[ad_1]

There has been no shortage of exciting news pertaining to Bitcoin (BTC) in the first month and a half of 2024. At the very start of the year, the U.S. Securities and Exchange Commission (SEC) announced it had approved 9 stop BTC exchange-traded funds (ETFs) and while the news initially led to a significant price decline, the world’s foremost cryptocurrency has since started surging.

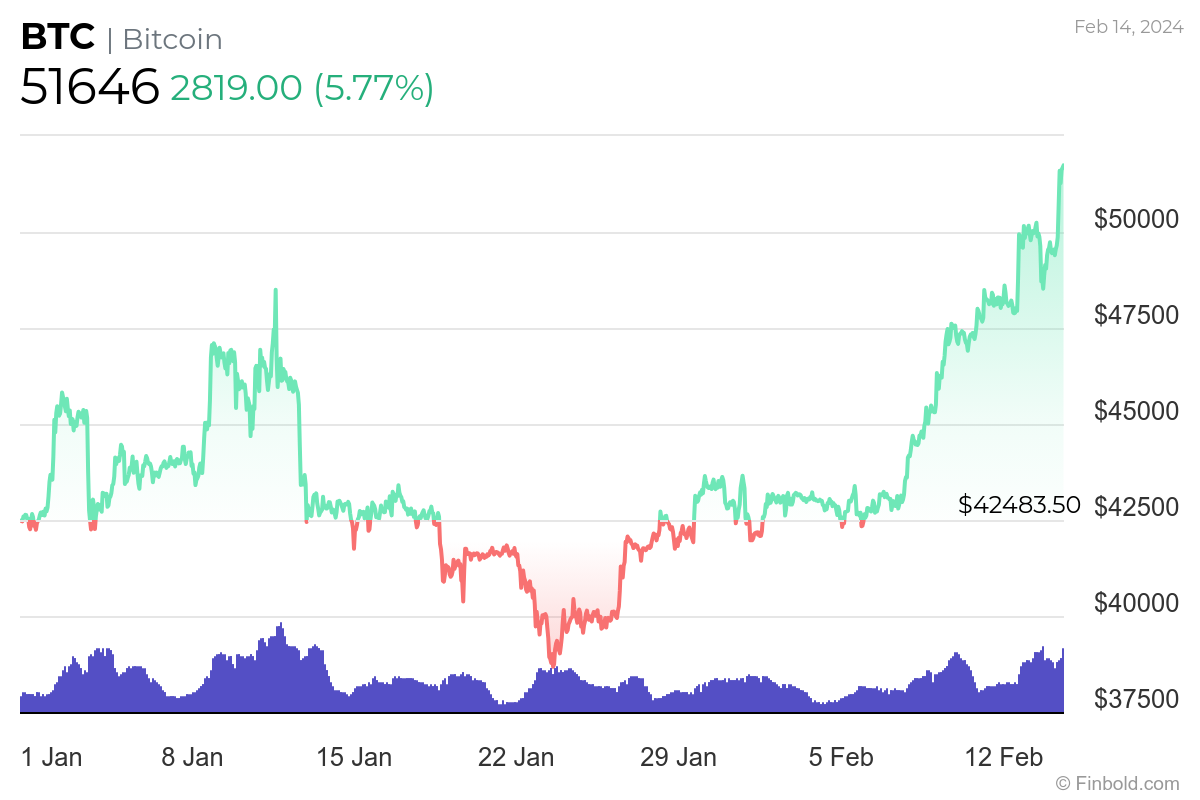

Since January 1, Bitcoin is up a total of 16.93%. The uptrend is also visible in the last 30 days – 23.74% – and the last 7 days – 20.7%. Additionally, while the news of the hotter-than-expected January CPI initially sent the cryptocurrency into a decline, it swiftly recovered and rose 5.77% to $51,646.

The latest rally also saw BTC reclaim a market cap greater than $1 trillion.

While the news so far has already been exciting, Bitcoin might be poised for an even greater surge as the next halving event is expected to take place in mid-April 2024. Given that previous havings led BTC to quickly surge tenfold or even a hundredfold, the crypto market is rife with speculation on just how high the coin will go this time.

In its quest for answers, Finbold decided to consult OpenAI’s flagship platform – ChatGPT – on where the world’s foremost cryptocurrency might find itself as the halving unfolds.

ChatGPT makes a prediction on Bitcoin

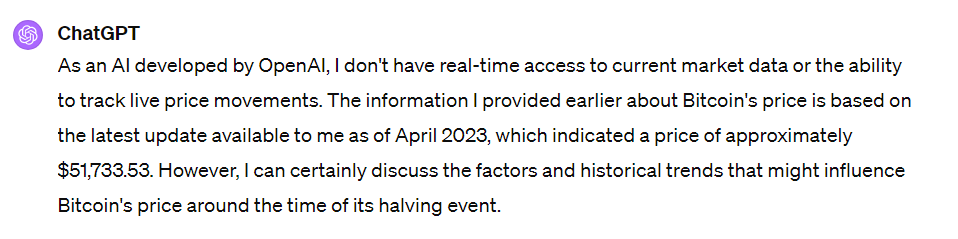

At the very start, ChatGPT was asked to analyze Bitcoin’s most recent movements as well as its historic performance around the previous halving events. After making some confusing statements at the start, the artificial intelligence (AI) model quickly remembered it had and already used its access to the live web and got its facts straight.

