[ad_1]

Bitcoin bull run is now underway, with prices soaring to a new all-time high of over $81,800. However, WazirX users are left out of this rally due to the exchange’s restructuring. Many users have criticized WazirX for not compensating creditors fully despite resuming trading.

The platform plans to share fees from new trades with creditors and has recently introduced a Rebalancing Calculator.

WazirX users not part of the Bitcoin upside

Bitcoin’s bull run seems to have started with BTC hitting an all-time high on Monday, surpassing $81,800 in price. However, WazirX users are not part of the upside after the July security breach, which pushed the exchange to a restructuring.

The users have called out the Indian exchange for not making the creditors whole despite resuming business. WazirX said last week that it would resume trading, with the generated fees shared with creditors. While the platform wants to generate revenue through fresh user trading activities, many say that the exchange is refraining from utilizing its own funds. Some X users point out that this strategy places the burden of debt repayment on the trading community.

The exchange also recently released its Rebalancing Calculator as part of a restructuring plan under the Singapore Court-granted moratorium. The Rebalancing Calculator shows how WazirX would distribute its liquid assets based on each creditor’s share of the total claims. The exchange says that it will update the liquid asset valuation daily to reflect the creditor’s share on the day. Deposits made after the hack along with delisted, illiquid, and airdropped tokens are excluded from the calculator with some other categories.

WazirX replaces 3 COC members

Co-founder Nischal Shetty filed the fifth affidavit with the court on Nov. 7 that revealed that 3 COC members have been replaced. Creditors forming the Committee of Creditors held their first meeting on Oct. 15. WazirX has now replaced 3 of the 6 inactive members after its second COC meeting and the fourth town hall.

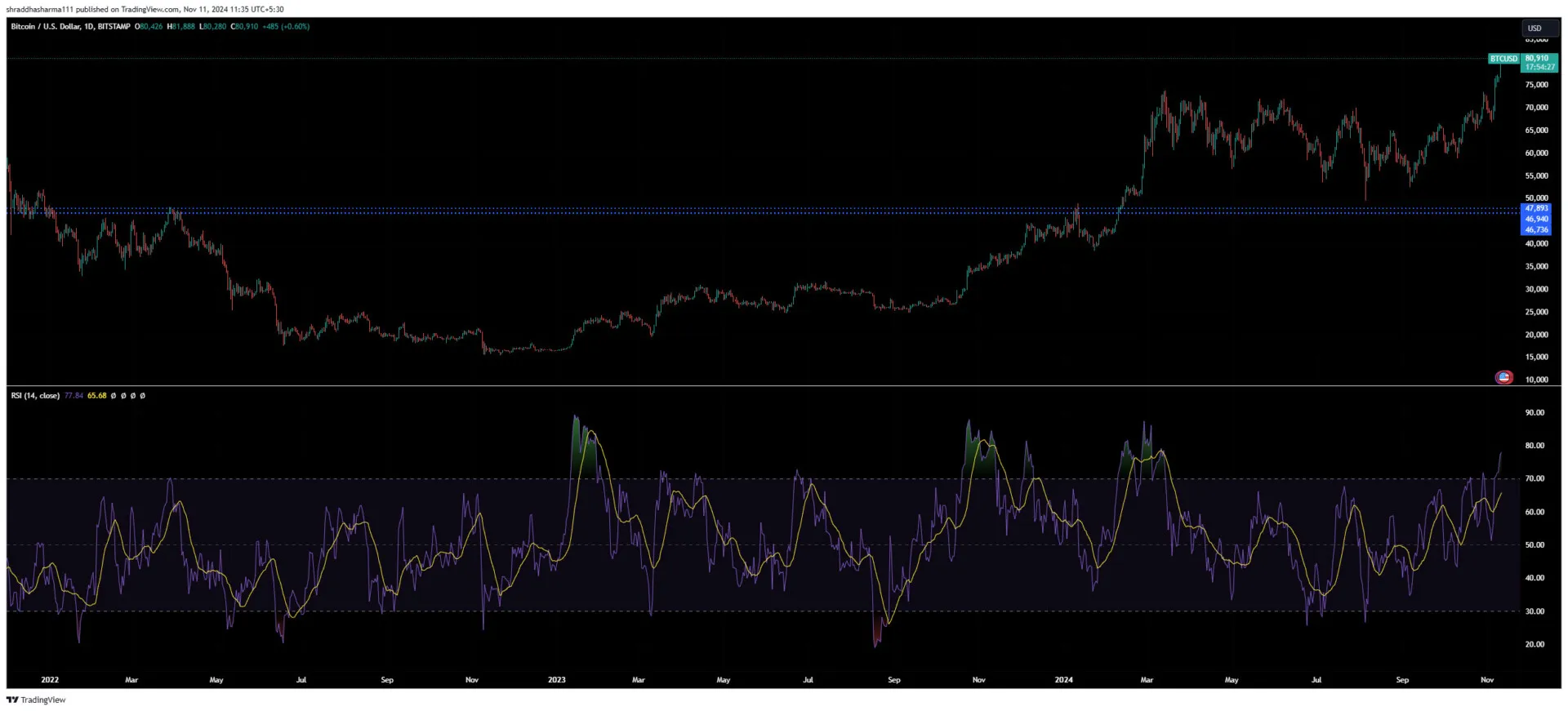

Bitcoin USD 1-day chart since July 18 | Image: TradingView

That said, Bitcoin was close to the $64K level on July 18, the day of the WazirX hack. With Bitcoin crossing $81K on Nov. 11, the relative strength index is approaching 80. The index suggests strong upward momentum on the back of a rapid price rise of around 26%.

CoinDCX co-founder Neeraj Khandelwal wrote on X that trust is crucial for any crypto project and predicts that Shetty-founded Shardeum and WazirX DEX will “fail.” Meanwhile, Cryptopolitan has reached out to WazirX representatives with questions. At press time, the responses are awaited.

[ad_2]