[ad_1]

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

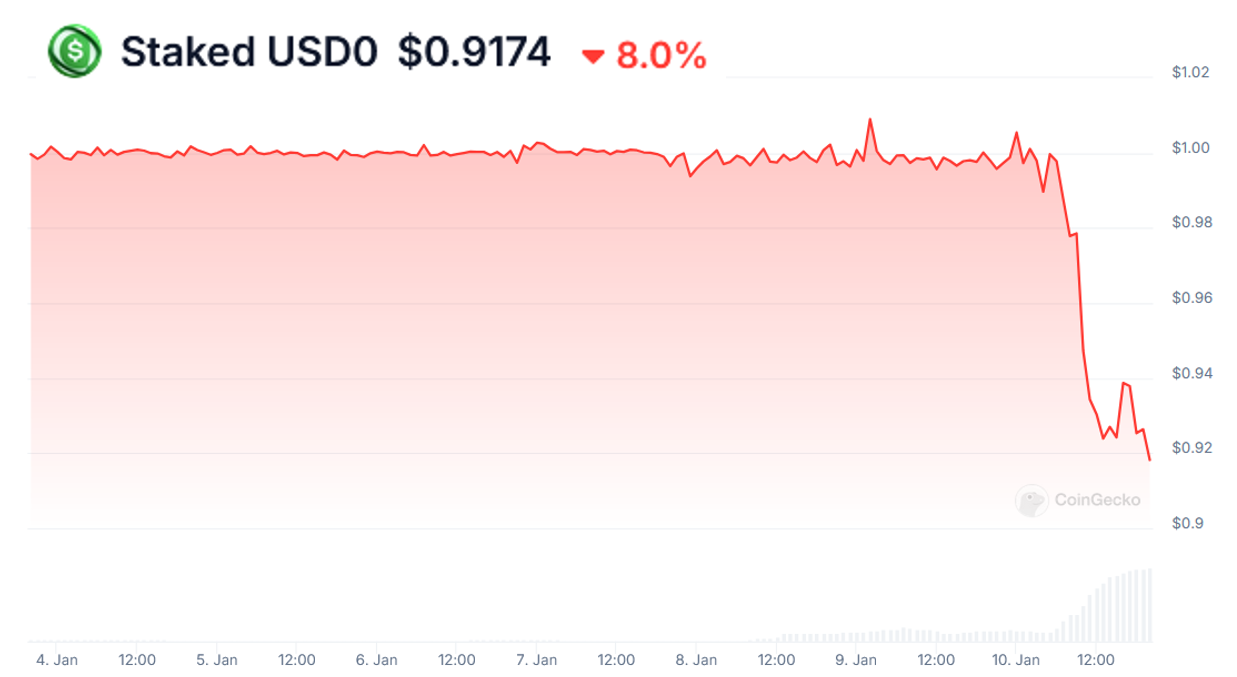

Usual protocol, the shiny new stablecoin on the block, is seeing its USD0++ “stablecoin” (a popular misconception) lose parity with USD0 as of 17 hours ago. It’s now trading at about $0.92.

But of course, USD0++ is not a stablecoin. It’s a liquid staking derivative of the USD0 stablecoin, somewhat like Lido’s stETH compared to ETH. (The USD peg of USD0 is fine, and the underlying T-bills have no backing issue.)

Usual’s business model is based on the idea of an “onchain Tether” that rewards users. By staking USD0 for USD0++, you receive the underlying T-bill yields and rewards in the protocol’s native token, USUAL.

Should USD0++ stakers change their minds before maturity, they can exit by forgoing rewards and unstake back to USD0 at a 1:1 exchange rate. This first exit option will be available as of next week.

This explains why the “depeg” between USD0 and USD0++ isn’t exactly a flaw. Think of USD0++ as a bond with four-year maturity. That bond should technically be trading at a discounted rate to reflect a risk premium for holding it for four years. Economists call that the “time value of money.”

Recall that in June 2022, Lido’s stETH too, depegged from ETH amid financial troubles around the now-defunct Celsius.

Market panic led to LPs pulling stETH liquidity from Curve pools, causing massive liquidity imbalances and a stETH:ETH depeg. Just like stETH does not necessarily have to trade at parity with ETH, USD0++ does not have to trade at parity with USD0.

What’s causing the USD0++ haircut today, however, is Usual’s announcement of an alternative USD0++-to-USD0 exit option. The feature was noted in a blog post published yesterday.

Based on updated docs, the new exit option would allow users to redeem USD0++ to USD0 at a manually set floor price of 0.87 USD0 per USD0++, while retaining rewards in USUAL emissions (unlike the original 1:1 exit option).

Why $0.87? Because it’s the discounted rate at fair value. As Treehouse Finance’s @mytwogweis explains:

If you expect 4% annually over four years, the fair value of USD0++ today should be around $0.855. This means you’d buy it at $0.855, hold it for four years, and redeem it at $1 for a risk-free 4% return.

To put it simply, the new exit option more accurately reflects USD0++ for what it is: a long-term bond.

The problem is that Usual’s go-to-market strategy had already been built on different premises.

Pendle PT-USD0++ farmers who entered into fixed yield trades are now suddenly finding they’ve “overpaid” for a bond at face value (on maturity, 1 PT USD0++ is equal to 1 USD0++).

The USD0++ Pendle pool (with a maturity date of Jan. 30, 2025), for instance, is seeing a dump.

Source: Pendle

To make matters worse, vault curators on Morpho lending markets have hardcoded the prices in USD0++:USDC markets at a 1:1 parity, rather than basing assets on a free floating market rate.

The result: Risk curator Gauntlet and other LPs promptly reallocated vault supply liquidity in USD0++ out of Morpho vaults above the current market rate of $0.91 ahead of the news, prompting public rumors of insider trading.

In an email to Blockworks, Tarun Chitra, founder and CEO of Gauntlet, said of the firm’s activity: “We were not privy to any advance notice, however, as the timestamp of these transactions show (the Usual team updated their docs on redemption before this). We were focused on making sure our users weren’t exposed, and we automatically rebalance out of markets when either risk or concentration limits are breached.”

MEV Capital has released a public statement denying it received any insider information from Usual, although it does not say who the firm received the information from.

USUAL, the protocol’s native token, has unwound -18.7% over the last 24 hours, as of 11:45 am ET.

Macauley Peterson contributed reporting.

[ad_2]