Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Insights by Jared Lenow on the good, the bad and the ugly implications of the DOJ’s increased focus on crypto seizures on the broader industry

- Two observations, two predictions and reader favorite quotes from 2025 by Andy Baehr

- Top headlines institutions should read by Francisco Rodrigues

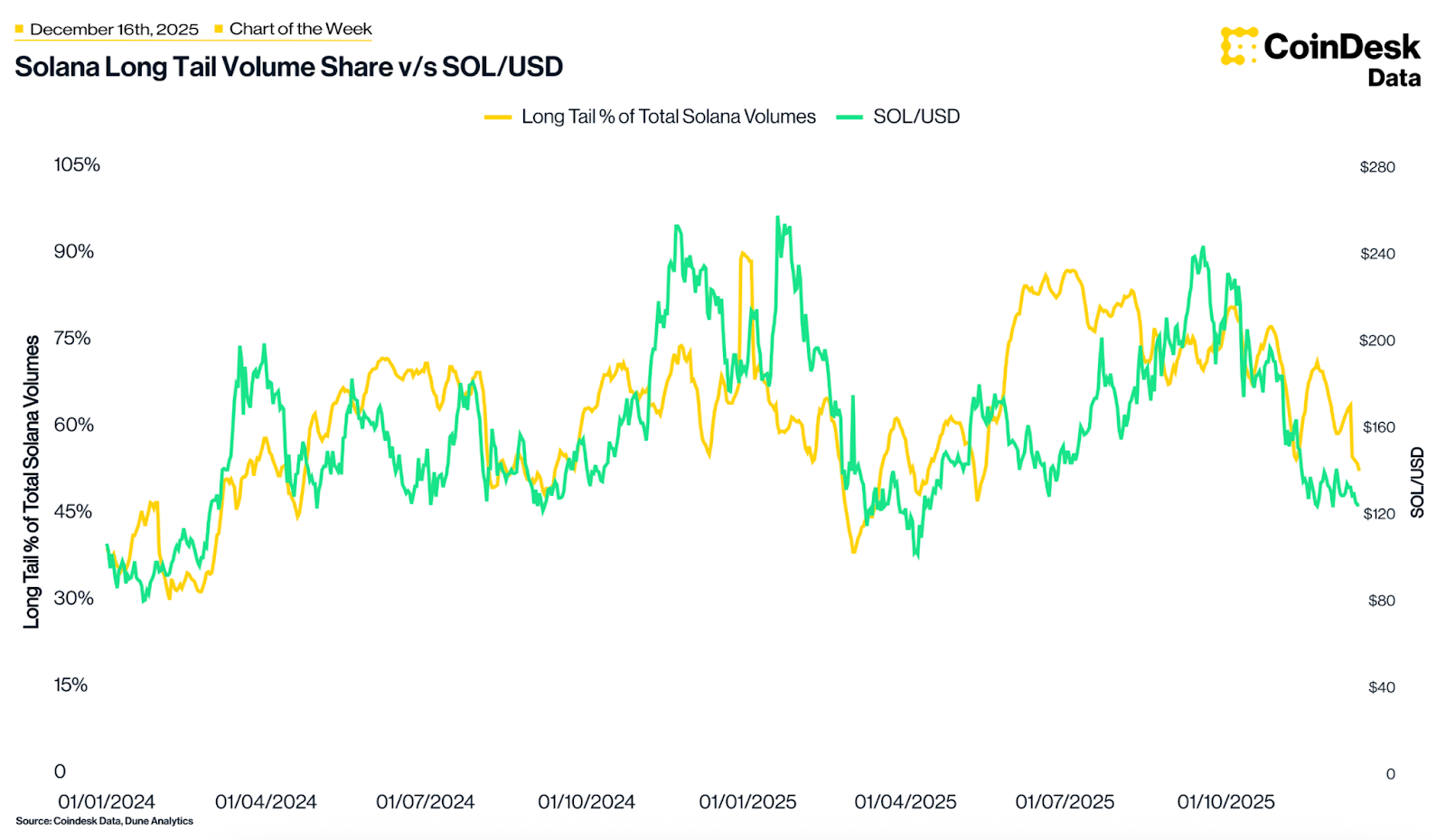

- Solana Long Tail Volume Share vs SOL/USD

– Alexandra Levis

Expert Insights

What the DOJ’s Massive Crypto Seizures Mean for the Industry

-By Jared Lenow, partner, Friedman Kaplan Seiler Adelman & Robbins LLP

Over the past six months, the U.S. Department of Justice has announced a series of massive cryptocurrency seizures. Most notably, in October federal prosecutors seized approximately $15 billion worth of bitcoin, more than three times the value of the assets that the Department recovered in connection with the Bernie Madoff fraud. And the DOJ’s aggressive pursuit of crypto seizures shows little sign of slowing. Just last month, the Department announced the creation of a “Scam Center Strike Force” to target what the government termed a “growing epidemic” of cryptocurrency-related fraud schemes costing Americans nearly $10 billion each year. Already, prosecutors in the Strike Force have seized over $400 million in crypto.

