[ad_1]

Traditional financial (TradFi) systems have served us relatively well for ages. But growing misgivings about them, like the much-publicized Trump family debanking, have sent us looking for suitable alternatives.

One outcome has been the discovery of decentralized finance (DeFi), which is the essence of this article. In it, we explain what DeFi in crypto is, how it works, its advantages, risks, and future potential.

Understanding DeFi (Decentralized Finance)

The best way to understand DeFi is to start by defining the concept. Next, you must know the features that distinguish it from TradFi services. Finally, it is important to appreciate the sector’s role in the wider cryptocurrency ecosystem.

The Definition of DeFi

DeFi is a peer-to-peer (P2P) financial system running on blockchain technology. Its foundation is smart contracts that facilitate trustless cryptocurrency transactions between trading parties. The system offers everything traditional finance (TradFi) set-ups do, such as lending, borrowing, insurance, and trading.

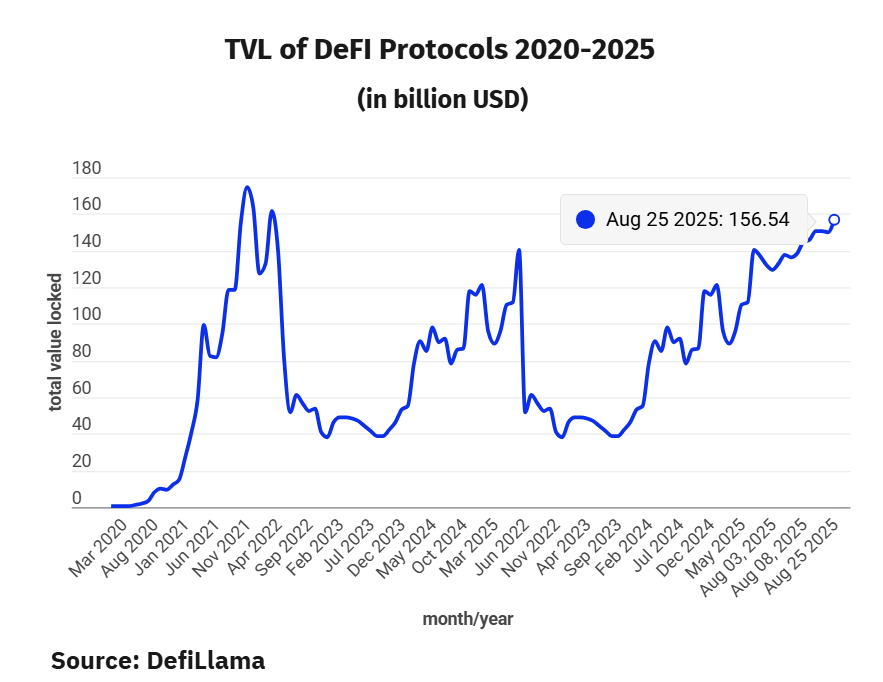

The sector is one of the most burgeoning ones within crypto, with a total value locked (TVL) of $148.991 billion at press time, a massive growth from roughly $800 million in January 2020.

How DeFi Differs from Traditional Finance

DeFi and TradFi are distinct approaches to managing financial systems. While the latter relies on gatekeepers to facilitate transactions and services, DeFi uses blockchain technology and smart contracts to bypass intermediaries. The table below outlines their key differences.

Why DeFi Matters in the Crypto Ecosystem

Decentralized Finance is vital to the crypto ecosystem as it enables financial services without intermediaries. This aspect democratizes access, allowing anyone with internet and a crypto wallet to participate.

Moreover, its transparency builds trust between counterparties through code. It drives innovation with tools like yield farming and automated market makers, attracting billions in capital.

By offering financial sovereignty and reducing costs, DeFi showcases crypto’s real-world utility, fueling adoption and transforming our finances.

How Does DeFi Work?

