U.S. President Donald Trump’s presidency has been characterized by a continuous stream of attention-grabbing statements and actions. Liberation Day is set to capture the attention of not just the people but nations and markets as well. Here is what you need to know about how this highly anticipated day may shape crypto markets.

In This Guide:

- What is Trump’s Liberation Day?

- How did crypto respond to Trump’s Liberation Day?

- How will Liberation Day affect markets?

- Short-term pain, long-term potential?

What is Trump’s Liberation Day?

In case you missed it, President Trump plans to implement several import taxes on April 2, which has been dubbed Liberation Day.

“We have Liberation Day, as you know, on April 2, because, and I’m not referring to Canada, but many countries have taken advantage of us — the likes of which nobody even thought was possible for many, many decades. And you know, that has to stop. ” — U.S. President Donald Trump

Trump’s announcement stems from a previous decision to implement tariffs on select countries, many of which were postponed until April.

Based on previous statements, many expect reciprocal tariffs, which will match other countries’ rates, while the rest will likely target key areas of manufacturing, production, and other sectors. The tariffs set for “Liberation Day” will likely include:

- Pharmaceuticals, semiconductors, copper, and lumber.

- 25% tariff on any country that imports oil from Venezuela.

- Separate tariffs on Canada and Mexico to “stop drug trafficking.”

- 20% tariffs on top of the existing 10% tariffs on China.

Trump’s history of tariffs

Timeline of Trump’s tariff policies: BeInCrypto

President Trump has been red-pilled on tariffs since the 1980s when he publicly criticized trade practices he believed were harmful to the United States.

In a 1987 appearance on Larry King Live, Trump remarked, “The fact is, you don’t have free trade… A lot of people are tired of watching the other countries ripping off the United States.”

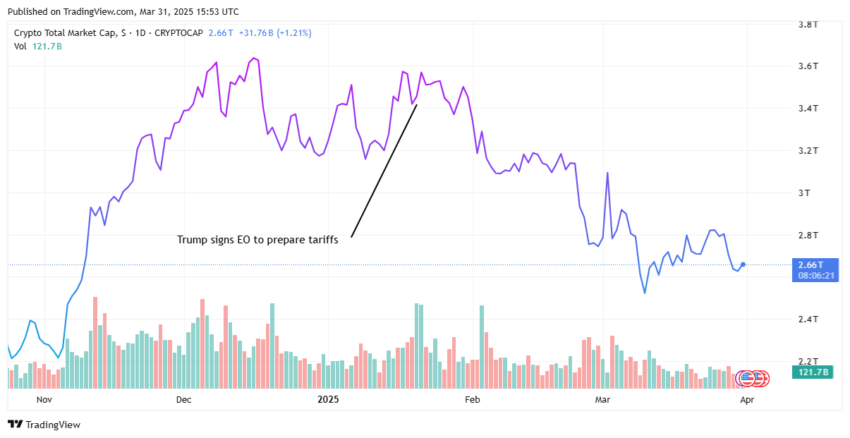

On Jan. 20, 2025, Trump signed an executive order to prepare tariffs. The first wave of tariffs was set to debut on Feb. 4, 2025. These included a 10% tax on all Chinese imports and 25% tariffs on Canada and Mexico.

Total crypto market cap: TradingView

How did crypto respond to Trump’s Liberation Day?

