[ad_1]

DeFi yield protocols see significant retail activity, yet only a handful of wallets make up the bulk of value locked. Yields for stablecoin and other deposits are still mostly a DeFi tool used by whales.

The bulk of value locked in yield protocols comes from whale wallets, where just 5.4% of user deposits make up 94.3% of total value locked. Retail deposits make up 62% of the total raw number of inflows, though contributing only a small amount to each protocol’s TVL.

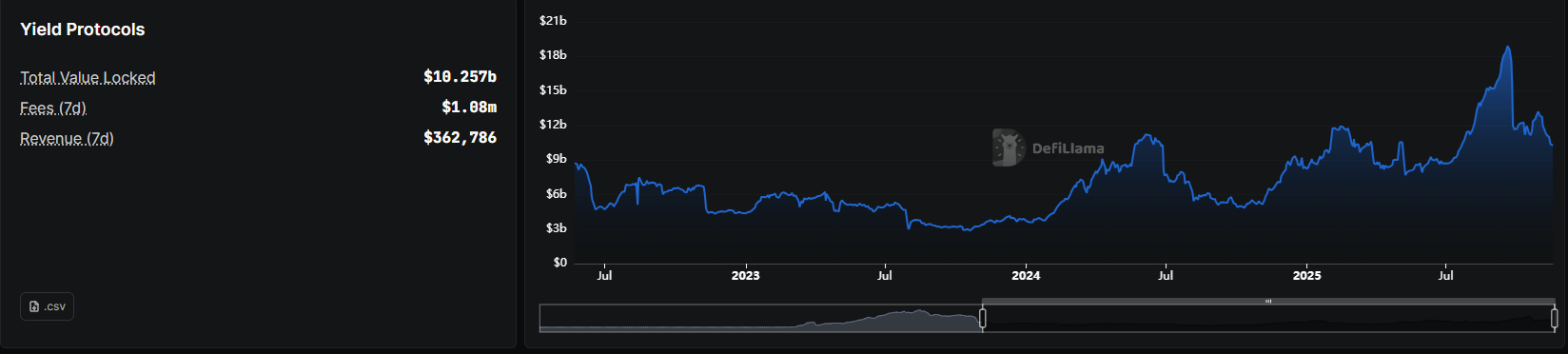

Whales are driving yield protocol liquidity, with most deposits coming from a handful of wallets. | Source: DeFi Llama

Yield protocols lock in a total of $10.28B, still unable to recover the 2021 levels of over $26B locked. In 2025, both protocols and depositors are more conservative and are operating under updated stablecoin rules.

Yield protocols also met with competition from lending vaults, which offer a similar service. However, lending vaults faced recent skepticism after several cases of liquidations due to flawed risk curation. Lending protocols still contain more liquidity compared to older yield protocols, standing at over $66B.

Will DeFi become institutional?

DeFi initially started as a way for retail trenches to gain risky yield, or trade without KYC. After the initial wave of permissionless trading, DeFi evolved.

In 2025, DeFi has already seen significant presence from whales and institutions. Whales are usually using their reserves from previous cycles, while institutions are more confident in using stablecoins and have larger reserves.

The top 10 depositors on Aave, for instance, make up over 51% of all value locked. On Morpho, the top 10% of depositors make up 90% of the value locked. Token holder distribution for DeFi tokens is also often skewed toward whale ownership.

The activity of retail wallets has been the main driver of transactions on DeFi protocols. However, the top users and depositors are whales or institutions. This also has repercussions for airdrops and point farming, where large entities reap the biggest rewards, while retail is left with fees and activity, but no significant allocation.

Institutional-grade DeFi also brings back limitations such as KYC or even excluding certain participants. Separate liquidity or restricted assets are changing the initial nature of DeFi as a permissionless trading venue.

DeFi liquidity drops in the past month

Overall liquidity in DeFi, DEX, yield protocols and lending protocols decreased in the past month. Top protocols slid by around 16%, bringing down total value locked to $125B.

In October, DeFi recovered its levels from 2021, briefly locking in over $165B. This time around, protocols were more conservative and survived even the de-pegging of several minor stablecoins.

DeFi still contains risks with low transparency, especially when depositing funds to synthetic stablecoin protocols.

[ad_2]