This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

In 2017, investor John Pfeffer published “An (Institutional) Investor’s Take on Cryptoassets,” a seminal paper on long-term investments of crypto tokens.

In retrospect, Pfeffer’s original thesis was way ahead of its time. It laid the formative groundwork for investor thinking around magic internet money, and made many prescient predictions that still hold up today.

Pfeffer argued that the equilibrium long-term outcome would be one dominant crypto asset as a monetary store of value, with bitcoin as the likely candidate. He projected BTC’s market cap within a range of $4.7 to $14.6 trillion ($260k-$800k per BTC).

There are many reasons Pfeffer believes bitcoin would be cemented as the dominant SOV, but key to the thesis is that BTC carries the least technological risk. For ETH to beat BTC at the SOV game requires massive intellectual coordination across a multiyear roadmap with lots of technical upgrades subject to delays and/or risk of failures.

As Hasu put it on an old Uncommon Core podcast, “nothing happening in bitcoin is actually the best thing that can happen to bitcoin.”

Turning to Ethereum, ETH bulls today tend to argue the superiority of ETH to BTC on a multi-prong level: Its use as a means of payment within the EVM ecosystem buttresses its value as a SOV (on top of its deflationary effects following EIP-1559).

But it’s not clear why that alone would make ETH a valuable SOV.

Pfeffer argued that crypto participants would simply convert their preferred “store of value via the payment rail at the time of payment in the exact amount needed and for as little time as possible.” He likened this to retailers converting bank deposits to physical cash for payments only at times of need.

Pfeffer also presciently argued that Ethereum’s scaling solutions — such as L2s and the move to proof-of-stake — would be “bullish for adoption/users but bearish for token value/investors.” This has turned out to be exceptionally spot-on in light of Crypto Twitter’s constant caterwauling about the lack of ETH’s price appreciation in the last year.

So what is ETH worth?

Today, Pfeffer’s landmark thesis is being revisited via a newly-published paper by Triton liquid fund, which he co-authored.

The paper’s conclusion: Ethereum is a technological marvel, but ETH’s risk-adjusted upside is a difficult projection to make.

One could try to value ETH as a cash-flow asset. But Ethereum’s constant innovation around its protocol and tokenomics makes a DCF analysis “incredibly difficult to do accurately.”

Even so, the paper makes an attempt based on generous assumptions that issuance is net-neutral, plus with an average growth rate of 5%. No matter what discount rate one uses, though, “ETH appears highly overvalued today as a cash flowing asset at $400b.”

Source: Triton

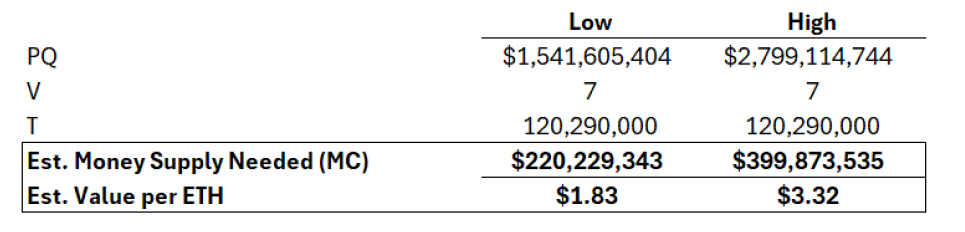

One could then turn to the “monetary premium” argument for ETH. But contrary to ETH bulls, ETH is not money — it’s not even the de facto unit of account in the EVM ecosystem (the US dollar is). Case in point: Base, Ethereum’s largest L2, started offering last month the use of USDC for gas costs rather than ETH.

Even if ETH was treated as the primary medium of exchange onchain, trying to justify ETH’s ~$400+ billion valuation based on “monetary premium” is an exercise laced with wishful thinking. The paper estimates Ethereum’s onchain “GDP” at about $2.8 billion (annualized based on the past six months), making it about 1000x overvalued by its current valuations.

Source: Triton

The strongest argument for ETH as an investable asset points to it as the dominant internet-native commodity and productive onchain asset. Holding ETH is not like holding gold bars or oil — one can stake it in DeFi to accrue a yield.

Yet, the paper questions that a 3% yield from Lido outweighs the inherent volatility of ETH for it to be used as an “internet bond.”

In conclusion: “At $400b today and given its current trajectory, it is difficult to justify ETH as a rational investment on a risk-adjusted long-term horizon, no matter which lens you use to value it…BTC still holds its position as a sound risk-adjusted bet that it can grow into its role as a non-sovereign store of value.”