BNB Chain TVL rises 2%, NFT trading volume surges 283%, but on-chain activity and network revenue decline.

Recent data shows that the BNB Chain experienced notable changes across various metrics in Q3 2024 despite facing market challenges. The chain saw a modest rise in Total Value Locked (TVL) and a significant increase in NFT trading activity.

However, network revenue and overall on-chain activity declined compared to the previous quarter.

BNB DeFi and Staking See Modest Gains

BNB Smart Chain’s DeFi TVL, measured in USD, increased by 2% QoQ, rising from $4.74 billion in Q2 to $4.85 billion in Q3. Despite this growth, BNB Smart Chain slipped to fourth place in the TVL rankings, overtaken by Solana.

Meanwhile, TVL denominated in BNB remained stable at 8.3 million BNB, indicating consistent capital inflows. Venus Finance retained its position as the leading protocol by TVL, with a 13% QoQ increase to $1.79 billion. However, borrowing on Venus dropped significantly by 36%, falling to $454 million.

BNB DeFi TVL

Staking activity also grew, with total BNB staked rising 7% to 32.4 million BNB. ListaDAO’s liquid staking solution, slisBNB, continued to dominate, though staked volumes fell 2% QoQ to 406,200 slisBNB.

In a key development, the YieldNest protocol introduced a re-staking feature, allowing users to convert slisBNB into ynBNB for further staking. This move aims to boost ecosystem liquidity.

BNB Chain Revenue Declines

BNB Chain’s revenue, which reflects the total fees collected by the network, declined in Q3. Revenue for the quarter totaled $34.9 million, a 28% decrease from $48.4 million in Q2.

Revenue denominated in BNB also decreased, falling by 22% QoQ. In Q3, revenue amounted to 63,500 BNB, down from 81,300 BNB in the previous quarter.

NFT Activity Surges

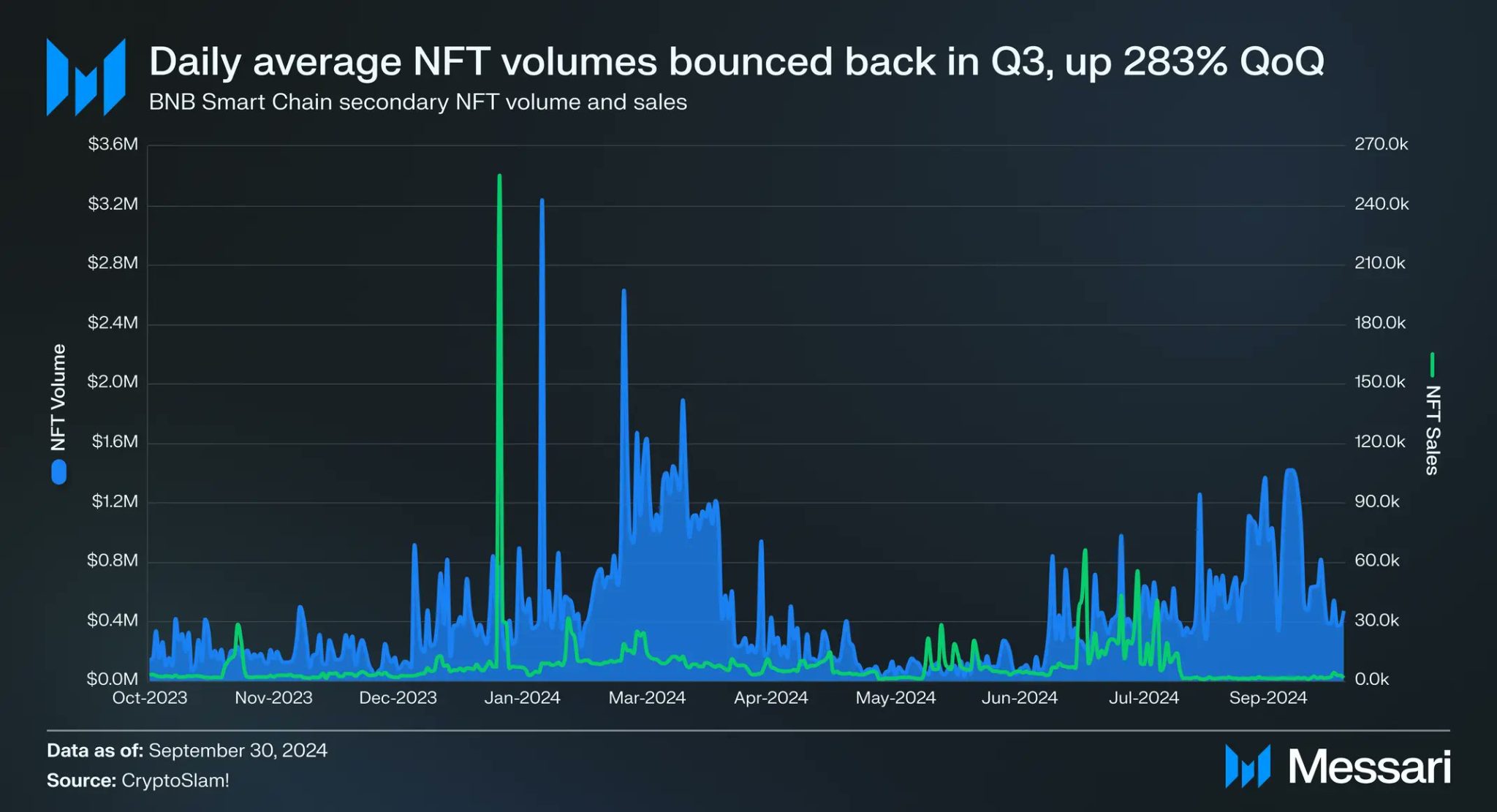

On the NFT front, BNB Chain saw a significant rebound after a quiet Q2, with average daily trading volume soaring by 283% to $600,400 in Q3. Average daily sales also increased by 47%, reaching 8,900.

BNB NFT Volumes

However, the number of unique daily buyers fell by 53% to 2,300, suggesting that recent NFT activity was driven by larger transactions from a smaller pool of high-value traders.

On-Chain Activity & Gas-Free Initiative

Despite positive momentum in some areas, BNB Smart Chain’s on-chain activity slowed. Average daily transactions decreased 8% QoQ to 3.4 million, while active daily addresses dropped 19% to 868,300.

Stablecoin transactions remained a strong point, with USDT leading in active addresses, averaging 294,000 daily—a growth of 8% QoQ. PancakeSwap remained the second most active protocol, with 94,600 daily addresses.

Amid these trends, BNB Chain launched its “Gas-Free Carnival” to enhance stablecoin usage. This initiative offers gas-free transfers for USDT, USDC, and FDUSD, supported by Bitget Wallet and SafePal. Additionally, fee-free withdrawals and free bridging options via Celer cBridge aim to improve user experience and boost adoption.