[ad_1]

The introduction of key exchange-traded funds or ETFs is a clear validation of a maturing crypto market. In 2024, the market buzz isn’t restricted to BTC and ETH ETFs. Instead, there is growing speculation around a host of ETF introductions, including a Solana ETF. This Solana ETF guide details all the elements associated with this prospect, including the top applicants, the creation-redemption process, and more.

Solana ETFs have not yet been approved in the U.S. Yet their global presence, including across the Toronto Stock Exchange and Deutsche Borse, has birthed numerous discussions around this potential. By the end of this piece, you will be familiar with the existing and upcoming Solana ETF landscape in 2024. Here’s what to know.

In this guide:

- The Solana ETF guide: Inception of ETF discussions

- Solana ETF Guide: What are SOL ETFs, and how do they work?

- Solana ETF guide: Types of Solana ETFs

- Solana ETF guide: Associated benefits

- Are there risks associated with Solana ETFs?

- Solana vs. Ethereum ETFs

- Solana spot ETFs vs. Solana futures ETFs

- Solana ETFs vs. Bitcoin ETFs

- How’s the future looking for Solana ETFs?

- Frequently asked questions

The Solana ETF guide: Inception of ETF discussions

Solana has been around for a while now. The network has overcome many challenges, including when, in late 2022, the FTX contagion surfaced. Solana was on the brink of virtual elimination, with SOL prices dropping to single digits. Critics and skeptics were quick to proclaim the potential end of Solana.

Despite the challenges, the core team remained. Throughout 2023 and 2024, Solana grew in terms of price action and TVL, restoring confidence in the network’s utility. Notably, the recovery wasn’t only about the price but also about adoption and market perception.

Also, here are some of the other factors pertaining to Solana that have contributed to the ETF momentum:

- Technical strengths and the rise of meme coins are specific to the Solana network.

- Institutional interest, with Canada’s 3iQ Solana ETF being one of the validations of these factors

- Positive price predictions, led by key analysts, with some even projecting that SOL will breach past $500 in the less than distant future

- Strategic partnerships with big names such as Circle have injected $250 million worth of USDC into the Solana ecosystem. This has significantly boosted its liquidity while demonstrating strong institutional confidence.

- Constant expansion with over 400 active projects thriving in the ecosystem

All these factors have contributed to the positive ETF momentum surrounding Solana. In late June 2024, the first filing applications were made for Solana ETFs.

“Love seeing the markets up like this. ETH ETF incoming Solana ETF following shortly behind. Be prepared for September.”

Burns, Co-Founder of D3fenders: X

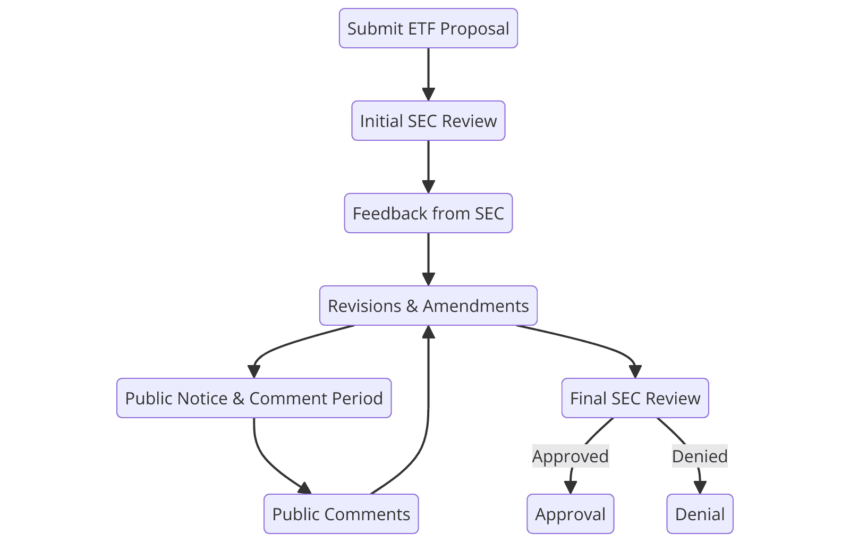

The standard approval process for Solana ETFs: BeInCrypto

Solana ETF Guide: What are SOL ETFs, and how do they work?

Solana ETFs are standard investment funds that trade on stock exchanges. They aim to track SOL’s performance, giving investors an accessible and regulated way to gain exposure to the digital currency. This approach ensures that exposure to Solana becomes easy for institutional investors and individuals.

Notably, Solana ETFs fulfill all the four requirements associated with the Howey test — another reason they are to be classified as securities and subject to regulation by the SEC.

Trading mechanism

Solana ETFs are traded on traditional stock exchanges, such as the Toronto Stock Exchange. Investors can buy and sell shares of the ETF through their brokerage accounts. Notably, the ETF’s price fluctuates throughout the trading day based on market supply and demand. This provides high market liquidity, making it easier for investors to enter and exit positions compared to directly trading cryptocurrencies.

