Ethereum (ETH) price shows signs of a possible recovery as on-chain data and technical indicators point to a change in momentum. While the broader market remained cautious, Ethereum’s weekly price structure holds above key support levels.

At the same time, large ETH holders continue to accumulate, which could affect price direction in the coming weeks. Several technical signals point toward a potential upward shift if conditions continue.

Technical Indicators Suggest Ethereum Price Reversal

The weekly Ethereum price pattern shows key trends that traders analyze before market movement reverses. The highly observed TD Sequential indicator currently displays a red “9” candle.

The standard interpretation among traders indicated the current bearish movement could reach its conclusion. This price pattern indicated a potential market direction changes when it develops close to established support levels.

The stochastic RSI indicator currently existed within its oversold region. It produced signals when it arrives near specific levels, indicating that recent selling pressure on the asset requires a price recovery.

The TD Sequential and Stochastic RSI indicator indicates reversal patterns, which strengthens the hypothesis of Ethereum undergoing an upward price movement. The token ETH currently trades at $1,647.95 on April 21, 2025, which is considered historically significant.

Source: X

The weekly candlesticks display signs that support a market trend reversal. The final market candles possess tiny bodies with lengthy wicks, which signifies that traders remain uncertain about future market movements.

Such market patterns emerge during periods of declining seller control when buying interest reappears in the market. The market sentiment may become bullish if the price maintains its current position while confirming the signs from on-chain metrics and whale support.

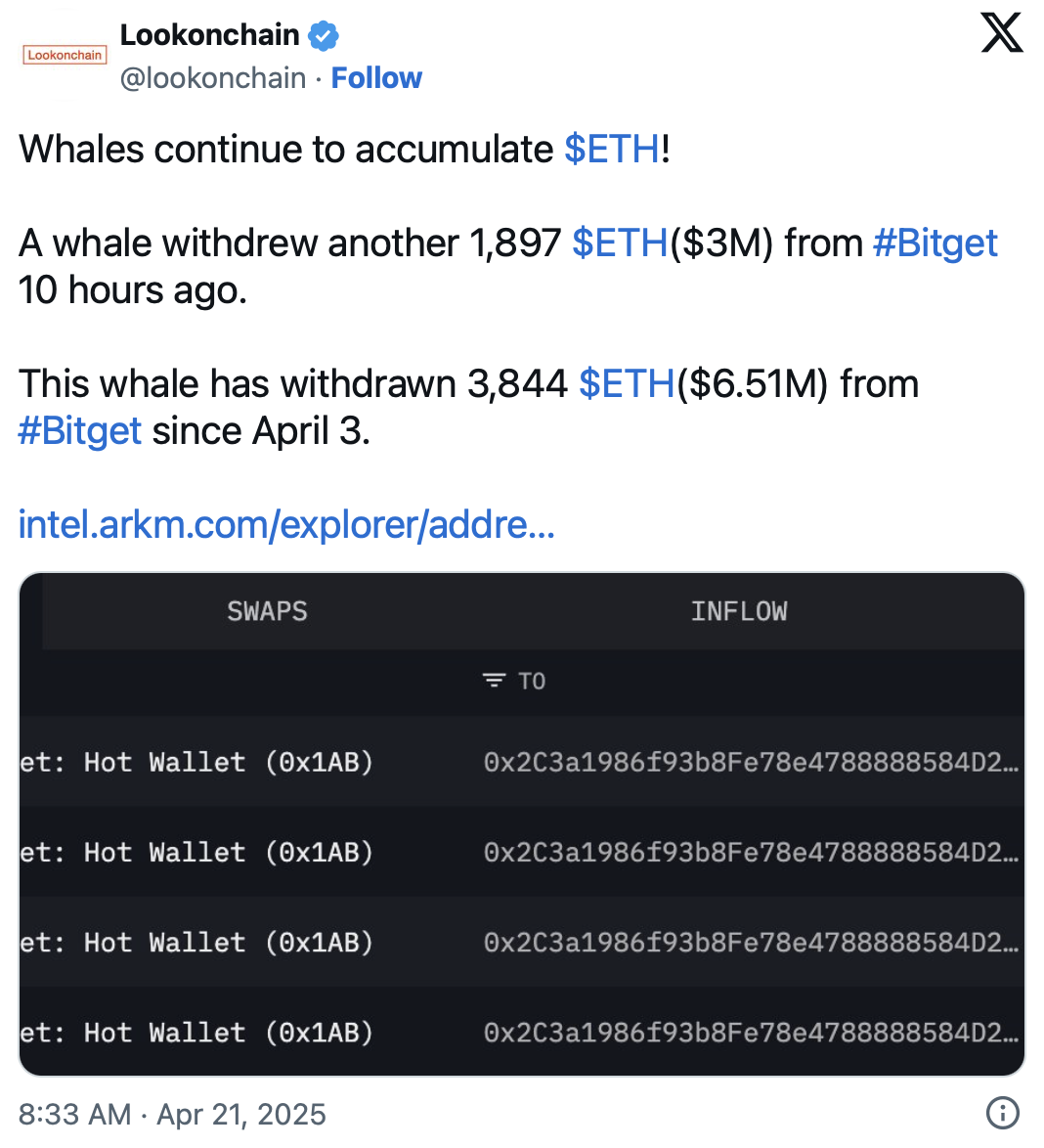

Whale Activity Shows Steady Accumulation

The Ethereum network has witnessed large investors conduct steady accumulation since the beginning of this month. On April 21, 2025, Lookonchain published blockchain information indicating that one whale conducted a withdrawal of 1,897 ETH worth $3 million from Bitget.

