[ad_1]

As bitcoin continues to lead the cryptocurrency market, its notable climb beyond previous peaks has drawn the interest of investors and supporters alike. The dominant cryptocurrency’s latest performance suggests it might approach a triple top, potentially exceeding $90,000. However, reaching the six-figure mark will be a significant psychological challenge, and it may fall short of the desired $100,000 milestone.

The Six-Digit Round Number — The Psychology Behind $100,000

In 2024, bitcoin (BTC) has once again astounded the financial world by shattering its 2021 high of $69,000 and setting a new record at $73,737 in mid-March 2024. Yet, the road ahead could bring a triple-top scenario, where bitcoin may approach but not quite reach the $100,000 mark. Bitcoin’s price movements have always been a topic of intense speculation. The digital currency’s ability to break through significant resistance levels is a testament to its strength and the bullish sentiment of its stakeholders.

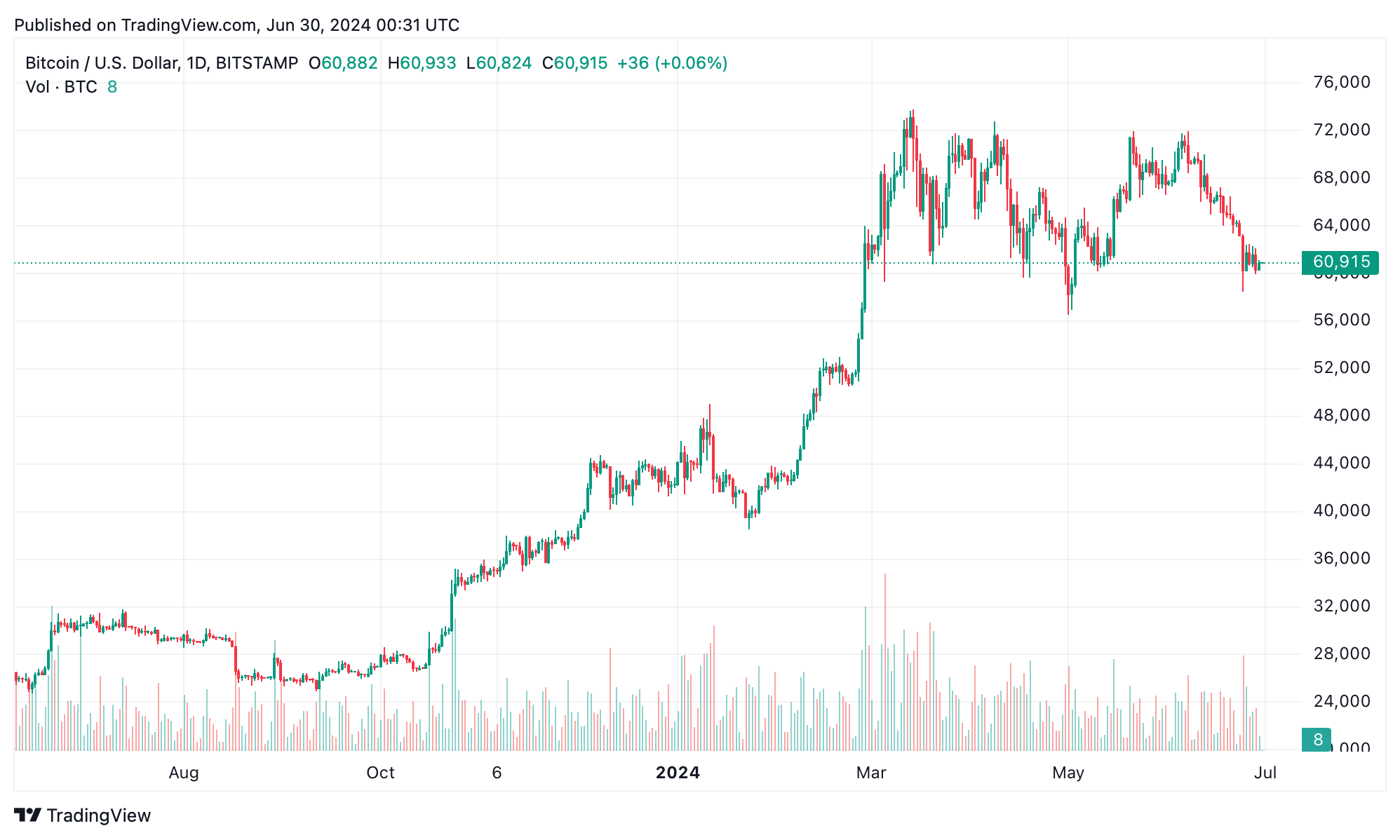

The recent climb past the 2021 peak to $73,737 on March 14, 2024, demonstrates solid market confidence. However, historical patterns indicate that after such significant gains, bitcoin typically faces strong resistance. Currently, BTC is 17% below its all-time high, and the 12-month chart reveals multiple rises above the $70,000 level. Bitcoin has closed at or above $70,000 for 14 days in 2024. Since 2013, BTC’s previous all-time highs have been fleeting, suggesting this trend might also be short-lived.

Bitcoin from June 30, 2023 to June 30, 2024. At 9:45 a.m. EDT on Sunday, BTC reached an intraday high above $61,500.

Psychology plays a crucial role in Bitcoin’s price movements. The anticipation of Bitcoin reaching $100,000 creates a psychological barrier. Few assets in the world command a six-digit price tag. Moreover, this milestone is not just a number; it represents a significant achievement and a major resistance level. As bitcoin approaches this figure, profit-taking behavior is likely to intensify significantly. People who bought in at lower prices may start selling to lock in gains, leading to price corrections.

Bitcoin’s market cycles historically exhibit periods of rapid growth followed by corrections. The current bullish phase may be part of a larger market cycle where significant gains are followed by consolidations. Numerous analysts and influencers predict BTC will surpass $100K, with several expecting the crypto asset to be well above that range by 2025. However, few talk about the chance that the price may fluctuate near the six-digit mark without fully reaching it.

Additionally, a macroeconomic event could prevent BTC from reaching that price threshold. Factors like inflation rates, interest rates, and geopolitical tensions significantly influence investor sentiment and market stability. The Covid-19 pandemic demonstrated that a Black Swan event could also impact the price. Just because bitcoin approaches the $100K range doesn’t guarantee it will hit that mark when predicted. It might take much longer to achieve that milestone, and prices just above $90,000 may be acceptable for some.

What do you think about bitcoin hitting $100,000 or higher? Do you think it is possible within the next year? Share your thoughts and opinions about this subject in the comments section below.

[ad_2]