Creation and redemption: Solana ETF mechanics

Creating and managing a Solana ETF involves a series of well-defined steps designed to ensure transparency, liquidity, and regulatory compliance.

Here is how the entire flow reads: (Creation only)

- Initiation by APs or Authorized Participants: These are typically large financial institutions that are responsible for creating ETF shares.

- Basket deposit: The APs transfer Solana tokens to the ETF’s custodian, an entity that securely holds the underlying assets.

- Issuance of ETF shares: In exchange for the deposited Solana, the ETF provider issues new shares of the ETF to the APs.

- Market introduction: The newly created ETF shares are then introduced to the market, where they can be traded on major stock exchanges like the Toronto Stock Exchange (TSX) or potentially the New York Stock Exchange (NYSE), depending on regulatory approval.

(Redemption only)

- Redemption request by APs: When APs want to redeem ETF shares, they submit a redemption request to the ETF provider.

- Returning ETF shares: The APs return the ETF shares to the provider, effectively removing these shares from the market.

- Asset transfer: In return for the ETF shares, the custodian releases the equivalent amount of Solana tokens or assets back to the APs.

- Settlement: The redeemed Solana tokens are transferred back to the APs, completing the redemption process.

Solana ETF guide: Types of Solana ETFs

Just like Bitcoin and Ethereum ETFs, Solana ETFs can be segregated into:

- Solana spot ETFs: Instruments that mirror traditional Solana price movements.

- Solana futures ETFs: These ETFs invest in futures contracts based on Solana rather than holding the physical SOL. These have better chances of getting regulatory approval.

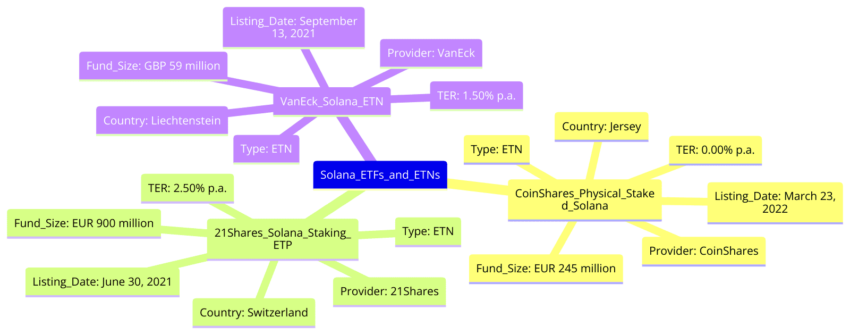

Major players dealing in Solana ETFs and ETNs

Here are some of the key players offering exposure to Solana, in some capacity, as an ETF or ETN:

3iQ Digital Asset Management (Canada)

- ETF: QSOL

- Exchange: Toronto Stock Exchange (TSX)

- Features: This is the first Solana ETF in North America. It tracks Solana’s price movements and offers staking yields.

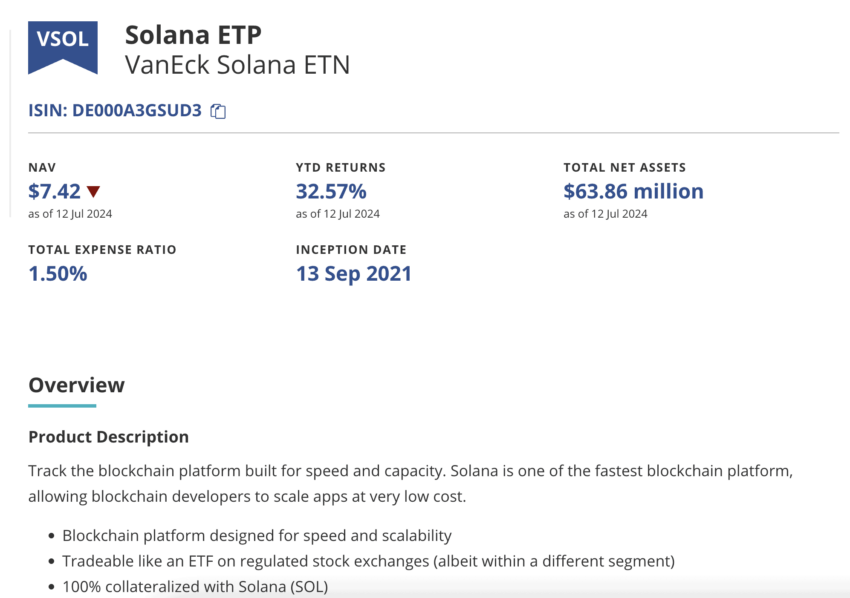

VanEck (Germany)

- ETN: VanEck Solana ETN (VSOL)

- Exchange: Deutsche Börse

- Features: The ETN replicates the performance of the underlying Solana index with a collateralized debt obligation backed by Solana’s physical holdings. It is a physically backed ETN with a total expense ratio (TER) of 1.50% per annum.

