[ad_1]

Introduction

In the dynamic and ever-evolving landscape of decentralized finance,PancakeSwap has emerged as a transformative platform that reimagines how cryptocurrency enthusiasts and investors interact with digital assets. Born from the innovative spirit of anonymous developers and nurtured by a vibrant community, PancakeSwap represents more than just a decentralized exchange—it’s a comprehensive financial ecosystem that democratizes access to advanced crypto strategies.

Origins and Historical Context

In the pulsating digital landscape of decentralized finance, PancakeSwap’s genesis unfolded as a marvel of technological innovation and strategic vision. The latter half of 2020 represented a pivotal moment in cryptocurrency and DeFi development, characterized by unprecedented technological breakthroughs and a fundamental reimagining of financial infrastructure.

The platform’s conceptual origins can be traced to a profound recognition of the systemic limitations plaguing existing decentralized exchanges, particularly those built on the Ethereum network. The developers behind PancakeSwap perceived a critical opportunity to revolutionize cryptocurrency trading by addressing the multifaceted challenges that had long hindered mainstream blockchain adoption.

The cryptocurrency ecosystem was riddled with barriers that excluded average and tech-novice investors. Despite the innovation, Ethereum platforms had architectural flaws, leading to high fees and slow transactions, making small trades unviable. Complex interfaces and the need for technical knowledge further alienated potential users, turning crypto trading into an elite-only activity.

Recognizing these profound challenges, the PancakeSwap architects orchestrated a strategic technological migration to the BNB Chain (BSC), a decision that would prove transformative. By leveraging BSC’s infrastructure, they engineered a decentralized exchange that reimagined the possibilities of cryptocurrency trading. They dramatically reduced transaction fees, making micro-trading economically viable, and had Near-instantaneous transaction processing speeds. Together with the intuitive, user-friendly interface designed for broad accessibility, it would prove to be very successful.

In short, the platform’s launch represented more than a technological innovation—it was a bold statement about the future of financial interaction, suggesting that sophisticated financial tools could be both powerful and easily accessible.

Core Functional Architecture

Automated Market Maker (AMM) Mechanism

At its technological heart, PancakeSwap operates as an advanced Automated Market Maker, offering sophisticated trading capabilities that go beyond traditional decentralized exchange models. The platform introduces two critical features that enhance trading precision and user control: Time-Weighted Average Price (TWAP) and Limit Orders.

TWAP (Time-Weighted Average Price)

TWAP provides traders with a more nuanced approach to price execution by calculating the average price of an asset over a specified period. This mechanism offers several key advantages:

- Reduces the impact of short-term price volatility

- Provides more stable and predictable price execution

- Minimizes the risk of significant price slippage

- Enables more strategic trading approaches

Limit Orders

The limit order functionality addresses a critical limitation of traditional AMM platforms by allowing users to:

- Set specific price targets for token trades

- Execute trades only when predetermined price conditions are met

- Maintain greater control over trading strategies

- Protect against unfavorable market movements

These advanced features transform PancakeSwap’s AMM from a simple token-swapping mechanism into a sophisticated trading platform that caters to both casual users and advanced cryptocurrency traders.

PancakeSwap’s UI is reported as easy-to-use (PancakeSwap website)

Comprehensive Platform Features

PancakeSwap has developed an ecosystem that extends far beyond simple token swapping. The platform offers a suite of sophisticated financial services designed to empower users and maximize their cryptocurrency potential.

One of the most intriguing features is the Syrup Pool, a unique staking mechanism that allows users to earn rewards by depositing CAKE tokens. Unlike traditional staking models, Syrup Pools provide extraordinary flexibility, enabling participants to earn tokens from various projects while maintaining liquidity and minimizing long-term commitment.