What are the implications of this law enforcement trend for the digital asset industry? Based on my prior experience serving for over a decade as a federal prosecutor in the Southern District of New York, as well as my current role representing companies and individuals in the industry, I see four major takeaways.

First, the DOJ’s heightened focus on crypto seizures increases the odds that innocent users will see their coins wrongly caught in the dragnet. Many crypto seizures are obtained based on inferences that government investigators draw from public blockchains and other transaction records. Here is an illustration of this sort of analysis excerpted from one of the Strike Force’s court filings, showing the alleged transfer of fraud proceeds through numerous wallets:

But investigators are often working with incomplete information and under time pressure, and this can result in mistakes about whether particular transactions reflect money laundering or perfectly legal activity. That is unfortunate, because while potential paths exist to remedy an improper crypto seizure, the recovery process can be expensive, time-consuming and stressful.

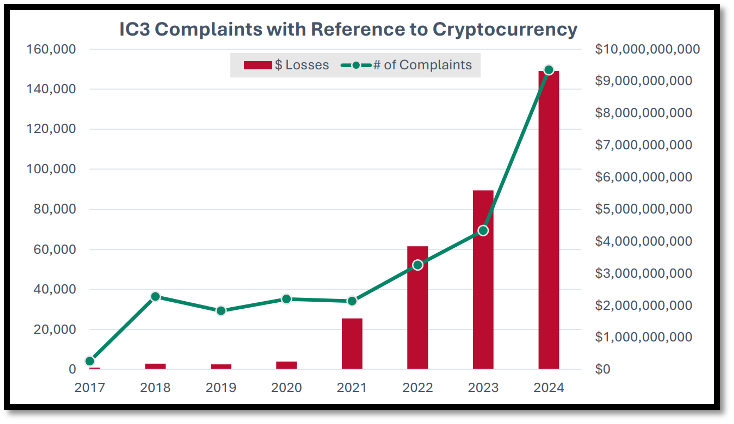

Second, this enforcement trend drives home the need for safeguards to avoid transactions with potential bad actors. According to a recent report from the FBI Internet Crime Complaint Center (also called “IC3”), the number of crypto transactions involving alleged fraud appears to be increasing exponentially:

Fortunately, there are a variety of commercially available compliance tools to help reduce the risk of inadvertently receiving tainted crypto assets, and the DOJ’s enforcement push has significantly shifted the cost-benefit analysis toward investing in such tools.

Third, digital asset businesses may be able to address some of their legal risks by establishing ongoing cooperative relationships with the DOJ and other law enforcement agencies. Indeed, in announcing the Scam Center Strike Force, the DOJ “specifically called on U.S. corporations to partner in the initiative,” stating that the “Strike Force will collaborate with U.S. companies to sever access to the scam centers, and prevent U.S. infrastructure from being weaponized against American citizens.” However, companies must also be mindful of their users’ privacy, and should consult counsel as they seek to determine what information they voluntarily share with law enforcement.

Fourth, the digital asset industry should be encouraged by the DOJ’s articulated law enforcement strategy of rooting out illegal conduct that victimizes honest crypto holders and businesses, while avoiding a “regulation by enforcement” agenda. Of course, allegations of wrongdoing in any particular case may be misplaced, and judges and juries may ultimately reject the Department’s claims when they see the actual evidence.

In sum, the DOJ’s new focus on crypto seizures presents both risks and opportunities. Digital asset companies and users should reevaluate and redouble their investments in compliance and risk-mitigation software, take advantage of opportunities to build relationships with law enforcement agencies where appropriate and be reassured that this latest enforcement push appears aimed at only alleged bad actors rather than the industry as a whole.

Headlines of the Week

– Francisco Rodrigues

This week saw major advances in both regulatory clarity and mainstream integration for the cryptocurrency sector. From the SEC’s tacit approval of tokenized securities to the OCC’s nod for five new trust banks, the once major regulatory hurdle keeps slowly vanishing.

- U.S. SEC Gives Implicit Nod for Tokenized Stocks: The SEC has issued a “no-action” letter enabling the Depository Trust & Clearing Corp. (DTCC) to begin tokenizing select securities.

- HashKey Seeks $215 Million in Hong Kong IPO While Racing Against Its Cash Burn Rate: Crypto exchange HashKey is set to price its Hong Kong initial public offering (IPO) near the top of its range, driven by stronger-than-expected interest from institutional investors. Its cash burn rate, however, remains a concern.