DeFi uses interconnected technologies to provide intermediary-free financial services. Here’s a breakdown of the nuts and bolts that make it tick:

Smart Contracts on Blockchains (Ethereum, Solana, BSC)

Smart contracts are the heart of the DeFi crypto ecosystem. These self-executing digital agreements direct transactions happening on the blockchain. Unlike typical contracts that rely on a trust agent, these automatically complete trades once the transacting parties meet their ends of the bargain.

Their immutability and transparency are the foundation of the trust between both sides to a deal. Smart contracts cover the whole gamut of DeFi transactions and are a brainchild of the Ethereum network.

However, they are also making headway in newer DeFi-centric networks like Solana and Binance Smart Chain (BSC).

The Role of Decentralized Applications (dApps)

Accessing DeFi protocols would have been challenging were it not for dApps, the websites, and mobile applications linking you to smart contracts. These run on permissionless networks, giving you full control over your funds and data.

Some common dApps include decentralized exchanges (DEXs) such as Uniswap, lending protocols including Aave, non-fungible tokens (NFTs) marketplaces like OpenSea, and crypto wallets as MetaMask.

Liquidity Pools and Automated Market Makers (AMMs)

The last key cog in the DeFi juggernaut is a set of interdependent concepts, liquidity pools, and automated market makers (AMMs). The first are smart contract-based reserves of crypto pairs. For example, an ETH/USDC pool typically contains equal dollar values of both digital assets.

Users (liquidity providers) deposit their tokens into these community-driven “trading pots,” for which they earn trading fees proportionate to their contributions. AMMs then kick in, providing the mechanism for using liquidity pools.

These protocols use algorithms to price assets based on the available liquidity. They are similar to the conventional order book, only that they are trustless, and instead of matching buyers and sellers, they link them to liquidity pools 24/7.

Key Features of DeFi

Though upending the traditional financial system will take a while, DeFi is creating compelling user-first alternatives. And as the technology matures, the following core features will play a big role in its adoption.

Permissionless and Open Access

DeFi is your hustle-free ticket to crypto trading and investments. Forget the lengthy application process, rigorous checks, and slothful approvals characteristic of TradFi systems. You only need a stable internet connection and a crypto wallet to start.

There are no minimum balance requirements, geographic restrictions, or discrimination based on your background or status. This all-embracing approach breaks down the barriers that have historically denied some people financial services.

Transparency and Auditability

TradFi service providers are often opaque about their actions and functions. Not so with DeFi. Since these systems run on blockchain and smart contract tech, their transactions are publicly accessible.

You can track money flows, verify how protocols manage funds, and even audit their smart contracts for vulnerabilities. This level of openness pushes accountability, increasing the whole system’s trustworthiness. Plus, it levelizes the playing field for all users.

Non-Custodial Control of Assets

Unlike in centralized finance (CeFi), where service providers hold your funds, DeFi gives full control of your assets through private keys. Your crypto wallet acts as a digital safe for which only you have the keys, and you manage it through smart contracts.

This non-custodial approach shields you from counterparty risks like debanking and bankruptcy. Besides, you have 24/7 access to your funds and a say in the protocol’s governance decisions.

Interoperability with Other Protocols

One of DeFi’s key draws is that it supports seamless connection and data sharing across protocols. This feature allows you to combine different tools, creating new financial products and experiences customized to your needs.

For instance, you can borrow ETH on one protocol, lend it on a different one, and stake your profits on another. This interoperability fuels innovation far beyond the siloed TradFi systems.

Examples of DeFi Applications

From trading and lending to creating stable assets and beyond, DeFi is reshaping how we interact with money. Here’s a look at some of the most exciting applications driving this revolution.

Decentralized Exchanges (DEXs) like Uniswap & Curve

Imagine trading cryptocurrencies without relying on a third party like a centralized exchange. That’s exactly what decentralized exchanges do.

