In the first quarter of 2025, fourteen US states disclosed combined holdings of $632 million in Strategy’s (formerly MicroStrategy) MSTR stock, held within public retirement and treasury funds.

The move highlights a growing trend among states to gain indirect exposure to Bitcoin (BTC) through Strategy, a company known for its substantial BTC reserves.

US States’ Combined MSTR Holdings Reach $632 Million

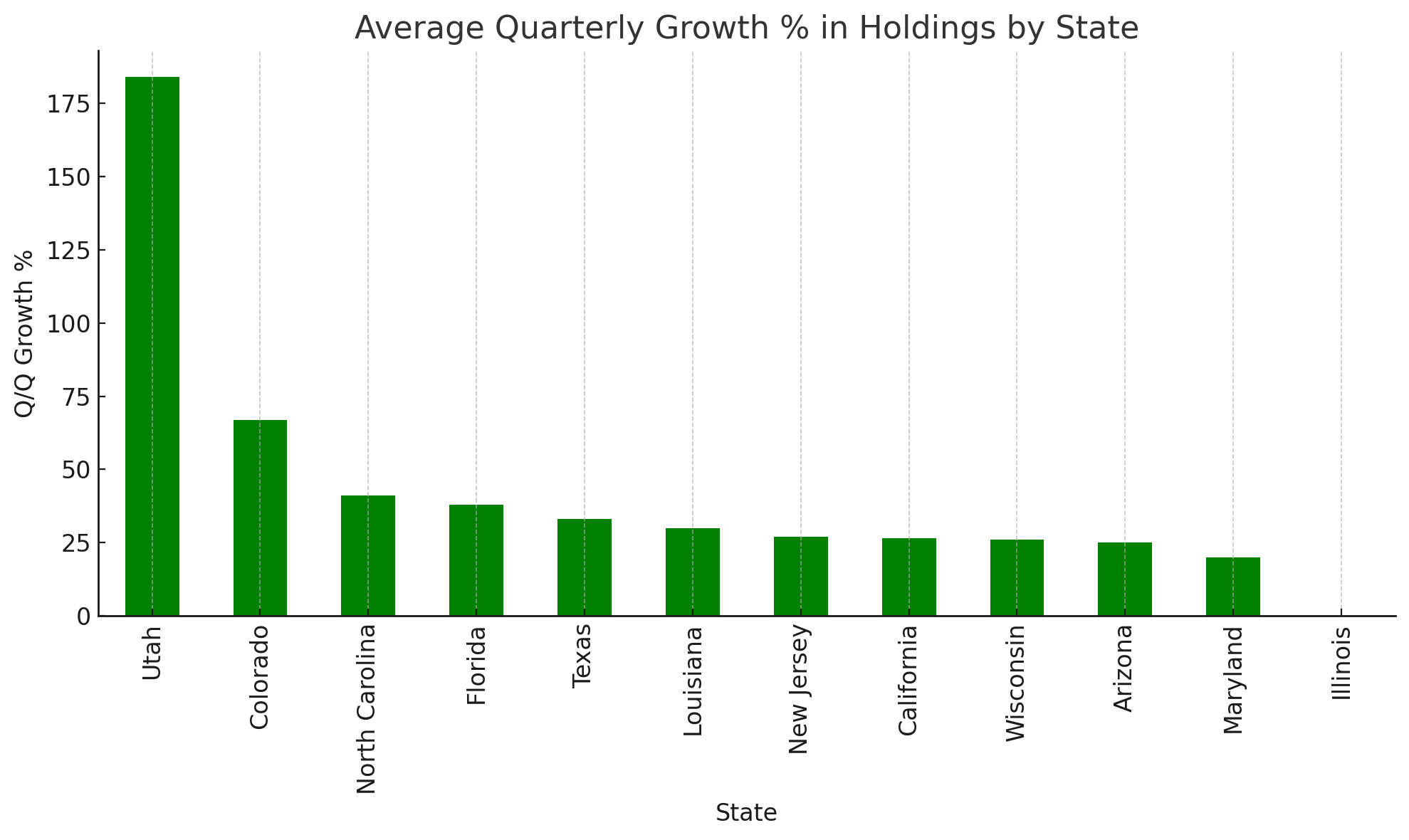

Bitcoin Laws founder, Julian Fahrer, highlighted the disclosure on X (formerly Twitter). The states increased their MSTR exposure by approximately 91.5% compared to their reported holdings of $330 million in Q4 2024.

“A collective increase of $302m in one quarter. The average increase in holding size was 44%,” Fahrer wrote.

California stands out as the largest investor. The state holds $276 million in MSTR shares across two major funds: the State Teachers’ Retirement System (CalSTRS) and the Public Employees Retirement System.

CalSTRS holds 336,936 shares, reflecting an 18% growth. In addition, the Public Employees’ Retirement System holds 357,183 shares. It increased its stake by 35%, adding 92,470 shares in Q1 2025.

US State MSTR Stock Holdings. Source: Data Curated by BeInCrypto

Florida follows with holdings worth $88 million in the State Board of Administration Retirement System. This represents 221,860 shares and a 38% quarterly growth. North Carolina and New Jersey both have $43 million in MSTR. The former’s Treasurer manages 107,925 shares, and quarterly growth was 41%.

In New Jersey, the Police and Firemen’s Retirement System holds 33,628 shares (40% growth). The Common Pension Fund D has 76,615 shares (14% growth).

Arizona, where the governor recently vetoed a Bitcoin reserve bill, has continued stockpiling MSTR. Its holdings have grown by 25%. As of the latest data, it holds 66,523 MSTR shares ($26 million).

Wisconsin’s Investment Board holds 127,528 shares valued at $51 million, growing 26% in the last quarter. The growth points to increased confidence in MSTR.

Yet, the Investment Board’s decision to fully divest from BlackRock’s iShares Bitcoin Trust (IBIT) highlights a cautious approach toward certain crypto investments. According to the latest 13 F filing, in Q1 2025, the board offloaded its entire $300 million stake in IBIT.

“Surprising that State of Wisconsin Investment Board sold their Bitcoin ETF shares for a couple of reasons. One being that they still have a $50 million position in MSTR,” Fahrer said.

Notably, despite holding a more modest 25,287 shares valued at $10 million, Utah has the highest quarterly growth rate of 184%, indicating rapid recent accumulation.

Percentage Growth in MSTR Holdings by State. Source: Data Curated by BeInCrypto

Colorado comes in next, with a strong quarterly growth of 67%. The state’s Public Employees Retirement Association holds 30,567 shares worth $12 million.

Meanwhile, MSTR itself has seen strong gains in 2025. According to Yahoo Finance data, its value has appreciated by 37% year-to-date.

Strategy (MSTR) Stock Performance. Source: TradingView

In fact, with Bitcoin’s recent rally, MSTR prices climbed to $430 on May 9, marking its highest price since December 16, 2024. Nonetheless, the stock fell 19.7% over the past day, closing at $397.