[ad_1]

The cryptocurrency industry is growing under tighter rules, as large exchanges shape their next cycle around licenses and products built to withstand regulatory scrutiny.

Instead of chasing explosive growth through speculative listings and high-leverage trading, the focus for 2026 is shifting toward sturdier foundations, such as tighter fiat ramps, compliant derivatives in more jurisdictions and building out stablecoin and tokenization rails.

Cointelegraph spoke with Haider Rafique, global managing partner at OKX, to unpack how major exchanges are preparing for the year ahead.

OKX signals ambition to dominate licensed onshore crypto markets. Source: Haider Rafique

Exchanges are leaving their onshore footprints

Rafique said that OKX has already done the hard part: obtaining the regulatory green light to operate in almost all the regions it cares about.

“We anticipate there’s going to be continued regulatory clarity in 2026,” he said, “mainly in the US and hopefully in other parts of Europe.” That will enable OKX to bring more of its derivatives franchise “onshore.”

The exchange now runs licensed services across the European Union (EU) from a Malta hub under the Markets in Crypto Assets (MiCA) license. It also holds a license in Dubai, operates registered entities in Australia, a central bank‑approved payments business in Singapore and a US platform that is licensed as a money transmitter in most states.

Related: OKX reports trading increase after expansion into US, EU

It also maintains locally compliant operations in markets such as Brazil and Turkey, making it, in Rafique’s words, “probably the most licensed exchange in the world our size.”

That’s a bold claim as OKX is not the only exchange that has been on a licensing spree lately.

Coinbase holds dozens of licenses and registrations across 45 US states and multiple international jurisdictions, and in June secured an EU‑wide MiCA license in Luxembourg.

Bybit has also obtained MiCA authorization via Austria and a nod from the United Arab Emirates Securities and Commodities Authority. Binance’s licensing list includes 20 licenses and registrations in various jurisdictions.

In 2026, Rafique said the job for OKX is to ensure its licenses find success through localized, “fine-tuned” products and fiat on-ramps.

Stablecoins as the new cash leg

OKX’s first big structural bet in 2026 will be stablecoins. The global stablecoin market cap climbed to about $310 billion in 2025, led by Tether’s USDT and USDC.

Rafique argued that exchanges are quietly transforming stablecoins into yield‑bearing financial products.

“If you put your money in a bank, you’re losing between 8% and 40% in high‑inflation markets,” he said, adding that funds also have to be locked up. In contrast, stablecoins let users park their crypto and earn with no lockup.

Related: Binance secures ADGM licenses to operate international platform

As benchmark interest rates have climbed into the mid‑single digits, yields on yield‑bearing stablecoins and centralized ‘earn’ products have also settled in roughly the 4%-8% range, instead of the double‑digit payouts seen in earlier cycles.

Paxos’ USDL, for instance, launched with a roughly 5% annual yield in 2024, while major exchanges such as Kraken and OKX market around 5% rewards on idle USDT and USDC balances.

Stablecoin balances on exchanges climbed to record or near‑record levels in 2025, according to Coin Metrics, highlighting the shift toward yield‑plus‑liquidity products.