Yield Farming represents another cornerstone of the PancakeSwap experience. Users can generate passive income streams with varying risk and reward profiles by strategically allocating liquidity provider (LP) tokens across multiple farms. The platform’s intelligent design ensures that even novice investors can easily navigate complex earning strategies.

veCAKE: Advanced Staking Mechanism

Syrup Pools represent a sophisticated staking mechanism that has evolved with the introduction of veCAKE (vote-escrowed CAKE), a groundbreaking enhancement to the platform’s tokenomics and governance model. Unlike traditional staking approaches, veCAKE introduces a time-locked staking system that provides users with increased benefits and voting power based on their commitment to the platform.

The veCAKE model offers:

- Longer lock-up periods with proportionally greater rewards

- Enhanced voting rights in platform governance

- Multiplier effects on yield farming and liquidity provision

- Reduced token emission rates

- Participation in IFO’s

- Increased platform stability and long-term user engagement

Users can convert their CAKE tokens into veCAKE by selecting a lock-up period, typically ranging from one week to four years. The longer the lock-up period, the more voting power and additional benefits the user receives. This mechanism incentivizes long-term platform participation and creates a more stable ecosystem by discouraging short-term speculative behavior.

Advanced Ecosystem Services: Beyond Traditional Trading

Initial Farm Offerings (IFOs): A Revolutionary Blockchain Launchpad

PancakeSwap’s Initial Farm Offerings (IFOs) represent a groundbreaking mechanism for democratizing access to emerging blockchain projects. This platform goes beyond typical investing, blending community involvement with tech innovation.

The IFO mechanism is a meticulously designed infrastructure serving multiple critical functions in cryptocurrency development. PancakeSwap transforms the traditional process of early-stage project investment into an inclusive, collaborative endeavor by providing a robust, transparent, and community-driven vetting process.

Participants are empowered to:

- Gain unprecedented early access to nascent blockchain initiatives

- Participate in comprehensive community-driven project evaluation processes

- Mitigate investment risks through collective intelligence and transparent screening

NFT Marketplace: A Digital Canvas of Blockchain Creativity

The PancakeSwap NFT Marketplace emerges as a digital ecosystem that redefines the boundaries between technological innovation and artistic expression. The platform creates a dynamic marketplace where creativity, blockchain technology, and economic opportunity intersect.

PancakeSwap’s NFT marketplace provides a comprehensive infrastructure for digital collectibles. The platform’s architecture is designed to support a multifaceted approach to digital ownership and creative expression.

Prediction Markets: Dynamic Financial Forecasting

PancakeSwap’s Prediction Markets offer an innovative platform for cryptocurrency price speculation, primarily focused onBNB token price movements. This feature transforms market forecasting into an interactive, skill-based experience that challenges participants to leverage their market insights.

Users can engage in a dynamic predictive ecosystem where:

- Precise price predictions become a strategic financial challenge

- Participants stake tokens to validate market forecasts

- Real-time market data informs potential winning strategies

- Blockchain-verified outcomes ensure fair competition

The mechanism creates a zero-sum environment that combines entertainment with financial strategy. Each prediction round provides a fixed time window with transparent staking parameters, eliminating potential systemic biases and creating an engaging platform for market enthusiasts.

PancakeSwap’s Lottery System

PancakeSwap’s innovative lottery system offers substantial CAKE token rewards while ensuring fairness and accessibility.

Users can participate for approximately $5 USD in CAKE tokens per ticket. The purchase limit is 100 tickets per transaction, but there is no overall cap on entries. The system leverages Chainlink’s Verifiable Random Function (VRF) to generate secure and unbiased winning numbers. Each player receives a self-chosen or random six-digit combination as a lottery ticket. Prizes increase based on how many numbers match from left to right. Additionally, bulk ticket purchases come with discounts of up to 10% for 100 tickets.

Cross-Chain Innovation and Expansion

PancakeSwap has evolved significantly beyond its origins on the BNB Smart Chain, embracing a multichain strategy that dramatically expands its accessibility and utility. This strategic expansion across multiple blockchain networks represents a significant evolution in decentralized finance accessibility and interoperability.

