Check out Vitalik Buterin net worth to find out how the co-founder of Ethereum was able to make up his crypto fortune and trace his financial journey over time.

This blog post gives an updated analysis of the net worth of Vitalik Buterin in 2024. We look into the detail of how Buterin has built his net worth, primarily through association with Ethereum, his holding in other cryptos, and the continuous impact in the crypto space.

We also aim to offer comparison with other Ethereum co-founders and prominent holders of Ethereum with Buterin’s net worth. This detailed account will provide insights into the individual’s net worth within this key personnel of the cryptocurrency circle, together with the dynamic nature of cryptocurrency investments.

Table Of Contents

- How did Vitalik Buterin become rich?

- How rich is Vitalik Buterin? (Vitalik Buterin net worth)

- Vitalik Buterin’s ETH portfolio

- Vitalik Buterin’s Crypto Net Worth Over Time

- Other Ethereum Co-Founders

- Who is The Richest Ethereum Holder?

- Conclusion

- FAQs

How did Vitalik Buterin become rich?

For the most part, his fortune was made on inventing a huge part of the cryptocurrency industry—Vitalik Buterin, the co-founder of Ethereum. The foray started when he was 17, and founding Bitcoin Magazine with Mihai Alisie.

But, not long after that, Buterin had started becoming deeply disillusioned with Bitcoin. Specifically, the limitations of its scripting language restricted the functionality of smart contracts that could be run on top of it, and more generally, the development of decentralized applications.

This is what led him to propose a solution, in the Ethereum Whitepaper released in November 2013. Then, with his co-founders, he established the Ethereum Foundation, a non-profit for the development of the Ethereum network. In 2014, he was given a $100,000 grant from the Thiel Foundation. This grant allowed him to work full-time on Ethereum and concentrate only on this project.

The pre-sale of ETH had an initial supply of over 72 million tokens, with 16.53% of those allocated to the founders. This would significantly boost Buterin’s net worth. Ethereum itself launched in July 2015, and Buterin, the only remaining founder, was at the helm of its development up to and through its move to Proof-of-Stake in 2022.

Most of Buterin’s known wealth comes from the ETH allocation he received during Ethereum’s launch, which briefly made him a billionaire when ETH’s price surpassed $3,000 in 2021. He also invested in various crypto companies, further contributing to his wealth.

How rich is Vitalik Buterin? (Vitalik Buterin net worth)

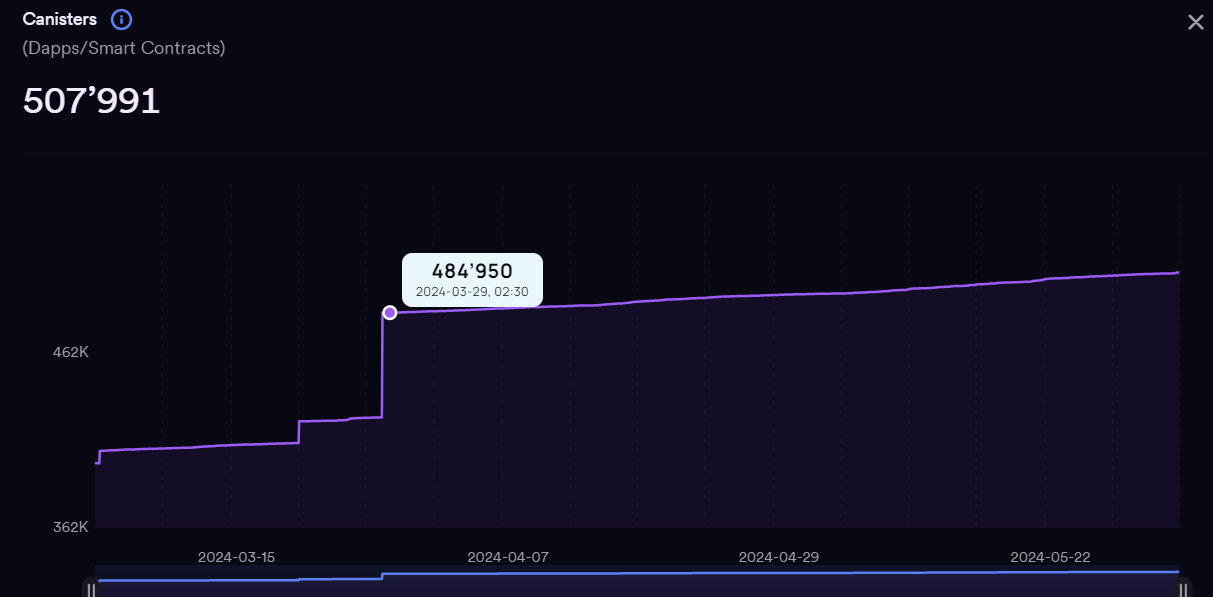

The co-founder of Ethereum, Vitalik Buterin, saw his net worth rise as he was sitting mostly with a huge net worth in Ether (ETH) tokens. June 2024 estimations pointed to Buterin owning 245.316K ETH tokens, with each token being valued at $3,871.40, which pegs the portfolio at nearly $949.72 million.