- Five Crypto Firms Win Initial Approvals as Trust Banks, Including Ripple, Circle, BitGo: Ripple, Circle, Fidelity Digital Assets, BitGo, and Paxos moved closer to federal charters after receiving conditional approval by the OCC. These charters enable them to offer regulated custody and payments services and follow in the footsteps of Anchorage Digital.

- Senate Punts Crypto Market Structure Bill to Next Year: Bipartisan talks stalled over SEC/CFTC jurisdiction and DeFi provisions, postponing markup and extending regulatory uncertainty despite industry push for clearer spot market rules.

- Binance Wins Full ADGM Approval for Exchange, Clearing, and Brokerage Operations: Three Binance entities secured full regulatory approval from the Abu Dhabi Global Market (ADGM) to operate under a comprehensive exchange, clearing and brokerage framework.

Vibe Check

Year End Vibes

-By Andy Baehr, CFA, head of product and research, CoinDesk Indices

Two observations, two predictions and reader favorite quotes from 2025

Observation 1: The crypto market’s attention span is 3 months

Crypto market performance seems to have a quarterly cadence. 2024: strong Q1, sideways Spring/Summer, strong Q4 (bookended by Sept 18 and Dec 18 Fed meetings). 2025 was similar, but shuffled: weak Q1, powerful rally in Q2 and Q3, heartbreak drawdown in Q4. Three months for a surge (or sag) to run its course feels aligned with our Trend Indicators’ performance over the past two years, curbing volatility and helping to navigate the seasons.

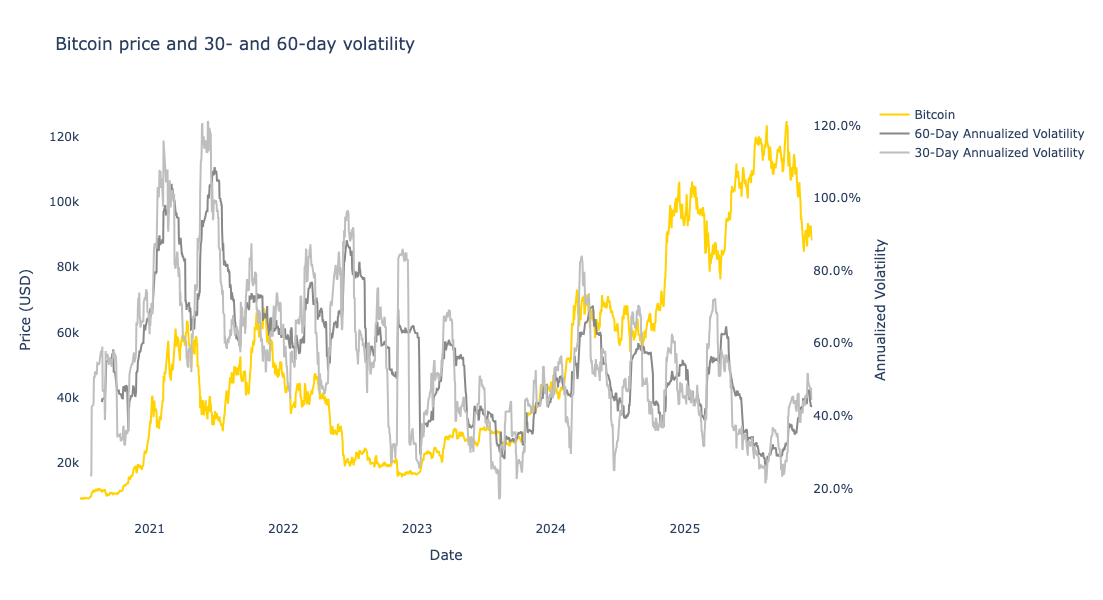

Observation 2: Bitcoin’s return properties are becoming more equity-like

In 2025, the relationship between bitcoin’s price and its volatility continued to more closely resemble equities. Volatility and price moved inversely, and vol remained very low during bitcoin’s two ATH events in the Summer. More pronounced “put skew” in options prices suggests that ETF and DAT option behavior is having a greater influence. The era of bitcoin’s price-up + vol-up “meltups” may be over.

Bitcoin price (gold) and volatility (grey) – used to move together, now move opposite

Source: CoinDesk Indices

Prediction 1: Bitcoin will remain important, but increasingly distant from other digital assets.

“There’s bitcoin, and there’s everything else,” is a talking point I heard more and more in 2025. Bitcoin’s advantages — narrative head start, clean story (scarce, portable, valuable), liquid US markets — will keep it front and center. But the “slow money” building blockchain infrastructure is happening elsewhere: stablecoins, tokenization and DeFi. As we saw throughout 2025, M&A continued (Coinbase/Echo, Ripple/Hidden Road), regulation advanced (SEC generic listing standards), and integration accelerated (JPMorgan accepting BTC/ETH as collateral). Narratives will diverge, and broader indices like CoinDesk 20 will emerge as the relevant asset class reference. We will see if lower correlations follow.

