blockchain.

These technological advances, combined with expectations of more price increases, open up new growth possibilities in the Bitcoin ecosystem, strengthening investors’ desire to hold onto their BTC.

The road ahead

Looking forward, Bitcoin’s path looks positive, but it’s important to be careful due to potential risks and uncertainties.

One major risk is the concentration of Bitcoin in the hands of a few large investors, or “whales.” Their actions can cause big price changes, so keeping an eye on whale activities and diversifying your investments can help reduce risk.

Additionally, while historical data suggests bullish outcomes following halving events, past performance does not indicate future results. Be cautious, and don’t base your investment decisions only on past trends.

In summary, while Bitcoin’s future seems bright, stay alert, consider different factors, and remember the key rule of investing: only invest what you can afford to lose.

Read more: Bloomberg analyst: Two major catalysts will drive expansion of Bitcoin ETFs in 2024

[ad_2]