Multichain Deployment

PancakeSwap now operates across nine major blockchain networks:

- BNB Smart Chain: The original network where PancakeSwap launched

- Ethereum: The pioneer of smart contract platforms

- Polygon: Known for its scalability and efficiency

- zkSync Era: Leveraging zero-knowledge rollup technology

- Arbitrum One: An Ethereum Layer 2 scaling solution

- Linea: A zero-knowledge rollup network

- Base: Coinbase’s Layer 2 network

- opBNB: Optimistic rollup chain for BNB Chain

- Aptos: A novel Layer 1 blockchain

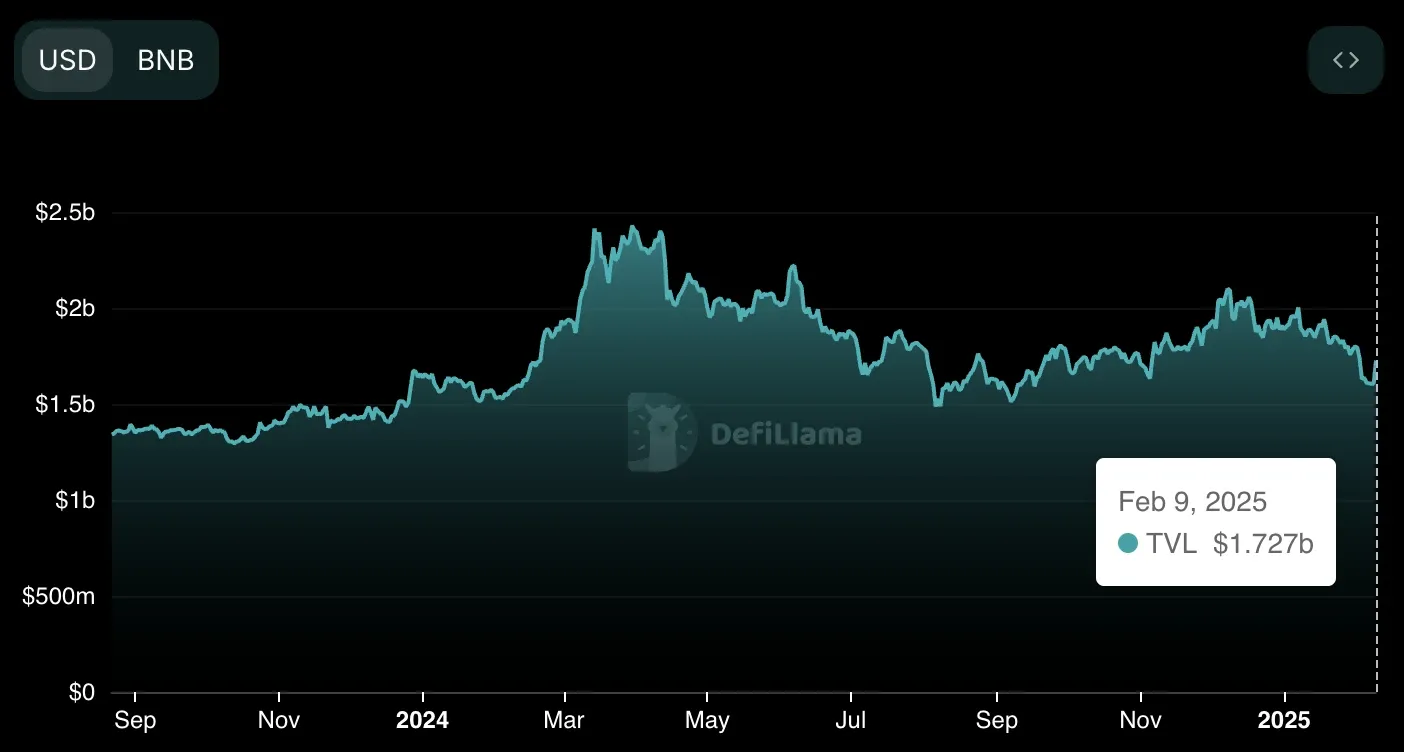

PancakeSwap’s functionality and support has attracted a current TVL over $1.7 billion (DefiLlama)

