[ad_1]

Aave (AAVE) may face selling pressure as whales and market makers are moving tokens back to centralized exchanges. Several large transactions moved AAVE to OKX, Binance and MEXC, potentially stalling the asset’s rally.

Aave (AAVE) may stop its growth after several large whales sent tokens to Binance. The lending protocol expanded in 2024, as it became the main source of yield. Three whales moved AAVE to centralized exchanges, with potential price pressures on the token.

One of the transactions belonged to market maker Cumberland, which moved 10K AAVE to OKX. Galaxy Digital and a smaller holder also unstaked their AAVE and moved the tokens to Binance.

The biggest whale to move AAVE unstaked 25,790 tokens from the protocol, valued at $3.38M. This cut the whale’s AAVE balance to zero, removing value from some of the lender’s vaults.

That same whale held AAVE for a relatively long time, starting accumulation back in the summer of 2023. The whale’s average buying price was $77.75, for a potential profit of $1.31M if the tokens are sold at the current price.

The transactions happened after a market-wide correction, which brought Bitcoin (BTC) under $70,000 once again. AAVE also traded near a one-month low at $130, though open interest increased from $75M yo $85M in a day. The token was considered one of the undervalued assets for this cycle, based on its low market capitalization to value locked ratio. Aave also turned into one of the busiest DeFi protocols, after Maker lost its positions during a rebranding to Sky.

The other possible explanation for the transfers to exchanges is the potential for the Aave buyback program. The Umbrella upgrade suggests Aave Labs may buy back some of its native tokens and use them in a vault for ecosystem incentives. A buyback announcement would boost the price of AAVE, potentially leading to higher realized profits.

AAVE has a market cap of $1.95B, though it has a total value locked of $13B. In the past few months, Aave became the most important lending protocol, which is used for yield by other DeFi apps. Aave represents the entire DeFi sector, and may be swayed by the US Presidential election results. The protocol feels downward pressure as ETH sank under $2,500 once again.

AAVE is seen as being in a period of re-accumulation and capable of another rally. The asset sank by more than 30% from its recent peak above $170.

AAVE shifted its on-chain profile in October

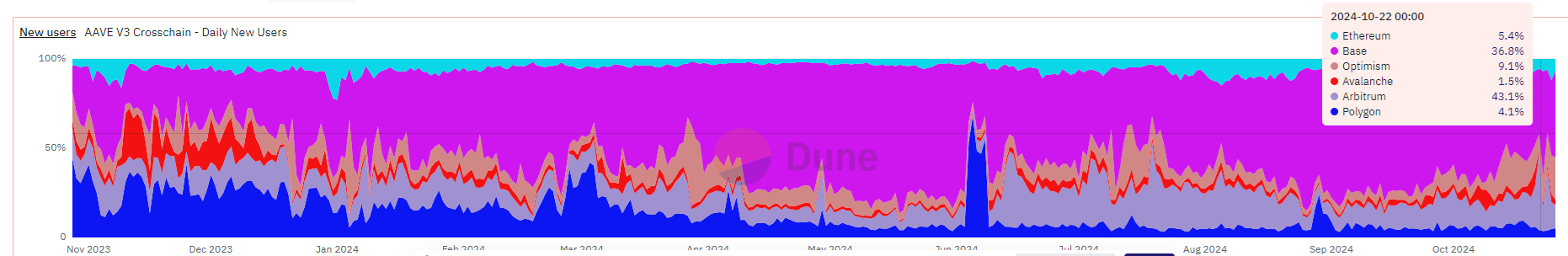

For a few months, Aave derived most of its growth from Base. From October onward, however, Aave grew its presence on Arbitrum and Optimsm. Base has diminished as a source of new users, after the initial on-chain hype.

Arbitrum and Optimism attract more new Aave users in the past month, while the share of Base decreases. | Source: Dune Analytics

AAVE still taps 13 chains with varied lending pools on each network. The goal of Aave was to also make GHO a cross-chain stablecoin. For now, GHO is being distributed among smaller DeFi protocols, as a lending asset against other crypto collaterals.

Over the past year, Aave has not seen outflows of its active loans, while gradually growing its vaults and pools. In the past six months, Aave loans grew from around $5B to over $8B. Despite higher user activity on other networks, the biggest share of loans is still on Ethereum, at $6.96B.

GHO supply rises, but no sign of buybacks

The supply of GHO rose above the cutoff level of 175M tokens, which would trigger some of the first AAVE burns. The GHO supply continued to rise in the past few days, adding another 5M tokens to a total market capitalization of $176,179,252 GHO. At one point, the supply of GHO touched 180M tokens.

However, the Aave protocol is still not ready with its Umbrella update, which should replace the old Safety module. The new Aave incentives with token burns may not be ready yet.

For now, all of GHO issued is still on Ethereum, and has not been sent to all the 13 chains where Aave has vaults. GHO is also offered as an alternative to USDT and USDC, and may become more prominent among DeFi protocols.

[ad_2]