[ad_1]

Bancor was once one of the biggest names in crypto. In 2017 it raised $153 million, one of the largest ICOs of that time, with a promise to change how tokens could be traded.

But only a year later, Uniswap launched with a far simpler design and quickly became the main place for token swaps.

Now Bancor has taken Uniswap to court, starting a legal fight (patent war) that could decide if this is about protecting ideas or just payback.

How It All Started Between Bancor and Uniswap

When Bancor launched in 2017, it was called a game-changer. It introduced Smart Tokens with built-in reserves, and its own token, BNT, was placed in the middle of every trade.

Prices were set by math formulas, but the process was not simple. People had to wrap tokens, hold BNT, and trust the system to manage risks. The design was complex, and for many users, confusing.

In 2018, Uniswap arrived with a much easier system. Instead of Smart Tokens, it used two-token pools. One side was ETH, the other was any ERC-20 token.

Prices were set by a very simple constant product rule. Anyone could add tokens, and anyone could swap. No token sale, no extra token exposure, no wrapping.

This clean model became popular fast. Developers liked Uniswap because the code was simple and easy to use.

Traders liked it because swapping coins felt quick and direct. By 2020, Uniswap had become the main place for token trades on Ethereum.

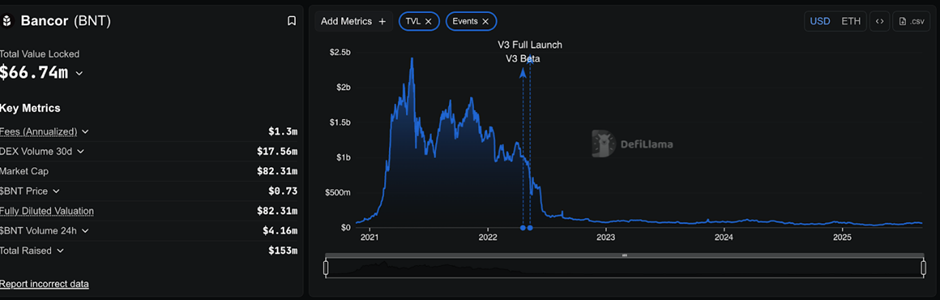

Numbers show how far the two have moved apart. In May 2021, Bancor’s total value locked (TVL) was close to $2.26 billion. Today, it has fallen to just $66.7 million.

Uniswap’s DeFi Growth | Source: DeFiLlama

Uniswap, on the other hand, had about $4.66 billion in TVL in 2021. The number has grown to $5.73 billion now.

How Did the Industry Respond?

In May 2025, Bancor filed a lawsuit against Uniswap Labs and the Uniswap Foundation in a U.S. court. The claim was that Uniswap copied Bancor’s design for automated token swaps, often called AMMs.

Bancor asked for damages and for the court to recognize its early work. Uniswap quickly replied that the case had no value, pointing out that all its code was open and public from day one.

That was only the start. The case soon drew attention from others in crypto.

Paradigm’s lawyer, Katie Biber, sent what is called an amicus brief. Such briefs can sometimes help judges think about the wider impact of a case.

Details On The Amicus Brief | Source: X

Dan Robinson from Paradigm also spoke up, saying that “patent wars have no place in our industry.”

The DeFi Education Fund and other groups agreed. They argued that Bancor’s patents were too broad and looked like an attempt to take over ideas that should remain open for everyone.

The shared concern was that if Bancor won, other protocols could also start suing, slowing down progress for everyone.

What the Case Means for DeFi’s Future

The lawsuit is not just about math or code. It comes years after Bancor lost its lead and struggled to bring users back. The timing makes it look less like protection and more like frustration.

After all, Bancor had the early advantage but lost it because its design was too complex. Uniswap, by staying simple, became the core of Ethereum’s trading layer.

Bancor’s DeFi Degrowth | Source: X

For traders, the outcome could affect daily life. If Bancor’s patents are upheld, other teams may face lawsuits for using the same type of market design.

That would raise costs, slow down development, and make token trading more expensive. If Uniswap wins, it would prove that these basic systems belong in the open.

That would give developers the confidence to keep building without fear of lawsuits.

In the end, this is more than just a courtroom story. It is about two very different approaches to crypto. Bancor tried to protect users with extra features, but broke under stress.

Uniswap gave users simple tools and trusted them to take risks on their own. One lost ground, the other became the leader. Now the legal fight is the last card Bancor has to play.

[ad_2]