[ad_1]

The DYDX token is an integral part of the dYdX Chain, focusing on decentralized financial (DeFi) instruments and derivatives. It has undergone significant changes after transitioning from Ethereum to the dYdX Chain, bringing new functionalities and an expanded utility. Here’s what you need to know.

From Ethereum to Cosmos

On October 26, 2023, at 17:00 UTC, the dYdX Chain was born, launching its very first block. DYdX transitioned to operate its own chain within the Cosmos ecosystem, moving beyond its initial deployment on Ethereum. This evolution signified a major step in its development, aiming to leverage the interconnectivity and efficiency of the Cosmos network.

The Proof-of-Stake (PoS) blockchain, built on the Cosmos SDK and using CometBFT for consensus, has embraced DYDX as its primary token, serving as a key to securing the network, a way to reward stakers for securing the chain and enabling community-driven governance. Its holders can delegate their assets to validators or become ones, bolstering blockchain safety. Moreover, they wield the power to shape the future of the dYdX Chain by voting on key proposals, from node software updates to community fund allocations.

The migration from Ethereum to the dYdX Chain involved a one-way bridge smart contract, where ethDYDX tokens were locked, and corresponding DYDX tokens on the dYdX Chain were allocated to users. This process was designed to be permissionless and automated, ensuring a seamless transition for token holders.

Key Differences and New Functionalities

Staking and Security

The DYDX token introduces a deeper level of engagement for its holders, allowing them to enhance the network’s security through a staking mechanism actively. This participation can take two forms: holders can either step into the role of validators themselves or delegate their stakes to existing validators. The design of the system bolsters the network’s defense mechanisms. As the volume of staked tokens increases, a wide array of validators significantly strengthens the network’s resilience against coordinated attacks.

DYdX distributes 100% of protocol fees to stakers in USDC instead of the native token, a highly unique model with many tangible use cases. As of today, holders have staked 148.83m DYDX with 17,88% APR.

Governance

The migration to dYdX V4 heralds a shift towards a more democratic governance system, empowering DYDX holders to directly influence the network’s future through proposal submissions and voting. In contrast to the last version of the protocol, holders only need 2 000 unstaked DYDX and a small amount for gas to vote. This evolution significantly enhances the token’s functionality, transitioning from its traditional roles to play a key part in shaping the dYdX Chain’s strategic development. Since the beginning of 2024, the number of governance votes totalled 52, compared to 30 for the entire 2023.

Community governance in DeFi plays a crucial role by democratizing financial systems, allowing token holders to influence decisions and policies directly. This engagement aligns the platform’s development with its users’ needs, fostering transparency and trust. Additionally, pooling collective wisdom and resources can intensify security and innovation.

Economic and Reward Mechanisms

As mentioned, the dYdX Chain’s economic framework rewards validators and stakers with 100% of protocol fees. This reward system motivates continuous participation and underpins the network’s expansion and long-term viability. It also ensures a steady development trajectory and strengthens security through widespread and engaged stakeholder support.

The protocol has distributed $19,7m between 18 800 stakers as of the time of writing.

Tokenomics

Tokenomics refers to the economics of a cryptocurrency, detailing how a token is issued, distributed, and managed within its ecosystem. It encompasses the token’s supply, distribution mechanism and incentives for holders. Understanding tokenomics is crucial for assessing a token’s long-term viability and potential impact on the project’s success and its value to investors.

The total supply of DYDX tokens is limited to 1 billion, with a current circulating supply of 464 677 529 at the time of writing. The latest circulating supply stats can be viewed on CoinMarketCap.

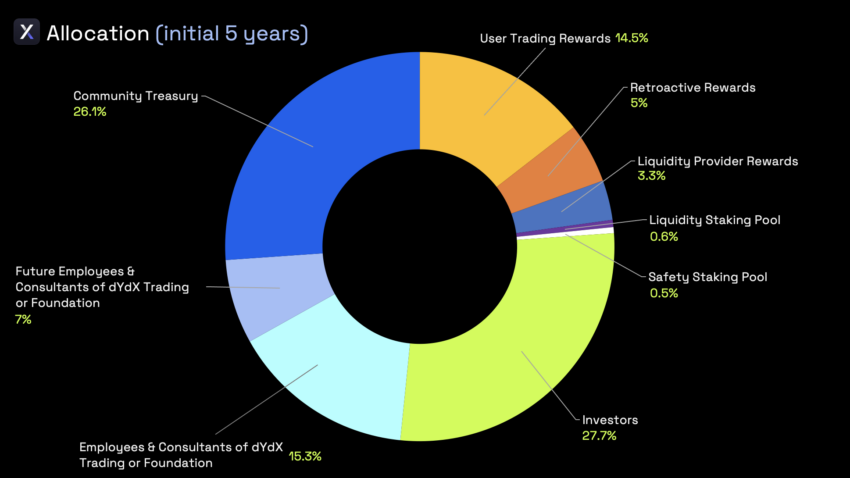

Post ethDYDX launch, several proposals (DIP 14, DIP 16, DIP 17, DIP 24) have adjusted these initial allocations. This move reflected the project’s distribution strategy dynamics to support its ecosystem and governance framework.

Currently, the allocation includes:

- 27.7% to Investors

- 15.3% to Employees and Consultants of dYdX Trading or Foundation

- 7.0% to Future Employees & Consultants of dYdX

- 14.5% to User Trading Rewards

- 5.0% to Retroactive Rewards

- 3.3% to Liquidity Provider Rewards

- 26.1% to Community Treasury

- 0.6% to Liquidity Staking Pool

- 0.5% to Safety Staking Pool

DYDX allocation

The transition of the DYDX token to the dYdX Chain, now part of the Cosmos ecosystem, significantly boosts its features and overall value. This move aligns with the DeFi sector’s push for more scalable, secure, and driven platforms by their communities. Unlike ethDYDX, which was used solely as a governance token, DYDX allows its holders to gain enhanced roles in governance, staking, and ensuring the network’s security, marking a notable development from its initial setup on Ethereum.

Where To Buy DYDX

You can purchase the DYDX native token on both centralized (CEX) and decentralized (DEX) platforms.

Some of the notable options include:

- OKX — one of the largest centralized exchanges where DYDX is available for trading.

- KuCoin — another major centralized exchange offering DYDX trading pairs.

- Osmosis — a leading decentralized exchange built on Cosmos. Here you can trade DYDX directly from your wallet without needing an intermediary.

These platforms provide different trading options, such as spot trading on centralized exchanges and direct wallet-to-wallet exchanges on platforms like Osmosis. Make sure to review each platform’s features and security measures before trading. For a more comprehensive list of where to buy DYDX and detailed market information, you can refer to CoinMarketCap’s market page.

[ad_2]