Solana ETF guide and VanEck ETN: VanEck

WisdomTree (Jersey)

- ETN: WisdomTree Physical Solana (SOLW)

- Exchange: Various European exchanges, including Euronext Paris, XETRA, and SIX Swiss Exchange

- Features: This ETN is physically backed by Solana and has a TER of 0.50% per annum. It offers direct exposure to Solana’s price movements and is designed for long-term investment strategies.

21Shares (Switzerland)

- ETP: 21Shares Solana Staking ETP (ASOL)

- Exchange: SIX Swiss Exchange

- Features: This ETP is unique as it offers staking rewards in addition to tracking Solana’s price movements. It has a TER of 2.50% per annum and provides investors with the benefits of Solana staking without the need to manage the process themselves.

Popular Solana ETFs: BeInCrypto

But that’s not all. A number of players have filed applications for Solana ETFs with the SEC. Here are the ones that you should know about:

VanEck

- Application: VanEck Solana ETF

- Details: VanEck submitted an S-1 form to the SEC for the VanEck Solana Trust, aiming to be the first U.S.-based Solana ETF.

21Shares

- Application: 21Shares Core Solana ETF

- Details: Following VanEck’s application, 21Shares also filed for a Solana ETF titled “21Shares Core Solana ETF.”

What’s up with the Grayscale Solana ETF?

Here are the important details regarding the Grayscale Solana ETF:

- Structure: Private Trust or Fund ETF

- Ticker: GSOL

- Exchange: OTC Markets

- Features: Provides exposure to Solana’s price movements without the need for direct purchase and storage of SOL.

- Regulatory status: Not registered under the Investment Company Act of 1940; hence, it does not require SEC approval as ETFs do.

- Target investors: Accredited investors initially, with secondary market trading available.

Grayscale’s Solana Trust trading on OTC markets: TradingView

Also, there are a few similar products that are either trading or awaiting regulatory approval. These include:

Bitwise Asset Management

- Product: Bitwise 10 Crypto Index Fund (BITW)

- Nature: Private trust offering exposure to a basket of cryptocurrencies, including Solana.

Osprey Funds

- Product: Osprey Solana Trust (OSOL)

- Nature: Private trust providing exposure to Solana, traded on the OTCQX Market.

VanEck

- Application: VanEck Solana Trust (pending SEC approval)

- Nature: Aimed to be an ETF but currently filed as a trust.

That’s all there is about the current ETF/ETN landscape concerning Solana.

Solana ETF guide: Associated benefits

Some of the top benefits associated with investing in Solana ETFs include:

- Diversification

- Liquidity

- Regulatory oversight

- Access to staking rewards for some ETFs/ETNs

- Accessibility

- Low fees as users need not worry about wallet setup, exchange fees, and other factors.

Are there risks associated with Solana ETFs?

Yes, even Solana ETFs are prone to risk. The most critical are

- Regulatory risks, courtesy of the changing environment and perception toward cryptocurrency

- Market volatility, which might impact spot and futures ETFs

- Technological risks

- Liquidity risks

- Custody risks as ETF custodians might get hacked

- Competitive risks

Solana vs. Ethereum ETFs

Here is a quick table highlighting the differences between Solana and Ethereum ETFs:

Do note that this table focuses solely on the ETF-specific differences instead of discussing Solana and Ethereum as blockchains.

Solana spot ETFs vs. Solana futures ETFs

It’s often easy to confuse spot and futures crypto ETFs. Here’s a table that outlines the differences between the two ETF categories.

Solana ETFs vs. Bitcoin ETFs

How does a Solana ETF stack up against a Bitcoin ETF piece? Firstly, the BTC ETF was the first crypto ETF to be approved in the U.S. While both come with risk, Bitcoin ETFs do not come with staking capabilities, unlike Solana ETFs.

Also, when comparing the investor profiles, it’s clear that Solana ETFs are suitable for investors seeking innovative technology, whereas Bitcoin ETFs are geared toward stability. However, both are meant to offer cryptocurrency investment opportunities to traditional players.

How’s the future looking for Solana ETFs?

The future of Solana ETFs hinges heavily on the fate of the U.S. Presidential Elections in November 2024. However, with market leaders like VanEck, 21Shares, and Blackrock having submitted and planning to submit applications, the expected approval of spot entities might not be distant. Notably, the approval process pertaining to a spot Solana ETF is expected to take several months, with the SEC having up to 240 days to make a decision in most cases.

Frequently asked questions

How does a Solana ETF differ from other ETFs?

What are the benefits of investing in a Solana ETF?

Are there any risks associated with Solana ETFs?

Will Solana ETF come before XRP ETF?

[ad_2]