[ad_1]

Telegram is fast becoming one of the world’s most effective crypto onboarding tools. With its mini-app ecosystem, wallet integrations, and large user base of 1 billion people, it turns even casual users into crypto participants without the friction commonly seen on traditional platforms. Much of this growing activity is powered by The Open Network (TON), which supports the network’s decentralized operations. Within this growing ecosystem, STON.fi stands out as one of TON’s most active and impactful DeFi projects. This detailed guide explores STON.fi’s features, ecosystem impact, and how it’s playing a key role in the growth of DeFi.

In this guide:

- What is STON.fi?

- How does STON.fi work?

- Omniston by STON.fi

- STON token

- Available tokens to swap and STON.fi partners

- STON.fi roadmap

- STON.fi Grant Program

- The future of DeFi on TON

- Frequently asked questions

What is STON.fi?

STON.fi is a leading AMM protocol that allows users to swap tokens permissionlessly without intermediaries. Some of the platform’s products include the STON.fi app and Omniston, which are advanced swapping and liquidity management tools.

To access the platform, you only need your cryptocurrency wallet.

As previously mentioned, STON.fi is built on TON, the blockchain powering Telegram’s web3 ecosystem. In addition to all of the aforementioned features, the platform also:

- Provides low-cost operations

- Facilitates permissionless swaps

- Has low slippage

- Provides direct integrations with TON wallets

- Gives users a smooth DeFi experience

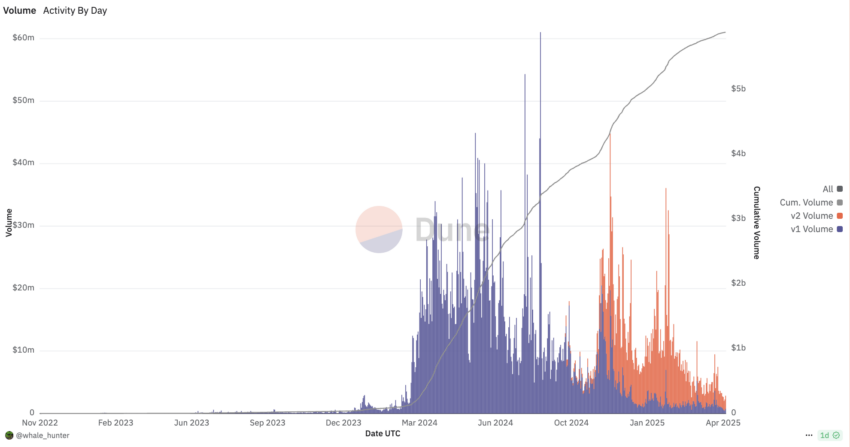

STON.fi was founded in 2022. Since then, the platform has grown to support millions of users and has surpassed $5.7 billion in total swap volume.

STON.fi volume: dune.com

Team and mission

The STON.fi leadership team is made up of experienced, tech-driven entrepreneurs who have joined forces to build one of the most advanced DeFi protocols on the TON blockchain — and are now working to expand its impact across the broader web3 ecosystem.

STON.fi is led by:

- Slavik Baranov, CEO: A seasoned technology executive with nearly 30 years of experience in software development, fintech, and blockchain innovation.

- Alexey Papirovskiy, CPO: A product visionary with deep expertise in building scalable fintech and DeFi solutions.

- Andrey Fedorov, CMO & acting CBDO: A marketing leader, entrepreneur, and blockchain strategist with over 20 years of experience driving growth and innovation in IT and the web3 space.

- Dmitriy Malinovskiy, CFO: A finance expert with 15+ years of experience in financial strategy, operations, compliance, and fundraising for fintech and crypto ventures.

- Ethan Clime, Head of Developer Relations: A longtime web3 educator and advocate, focused on supporting developer communities and empowering new projects within the TON ecosystem.

The team’s goal is to provide the core infrastructure for DeFi on TON, enabling scalable liquidity, frictionless user experiences, and powerful tools for developers building the next generation of DeFi applications.

By providing low-cost permissionless operations, reliable infrastructure, and (soon-to-launch) efficient cross-chain swaps, STON.fi aims to create an inclusive financial environment where you can take control of your financial future.

“STON.fi was born from the belief that the next wave of DeFi adoption would come through platforms people already use — like Telegram. By leveraging the TON blockchain, we’re not just building an AMM protocol; we’re helping shape an entire ecosystem where liquidity, access, and community ownership are the default,”

Slavik Baranov, CEO of STON.fi.

