[ad_1]

It has been over ten months, and through 2024, tether (USDT), the leading stablecoin by market value, has expanded its supply by 34.27%.

Tether’s USDT Expands by 34% in 2024

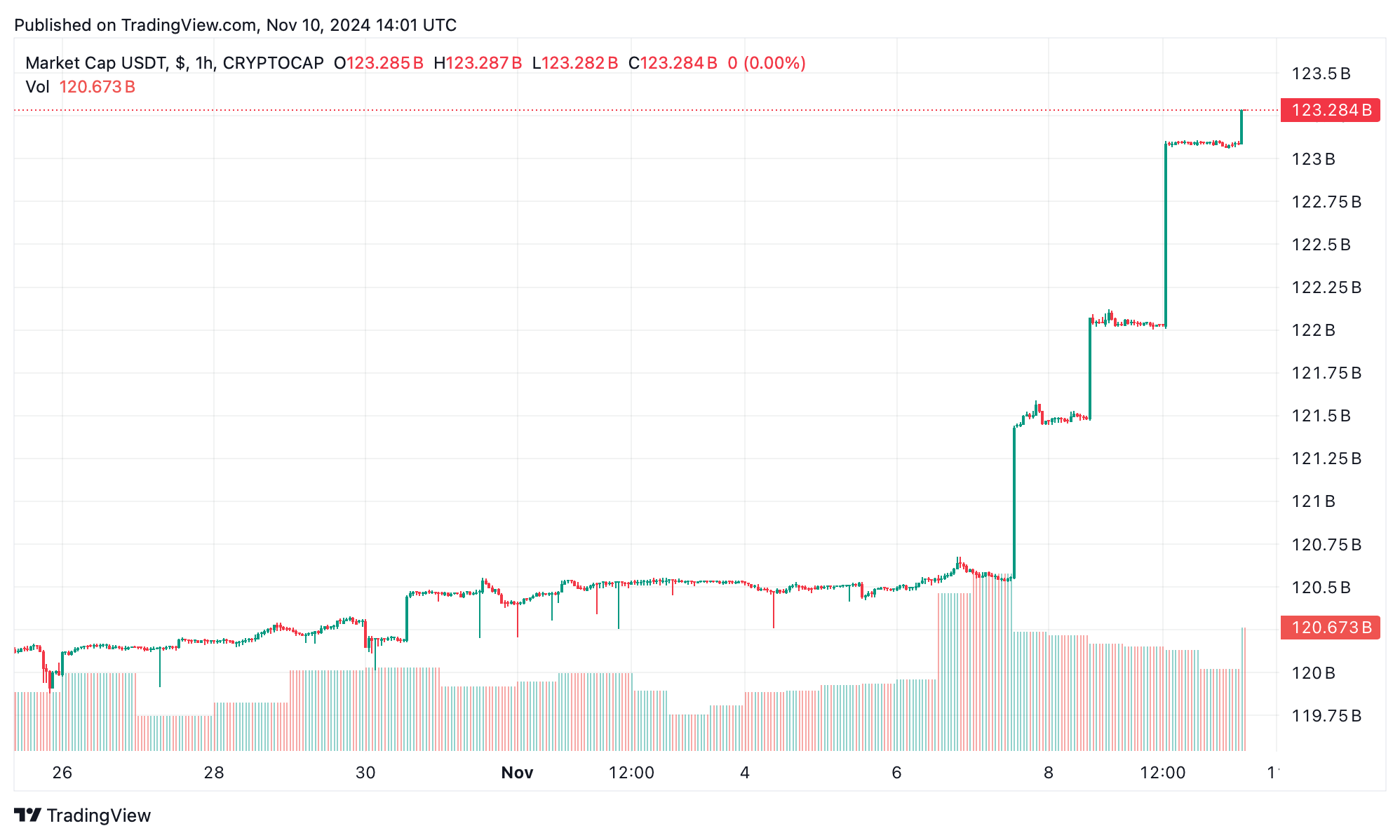

Over the past year, USDT’s supply climbed by 34.27%, rising from $91.73 billion to $123.17 billion. Tether, launched nine years and eight months ago with a market cap of just $304,476, now holds a staggering $123.17 billion valuation, marking a growth of over 40,000,000%. In contrast, its closest competitor by market cap, usd coin (USDC), saw a 50.57% increase since Jan. 1.

Of the 123.2 billion USDT in circulation, 61.79 billion exist on the Tron blockchain, and 57.93 billion are on Ethereum. The Ton blockchain holds 1.22 billion, and Avalanche has 1.19 billion. Solana holds approximately $1.88 billion, with the remaining USDT distributed across Near, Celo, Cosmos, Omni, EOS, Tezos, Polkadot, Aptos, Algorand, and Liquid. Beyond its scale, USDT also outperforms its peers and the broader market in daily trade volume.

USDT Market cap as of Nov. 10, 2024.

For example, on Nov. 9, trading volume decreased by 17.91% from the previous day to $104.28 billion. Of this, $81 billion, recorded across hundreds of global exchanges, was tied to USDT. Tether remains the top trading pair with BTC, ETH, SOL, XRP, DOGE, and countless other assets. While bitcoin is often seen as the dominant crypto asset, USDT has arguably become the stablecoin king, maintaining a pervasive presence despite ongoing scrutiny.

With its extensive market share and grip on trading volume, it is difficult to envision a competing stablecoin overtaking USDT anytime soon. With USDT’s market cap standing at around 3.33 times that of USDC, the gap between the two stablecoin leaders raises questions about market dynamics. Below USDC, the next contender, USDS, holds a market cap of less than $6 billion—a figure that pales in comparison to these two major players. As smaller competitors strive to establish their footing, the considerable gap suggests a long lead.

Recent shifts in the stablecoin market reveal a pivot toward yield-bearing rewards, aiming to entice users and stand apart from established names. Emerging tokens like Ethena’s USDE and Sky’s USDS now offer incentives to institutions and users contributing liquidity or merely holding tokens. This move is motivated by ambitions for transparency, broader adoption, and expanding decentralized finance (defi) avenues.

Although USDT maintains a strong presence in the defi world, yield-bearing stablecoins offer a distinct approach by sharing returns from assets or reserve profits to add value for holders while promising stability. Sky’s USDS ranks third in market cap, and Ethena’s USDE is fifth. While these yield-bearing options spark interest, USDT’s position remains unchallenged—at least for now.

[ad_2]