Platforms like Uniswap and Curve allow users to swap tokens directly in a completely trustless and transparent way. Their innovative use of liquidity pools means you can trade with lower fees and enjoy seamless access to diverse assets.

Lending & Borrowing Platforms like Aave & Compound

Do you have idle assets you’d want to invest in for gain? DeFi has your solution through its credit offering platforms like Aave and Compound. These P2P crypto lending marketplaces allow users to loan each other at interest.

All it takes is depositing your holdings into a lending pool from which borrowers take loans. Smart contract technology and market forces determine the interest rates. You can also borrow funds from the said pools upon providing some security.

Stablecoins and MakerDAO’s DAI

Perhaps crypto’s greatest infamy is its wild price swings. Luckily, we have stablecoins. These cryptocurrencies strive for stability by pegging their values to steady assets, typically fiat currencies like the USD.

MakerDAO’s DAI stablecoin takes this pegging a notch higher. Instead of shoring its value with real-life dollars, it uses a smart contract-run vault of other cryptocurrencies. This shift makes it a truly decentralized stablecoin.

DAI and other stablecoins are a boon to the DeFi ecosystem. Their stability makes transacting, saving, and building other financial products easy.

Yield Farming & Staking

If you’re looking for ways of creating passive crypto income, yield farming and staking are some of the easiest ways of doing so. In the former, farmers (investors) provide DEXs and lending protocols with liquidity in exchange for rewards. The process involves moving funds from one protocol to another, looking for the best yield (returns), hence the term.

Meanwhile, staking involves locking your crypto to support proof-of-stake (PoS) blockchains like Ethereum. It’s akin to holding a dividend stock in TradFi. Your deposit helps secure the network and validate its transactions, for which it pays you back with staking rewards (dividends) in tokens.

DeFi Insurance & Synthetic Assets

Beyond lending and trading, decentralized finance crypto is big on securing and futureproofing your investments. That’s the reason behind cutting-edge products like DeFi insurance and Synthetic assets.

The former works like your regular insurance, albeit decentralized. DeFi insurance platforms, such as Nexus Mutual, cover you against losses resulting from smart contract hacks and exploits or platform failures.

Synthetic assets, on their part, are digital tokens mirroring prices of real-world assets (RWA) like securities, commodities, and even fiat currencies. Outlets like BitShares, Synthetix Network, and Mirror Protocol allow you to mint synths – synthetic versions of RWA – without holding the actual asset. For instance, you can trade synthetic Apple stock (sAAPL) without owning the tech giant’s shares.

By tokenizing RWA, synths open up a new frontier of decentralized trading without the limitations of time and geographical location.

Benefits of DeFi

Whether it’s reaching the unbanked, reducing transaction costs, or enabling borderless trades, DeFi brings financial services to a broader audience in smarter, faster ways.

Accessibility for the Unbanked

The World Bank estimates that nearly 1.4 billion people don’t have access to formal financial systems, which keeps them in poverty. Defi crypto offers a lifeline to this unbanked population by simplifying their onboarding to financial products and services.

A smartphone and internet connection are all one needs to start saving, borrowing, lending, and investing, no matter how far-flung they may be globally.

Lower Costs and Faster Settlements

Decentralized finance crypto operates on a P2P basis, thus cutting out intermediaries and significantly impacting transaction speeds and costs. With DeFi, users needn’t go through go-betweens, hastening settlement times while saving on transaction fees.

Transparency and Global Reach

All DeFi transactions occur on a public blockchain, allowing for easy verification. Additionally, it’s a permissionless system, meaning you can trade with anyone, anywhere, worldwide. This aspect makes it a truly borderless financial setup.

Risks and Challenges of DeFi

It isn’t always sunshine and rainbows in the DeFi space. That’s because the same openness and innovation that make it a novelty come with risks you should understand before diving in.

Smart Contract Exploits & Hacks

Code is the cornerstone of smart contracts, but these can have vulnerabilities, turning them into a hacker’s playground. Hackers exploit buggy or flawed smart contracts to drain funds from affected crypto Protocols.