Prediction 2: Investors will demand clearer connection between blockchain growth and token value.

Traders got more to play with in 2025, with a bounty of new ETFs and DATs listed in U.S. markets. The prospect of large-scale and regulated prediction markets and tokenized equities will make markets even richer. However, as investors and advisors look to make more serious long-term allocations to digital assets, they will demand a more cogent investment framework. Why should ETH go up just because there are more stablecoins and tokenized assets? And so forth. (The one exception is, of course, bitcoin, whose investment thesis is clear: a scarce asset with store-of-value properties.)

For 2025’s final Vibe Check, here are a dozen quotes that folks told me they enjoyed:

1. “Out with the old bold, in with the bold old. Mass adoption, retirement fund style.” (January 5)

On reversing a bishop’s New Year’s message: retirement funds as the next frontier for crypto adoption. “Imagine if some of those newly-minted 65-year-olds were able to stow some bitcoin (or some CoinDesk 20) in their plan for 10 years. It could only be life-changing in a good way.”

2. “Bitcoin, still in its adolescence… there are things I don’t expect or enlist my teenage children to do.” (April 13)

On why bitcoin shouldn’t be expected to function as a mature safe-haven asset during extreme volatility.

3. “You can’t just say, ‘Strategy.’ You have to say, ‘Strategy; you know, it used to be Microstrategy.’ Like Prince, Puff Daddy, Kanye West and Twitter.” (May 4)

On the name change confusion and having to suppress the eye-roll reflexes that MSTR triggers.

4. “Wall Street is a giant ‘selling machine.’ Once you get that, everything falls into place.” (May 18, Consensus)

Anthony Scaramucci’s key quote from the panel discussion on whether crypto had reached “asset class” status.

5. “Saylor’s formula appears to be: 1/CFA.” (June 1)

On Michael Saylor reprogramming followers away from diversification and volatility management — the inverse of CFA principles.

6. “This wasn’t the usual opening bell tea ceremony.” (June 8, Circle IPO)

Describing the NYSE floor celebration for Circle’s listing: “It didn’t have the vibe of MSTR rapture or youthful DeFi exuberance. It felt mature and financial — adults celebrating.”

7. “Good bananas or bad bananas?” (July 13)

On a quant analyst asking for clarification: “You will occasionally say something is ‘bananas.’ Sometimes it’s very good, sometimes very bad. I don’t always know which way to interpret the event.” From that day forward, the team made sure to clarify.

8. “Another long sideways Summer of choppy bitcoin and saggy alts?” (July 13)

Describing the pre-breakout doldrums before the July rally.

9. “Five days, five European cities. Planes, trains, automobiles and one funicular. Suits, ties and good shoes worn without irony or costumery. Demitasse after demitasse of strong coffee with a chocolate placed beside.” (October 5, “The hills are alive”)

Opening description of a 20-meeting, 100 investor European roadshow that was fortunately postponed six months when my appendix let go hours before the flight over.

10. “My YouTube feed showed Moses the Jeweler taking an iced-out AP to the melter, harvesting the gold. If that’s not a top, what is?” (October 26)

After gold fell 5.7% from its peak, the largest one-day drop in over 10 years.

11. “There is some irony that the U.S. government did more to depress crypto prices by being shut than by being open” (November 16)

Reflecting on the government shutdown’s market impact.

12. “Market volatility, while anxiogenic, can also be exhilarating.” (November 23)

On a conversation with Hyperion Decimus’s Chris Sullivan about derivatives trading psychology during bitcoin’s 1/3 drawdown in seven weeks.

Chart of the Week

Solana Long Tail Volume Share vs. SOL/USD

The share of Long Tail token volumes on Solana has dropped to 55%, reaching its lowest point since the second quarter of 2025. Historically, the price of SOL has generally mirrored the movement of this Long Tail volume market share, which acts as a proxy for speculative or ‘gambling’ interest on the chain. Consequently, without a new, clear catalyst to drive a pickup in the Long Tail volume share from these reduced levels, the momentum required to push the SOL price significantly higher appears.

Listen. Read. Watch. Engage.

- Listen: “Inside the CFTC’s Digital Asset Pilot Program,” with acting CFTC Chairman Caroline D. Pham and CoinDesk’s Jennifer Sanasie.

- Read: Exchange Review, November 2025. Combined spot and derivatives volumes experienced their largest month-on-month decline since April 2024

- Watch: Andrew Baehr, CFA joins NYSE to chat about the themes dominating the digital asset headlines and Twenty One Capital’s NYSE listing.

- Engage: Is Consensus Miami on your calendar? View the speaker lineup and register today before prices increase.