How does STON.fi work?

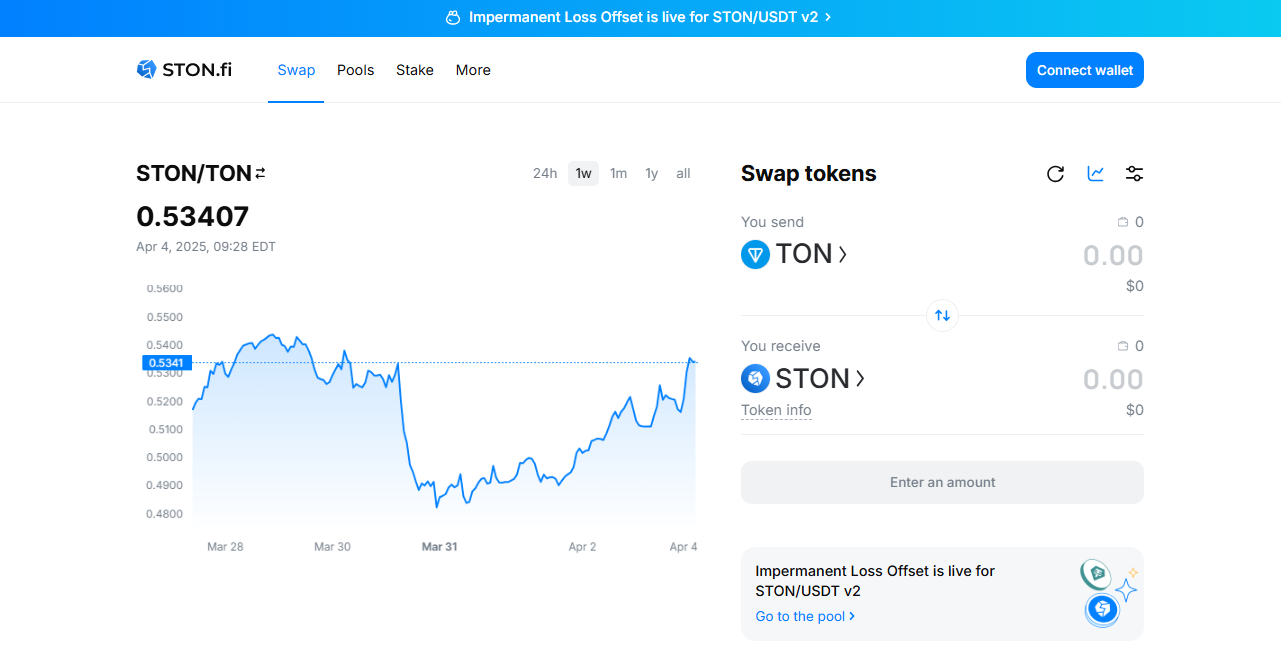

Swap interface: STON.fi

STON.fi is an automated market maker (AMM) protocol. In simple terms, this means you can swap tokens instantly without needing to wait for someone on the other side of the exchange. Think of it like a high-tech vending machine for tokens. Whenever you want to buy or sell, it’s always ready, 24/7.

Additionally, the system is fully decentralized. STON.fi does not have access to your coins or tokens and never collects your location, IP address, or personal information.

Funds are held in permissionless smart contracts or liquidity pools. Anyone can create a pool; however, no one has control over the pool’s assets or functionality, a design that protects users.

This means that no individual liquidity provider can update, delete, or steal the pool’s funds. Liquidity providers can only take out their share of the pool’s assets, and users can only receive coins or tokens through an equivalent exchange of crypto.

When you swap on STON.fi, as a rule, you will incur a 0.3% fee, 0.2% of which will go to the liquidity providers, and 0.1% will go to the STON.fi protocol.

