Ethereum (ETH) is showing signals that point to shifting dynamics among its largest investors. On-chain data revealed distinct trends between different groups of whales.

This highlights uncertainty around the asset’s next move. Combined with falling exchange supply and ETH’s rising market activity, this could likely mean Ethereum is approaching a critical pivot point.

Mega Whales Pause, Mid-Tier Whales Buy—ETH at Critical Inflection Point

In a recent post on X (formerly Twitter), Glassnode, a blockchain analytics platform, highlighted that Ethereum whales showed diverging strategies.

“In August, ETH’s biggest holders moved in opposite directions,” the post read.

The mega whales, those controlling more than 10,000 ETH each, were the main drivers of ETH’s rally, accumulating over 2.2 million ETH in 30 days. However, their buying momentum has now stalled.

At the same time, the large wallets, holding between 1,000 and 10,000 ETH, shifted their strategy. After spending weeks offloading ETH, they have returned to accumulation, adding roughly 411,000 ETH in the same 30-day window. This divergence highlights that not all whale groups move together.

Diverging Behavior Among Ethereum Whales. Source: X/Glassnode

The behavioral split between whale cohorts may reflect differing risk appetites or investment horizons. Moreover, this divergence has also sparked varied interpretations among the community. Some market observers caution that the mega whales’ pause could signal a ‘bait.’

“The pause at the top is bait, the mid-tier rotation is the real tell,” FOMOmeter wrote.

This means that when the biggest whales stop buying, the market can look like it has run out of steam, tempting smaller traders to sell. This pause is the ‘bait,’ because it creates the illusion of weakness.

At the same time, mid-tier whales, who hold comparatively smaller but still significant amounts, begin shifting from selling back into buying. That rotation is the true signal of strength. It shows that informed investors are quietly accumulating while others are being shaken out.

In other words, the trap is that the rally appears to be ending. Yet, beneath the surface, demand is building for the next move higher.