Buterin primarily derives his wealth from the initial supply of over 72 million ETH tokens that were allocated during the pre-launch sale of Ethereum in 2014. Out of that, 16.53% was allocated to Buterin and his other seven co-founders in Ethereum. This initial allocation forms the majority of Buterin’s current crypto portfolio.

Buterin’s net worth, however, is highly dependent on the fluctuating price of Ethereum’s cryptocurrency, Ether. As of June 2024, Buterin held 0.2% of the total ETH supply, down from 0.9% at the end of 2015.

Vitalik Buterin’s ETH portfolio

The greatest portion of the portfolio of Vitalik Buterin, the founder of Ethereum, is concentrated in Ethereum itself (ETH).

According to data from Arkham Intelligence, his ETH holdings on June 6, 2024 were worth about $949.72 million, and they accounted for the majority of his net worth of $953.4 million. Besides ETH, he also holds other cryptocurrencies such as STRK, KNC, DEGEN, SDOG, DINU, among others.

How Much Crypto Does Vitalik Buterin Own?

As of now, the known holdings of Buterin in cryptocurrencies amount to $953,831,334, with most of that wealth coming from his ETH holdings. All these calculations are made using his known addresses related to wallets and do not consider addresses that have not been publicly disclosed. However, since the known wallets hold an enormous value, it would generally represent the largest part of his net worth.

Vitalik Buterin’S Ethereum Holdings

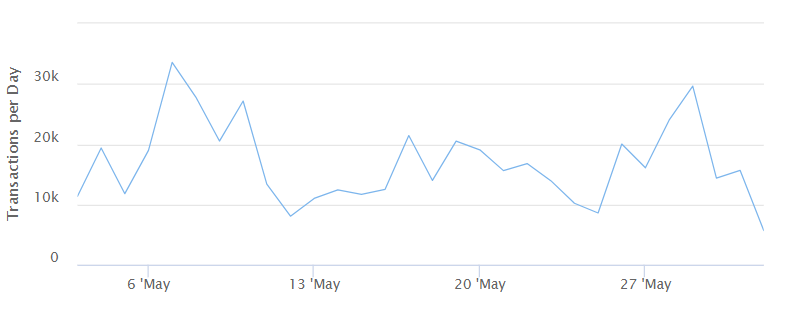

In a tweet from 2018, the co-founder of Ethereum, Vitalik Buterin, stated that he never held more than about 0.9% of the total supply of the asset. It is possible to check this fact by analyzing the volume of ETH that his known wallets contained from 2015 to the present.

This data is in the portfolio archive section of his profile at Arkham. An annual comparison of his share of the total ETH supply over the years can thus be carried out in confirmation of Buterin’s tweet.

Source: Arkham

His share of ETH peaked in 2015 at 0.91% and has since then annually decreased due to the sale of tokens and the continuous issuance of more ETH through the design of an inflationary mechanism built into the network.

Buterin’S ETH Holder Ranking

When assessing the ranking of the top Ethereum holders, Buterin is placed 29th on the list of holders with the most ETH. This list can be obtained from the full details of top ETH holders on Ethereum’s Arkham profile.

Readmore: Vitalik Buterin Criticizes Iggy Azalea’s MOTHER Token Over Celebrity Trend

Vitalik Buterin’s Crypto Net Worth Over Time

With the above data in hand (collected from Arkham Intelligence), we can now estimate the progression of Vitalik Buterin’s Crypto Net Worth over time. We illustrate this in the table below, which uses his holdings on October 11th of each year as a yearly benchmark for his Crypto Net Worth.

Readmore: Vitalik Ethereum Enshrinement: The Risky And Complex Tradeoff In Protocol

Other Ethereum Co-Founders

Other Ethereum Co-Founders, Who also Became Millionaires Ethereum’s other co-founders also became multi-millionaires as a result of their holdings of the project’s native token. This section compares Buterin’s estimated assets with those of the other Ethereum co-founders.

Since doubts have been raised concerning Buterin’s non-crypto holdings, the assumption remains that his publicly known crypto assets of $951 million represent the better part, or all, of his net worth.

The other co-founders’ estimated net worth, wherever available, is presented in the section below. Note that not all net worth estimates for all co-founders for 2023 should necessarily be available. So, net worth data may be based on the latest available information and may either be the peak or way lower.

