Technical analyst Ali Martinez has said that the drop in crypto prices has allowed whales to accumulate more assets. In a post on X, Martinez reported that 342 new wallets holding more than 100 BTC were created as Bitcoin dipped from $104,000 to around $90,000.

According to Martinez, whales are buying every dip as a sign of their strong bullishness about Bitcoin. He added that the price correction is merely a test of investors’ resilience, and those who took advantage are best positioned to ride the next wave.

He said:

“This correction is a test of resilience, and if you play it right, you’ll be positioned to ride the next wave. This is how the 1% operates—buying fear while the rest of the market hesitates.”

Meanwhile, whales’ acquisition during the dip is not completely surprising. Crypto analyst Mac_D observed that Coinbase Premium surged while the Bitcoin price fell. Coinbase Premium describes the percentage difference between the price of BTC on Coinbase Pro and Binance, usually indicating the time when US institutional investors are buying. The rebound in the Premium implies that US investors buy heavily when there are massive sell-offs on Binance.

Bitcoin Coinbase Premium surged as price fell – (Source: CryptoQuant)

The analyst noted:

“This rebound suggests that when excessive panic selling occurs on Binance, which has a higher proportion of small investors, U.S. institutional investors are likely to adopt an aggressive buying strategy.”

Interestingly, Bitcoin is not the only asset investors bought because of its dip. Onchain data also show that whales bought more than 100 million XRP as the token price fell due and retail sold in panic.

Analysts predictions come true as crypto prices rebound

Meanwhile, the dip now appears to be over for now, as almost every crypto asset has seen a surge in price over the last 24 hours. Bitcoin which fell as low as around $94,000 is now back above $101,000 after over 6% increase in its value.

With the rise in Bitcoin price, every other major cap token has followed, with XRP seeing the most gains in 24 hours at 18%, according to CoinMarketCap. SOL also increased by 10%, while BNB, DOGE, and ADA added 5%, 8%, and 13%, respectively.

Most analysts who predicted the rebound were not surprised. According to Santiment analysts on December 10, the FUD among traders who expect Bitcoin to drop below $90,000 is a positive sign of incoming retail capitulation. This is a good sign, as prices tend to move against market expectations.

They wrote:

“FUD is beginning to appear amongst traders. With some calls for $80K-$89K appearing across social media from the crowd once again, take this as a positive sign that retail capitulation is returning. Prices move the opposite direction of crowd expectation, meaning fear is generally necessary for prices to rebound.”

However, Cryptoquant founder Ki Young Ju explained the quick rebound, noting that price corrections for BTC will be relatively small in this bull cycle. He attributes this to steady demand from institutions and exchange-traded funds (ETFs).