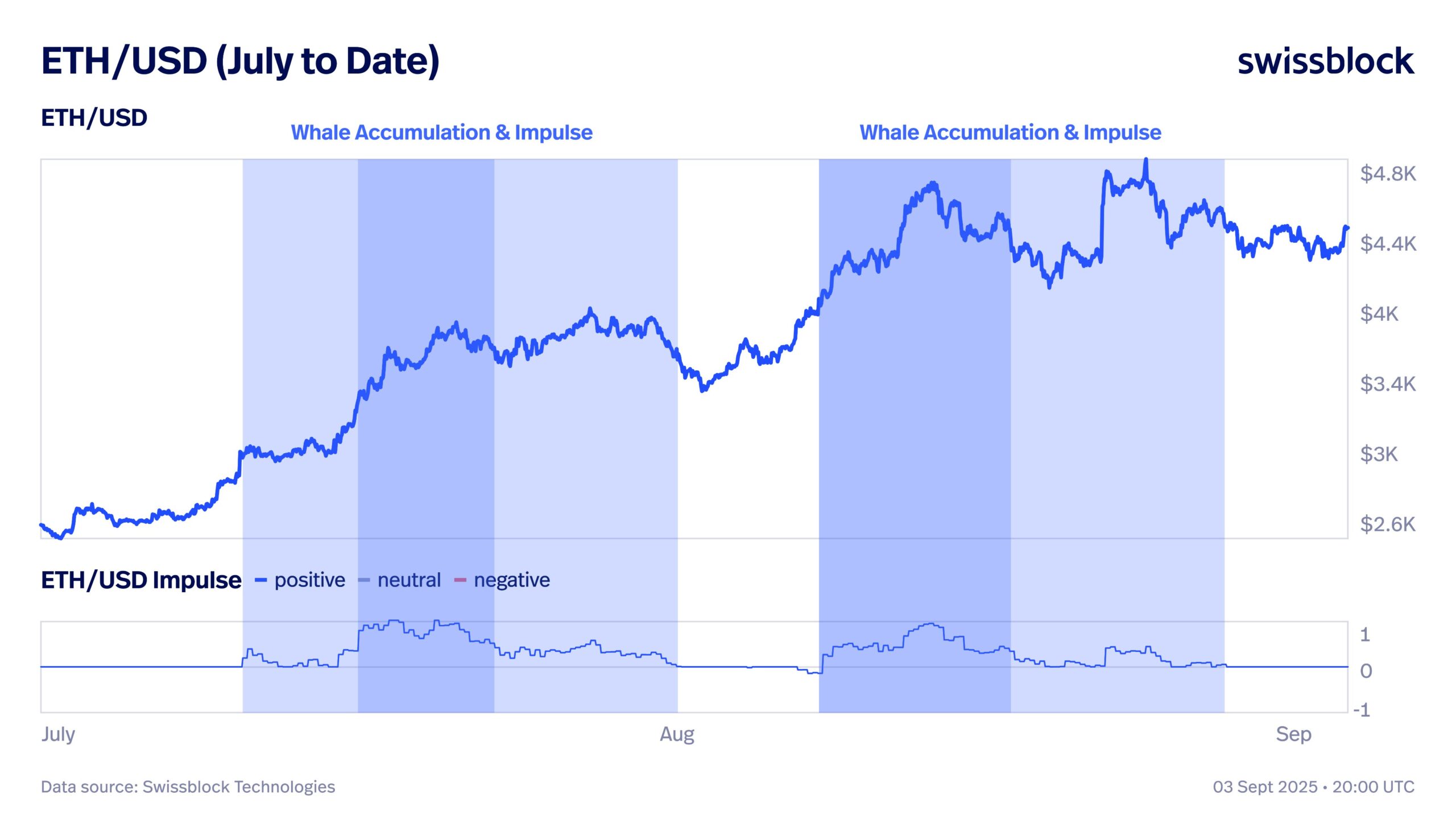

Meanwhile, Altcoin Vector noted that Ethereum’s big moves upward are closely tied to whale accumulation.

“The accumulation of whales is key: Mid-July through August showed strong accumulation by mega whales (≥10K ETH), followed by large whales (1K–10K ETH). Here’s the interesting part: those accumulation periods align with the development of ETH’s aggregate impulse,” Altcoin Vector stated.

ETH Positive Impulse and Whale Accumulation. Source: X/Altcoin Vector

The post added that to break $5,000, ETH needs renewed accumulation from whales to create a fresh impulse. Moreover, Altcoin Vector said that right now, derivatives trading is driving much of ETH’s price action rather than actual spot buying of ETH. That makes rallies less stable, since speculation can reverse quickly.

“Nevertheless, this can change if ETH breaks out and spot demand increases. Confidence in the short-term trend could resume and generate a new impulse capable of clearing the prior highs,” Altcoin Vector added.

Further supporting the optimistic case, a Kaiko report highlighted that ETH spot trading volume surpassed Bitcoin’s in early September, indicating heightened institutional and retail interest.

“There’s a major shift between BTC & ETH: $4 billion Bitcoin whale pivots to ETH, buying 886K ETH. $1.4 billion ETH ETF inflows vs BTC’s $748 million. Finally! Ethereum cross-chain UX upgrades in the works. DeFi + NFTs showing fresh upside. These sharp moves signal momentum building for ETH,” Token Metrics posted.

Ethereum vs. Bitcoin Spot Market Share. Source: Kaiko

This surge, combined with a declining exchange supply, is often interpreted as a bullish signal due to reduced selling pressure and suggests that ETH may be set for significant upside potential.

“Ethereum supply on exchanges hits 3-year LOW at 17.4 million ETH. Quant says the supply shock will be monumental for returns in Q4,” Crypto Crib forecasted.

Overall, Ethereum finds itself at a critical point. Divergent whale behavior reflects uncertainty, but tightening supply and surging trading volumes highlight the potential for sharp movements.

The post What Does the Divergence Between Ethereum Whales Mean for the Market? appeared first on BeInCrypto.