Staking

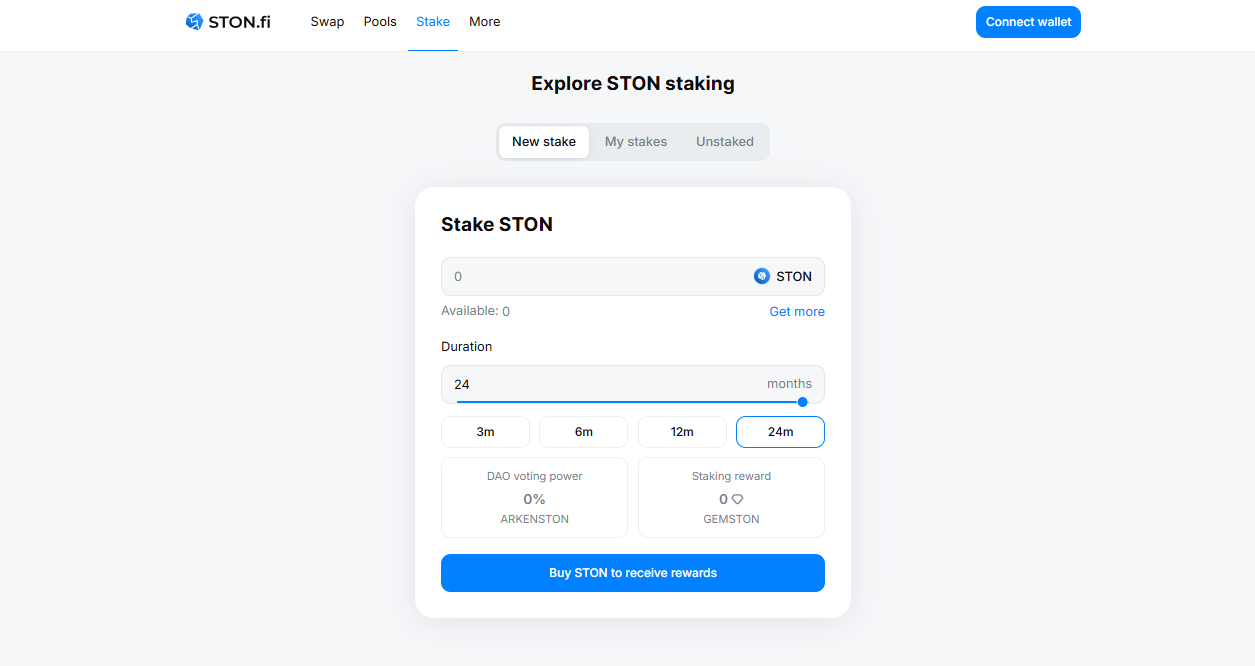

Staking: STON

You also have the option to stake your STON tokens. Once the DAO is launched, you will be granted voting power through ARKENSTON and will also receive GEMSTON, which can be transferred, traded, or held. To stake, you must do the following:

- Lock your STON token in the staking contract for three to 24 months.

- After staking STON, you automatically receive ARKENSTON.

- Rewards are paid in GEMSTON.

ARKENSTON is a governance token that will give its holders the right to make decisions regarding the STON.fi protocol. These are soulbound NFT tokens, meaning they can not be transferred. This token is burned after the user unstakes.

GEMSTON is used to incentivize active participation in the STON.fi protocol.