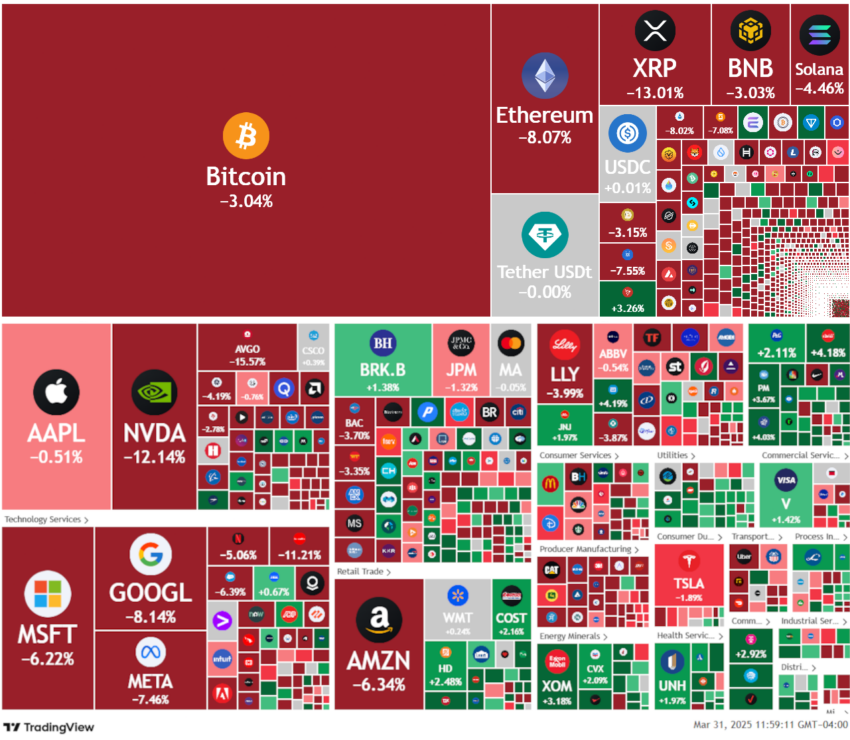

Upon the announcement of Trump’s Liberation Day, crypto and equities markets took a big nosedive. Bitcoin (BTC) and Ether (ETH) were down ~3% and ~8% on the week, respectively, while NVDA and GOOGL were down ~12% and ~8%.

Crypto and stocks heatmap: TradingView

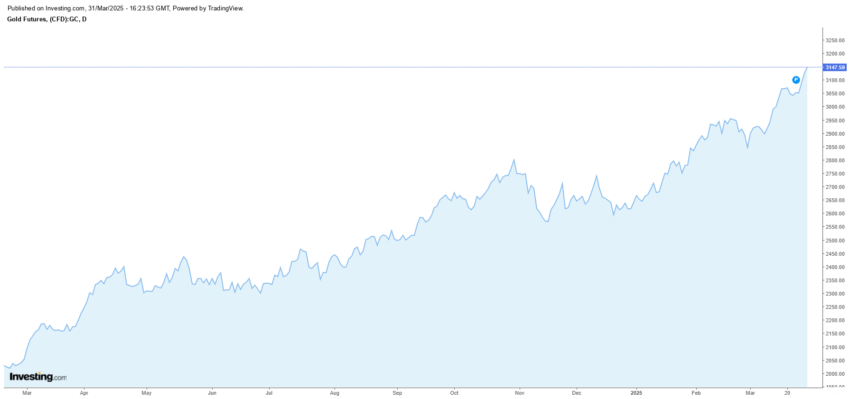

While many markets have taken a hit, gold has performed exceptionally well. This could be seen as a possible market flight into safer assets amidst the looming trade war between major economies.

Gold Futures: investing.com

How will Liberation Day affect markets?

Many people have suggested that Trump’s tariffs are tools for negotiating trade and border security. Others say the revenues will help reduce the federal budget deficit.

The Federal Reserve admittedly underestimated the effects of the tariffs and has also revised its expectations for inflation. During its March 2025 meeting, the Fed raised its 2025 core inflation forecast to 2.8%, up from the previous projection of 2.5%.

Trump argues these measures will reduce U.S. reliance on foreign goods and reclaim economic power. However, critics warn of higher consumer costs and potential retaliation efforts from affected nations. Here are the possible effects Liberation Day could have on crypto and equities markets.

Continued de-risking

While making projections on the possible outcome of tariffs on crypto and other markets can be difficult, we already have some data to work with. In Q1 2025, every tariff announcement has triggered a pullback in riskier assets. Here’s why:

- Tariffs raise the cost of trade

- The U.S. imports more than it exports (by a lot)

- That means higher prices across the board — not just for luxury, but essentials too

If prices rise fast enough, people will spend less. That, in turn, puts pressure on corporate earnings, especially for multinationals with tight margins or high input costs. Eventually, big money will move away from risk.

Crypto falls squarely in that risk-on category. It thrives in environments where liquidity is strong and investors are chasing the upside.

Alternative scenarios

Some alternate scenarios could be bullish for crypto, but they are uncertain, especially considering President Trump’s sheer determination to renegotiate trade agreements.

Firstly, Trump has been known to shift course at the drop of a dime. Therefore, it is possible that he could scrap tariffs altogether or at least some tariffs on certain countries. This could create a short-lived rally.

However, given the fragility of global liquidity and even rate cuts from central banks, underlying conditions persist. Tariffs may not be enough to offset the greater macroeconomic landscape.

Secondly, if tariffs have a great enough impact (e.g., reduced liquidity, discretionary spending, etc.), alongside other conditions, this could lead to a recession in the U.S.

If a recession were to occur or is likely to occur, you could see reduced interest rates from the Fed or even government stimulus and bailouts to backstop the economy. This could cause increased demand for risk assets, which crypto would likely absorb, leading to a possible bull market.

Short-term pain, long-term potential?

Trump’s Liberation Day is part of an ongoing strategy to renegotiate trade relationships and bargain with major U.S. trade partners. However, this “America first” policy has sparked a trade war with many major economies. In anticipation of continued inflation and a possible recession, many investors are de-risking from assets like crypto. While it is most likely that tariffs could indirectly negatively impact crypto in the short term, in the long term, Bitcoin’s role as a hedge against such measures could increase, especially if they trigger economic instability. Conversely, this may boost the crypto market.

In the short term, ensure your portfolio is well-diversified and that you have only invested what you can afford to lose. Never be in a situation where you have to exit the market at a loss.