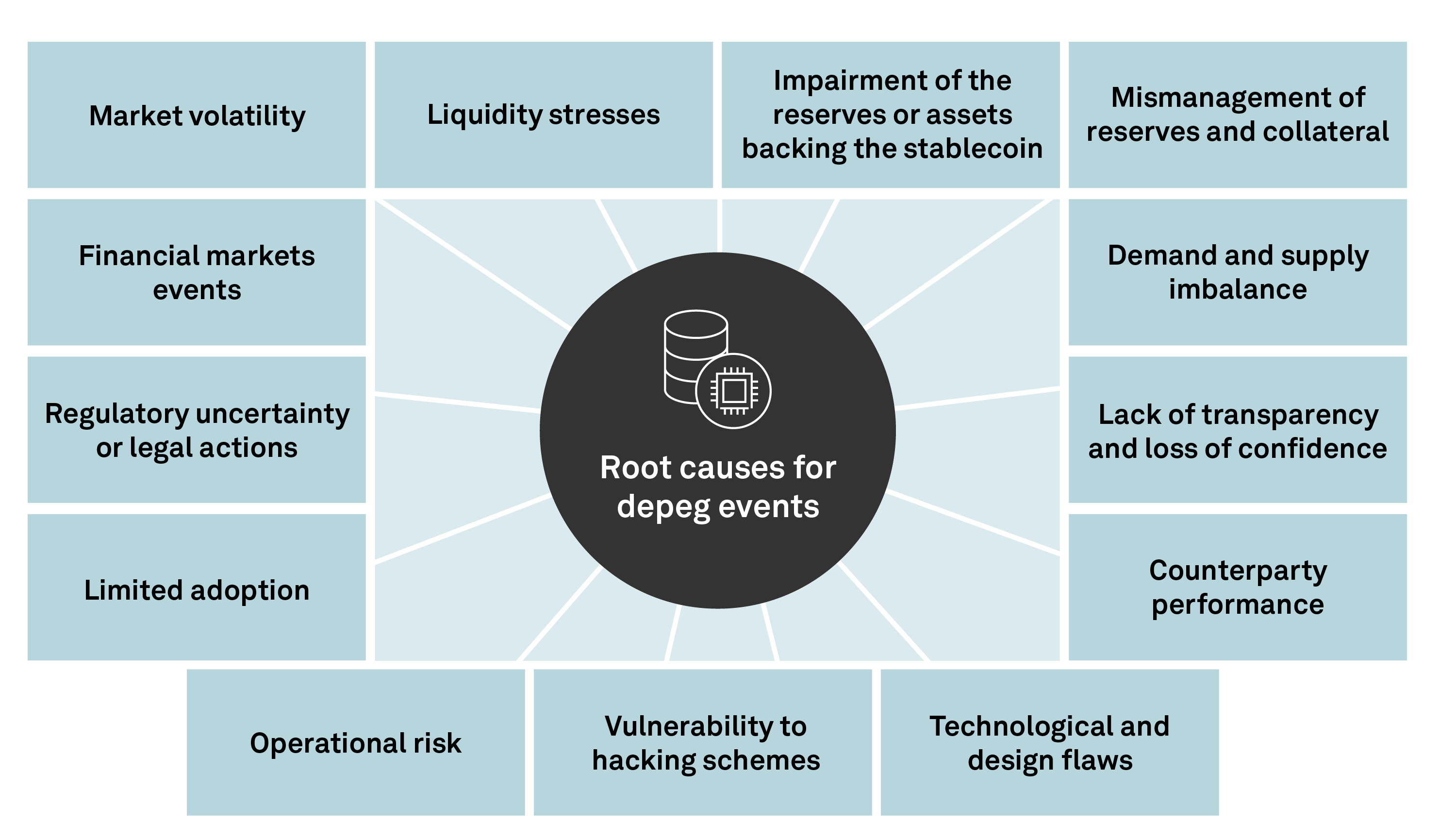

Still, S&P Global, warned in a 2023 research that stablecoins are not risk-free as they can be vulnerable to de-pegging. The tokens are also “subject to market volatility, market confidence and adoption, technology risk, demand and supply, and market liquidity.”

Understanding root causes for depeg events | Source: S&P Global

Elsewhere, the European Central Bank has warned that stablecoins pose global financial stability risks and could draw retail deposits away from eurozone banks, sparking a sell-off of reserve assets.