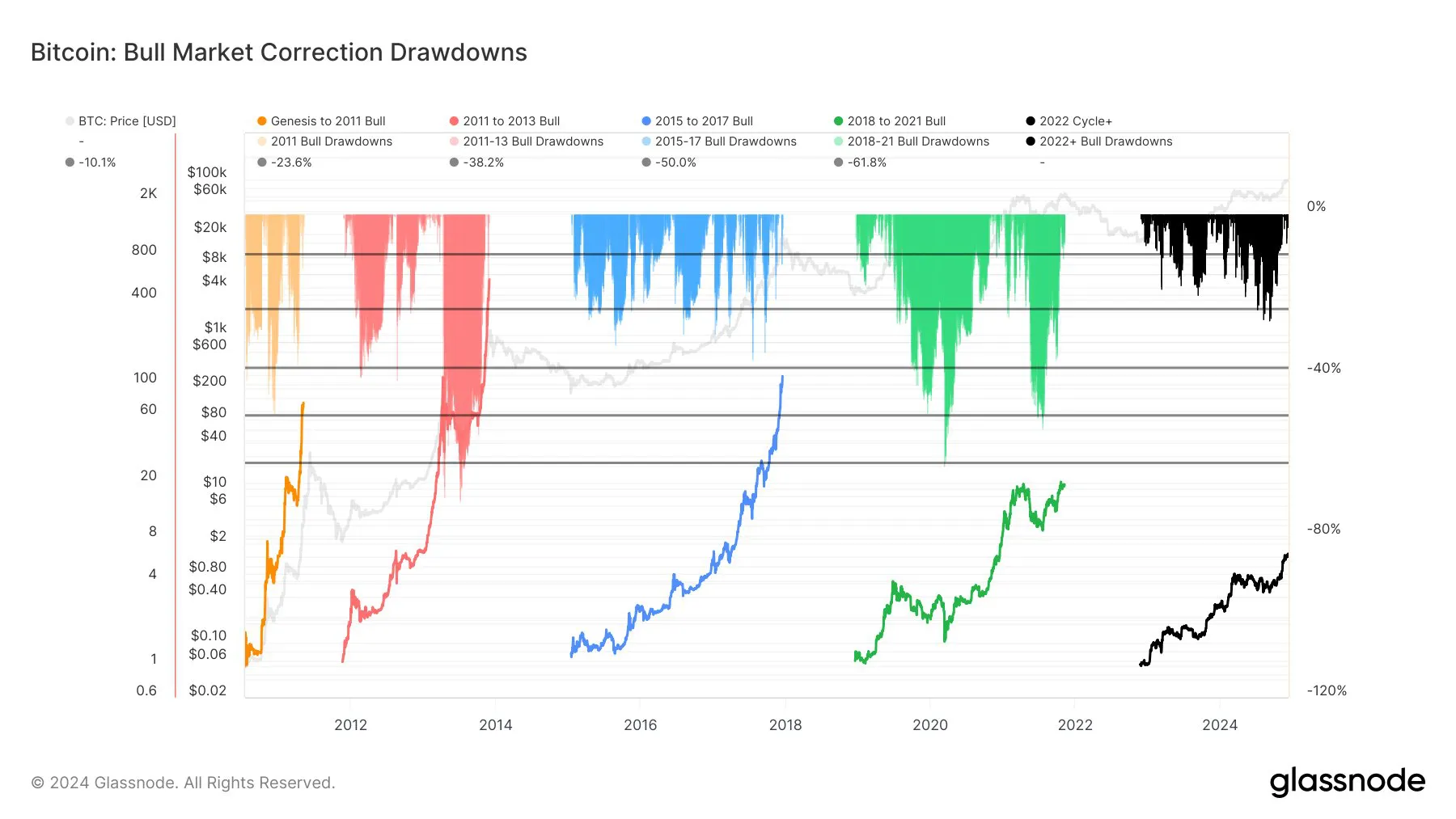

This has been the least volatile Bitcoin bull cycle (Source: Glassnode)

Glassnode data also supports this, with analysts noting that the average drawdown since 2022 is -7.68% compared to -16.24% overall. The maximum drawdown for this cycle is only -26.25%, far smaller than the -71.15% between 2011 and 2013. This shows that this cycle has been the least volatile for Bitcoin.

Bitcoin bull cycle expected to last longer as distribution continues

With Bitcoin returning to over $100,000 again, there are already some concerns about how long the good times will last. Experts at Glassnode believe the bull cycle is still in the mid-to-late stage with the potential for more price increases. They noted that cyclical long-term holders (LTH), excluding the ultra LTH who have held for over seven years, now have less than 50% of the BTC supply.

Generally, these LTHs hold the majority of BTC at the beginning of the bull cycle, and by the peak, their supply has dropped, and short-term holders (STH) have around 70% – 80%.

Although the ETFs have changed the dynamics to some extent, STH still only holds around 50%, far below the over 80% they had when the market peaked in 2021. However, the level of distribution has increased over the last 30 days, with the Long/Short-Term Holder Supply Ratio dropping to 3.78, which is the lowest it’s been this cycle.