For example, a hacker in the 2022 Poly Network attack 2022 made away with over $600 million. Mitigating such events calls for regular third-party audits of any protocol’s smart contract to reveal any errors for timely corrections.

Rug Pulls and Fraudulent Projects

One of decentralized finance crypto’s strongest points, permissionlessness, is ironically its weakest link too. Its openness attracts everybody, including those with malicious intentions.

Grifting is a common occurrence here, with rug pulls leading the way. In this scam, unscrupulous developers hype a new project, attracting unwitting investors. They then withdraw the funds, leaving their victims holding worthless tokens.

To avoid falling for such schemes, you must research projects thoroughly. Also, be extra vigilant about projects promising impossible returns.

Regulatory Uncertainty

DeFi is still in its nascency. Consequently, many governments are still grappling with how to classify and regulate the different asset classes falling under its ambit.

This uncertainty creates risks for developers and users, as new regulations could impact the legality or functionality of certain protocols/products. Overcoming this challenge requires watching crypto regulation news and trends in your jurisdiction.

Scalability and High Gas Fees

While the growing adoption of DeFi is a major boost for mainstreaming crypto, it comes with a special challenge – the scalability of existing infrastructure. Most popular protocols run on the Ethereum blockchain, which is prone to clogging in periods of high traffic.

This network congestion causes high gas fees, making it uneconomical for small transactions, thus pricing out many potential users. Layer 2 solutions and alternative blockchains offer relief, but often at the cost of security or decentralization, the classic blockchain trilemma.

The Future of DeFi in 2025 and Beyond

The decentralized finance sector is quickly positioning itself as an integral part of the global financial landscape. And looking at 2025 and beyond, several key trends are shaping what its future could look like.

Institutional Adoption

Once skeptical of the concept, TradFi institutions like banks and asset management firms are now actively embracing DeFi.This institutional adoption deepens liquidity, reduces volatility, and increases the sector’s legitimacy.

But importantly, it creates a feedback loop where we reimagine TradFi concepts through decentralized lenses, creating more hybrid products such as BlackRock’s BUILD tokenized fund. Expect permissioned DeFi protocols to snowball as custody solutions mature and regulatory frameworks solidify.

Real-World Assets (RWAs) in DeFi

RWAs are increasingly entering DeFi, buoyed by their rapidly maturing infrastructure. Today, Oracle networks provide reliable price feeds for non-crypto assets, while legal frameworks are emerging to ensure proper asset backing and compliance.

Moreover, Smart contracts are evolving to handle complex asset characteristics like dividend distributions and voting rights. As this infrastructure solidifies, we’ll likely see traditional assets migrating to blockchain-based systems not as an alternative, but as the primary method of issuance and trading.

Role of Layer 2 and Cross-Chain DeFi

High gas fees and slow transaction times have long plagued Ethereum, DeFi’s hub. However, Layer 2 (L2) scaling solutions like optimistic and zero-knowledge (ZK) rollups are changing the game. These “express lanes” run on Layer 1 blockchains, allowing off-chain transaction processing.

Thus, they increase throughput and drastically reduce costs, making DeFi applications accessible. Meanwhile, cross-chain DeFi through sidechains and bridges supports the seamless movement of assets and data across blockchains. This is essential for a future where users won’t care about which network they’re on, as liquidity becomes more unified across the entire crypto ecosystem.

Regulation and Mainstream Integration

Governments and financial bodies worldwide are actively working on regulating digital assets. While some purists may view this as a threat to decentralization, it’s a necessary step for mainstream DeFi integration.

We’re seeing more regulation on stablecoins and digital securities, through legislation like the EU’s MiCA framework and the US’s Genius Act. These laws will provide legal certainty and encourage institutional participation.

Regulatory clarity will pave the way for DeFi to become a more legitimate and accessible alternative to traditional finance.

[ad_2]