[ad_1]

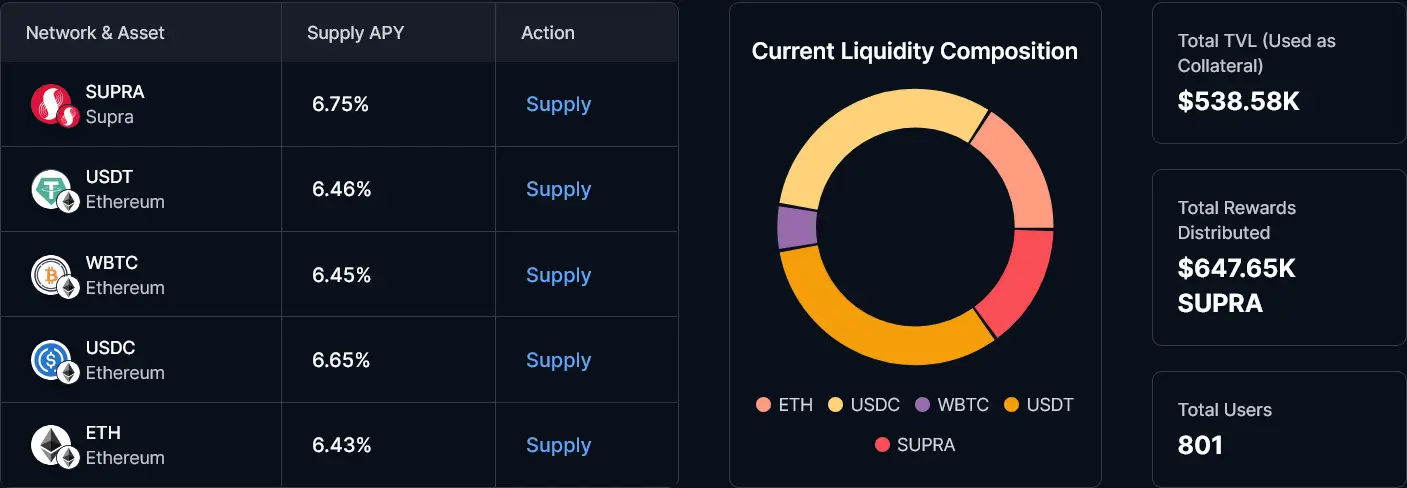

iAssets are Supra’s liquid staking tokens that let you earn passive $SUPRA rewards while keeping your crypto fully usable in DeFi. Deposit ETH, USDC, WBTC, or $SUPRA into Supra’s IntraLayer Vault, receive a wrapped version (like iETH or iUSDC), and start collecting block rewards without locking anything up. The feature launched its bootstrap phase in mid-January 2026 and has already attracted over $538,000 in Total Value Locked.

How Do iAssets Work?

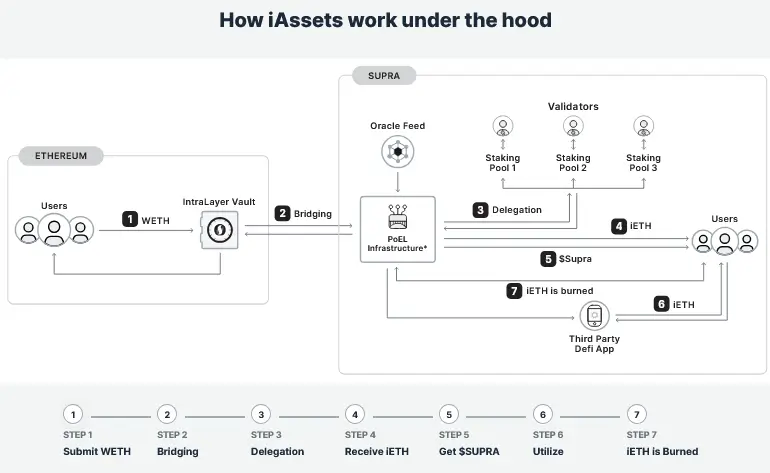

The process is straightforward. You deposit a supported asset through SupraNova.ai, Supra’s bridging and vault interface. The vault mints your corresponding iAsset at a 1:1 ratio. Hold that iAsset, and you passively accumulate $SUPRA rewards from block production. Early reports show stablecoins like iUSDC earning around 6.5% to 6.75% APY as a base rate.

Your iAsset stays liquid. You can lend it on Supralend, use it as collateral to borrow other tokens, or deploy it in yield farming strategies. Each layer stacks: base staking rewards, plus lending APY, plus any additional farming incentives. When you want out, burn the iAsset and reclaim your original deposit along with accrued rewards.

This setup runs on Supra’s Proof of Efficient Liquidity (PoEL) protocol. Deposited assets serve as collateral supporting network validation and security. The rewards generated from those operations flow back to iAsset holders.

How iAssets work (supra.com)

What Is Supra?

Supra is a Layer-1 blockchain that launched its mainnet in November 2024. The network claims performance of up to 500,000 transactions per second with sub-second finality, powered by its Moonshot Consensus algorithm. Testing occurred across 300 globally distributed nodes.

Supra’s edge is vertical integration. The chain includes native decentralized oracles delivering price feeds with full finality in 600 to 900 milliseconds. It offers verifiable randomness (dVRF), native cross-chain messaging through IntraLayer, and AutoFi for onchain automated DeFi execution without external keepers. MoveVM runs natively, with EVM and SolanaVM support planned.

The project has raised funding from investors, including Animoca Brands and Hashed. The native $SUPRA token handles gas fees, staking, governance, and rewards across the ecosystem.

What’s the Current Status of iAssets?

Adoption has been fast. January 14 marked the first liquidity phase, with $iSUPRA available for staking and DeFi use. As of mid-January, iAssets TVL has reached over $538,000 with 801 users participating. Supra’s overall chain TVL sits around $2.35 million.

January 19 brought a significant milestone when iAssets went live on Supralend, Supra’s native lending protocol. Users can now lend their iAssets to earn dual yields: the base lending APY plus PoEL staking rewards. Alternatively, they can borrow against iAssets without giving up their staking position.

Additional integrations are expanding utility. Atmos Protocol now offers boosted LP rewards for iAsset holders. The team has emphasized a controlled, sustainable approach focused on monitoring growth patterns rather than chasing hype metrics.

iAssets APY and Liquidity (supra.com)

Who Benefits from iAssets?

For holders, iAssets put dormant crypto to work. Stablecoins sitting in a wallet can earn roughly 6.5% or more, depending on how you stack yields. Blue-chip holdings like ETH and (W)BTC generate returns while staying available for other opportunities.

For the broader ecosystem, liquid staking tokens increase composability. More usable collateral means more lending activity, more borrowing demand, and higher overall TVL. Validators and the network also benefit since PoEL diversifies collateral sources beyond just native token staking.

Conclusion

iAssets offer a practical solution to DeFi’s classic staking tradeoff: earn yield without sacrificing liquidity. Built on a high-performance L1 with native oracles and automation, the feature is seeing strong early traction. With Supralend integration now live, the path to compounding multiple yield sources is open.

For more information, visit the official website at supra.com or follow Supra on X at @SUPRA_Labs.

Sources:

- Supra Official website and documentation for Supra blockchain and iAssets

- SupraNova Supra’s official bridging and vault interface for iAsset minting

- Supra on X Official announcements regarding iAssets bootstrap phase and TVL milestones

- DefiLlama TVL data for Supra blockchain

[ad_2]