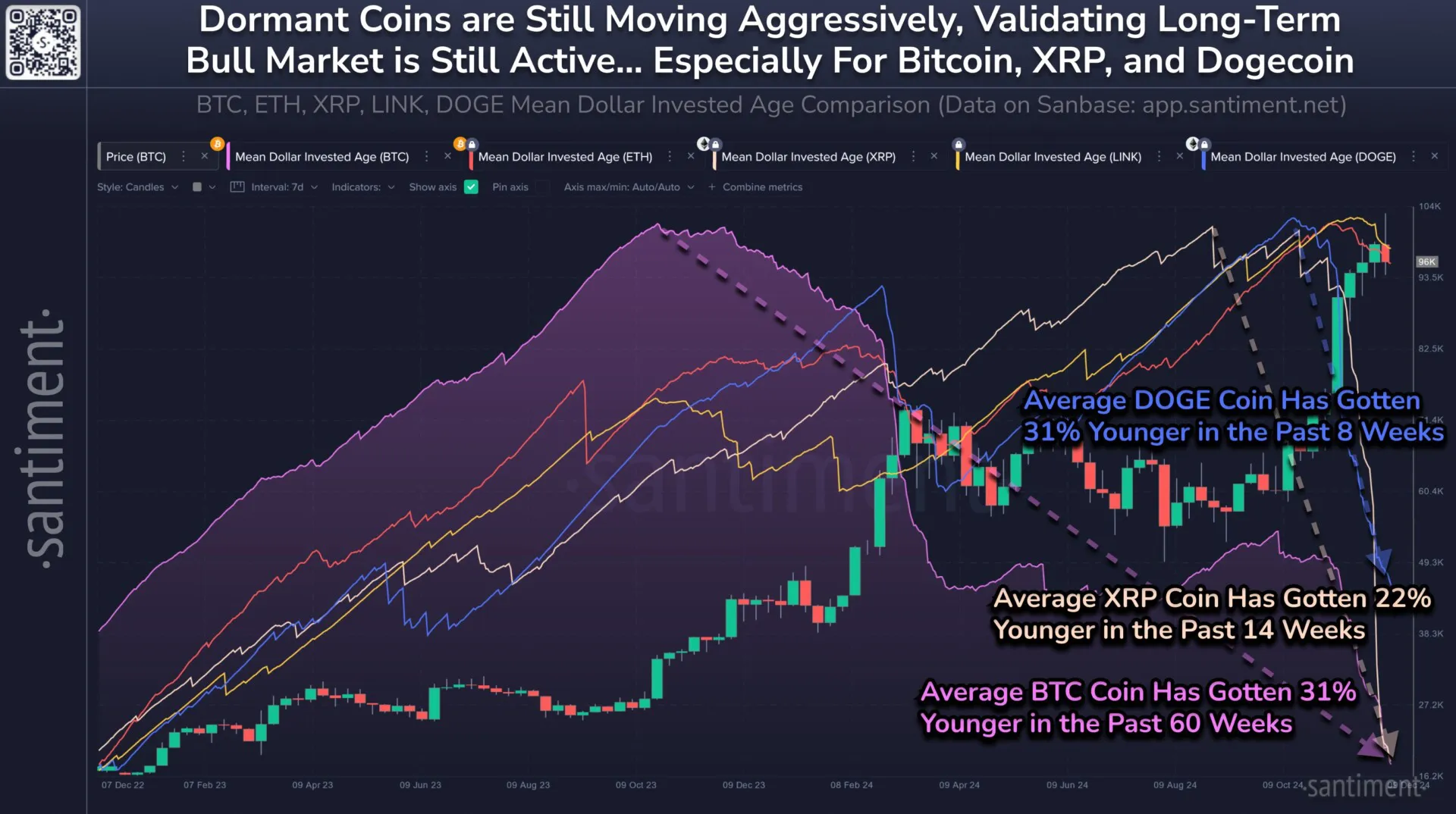

The decline in the Mean Investment Age suggests the Bull Cycle is still on – (Source: Santiment)

Meanwhile, Santiment data shows that the Mean Dollar Invested Age has been declining. This metric, which determines how long a wallet has held an asset, has fallen 31% in 60 weeks for Bitcoin, 22% in 14 weeks for XRP, and 31% in eight weeks for Dogecoin. The fact that coins in wallets are getting younger means that there is distribution, and historically, a bull market only ends when the mean age starts increasing.