[ad_1]

BTCFi, short for Bitcoin Decentralized Finance, refers to financial services like lending, borrowing, and trading that run on Bitcoin or its layers. These innovations aim to let you do more with your BTC than just HODL. In this guide, you will learn what BTCFi is, how it works, its key protocols, and how it compares to DeFi on Ethereum.

In this guide:

- What is BTCFi?

- How Bitcoin enables decentralized finance

- Key protocols in Bitcoin’s DeFi ecosystem

- BTCFi. vs. Ethereum DeFi in a nutshell

- What’s next for Bitcoin DeFi?

What is BTCFi?

Put simply, it’s about unlocking Ethereum-like DeFi capabilities for Bitcoin. Traditionally, Bitcoin was seen purely as a store of value or for simple payments, while blockchains like Ethereum took the lead in DeFi with smart contracts and complex DApps.

However, interest in Bitcoin-based DeFi is rising for a few key reasons. These include:

Huge capital base

Bitcoin is the largest cryptocurrency by market value, and even a small percentage of BTC entering DeFi could unlock massive liquidity.

Until now, many Bitcoin holders have used wrapped BTC on Ethereum to chase yields. So, if DeFi becomes viable on Bitcoin itself, odds are high some of that activity could shift back from Ethereum.

Security and resilience

Bitcoin’s blockchain is known for its reliability and has never been breached at the protocol level. Notable outages on other chains (like Solana’s five-hour halt in February 2024) make a case for building DeFi on Bitcoin’s more resilient network.

The idea is that Bitcoin’s conservative design might offer a steadier foundation for DeFi apps — it’s basically trading off some flexibility for security.

Impact of new tech breakthroughs

Bitcoin’s early limitations are fading thanks to scaling upgrades and smart contract layers.

For reference, Rootstock’s total value locked (TVL) stood at around $172 million as of April 9, 2025. This figure reflects overall activity across the Rootstock network — not just BTCFi — but it underscores how Bitcoin-native ecosystems still trail Ethereum in total liquidity. The decline in TVL mirrors broader market conditions rather than signaling weakness in Bitcoin DeFi alone.

Rootstock TVL (overall): DeFiLlama

Still, there are strong signs of momentum. The supply of Bitcoin held by long-term holders continues to rise, matching increased institutional interest and the creation of a U.S. strategic Bitcoin reserve.

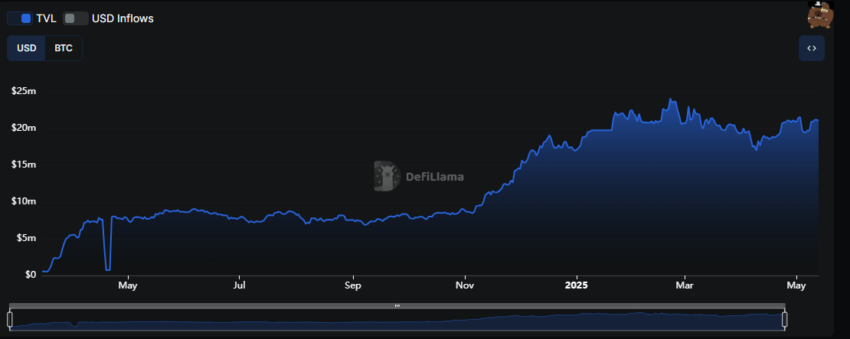

BTCFi has seen a 2,767% surge in TVL over the past year, driven by new protocols, cross-chain integrations, and demand for native Bitcoin-based financial infrastructure — rather than routing BTC to Ethereum or other chains.

BTCFi TVL: DeFiLlama

If interest rates are cut in 2025, this could further support appetite for higher-risk assets, especially Bitcoin, which now has expanding on-chain utility.

Meanwhile, integrations with platforms like LayerZero and Meson Finance also point to long-term potential. Together, these developments are positioning Bitcoin to support more complex financial applications directly on its own network — not as a proxy through wrapped tokens elsewhere.

How Bitcoin enables decentralized finance

Isn’t Bitcoin too limited for DeFi? It’s true to an extent, considering Bitcoin’s base layer was never built for smart contracts. Unlike Ethereum, Bitcoin uses a restricted scripting language that doesn’t support the complex logic needed for DeFi apps like lending or decentralized exchanges.

So, here’s how BTCFi works:

It all depends on the external layers and sidechains that extend Bitcoin’s capabilities without altering its core.

- Lightning Network: This layer-2 protocol allows near-instant BTC payments at low fees by handling transactions off-chain and only settling final balances on Bitcoin’s mainnet. While Lightning isn’t built for DeFi contracts, it lays the groundwork for high-volume BTC transfers, which other protocols can build on.

- Sidechains and connected chains: These are independent networks that peg into Bitcoin. Some, like Rootstock (RSK), use a 1:1 pegged token (RBTC) to bring Bitcoin into a smart contract environment. Others, like Stacks, write smart contracts and settle their final state on Bitcoin. This lets you use BTC in DeFi-like systems without changing Bitcoin’s core protocol.

Key protocols in Bitcoin’s DeFi ecosystem

Bitcoin’s DeFi ecosystem is growing through protocols that add smart contract and asset-layer functionality without altering the base chain.

Stacks: Stacks is a separate blockchain that settles on Bitcoin using proof-of-transfer. It supports smart contracts, NFTs, and DeFi apps via the Clarity language. STX is used for gas and governance, and STX holders can earn BTC through “Stacking.” While BTC isn’t directly programmable, Stacks apps can observe and react to Bitcoin activity.

Rootstock (RSK): RSK is a Bitcoin sidechain merge-mined with Bitcoin, running an Ethereum-compatible EVM. BTC is locked on-chain and represented as RBTC, which fuels smart contracts. Developers can port Solidity apps, enabling lending, trading, and more, all settled in BTC.

Sovryn: Built on RSK, Sovryn offers Bitcoin-native DeFi with margin trading, BTC lending, stablecoin swaps, and automated strategies. BTC and RBTC are used as the base currency. Sovryn also launched Bitcoin-backed stablecoins like DOC and DLLR, which further extend BTC’s use in DeFi.

Lightning Network + Taproot Assets: Lightning enables instant BTC transfers via off-chain channels. Taproot Assets (formerly Taro) builds on Lightning to issue tokens like stablecoins on Bitcoin. In 2025, Tether confirmed it would issue USDT using this protocol. This makes fast, low-cost, stablecoin transfers possible on Bitcoin rails.

BTCFi. vs. Ethereum DeFi in a nutshell

What’s next for Bitcoin DeFi?

BTCFi is still early but maturing quickly. What began as a few experiments has become a growing ecosystem of sidechains, layer-2s, and apps expanding Bitcoin’s capabilities. Today, you can lend, borrow, and trade BTC in decentralized ways once thought impossible. The ecosystem is smaller than Ethereum’s and faces hurdles like bridging and scaling. But progress is steady and aligned with Bitcoin’s cautious, security-first ethos. If you’re exploring BTCFi, research each platform carefully, considering that many of these platforms use new tech with unique trust models that differ from Bitcoin’s core design.

[ad_2]