Bridge Functionality: Seamless Cross-Chain Navigation

PancakeSwap’s native bridge function represents a significant advancement in cross-chain operability. The feature enables users to transfer assets between supported networks with unprecedented ease, eliminating the traditional complexity of cross-chain transactions. The bridge serves as a unified gateway to the platform’s multi-chain ecosystem. Through this innovative functionality, users can seamlessly transfer tokens between different blockchain networks while maintaining the familiar PancakeSwap interface. This unified approach allows traders and investors to explore various blockchain ecosystems’ unique opportunities and features without navigating multiple platforms or interfaces. Furthermore, the bridge empowers users to optimize their trading strategies across multiple chains, creating a more efficient and flexible trading environment.

Ecosystem Benefits of Multichain Strategy

The comprehensive multichain approach delivers several crucial advantages that strengthen PancakeSwap’s ecosystem. First and foremost, enhanced accessibility ensures users can engage with PancakeSwap’s features regardless of their preferred blockchain network. This widespread availability is complemented by increased liquidity, as the platform effectively taps into multiple liquidity pools across different networks, creating deeper markets and more stable trading conditions. The distribution of trading and liquidity provision across various chains significantly helps mitigate network-specific risks, providing users with a more secure trading environment. Users benefit from cost optimization opportunities by choosing the most cost-effective network for their transactions, while the platform itself experiences substantial market expansion through access to diverse user bases and market opportunities across different blockchain communities. This interconnected approach creates a robust, flexible, and user-centric trading ecosystem that adapts to the diverse needs of the global cryptocurrency community.

CAKE Token: The Heartbeat of the Ecosystem

Tokenomics and Strategic Design

The CAKE token serves as the fundamental economic unit of the PancakeSwap ecosystem, embodying a carefully crafted tokenomic model that prioritizes long-term sustainability and community value.

