[ad_1]

Bitcoin’s current behavior mirrors its path in a previous halving cycle. What can we expect from the next halving?

Following the U.S. SEC’s approval of spot ETFs on Jan. 11, Bitcoin (BTC)began a bullish streak, soaring to impressive heights.

Bitcoin hit a new all-time high of $73,750 on Mar. 14. However, this peak was short-lived as Bitcoin experienced a correction, dropping to levels around $60,000 to $61,000 on Mar. 20.

Amid bullish sentiments, Bitcoin recovered from this dip. As of Mar. 22, it trades at around $63,000.

According to a report by Coinbase, Bitcoin’s current path mirrors its behavior in 2018-2022, where Bitcoin witnessed a remarkable 500% increase from its lowest point in the cycle.

For those unfamiliar, the Bitcoin network halves the rate at which it generates new Bitcoins approximately every four years in an event known as the Bitcoin halving. This built-in feature of Bitcoin’s code aims to control its inflation rate.

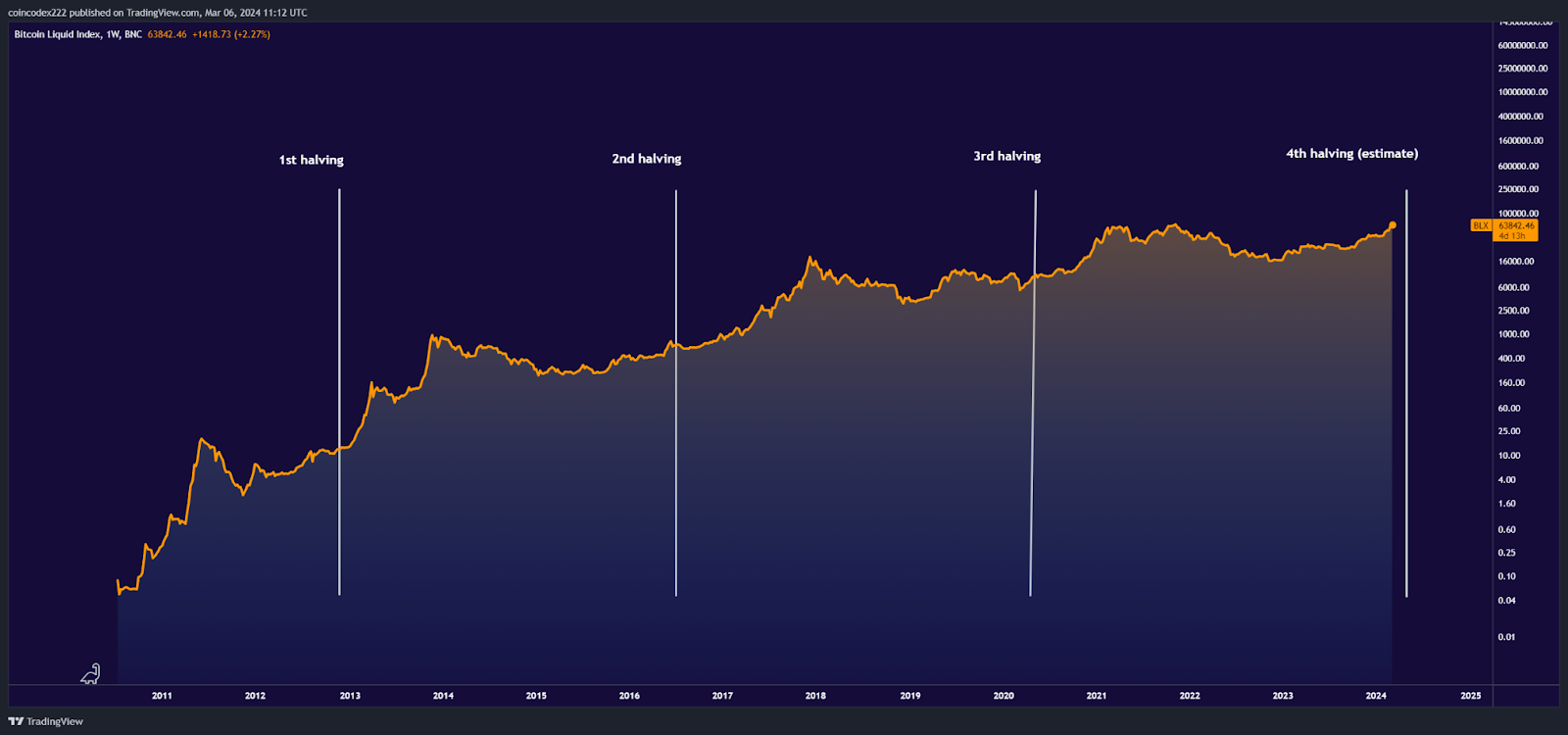

Historically, Bitcoin has followed a pattern surrounding its halving events. It usually experiences a price increase leading up to the halving, followed by a period of correction or consolidation, before ascending to new highs post-halving.

BTC halving price chart | Source: TradingView

Let’s delve deeper into Bitcoin’s past cycles, examine its behavior, and predict its potential direction in the current cycle.

The first halving: 2012

The first halving event in 2012 reduced the block reward from 50 to 25 BTC, slowing down the rate at which new Bitcoins entered circulation.