Tokenization, RWAs and the 2026 product slate

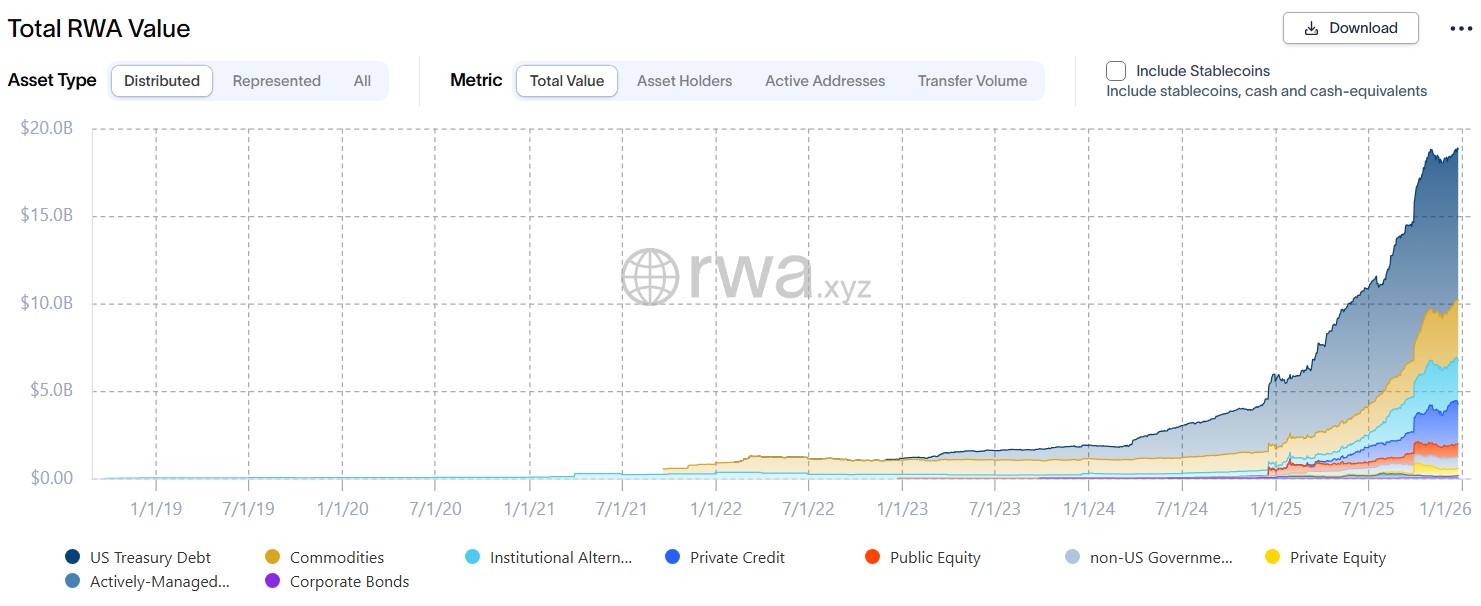

Beyond stablecoins, exchanges are gearing up for the real‑world asset (RWA) tokenization wave. The market for onchain tokenized assets climbed from under $10 billion in 2022 to more than $19 billion in 2025, and research from 21.co projects it to $5 trillion by 2030.

The RWA market started to attract sustained institutional interest in 2025. Source: RWA.xyz

Rafique said that RWAs are “in the very early innings,” pending regulatory clarity on whether tokenized assets qualify as utilities or securities. Once that distinction crystallizes, “companies are going to take this really seriously,” bringing commodities, stocks, and metals like gold and silver onchain, wrapped and tradable in exchanges.

A survey by a16z found that around half of US Gen-Z and millennial adults now own or have traded crypto in the past year, putting digital assets on par with direct stock ownership for many younger investors.

For Rafique, that’s why tokenized stocks and RWAs belong on exchange apps. They bring traditional assets into the venue that younger users already treat as their primary market.

Building for a less explosive Bitcoin

Underpinning OKX’s strategy is a more tempered view of Bitcoin’s (BTC) future, as the asset’s leading indicators shift from hype toward macroeconomic forces. Rafique said he sees BTC as increasingly tied to US Treasury yields, rate expectations, and equity correlations.

“I’m not like other folks where I’ll come up with a really obnoxious number,” he said when asked his Bitcoin price prediction for 2026.

His bear case for BTC is around $90,000, which rises to a range between $150,000 and $200,000 if rates ease and liquidity returns. He rejected “extreme bull cases” as reckless optimism that mislead retail investors.

“I don’t want people to lose their shirts,” he said.

That view defines OKX’s product lens for the coming year: treating crypto less like a once‑in‑a‑lifetime lottery ticket and more like a core macro asset that drives steady spot, derivatives and RWA flows across its newly licensed markets.

[ad_2]