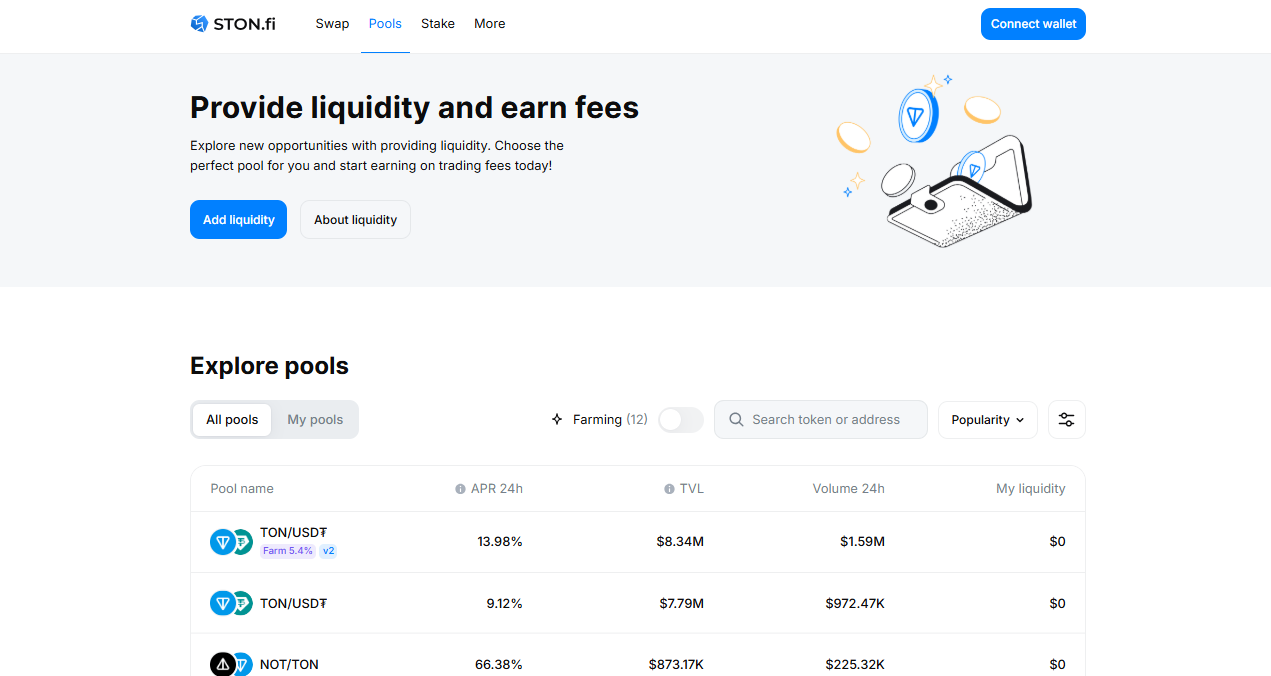

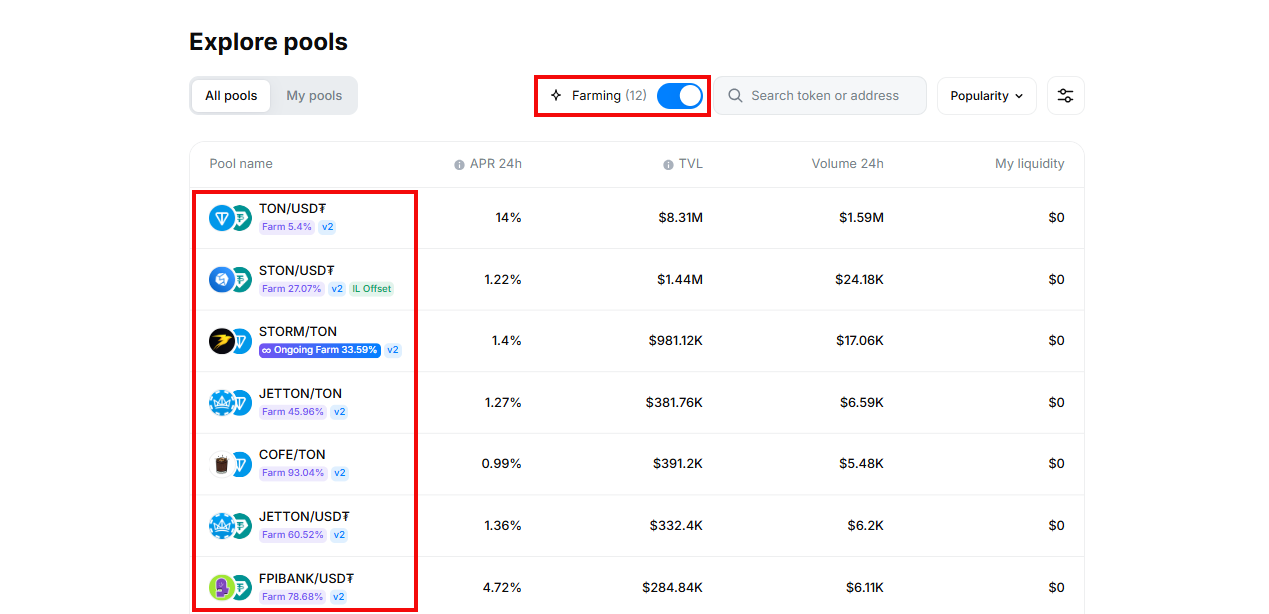

Farming

Farming: STON.fi

It is also important to note that you can engage in farming by staking your liquidity provider (LP) tokens. As mentioned earlier, anyone can become a liquidity provider on STON.fi. When you deposit your tokens in a liquidity pool, you will receive LP tokens.

Simply stake these LP tokens in a farm to begin earning rewards. Liquidity farming, often shortened to just farming, is a mechanism where you provide liquidity and stake your tokens across multiple pools to receive compounded rewards.

