The U.S. dollar is losing its grip on the world. In 2024, its share of global reserves dropped to 59%, down from 72% in 2002. That’s a 13% decline over the last 22 years.

The numbers are clear: countries, especially those in the BRICS bloc, are distancing themselves from the dollar. During the same period, China’s yuan inched up by 3%.

The U.S. dollar has been the world’s leading reserve currency since World War II. Today, it still represents 58% of the value of foreign reserve holdings. But the writing is on the wall.

The euro, the next in line, barely holds 20%. With recent global events, like Russia’s invasion of Ukraine, countries are increasingly looking to diversify their reserve holdings and reduce their reliance on the dollar.

BRICS and their de-dollarization

The BRICS nations have been the loudest in calling for a move away from USD. Over the past two years, they’ve ramped up efforts to promote the use of their national currencies in trade.

China, in particular, has been pushing hard to expand its Cross-Border Interbank Payment System (CIPS).

The goal? To create an alternative financial infrastructure that doesn’t rely on the dollar or SWIFT, the global financial messaging network.

CIPS has been growing fast. Between June 2023 and May 2024, 62 new participants joined the system, bringing the total to 142 direct and 1,394 indirect participants.

While SWIFT is still the big dog with over 11,000 connected banks, CIPS is making moves. China’s push to use the yuan in international transactions is a direct challenge to the dollar’s dominance.

And while the yuan’s share in global reserves slipped slightly from 2.8% in 2022 to 2.3% in 2023, the push for de-dollarization is gaining traction.

The BRICS are also exploring new payment systems that could further reduce reliance on USD. Talks are ongoing about a potential intra-BRICS payment system.

This system could include cross-border central bank digital currencies (CBDCs) and currency swap agreements.

Is the dollar’s dominance actually under threat?

The dollar is not going down without a fight. The Atlantic Council concluded that USD’s role as the primary global reserve currency is still secure in the near and medium term.

The dollar continues to dominate foreign reserve holdings, trade invoicing, and global currency transactions. The euro, despite its best efforts, isn’t a real threat.

Neither is the yuan, at least not yet.

The dollar’s dominance isn’t just about reserve holdings. It’s deeply embedded in global trade and financial transactions. The USD is still the currency of choice for settling international trade.

And even though countries like China are pushing for alternatives, the infrastructure supporting the dollar is massive. This is why the dollar remains strong in reserves, trade, and transactions, despite the efforts to dethrone it.

Despite China’s best efforts, the yuan is still seen as a risky bet. Concerns about China’s economy, its stance on the Russia-Ukraine war, and rising tensions with the U.S. and G7 countries are holding back the yuan’s rise.

Reserve managers are cautious, and this has kept the yuan’s share of global reserves relatively low, even as China pushes for more international use.