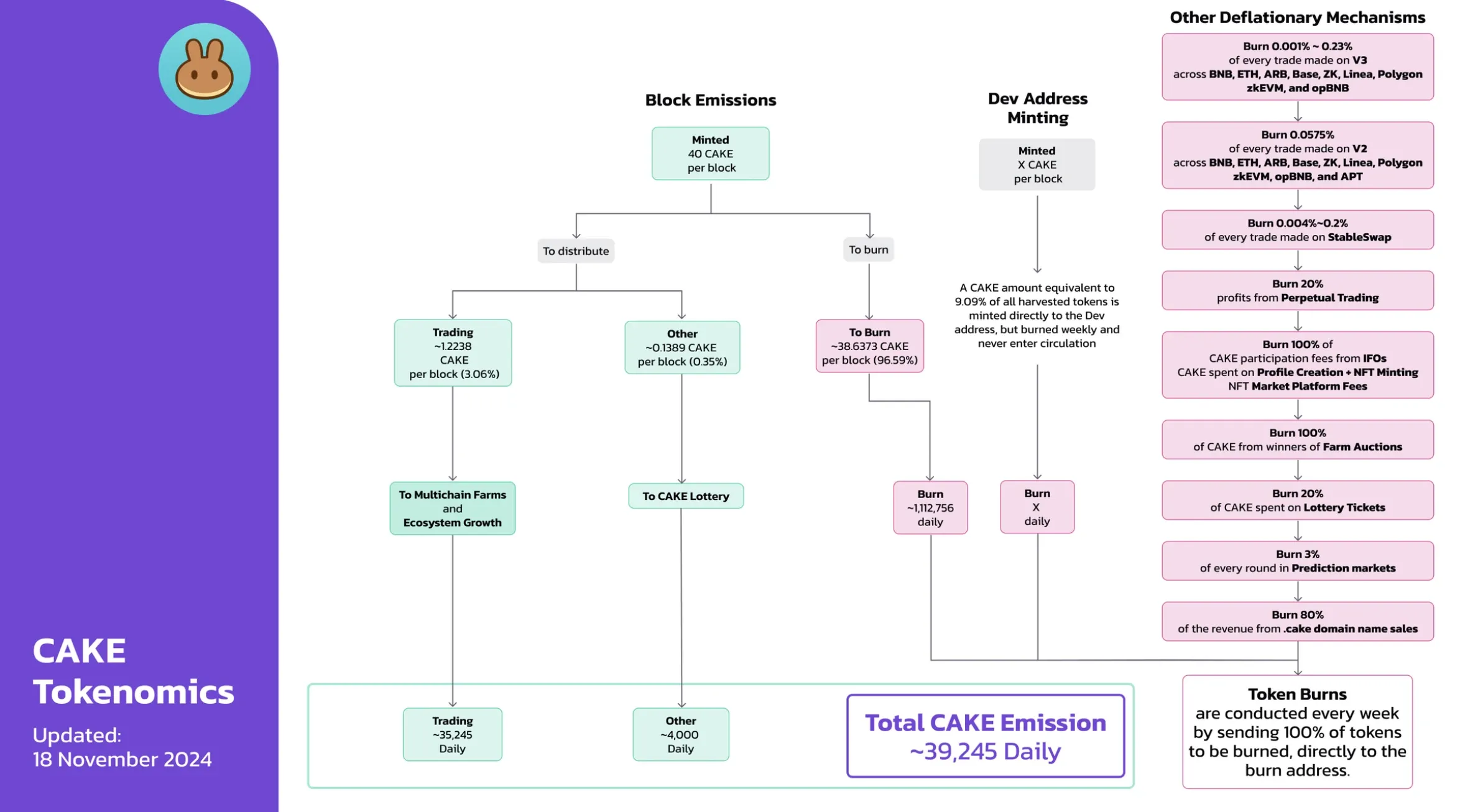

The current circulating supply for CAKE tokens is roughly 291 million tokens, out of a total supply of 379.4 million tokens. Although CAKE aims to be deflationary and will probably never reach the maximum supply, even so, the team has set the maximum supply for CAKE tokens to 450 million tokens; no more shall exist.

Some of the Key tokenomic characteristics include:

- Deflationary supply mechanism

- Regular token burn events

- Community-governed monetary policy

- Multi-dimensional utility across platform services

Details of the CAKE token and its tokenomics (PancakeSwap docs)

Token Utility and Governance

Beyond mere speculation, CAKE tokens provide holders with substantial utility. Users can participate in platform governance, stake tokens for rewards, enjoy reduced transaction fees, and engage with an expanding array of platform features. This multifaceted approach transforms CAKE and veCAKE into a comprehensive financial tool.

Revenue Generation and Economic Model

PancakeSwap has engineered a sophisticated revenue generation strategy that creates multiple income streams. The platform generates revenue through:

- Transaction fees (typically 0.25% per trade)

- Performance fees on specific liquidity pools

- Initial Farm Offering (IFO) participation fees

- Strategic token-burning mechanisms

Competitive Landscape and Differentiation

In a crowded decentralized finance market, PancakeSwap distinguishes itself through relentless innovation and user-centric design. Platforms likeSushiSwap and Uniswap offer similar services, but PancakeSwap’s low-cost transactions, rapid processing speeds, and diverse earning opportunities have carved out a unique market position.

Security and Trust Framework

The platform maintains rigorous security standards through comprehensive smart contract audits, an active bug bounty program, and a transparent, community-driven governance model. These systematic approaches have built user confidence in a volatile digital finance landscape.

Future Trajectory and Vision

PancakeSwap continues to evolve, with roadmap objectives focusing on cross-chain (veCAKE) integrations, V4, and advanced DeFi tools. The platform’s commitment to continuous improvement ensures its relevance in the rapidly changing cryptocurrency ecosystem.

Conclusion

PancakeSwap redefines the idea of a decentralized exchange, emerging as a comprehensive financial platform that empowers users through cutting-edge technology, strategic design, and community-driven development. As decentralized finance evolves, PancakeSwap excels in both technological and financial innovation, setting the stage for a new era in finance.

[ad_2]