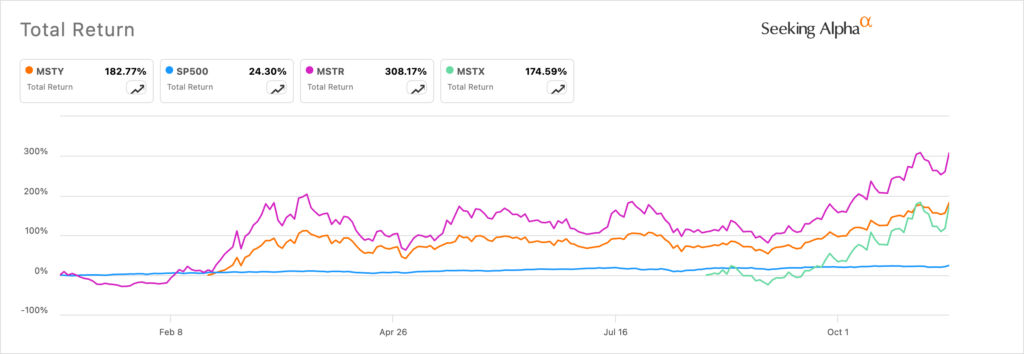

MicroStrategy stock price surged hard in 2024, making it one of the best-performing assets this year. It has soared by over 308% this year, beating the S&P 500 index, which is up by 24%. MSTR has also beaten other companies like NVIDIA and Microsoft.

Bitcoin price surge

The MicroStrategy stock price has soared because of the ongoing cryptocurrency bull run after Donald Trump won the election.

Bitcoin soared to a record high of $76,520, much higher than the year-to-date low of $38,420. It has also jumped by 380% from its lowest level in 2023.

Technicals suggest that Bitcoin’s rally is just getting started. On the weekly chart below, we see that the coin has constantly remained above all moving averages, a signal that bulls were in control for now.

The recent consolidation was part of the coin’s formation of a cup and handle pattern, one of the most popular bullish patterns. Unlike other patterns, this one takes a long time to form and complete. In this case, it has been forming since November 2021, when Bitcoin price soared to $68,000.

Therefore, because of this pattern, there are rising odds that the price of Bitcoin will continue soaring in the coming months. If this happens, the next point to watch will be at $100,000, which is an important psychological level. Peter Brandt, a popular crypto trader expects the coin to soar to between $130k and $150k.

Bitcoin $BTC is now in the sweet spot of the bull market halving cycle that should top in the $130k to $150K range next Aug/Sep. I measure cycles differently than most. For background see link here: peterlbrandt.com/the-beautiful-…

Read 102 replies

Most analysts see this happening during the Trump presidency since he will enact crypto-friendly policies. At the same time, his other external policies like tax cuts and trade wars will push Bitcoin higher as the public debt is expected to explode higher over time.

Bitcoin, which has a supply cap of 21 million coins, is widely seen as a better alternative to fiat currencies and is a hedge against financial instability.

All these factors are positive for MicroStrategy stock because the company holds the most coins globally. It has 252,300 coins in its portfolio, a figure that Michael Saylor has pledged to continue growing over time.

Read more: Bitcoin price prediction: 4+ reasons BTC could go parabolic

BTC chart by TradingView

Is the MSTY ETF a good buy?

For an investor, you can invest in Bitcoin or MicroStrategy. Data shows that the MSTR stock does better than Bitcoin when there is a strong bull run in the crypto industry. For example, it has jumped by over 300% this year, while Bitcoin is up by less than 100%.

There are other unique MicroStrategy alternatives to consider. First, there is the YieldMax™ MSTR Option Income Strategy ETF (MSTY). This is an ETF that aims to give users an exposure to MicroStrategy stock, while at the same time, providing them with a regular dividend return.

The dividend part is important because MicroStrategy does not pay dividend, making it less ideal for income-focused investors.

MSTY ETF does this by using the covered call strategy. In the first stage, the creators buy a fnancial instrument that resembles the MicroStrategy stock, ensuring that the fund will do well as the bull run continues.

Another part of the money is invested in call options, which gives users a right to buy an asset at a certain price. This trade comes with a premium payment, which the developers distribute to their shareholders.

The main challenge for the fund is that it could see you miss up more gains when the strike price is hit. This explains why the MSTY ETF’s total return this year is 182% compared to MSTR’s 308%. Remember that the MSTY ETF still has a dividend yield of 186%.

What about the MSTU and MSTX ETFs?

MSTU vs MSTX vs MSTR vs S&P 500

The other alternative to take advantage of the surging MicroStrategy stock is to invest in the T-Rex 2X Long MSTR Daily Target ETF (MSTU) and Defiance Daily Target 2X Long MSTR ETF (MSTX), which have accumulated over $685 million and $477 million in assets, respectively.

The two ETFs have a simple approach for generating returns to their shareholders. They use leverage to ensure that their daily returns are twice that of the MSTR stock. As such, if the MSTR stock jumps by 1% in a day, their gross daily returns will be 2%.

MSTX and MSTU are fairly expensive funds with an expense ratio of 1.29% and 1.05%, respectively.

Therefore, if you strongly believe that the MSTR share price will continue rising in the long term, these are the two funds to buy. Because of the low expense ratio, the MSTU fund is even better.

Data shows that the MSTU ETF has jumped by 70% in the last 30 days, while the MSTX has soared by 61% in the same period.

The best example to look at these is the ProShares UltraPro QQQ (TQQQ) ETF, which has constantly outperformed the Invesco QQQ fund. Its sister fund, ProShares UltraPro Short QQQ fund has fallen by almost 100% over time.

The risk of investing in these funds is that their performance will be worse than MicroStrategy stock retreats.

The post MSTY vs MSTX vs MSTU: Which is the better MicroStrategy ETF? appeared first on Invezz