[ad_1]

American investment manager VanEck has filed to establish a trust entity for a proposed BNB exchange-traded fund in Delaware. The establishment of a trust serves as a preparatory measure in the ETF launch process, preceding the formal application to the SEC.

VanEck’s filing marks the first attempt to launch a Binance Coin (BNB) ETF specifically in the US market. While BNB-related products like the 21Shares Binance BNB ETP exist, they are not US-based ETFs.

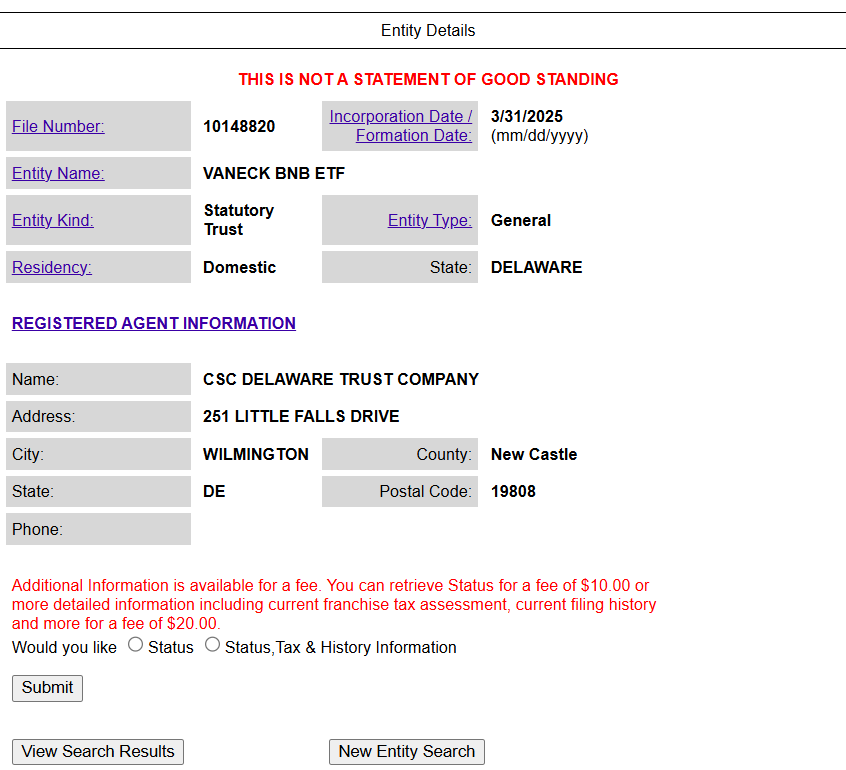

The firm, managing nearly $115 billion in client assets globally, registered the new product on March 31, called VanEck BNB ETF, under filing number 10148820 as a trust corporate service company, according to public records on the official Delaware state website.

The filing means BNB joins Bitcoin, Ether, Solana, and Avalanche as the fifth cryptocurrency to have a standalone ETF registration initiated by VanEck in Delaware. VanEck’s spot Bitcoin and Ether ETFs already debuted last year after securing approval from the SEC.

The prospective BNB ETF would track the price of BNB, currently ranked as the fifth-largest crypto asset by market capitalization. The crypto asset was trading at around $608 at press time, with little price movement in the last 24 hours, per CoinGecko.

VanEck filed for a Solana ETF in June 2024. This was the first Solana ETF filing in the US. After this initial filing, VanEck and other asset managers, including 21Shares, submitted additional necessary filings, including the 19b-4 form, to proceed with the approval process.

Last month, VanEck applied for SEC approval to launch the first AVAX ETF, following its successes with spot Bitcoin and Ethereum ETF offerings.

The company has established itself as a major player in the crypto ETF market, having been the first ETF provider to file for a futures Bitcoin ETF in 2017.

[ad_2]