Farming, unlike staking, offers the potential for higher rewards by actively providing liquidity to specific pools. While it requires a few more steps and a better understanding of the process, it comes with higher risk — especially for newcomers. However, it can be more rewarding for experienced and engaged users.

Explore pools: STON.fi

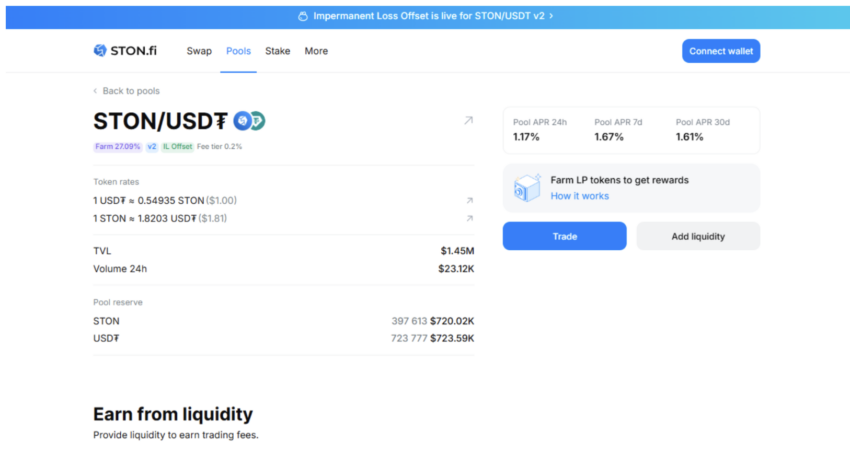

Impermanent loss protection

One of the unique features of STON.fi is its Impermanent Loss Protection feature. Impermanent loss happens when the prices of your tokens in a liquidity pool change, and you end up with less value than if you had just held the tokens.

To participate, you must provide liquidity in the STON/USDT pool before the start of each validity period (usually on the first day of the month).

STON/USDT: Ston.fi

“For us, this program isn’t just about numbers — it’s about creating confidence. When users feel secure providing liquidity, the entire ecosystem thrives. The doubling of liquidity providers since launch is a strong signal that we’re on the right path. Right now, we’re evaluating ways to improve the experience and exploring the possibility of expanding the program to additional pools. Our priority is to create a more secure and rewarding environment for everyone who participates in STON.fi.”

Slavik Baranov, CEO of STON.fi.

Omniston by STON.fi

Omniston is a decentralized liquidity aggregator brought to DeFi applications, developers, and liquidity providers by STON.fi. It addresses the challenges of sourcing liquidity for DeFi protocols and securing optimal swap rates across multiple DEXs and other liquidity sources.

Omniston simplifies this process by providing access to deep liquidity and competitive swap rates across a range of sources, all through a single integration.

The aggregator enables LPs to leverage smart routing, which directs liquidity to where demand is highest. Meanwhile, developers can concentrate on building application features while Omniston handles the complexities of sourcing liquidity.

How Omniston works

All transactions are executed in a trustless environment, using smart routing and decentralized swap mechanisms to ensure secure and efficient execution. If all participants follow the protocol, the swap completes successfully. If any party deviates or misbehaves, the transaction is automatically canceled, and all funds are returned to the respective parties. The process works as follows:

- A user initiates a swap through an application.

- The application forwards the request to Omniston.

- Omniston generates a request-for-quote (RFQ) and distributes it to connected resolvers.

- Resolvers return their quotes to Omniston.

- Omniston selects the most favorable quote and executes the transaction.

- Both parties receive the tokens.

STON token

STON.fi price: CoinGecko

STON is a utility token native to the TON blockchain. It is central to the protocol’s core functions, including governance participation through staking. The token has a maximum supply of approximately 100,000,000 STON, with around 1,000,000 currently in circulation.

Available tokens to swap and STON.fi partners

In addition to its native token, STON.fi lets you swap a wide range of assets and has formed strategic partnerships across the TON ecosystem and beyond.

Here’s a closer look at the available tokens and the partners helping grow the network.

With over 23,000 trading pairs available, STON.fi supports a wide range of tokens native to the TON ecosystem, as well as ecosystem-specific tokens from various projects. New tokens are regularly added, and users can even deploy their own pools thanks to STON.fi’s permissionless architecture.