During this time, Bitcoin was largely flying under the radar, and it was known within niche tech communities. It wasn’t until the price skyrocketed from double digits to over $1,000 in 2013 that it began to capture mainstream attention.

You might also like: Why aren’t large Bitcoin holders selling despite high prices? Insights and analysis

Despite this surge, the broader financial world dismissed Bitcoin as a passing fad, failing to recognize its potential.

Following this meteoric rise, Bitcoin experienced a quick correction, with prices falling back to around $200 by 2015.

Critics were quick to declare the end of Bitcoin, citing the burst of what they deemed a speculative bubble. However, as subsequent cycles have shown, such claims were premature.

The second halving: 2016

In July 2016, Bitcoin underwent its second halving, reducing the block reward from 25 to 12.5 BTC. This event garnered widespread attention as Bitcoin had already started to gain traction in the mainstream financial world.

Before the 2016 halving, Bitcoin exhibited a somewhat bullish pattern. In January that year, prices hovered around $430, climbing to over $750 by early June, ahead of the halving.

However, as the halving event approached, the price experienced some volatility, dipping to around $590 by the end of Jun.

Following the completion of the halving, Bitcoin entered a period of consolidation, trading sideways for several months. However, this phase was short-lived as the effects of the halving began to materialize.

By Dec. 2017, approximately 1.5 years after the halving, Bitcoin had surged to new heights, reaching above $19,000, making over 12,000% gains in that cycle.

BTC price chart from Jan. 2016 – Dec. 2017 | Source: CoinGecko

The second halving saw Bitcoin taking the spotlight, attracting widespread media attention. Alongside Bitcoin’s rise, there was a proliferation of altcoins and initial coin offerings (ICOs), which unfortunately brought a wave of scams and failed projects.

You might also like: Scammers on the rise: three on-chain cybersecurity predictions for 2024 | Opinion

The third halving: 2020

Leading up to the 2020 halving, Bitcoin displayed a consolidation phase. In early January, prices traded in a narrow range of $7,000 to $7,500. As the year progressed, Bitcoin’s value saw modest gains, reaching around $9,000 in anticipation of the halving.

Following the halving, Bitcoin witnessed a notable uptick in momentum as the supply of new coins became scarcer.

You might also like: The flippening debate: can Ethereum surpass Bitcoin?

By November 2020, Bitcoin had surged to around $15,000, marking an uptick from its pre-halving levels. This upward trajectory continued, resulting in Bitcoin reaching a new all-time high of nearly $69,000 in Nov. 2021.

BTC price chart from Jan. 2020 – Nov. 2021 | Source: CoinGecko

BTC gained about 2,000% during this cycle, which was lower than in previous cycles but still significant enough.

It’s worth noting that the 2020 halving occurred amid the backdrop of the COVID-19 pandemic, a global crisis that disrupted economies and financial markets worldwide.

Despite the turmoil, Bitcoin’s price pattern largely adhered to the established cycle, demonstrating its resilience in the face of external challenges.

During this period, prominent institutional investors, such as Paul Tudor Jones and Michael Saylor, publicly announced their allocations to Bitcoin, signaling a growing acceptance of the crypto among traditional investors.

The third halving cycle also reiterated the familiar pattern observed in previous cycles: a surge in price leading up to the halving, followed by a brief correction and consolidation phase before a significant bull run. The peak occurred approximately 18 months post-halving, consistent with historical trends.

What to expect from the next halving?

Reddit users suggest we’re on the cusp of a bull market. Yet, this time, it’s not just about halving.

Many see the spot BTC ETFs as a game-changer, a sign that Bitcoin is moving from the fringes to the mainstream financial world.

Michaël van de Poppe, a well-regarded crypto-analyst, echoes this sentiment. He suggests that we are entering an “institutional cycle” marked by huge capital inflows into the market, as evidenced by recent ETF activities. According to van de Poppe, this sets the stage for a bull cycle unlike any before.

#Bitcoin to $200,000 or $500,000 in this bull cycle?

It’s the institutional cycle.

This means that an influx of money, which the markets haven’t seen before, is coming to the markets. The recent inflow in the ETF has shown interest.

What does that mean? Where’s the top? ⬇️… pic.twitter.com/hxTZMQvetl

— Michaël van de Poppe (@CryptoMichNL) February 10, 2024

Van de Poppe questions the “diminishing returns” theory, which suggests each crypto bull cycle will peak lower than before.

He highlights technological advancements and institutional investments as drivers for potentially unprecedented market highs, arguing that peaks might hit anywhere between $250,000 to $600,000, or even more, as markets often outdo expectations.

Van de Poppe also speculates that we might be on the brink of a “Crypto Dot.com” bubble, drawing parallels to the dot-com bubble of the late 1990s.

However, he anticipates this crypto cycle could last longer, influenced by economic elements like liquidity and interest rates.

He cautiously predicts a peak in Q3/Q4 2025, with the potential for the bull cycle to extend into 2026 or 2027, depending on economic conditions.

Yet, he warns of a subsequent crash and advises investors to focus on purchasing power rather than USD valuations.

Looking forward

Experts predict the next Bitcoin halving will likely happen around late April, though it might stretch into May.

Every halving brings its market patterns, and the next one will too. So, prepare for some ups and downs, and be careful with your trades.

Read more: The Bitcoin effect: why altcoins follow BTC’s lead

[ad_2]