[ad_1]

Uniswap activity recovered in the past month, with a new activity record on L2 chains. The Uniswap versions on Base and Arbitrum led the way, leading to a new trading volume all-time high.

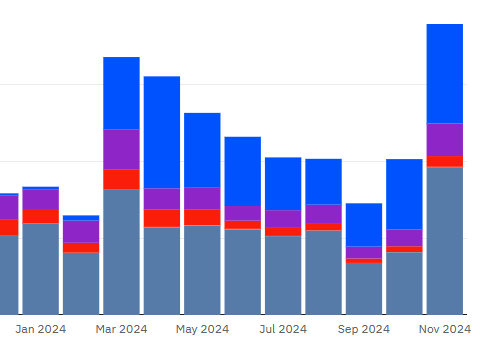

Monthly volumes for Uniswap versions on L2 chains reached a new all-time high. The expansion was driven by the versions on Arbitrum and Base, the two leading L2 chains in terms of apps and activity. Uniswap activity increased after expectations of a more lenient stance from Trump’s renewed Securities and Exchange Commission (SEC) team.

Uniswap volumes on Arbitrum grew from $8.1B in September to $19.28B at the end of October. Uniswap V3 on this L2 chain is behind Aave and GMX, two DeFi protocols with lending vaults and much higher value locked. However, Arbitrum is becoming a key venue for scalable, cheaper DEX trading, with more than $365M in liquidity in the decentralized trading pairs.

On Base, trading volumes expanded from $9.91B to $12.97B, while Uniswap remained the second most active DEX on the tokenless chain. The growth of Uniswap coincided with an overall recovery for L2 projects, in terms of token market price, as well as transaction activity.

Uniswap expanded its activity to an all-time high, boosted by its versions on Arbitrum and Base. | Source: Dune Analytics

Uniswap V3 is the prevalent DEX, with representation on a total of 23 L1 and L2 chains. However, most of the activity is concentrated on a handful of top chains. This is due to fragmented liquidity, which sits in the assigned liquidity pairs. There is little overflow between Uniswap V3 versions, though there is significant liquidity inflows and outflows between top L2 and Ethereum.

Uniswap fees expand beyond Ethereum

The increased activity on Uniswap is reflected in both monthly and short-term fees. As of November 27, Uniswap surpassed Ethereum and lined up among the top 5 fee producers among chains and apps. The Uniswap Universal Router burns more than 10% of total gas on Ethereum, surpassing even the Tether (USDT) smart contract. The primacy of Uniswap also reveals the main use cases on Ethereum, focusing on stablecoin transfers and DEX trading.

Uniswap produced $5.44M in fees on all chains, surpassing Ethereum. The DEX is still behind Raydium, with $6.44M in fees. Uniswap may have a chance to surpass Raydium if meme token activity slides further.

Uniswap V3 achieved $100.43m fees in November to date, making it the strongest month in H2. The recent performance surpasses even the success in October, showing DEX are also reacting immediately to market rallies. Based on Token Terminal data, in October, Uniswap achieved $59.91M in fees.

The DEX still has $7.86M in monthly losses, due to paying out incentives. Despite this, Uniswap is a net benefit to its ecosystem participants and liquidity providers.

The heightened activity on Uniswap does not come from memes, as swaps are still relatively expensive on Ethereum. Instead, the most active asset is Wrapped ETH (WETH), traded as a way to bridge liquidity to other assets. Uniswap also relies on USDT stablecoins for cashing out of WETH. Trading WETH may be a way to lock in gains, or bet on the price of ETH on the open market.

Uniswap is ranked sixth in terms of total value locked, holding $6.19B in liquidity in its trading pairs. In the past month, the value locked expanded by 30% as ETH and other assets appreciated.

UNI token reflects peak November performance

UNI tokens broke above $13.20, reaching a one-month peak. UNI has a chance to revisit its 2024 high at $15.39, this time trading with higher volumes compared to the May peak. UNI has spent months in accumulation, now awaiting a breakout if speculation moves to altcoins.

UNI open interest moved to a six-month high of $212.9M, with a 65% dominance of long positions. At this stage, UNI may remain risky in the short term, but retaining optimism for long-term expansion to its all-time high. UNI is seen as a long-term bullish token, reflecting the indispensable DEX activity for crypto adoption.

DEX tokens as a whole became more active, surpassing $38B in valuation. UNI was among the biggest gainers, adding 53% in a week, surpassing the growth of Raydium (RAY). Demand for DEX tokens also lifted other assets like JUP and CAKE, reflecting heightened decentralized trading.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap

[ad_2]