Source: Arkham

Who is The Richest Ethereum Holder?

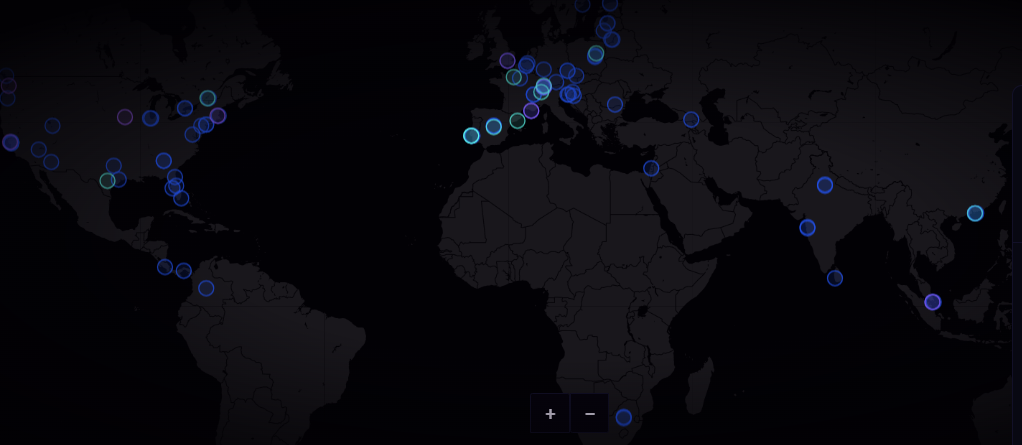

What sits behind the title of the richest Ethereum holder is not a person, but an entity—the Beacon Deposit Contract, with 45.7 million ETH. It stands in a secured deposit to execute staking and represents, accordingly, the totality of ETH staked in the securing of the network.

But considering the individual holders, the largest holder of Ethereum is Rain Lohmus, with 250,000 ETH worth over $960 million. Unfortunately, Lohmus has lost access to his wallet, meaning his holdings are currently inaccessible.

The second-largest individual holder is Ethereum co-founder Vitalik Buterin, who holds 243,000 ETH, amounting to around $940 million. Still, unlike Lohmus, Buterin has access to his holdings.

A further interesting observation is that the top 20 holders of Ethereum are significantly contributed to by exchanges, with the largest being held by Coinbase. Other celebrities who hold substantial amounts of ETH include Donald Trump, Mark Cuban, and Justin Bieber.

Readmore: Vitalik’s Tech Future Outlook: AI Launch Is Worth Being Uniquely Careful

Conclusion

Conclusively, Vitalik Buterin, the co-founder of Ethereum, became one of the wealthiest people on earth mainly because of the pre-sale of ETH tokens when the platform was launched. Much of his net worth can be attributed to changes in the value of Ether, the cryptocurrency of the Ethereum network.

However, Buterin has made this huge amount of money not only from Ethereum but also from investing in many other crypto companies. The cryptocurrency market is still very volatile, but at the moment, Buterin is a key person in it, shaping further developments in the industry.

FAQs

Who is the richest Ethereum owner?

The richest Ethereum owner is the ETH2 Beacon Deposit Contract, which holds over 45.7 million ETH, equivalent to approximately $176.61 billion. In terms of individuals, Rain Lohmus owns the most ETH – with 250K in his stash, though he can’t access it as he lost the private keys to his wallet. The largest individual holder of accessible ETH is co-founder Vitalik Buterin, who holds 245.42K ETH.

How does Vitalik Buterin make money?

- Ethereum Holdings: He holds some serious amounts of Ether (ETH), which has appreciated.

- Staking: He earns rewards by staking his ETH to help secure the network.

- Professional Speaking and Consultation: He earns income from public speaking engagements at conferences and consultation.

- Investments and Advisory Roles: Investing in and advising blockchain projects to get equity or tokens.

- Writing and Publications: He earns from his articles and research through royalties and grants.

- Grants and Donations: He receives financial support for his work from grants and donations.

What does Vitalik think of Bitcoin?

In his opinion, Bitcoin’s failure to provide sufficient fees may turn into a problem for security in the long term. Therefore, he pointed out that Bitcoin’s essential amount of transaction fees, which are vital to its security once the coins are all mined, is not growing at a rate sufficient to guarantee the security of a potentially multi-trillion-dollar system.

In addition, he questions whether the proof-of-work system that Bitcoin follows could be relied upon, since it might turn Bitcoin into an attack surface. He proposes that, perhaps, the proof-of-stake system that Ethereum has chosen may be a more secure alternative.