The wallet withdrew 3,844 ETH worth approximately $6.51 million starting from April 3. The regular withdrawals indicate the holder plans to maintain ETH ownership without redepositing funds.

In contrast, another whale sold 10,293.78 ETH on April 20, 2025, at an average price of $1,613.84, earning a $323,000 profit. ETH’s price dropped by 0.75% following the sale within 15 minutes. During this time, trading volume surged 12% to 1.8 million ETH, and ETH/BTC declined 0.5%.

Source: X

This shows that whale movements can influence short-term market behaviour. Despite some selling, the overall trend points to accumulation, especially among long-term holders moving funds off exchanges. Traders monitor these transactions closely for signals about Ethereum’s next price move.

Resistance Levels and Wallet Distribution

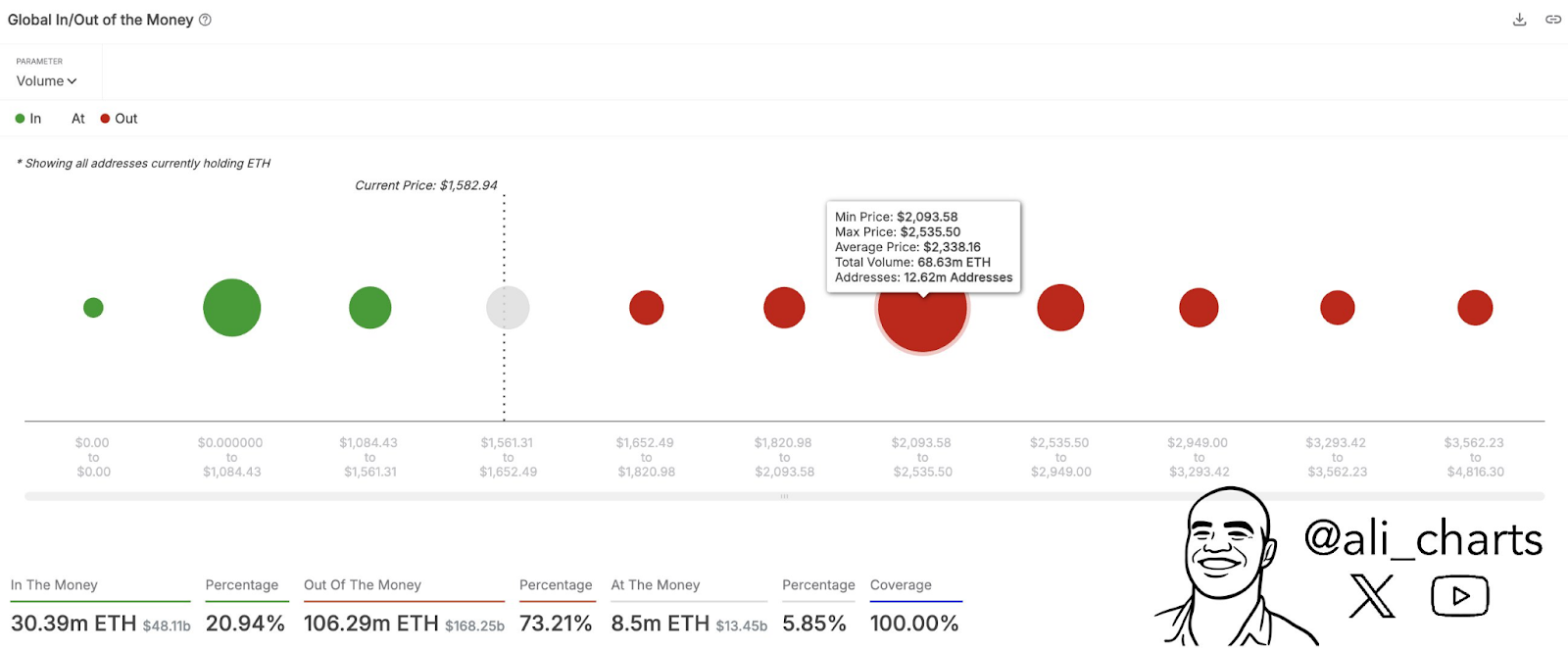

The present on-chain analytics indicates numerous Ethereum wallets retain their crypto assets with values higher than current market rates.

The data from analytics platforms demonstrates that 20.94% of wallets would experience a profit based on April 20, 2025, when ETH is valued at $1,582.94. These addresses hold around 30.39 million ETH. In contrast, 73.21% of addresses, holding 106.29 million ETH, are considered “Out of the Money.”

The heaviest area of wallet concentration is between $2,093.58 and $2,535.50. In this range, around 12.62 million addresses hold nearly 68.63 million ETH. As the Ethereum price grows, users holding their positions will consider selling their investment. Such selling pressure will subdue upward momentum as traders start to sell near this price point.

Source: X

The resistance zone acts as a precautionary boundary against market buyers but may open new opportunities when it breaks. Wallet concentration levels provide traders with crucial price observation points, which function as support and resistance boundaries.