[ad_1]

Data on whale wallets shows that these investors have been consistently selling Bitcoin (BTC) since the start of March, according to the latest “Bitfinex Alpha” report. Bitfinex’s analysts explained that these movements often lead to a phase of volatility, and short-term decline to form a local dip, and realized prices indicate that Bitcoin is unlikely to drop below $56,000 in the current market cycle.

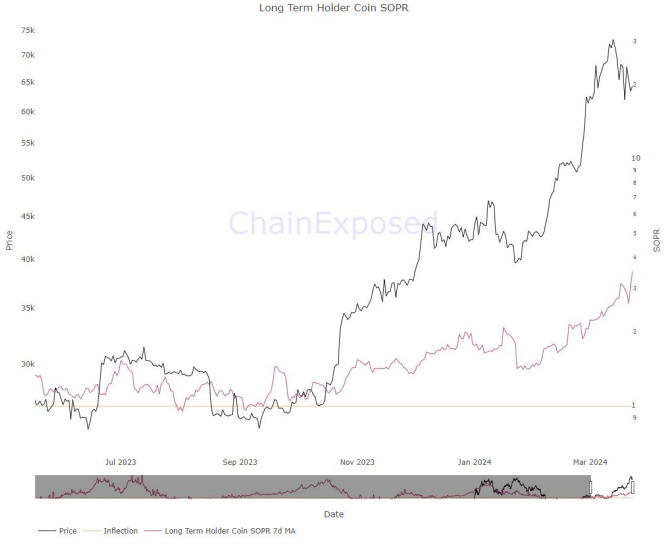

The report explains that whale wallet outflows typically signal the onset of a healthy Bitcoin price correction, while spent output profit ratio (SOPR) values significantly above 1 suggest aggressive profit-taking. Long-term holder SOPR values have stayed elevated since March, showing increased selling by major holders.

However, long-term holders have hardly purchased Bitcoin since February, with their realized price below $20,000. This suggests Bitcoin will likely not fall to that level this cycle. The short-term holder realized price currently sits at $55,834, serving as key dynamic support throughout 2023.

Bitfinex estimates the average cost basis for Bitcoin spot ETF inflows is around $56,000. As the report outlines, this is a crucial level for BTC, offering a convergence of technical indicators that suggest this price point could act as a pivotal area for Bitcoin’s short-term market trajectory.

Spot ETF outflows are not a concern

Last week, spot Bitcoin exchange-traded funds (ETFs) listed in the US, notably the Grayscale Bitcoin ETF, experienced unprecedented net outflows exceeding $2 billion. However, when considering the inflows into other ETFs, the net outflow tallies to $896 million.

This shift could initially appear alarming, Bitfinex’s analysts highlighted, given the continuous growth phase that the cryptocurrency market has experienced, with inflows in some periods exceeding $1 billion per day. Yet, this scenario does not necessarily spell trouble for the market’s future.

There are significant reasons why these outflows do not raise red flags. One key factor is the transition of investors from the Grayscale Bitcoin ETF to other ETF providers that offer more competitive and financially attractive management fees. Furthermore, the absence of outflows in other ETFs might be attributed to the prolonged bear market period during which the GBTC traded at a steep discount, sometimes exceeding 50%.

With the transformation of the fund into an ETF, this discount has nearly vanished, making the investment more appealing and lucrative for large BTC holders who had invested during the bear market.

These investors are now seeing returns more than double those of direct BTC market participants, leading to earlier-than-expected profit-taking among this group. This shift indicates a maturation within the investor base, reflecting a strategic move rather than a lack of confidence in the market.

Looking ahead, the report points out that the market is poised for a period of stabilization. While a downturn is anticipated, it is expected to be moderate, with declines of 20% to 30% being considered normal in the volatile crypto markets. Importantly, the recent pullback has had a more pronounced impact on some altcoins compared to BTC, suggesting that any potential decline for Bitcoin may be less severe.

Additionally, ETF flows as a proportion of spot trading volumes on centralized exchanges (CEXs) have been on the rise, peaking at over 21.8% of the net spot trading volume for Bitcoin on Mar. 12. This trend underscores the growing importance of ETFs in the cryptocurrency market and suggests that spot order flow may soon become a less reliable indicator of real-time ETF flows.

[ad_2]