[ad_1]

A new crypto venture has emerged as former President Donald Trump’s family launches World Liberty Financial, aiming to create a U.S.-dollar-backed stablecoin. This comprehensive guide explains their plans to enter the cryptocurrency market and compete with established players like Tether and USDC.

World Liberty Financial’s entry into the crypto space has garnered substantial attention, though initial fundraising efforts have fallen short of expectations. Despite aiming to raise $300 million, the project has secured only $14 million in its initial token sale, with just 4.7% of available tokens purchased by investors.

This modest start hasn’t dampened the team’s ambitions to create a significant presence in the stablecoin market. The project is now reportedly planning to develop a stablecoin pegged to the U.S. dollar, as reported by Decrypt.

Trump Crypto Project World Liberty Plans to Issue Stablecoin, Sources Say (via @decryptmedia) https://t.co/UrMN4tEhKZ

— jonnycomp (@jonnycomp344502) October 29, 2024

Although the WLFI token has not been warmly received, the proposed stablecoin is expected to have a better chance of success.

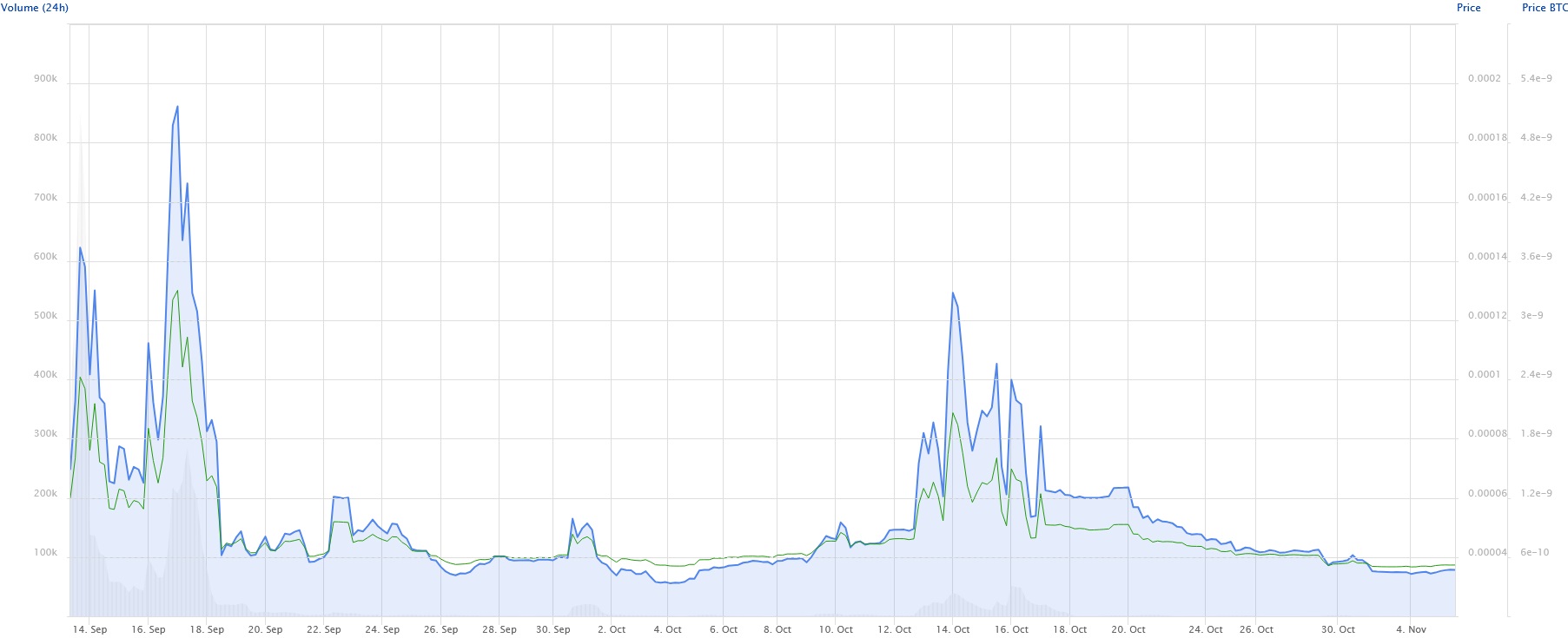

WLFI token price. Source: Coinpaprika.com

The Stablecoin Vision

The project’s cornerstone is the development of a cryptocurrency pegged to the U.S. dollar, entering a market dominated by established players like Tether and USDC. The World Liberty team envisions their stablecoin as more than just another digital asset – it’s positioned as a crucial tool for maintaining U.S. dollar dominance in the digital economy.