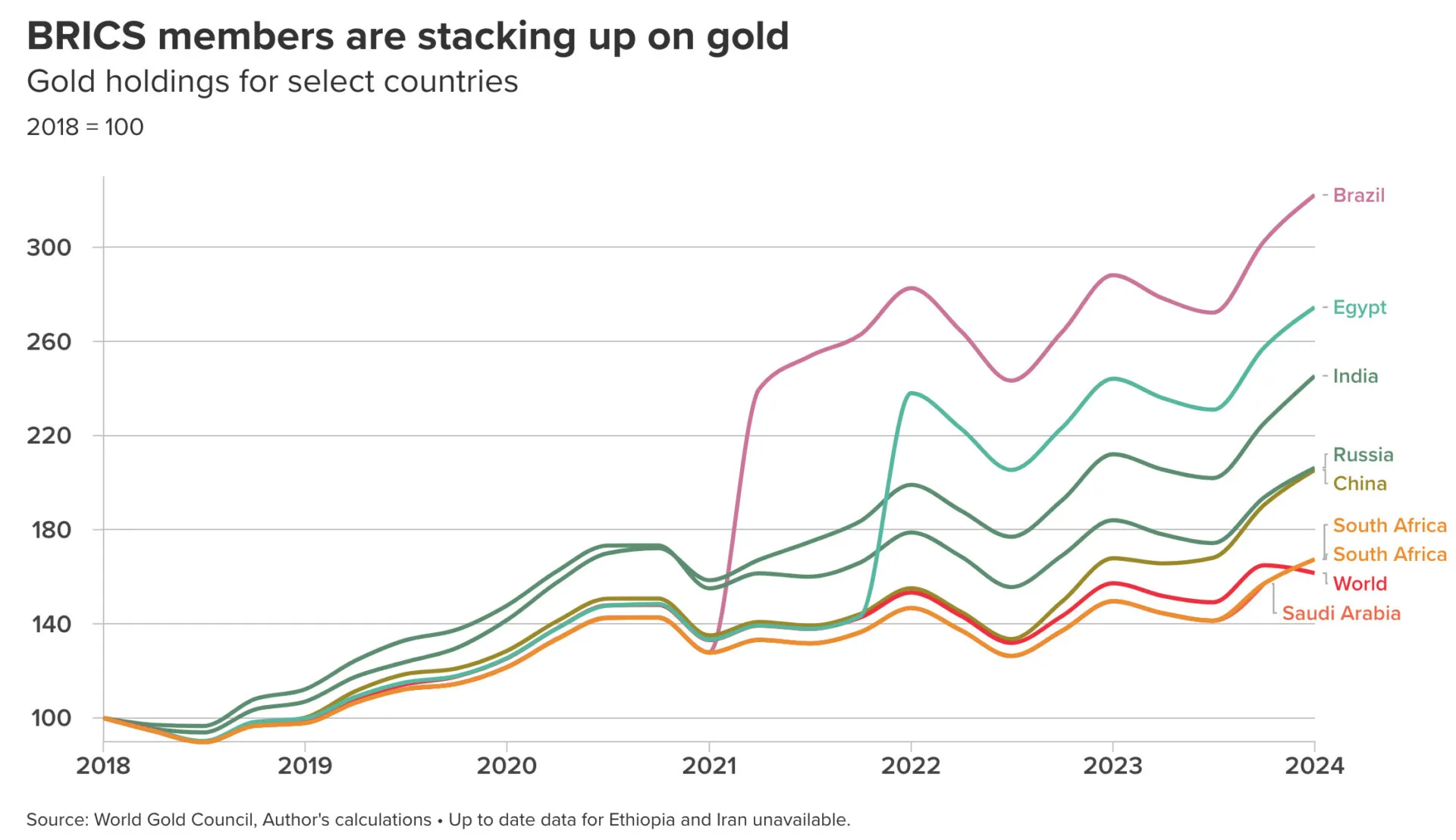

Gold is also making a comeback. Nearly a third of all central banks plan to increase their gold reserves in 2024. The 2022 sanctions on Russia showed that even the euro comes with geopolitical risks, similar to the dollar.

This has driven some reserve managers to look to gold as a way to de-risk their portfolios. While gold can’t replace USD, it’s becoming an important part of the equation as countries try to diversify their reserves.

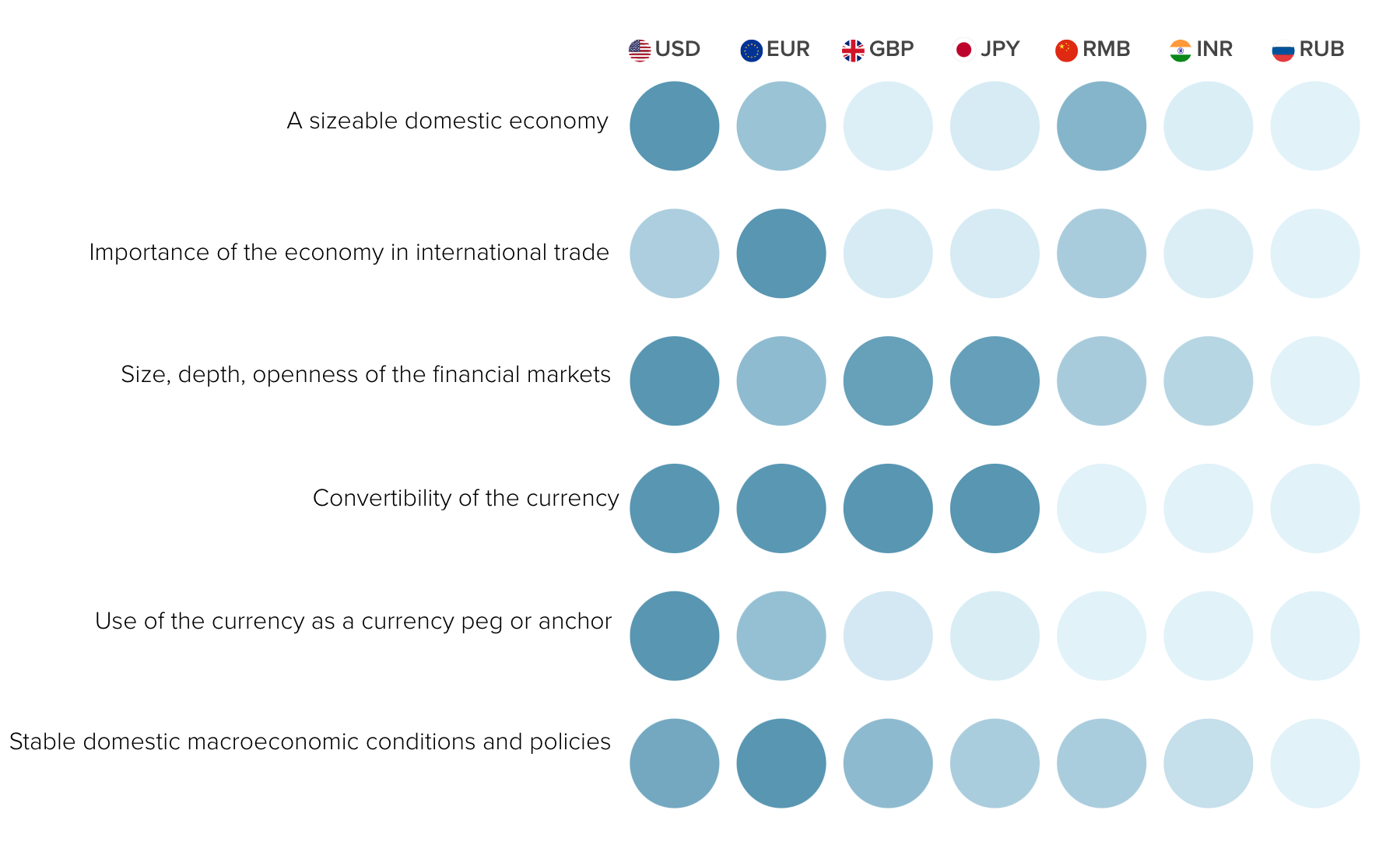

So, what does it take to be a reserve currency? Stability, liquidity, and trust. The USD has these in spades, which is why it’s held the top spot for so long.

The IMF’s Special Drawing Rights basket includes the dollar, euro, yuan, yen, and pound. Among these, the dollar still outshines the rest.