Whether you’re swapping stablecoins, meme coins, or project-specific assets, STON.fi offers deep liquidity and competitive rates via smart routing powered by Omniston.

STON.fi has also partnered with a range of trusted wallets and platforms. This includes popular TON-native solutions like Wallet, Tonkeeper, launchpads like Blum, Ton.fun, and AMM DEXs like Symbiosis.

STON.fi roadmap

STON.fi is quite ambitious and, as a result, has a lot of plans down the pipeline. Here is what you can expect from the platform in the future:

- Phase 1: Cross-chain swaps between TON and Tron networks without the need for wrapped tokens and bridges. The cross-chain software development kit (SDK) will allow anyone to integrate cross-chain operations.

- Phase 2: Cross-chain swaps to Polygon and other Ethereum Virtual Machine (EVM) compatible blockchains. This phase will also introduce stableswap routing, a mechanism designed for stablecoins that lets you trade large amounts quickly and with minimal fees without being limited by available liquidity.

- Phase 3: This phase will fully implement the cross-chain protocol, allowing you to access any tokens from the integrated networks. A new network will also be added to the protocol.

- Phase 4: STON.fi will create a Telegram bot to provide all Telegram users with cross-chain access. It will also launch a decentralized autonomous organization (DAO) protocol.

- Phase 5: This phase will introduce a limit order book, margin trading, and gasless swaps, vastly expanding trading capabilities and providing a user experience on par with traditional trading platforms. This phase also includes the launch of the V3 pool, introducing features like concentrated liquidity — a major step forward in capital efficiency for both liquidity providers and users.

STON.fi Grant Program

STON.fi is committed to supporting the developers driving innovation on the TON blockchain. The company’s Grant Program supports developers and teams integrating STON.fi’s SDK into their products.

The program offers financial assistance, technical support, and an assortment of free perks to support costs from STON.fi’s partnered service providers.

The program provides up to $10,000 in USDT for development tasks, such as coding, debugging, and testing. The grant is open to a vast range of applicants, including individual developers, startups, and established teams and companies.

There is no set deadline; you can apply anytime. The eligibility requirements are simple. Applicants must meet the following criteria:

- Develop a DeFi product or integrate DeFi mechanics into existing platforms.

- Be in the conceptual phase, under active development, or seeking to add new features.

- Submissions should be technically feasible with a clear plan for integrating the STON.fi SDK.

- Must adhere to relevant legal and regulatory standards applicable in their region of operation.

- Should be willing to actively engage with the STON.fi team and community.

- Should demonstrate a long-term vision with the potential for sustainable impact.

- Should have well-articulated proposals that clearly outline the project’s goals, milestones, and alignment with the STON.fi SDK.

How to apply

To apply for the STON.fi Grant Program, you must do the following:

- Complete the application form: Provide detailed information about your project, team, and how you plan to use the grant.

- Receive confirmation: An acknowledgment email will be sent upon submission.

- Await review: The STON.fi team will review your application and respond with their decision.

Stonbassadors program

STON.fi makes it a point to reward its supporters in meaningful ways, including through the Stonbassadors program.

This is an initiative by STON.fi designed to engage and reward community members who contribute to the platform’s growth and visibility. Ambassadors, known as Stonbassadors, play an important role in connecting STON.fi with the broader community.

The program is open to all individuals passionate about STON.fi and DeFi in general. There is no formal application or verification process; interested participants can start contributing immediately.

Contributions are recognized and rewarded through a monthly pool of up to 10,000 STON tokens, distributed among ambassadors based on the quality and impact of their work.

How to apply

To receive rewards, ambassadors must submit their contributions via a form available on the Stonbassadors Program page at the end of each month. The STON.fi team reviews submissions and allocates rewards accordingly.

The program also features a referral system, allowing ambassadors to invite others to join. Ambassadors earn 10% of their referrals’ rewards for at least six months, provided the referred individual earns $50 or more in STON tokens.

The future of DeFi on TON

STON.fi is a one-of-a-kind AMM protocol on the TON blockchain. It democratizes access to financial services regardless of location, offering user-owned liquidity and supporting developers and liquidity providers with its many incentives.

With cross-chain DeFi solutions on the horizon, the platform is evolving into a gateway that connects TON’s ecosystem with other major blockchain networks, expanding opportunities for developers and users while shaping a more open, interoperable financial future.

[ad_2]