The stablecoin will maintain a 1:1 ratio with the U.S. dollar through proper collateralization, a feature that distinguishes it from failed experimental approaches that have plagued the industry. This conservative approach reflects lessons learned from past market failures, particularly the collapse of Terra in 2022, which resulted in billions in losses.

Technical Leadership and Market Position

A significant boost to the project’s credibility came with the appointment of Rich Teo, former co-founder of Paxos, as the lead for stablecoin development. Teo’s experience with the dollar-backed Paxos Standard Token brings valuable expertise to the initiative. Under his guidance, the team is meticulously working on security protocols and regulatory compliance before market launch.

- Rich Teo, who helped build another successful digital money company called Paxos

- Barron Trump as the “Chief DeFi Visionary”

- Eric and Donald Trump Jr. as “Web3 Ambassadors”

- Donald Trump as the “Chief Crypto Advocate”

Market Context and Competitive Landscape

The timing of World Liberty Financial’s entry coincides with unprecedented growth in the stablecoin market. Tether’s recent performance, reporting a 5.2 billion profit in the first half of 2024, demonstrates the sector’s potential. The total stablecoin market cap exceeding $172.8 billion indicates substantial room for growth and competition.

Governance Structure and Token Economics

The project’s governance model centers around the WLFI token, which grants holders voting rights on platform decisions. The ownership structure reveals a significant concentration among insiders, with 70% held by the Trump family and associates, 20% allocated to founders, and 10% available to the public. This distribution has raised both interest and concerns among potential investors.

The ownership of the project tells us a lot about who’s in control:

Integration and Development Strategy

World Liberty Financial is building its platform on established infrastructure, utilizing the Aave V3 protocol on Ethereum. This strategic choice allows for seamless integration with existing DeFi platforms while providing a foundation for mass adoption. The team emphasizes user accessibility, with Eric Trump stating their commitment to making the platform “intuitive and user-friendly.”

The project plans to integrate with:

- Major crypto exchanges

- DeFi platforms

- Bitcoin trading pairs

- Stablecoin and payments networks

Future Outlook and Market Impact

As the project progresses toward its planned launch in the first half of 2025, several critical factors will influence its success. The team must navigate regulatory requirements, secure additional funding, and build market trust. The project’s association with the Trump name has generated significant attention, potentially providing what one expert called “the most free marketing that any crypto company could ever get.”

The development team is prioritizing safety and regulatory compliance, recognizing the importance of proper oversight in the stablecoin sector. This cautious approach reflects an understanding of the regulatory scrutiny faced by cryptocurrency projects, particularly those involving stablecoins.

To Sum Up

World Liberty Financial represents an ambitious attempt to merge traditional financial authority with cryptocurrency innovation. While the project faces significant challenges, including funding shortfalls and intense competition, its unique positioning and high-profile backing make it a noteworthy development in the cryptocurrency landscape. As the team works toward their launch, the crypto community watches closely to see if this venture can successfully bridge the gap between traditional finance and the digital asset ecosystem.

The success of this initiative could significantly impact the future of stablecoins and decentralized finance, potentially reshaping how digital assets interact with traditional financial systems. However, the project’s ultimate success will depend on its ability to execute its vision while maintaining regulatory compliance and building market trust.

FAQ

What is Trump’s crypto project planning with a dollar-backed stablecoin?

World Liberty Financial, backed by the Trump family, is developing a U.S.-dollar-backed stablecoin that aims to maintain the dominance of the U.S. dollar in digital finance. The project has already launched its WLFI governance token and raised $14 million, with plans to create a fully collateralized stablecoin that maintains a 1:1 peg with the U.S. dollar. The project will operate on the Aave V3 protocol and is being developed under the leadership of former Paxos co-founder Rich Teo.

What makes this stablecoin different from others?

The project emphasizes: Full dollar collateralization, integration with decentralized finance platforms and association with the Trump brand. What is more, it focuses on maintaining U.S. dollar dominance.

It enters a market dominated by established players like Tether and USDC, which have market caps in the billions and proven track records.

[ad_2]