[ad_1]

The following is a guest post by Rajagopal Menon, the Vice President of WazirX.

Come the bull market, cometh the models to predict the price of Bitcoin. In the last bull market in 2021, the Stock-to-Flow (S2F) model was the flavour of the season. This model, created by Plan B, assessed asset scarcity by comparing stock to annual production. Applied to Bitcoin, the S2F model emphasised its ‘digital gold’ potential and provided scarcity-based, long-term price forecasts. However, the S2F model faded in the crypto winter in 2022.

But fear not, in the current bull run, there’s a new model in town – the Power Law Model, claiming to predict the price of Bitcoin with remarkable accuracy.

Understanding Power Laws

In a world seemingly filled with chaos and randomness, scientists have uncovered hidden patterns and relationships known as power laws. These laws provide a framework for understanding how different phenomena interact, revealing consistent mathematical patterns that govern various aspects of our universe.

Power Laws in Everyday Life

Power laws are fascinating mathematical relationships that appear in numerous phenomena, offering insights into the underlying simplicity of complex systems. They describe how two quantities relate to each other, with a change in one quantity leading to a proportional change in the other. This relationship spans different scales, from the microcosmic to the cosmic, influencing biology, society, technology, and natural phenomena.

The Size Limits of Animals

Galileo’s square-cube law is a classic example of a power law in nature, explaining how an animal’s size affects its strength. As animals grow larger, their volume and weight increase much faster than their strength. This law sets natural limits, explaining why larger animals have thicker bones and why the largest animals are found in aquatic environments where buoyancy offsets weight.

Metabolic Rates

Max Kleber’s research on metabolic rates further demonstrates the applicability of power laws. It reveals that an organism’s metabolic rate scales to the ¾ power of its mass, indicating that larger animals are more energy-efficient. This principle significantly impacts understanding species’ lifecycles, growth rates, and sustainability.

Natural Phenomena and Human Activities

Power laws govern diverse phenomena, from the distribution of earthquake magnitudes to the frequency of words in a language. They explain why we observe a small number of significant events alongside numerous smaller instances. For example, Zipf’s law describes word frequency in languages, highlighting the disproportionate occurrence of common words compared to less frequent ones.

Beyond Natural Phenomena

Power laws extend into human activities like economics, finance, and technology. They elucidate wealth distribution, where a few individuals possess a significant portion of wealth. In technology, power laws describe how content interacts on the internet, with a few highly popular nodes and many less popular ones forming a long tail distribution.

Bitcoin’s Power Law

Astrophysicist Giovanni Santasi discovered this connection. He says that 15 years of data show that Bitcoin also follows a power law principle. Santostasi first shared the power law model in the r/Bitcoin subreddit in 2018. However, it witnessed a resurgence in January after finance YouTuber Andrei Jeikh mentioned it to his 2.3 million subscribers in a video.

Giovanni’s theory says that Bitcoin’s price is not as random as it seems. There is randomness to it, but over the long term, Bitcoin price follows a specific mathematical model. It’s not just a mathematical formula that some guy drew a line through; instead, it follows a power law like the ones observed throughout the universe.