At the start, ChatGPT made a forecast that BTC is likely to continue its rally in the leadup to the halving and, on the eve of the event, find itself somewhere between $60,000 and $70,000.

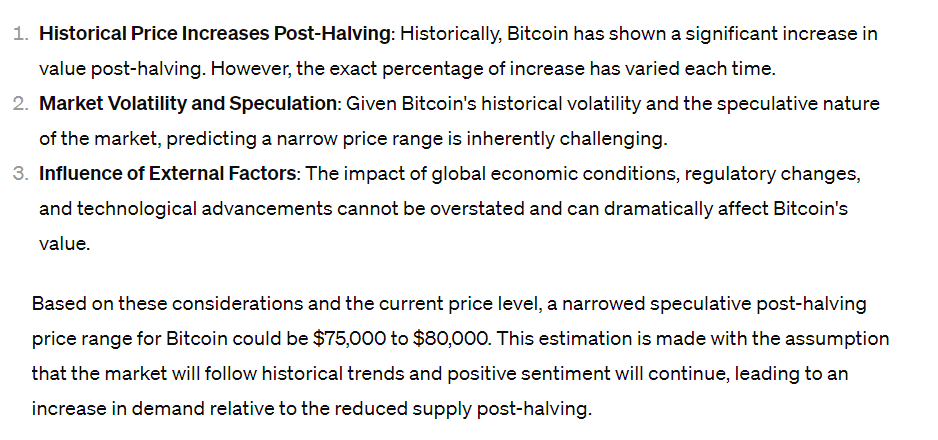

Initially, it offered a very wide range of between $70,000 and $100,000 immediately upon the halving’s competition but when asked to narrow it, it settled for between $75,000 and $80,000 – though it pointed out that the narrowing also reduced its confidence in the already-speculative price target.

Given that many of the previous halvings saw Bitcoin surge only after many months, ChatGPT was also asked to predict where the cryptocurrency might stand on the last day of the year – December 31, 2024.

The AI, seemingly, assessed that it is safest to assume that Bitcoin is unlikely to see a surge as big as with the previous halvings and settled for a range between $80,000 and $85,000.

ChatGPT assesses extraordinary scenarios

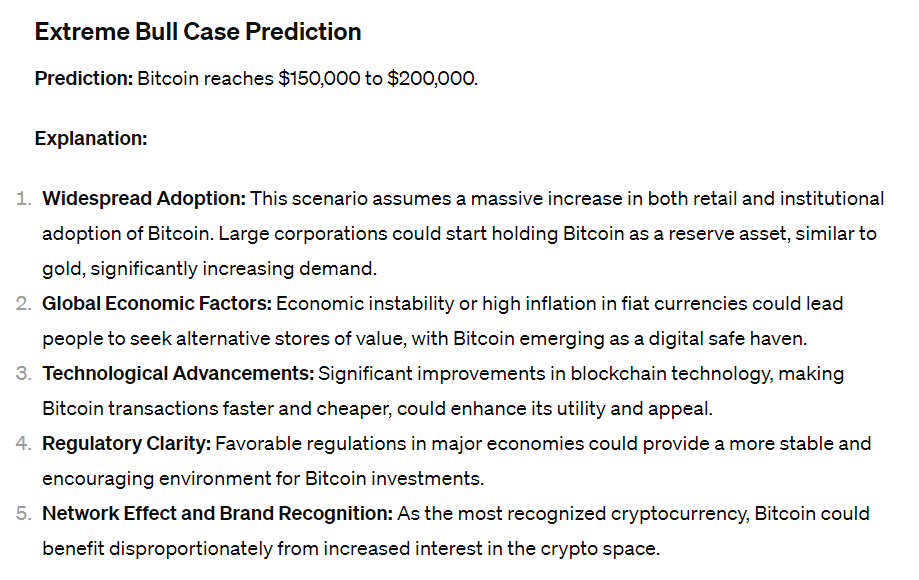

In fact, the large language model (LLM) also proved fairly conservative when asked to make a plausible bullish prediction. It stated that such a surge – probably driven by widespread adoption as made possible, in part, by the approval of spot BTC ETFs and wider institutional acceptance – would still see Bitcoin reach no higher than $200,000.

On the other hand, the AI’s bear case was rather drastic as it saw the price of BTC dropping as low as $10,000 by the end of 2024 should market fatigue set in, a major regulatory crackdown begin, or a strong competitor arise.

Still, ChatGPT’s justifications for the extreme bear case appeared to make significantly bigger assumptions than its bull case, given the recent trends that saw the approval of ETFs, organizations formerly hostile to cryptocurrencies start investing in the industry, and new legislation enshrining the rights of the crypto community get made into law.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

[ad_2]