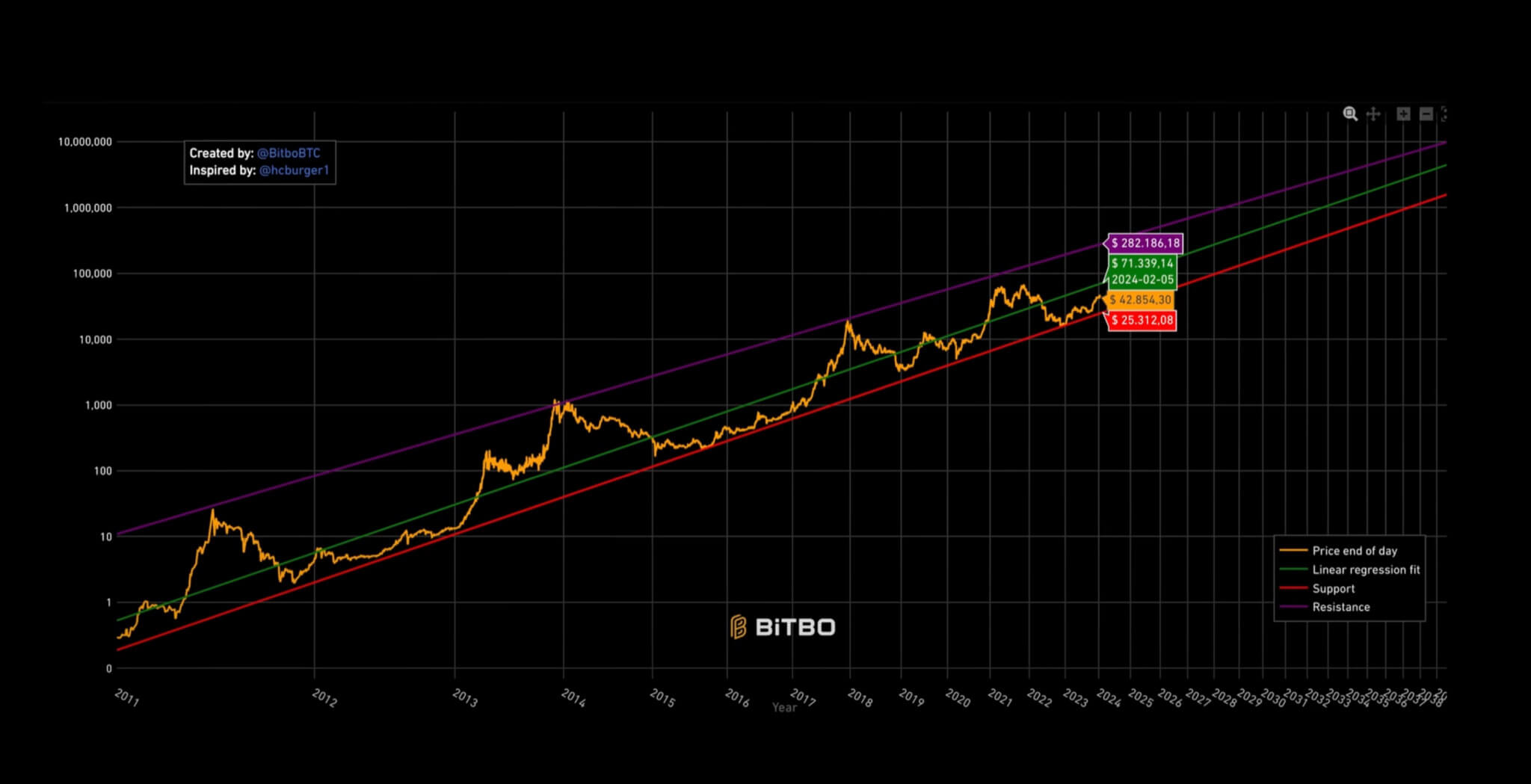

The yellow line represents the current price, and the red line represents the support line, the level Bitcoin usually never drops below. The green line is the linear regression line, which is like the fair value price, where Bitcoin will eventually go back to, and the purple line is the resistance line that Bitcoin typically maxes out at.

Predicting Bitcoin’s Future

Santostasi’s Power Law Model charts Bitcoin’s price trajectory with remarkable precision. It presents a graph showcasing Bitcoin’s current price, a support line indicating the level Bitcoin typically doesn’t drop below, a linear regression line representing a fair value price, and a resistance line marking the level Bitcoin typically reaches before a downturn.

This model underscores the remarkably linear growth of Bitcoin, particularly evident when outliers are removed. Despite occasional fluctuations, Bitcoin’s overall trajectory follows a discernible pattern reminiscent of other phenomena governed by power laws.

Implications for Investors

The Power Law Model offers intriguing insights into Bitcoin’s potential future peaks. Santostasi’s analysis suggests that Bitcoin could peak at $210,000 in January 2026, followed by a subsequent decline to around $60,000. He goes on to predict that Bitcoin will be worth $1 million in July 2033. While mathematical models provide valuable insights, they are not immune to errors and may fail to account for unforeseen events that can significantly impact prices.

“All models are broken but some are useful” means that while models may not be perfect, they can still provide valuable insights. Models, like the power law model or the stock-to-flow model for predicting Bitcoin’s price, have their flaws and limitations. For example, Julio Marino from Crypto Quant pointed out issues with the power law model, such as underestimating errors and giving a misleading impression of accuracy.

Interestingly, both the power law and stock-to-flow models have faced similar criticisms. Despite their flaws, they have historically made almost the same predictions for Bitcoin’s price. However, over time, they may diverge in their forecasts.

The question arises: if these models are correct, why bother with traditional investment strategies like the 60/40 portfolio? Some argue that new models explaining Bitcoin’s behavior could offer better returns.

While some may think these models are worthless, others, like the person speaking, believe they still hold value. Scarcity, driven by Bitcoin’s fixed supply, plays a role in its price appreciation. Additionally, factors like M2 growth also influence Bitcoin’s price.

While models can provide helpful insights, they cannot predict the future. Even if models have flaws, Bitcoin’s trajectory seems upward. So, while it’s essential to consider these models, it’s also essential to recognize their limitations.

[ad_2]