[ad_1]

Uniswap, the second-largest decentralized crypto exchange (DEX) by trading volume, is nearing $1 trillion in yearly volumes, but holders of the platform’s token say that the success is not being shared with them. UNI holders took to X this week to call out that Uniswap’s soaring metrics have not provided them with payouts, revenue share, or some other structural benefits.

The uproar on X started after Uniswap founder Hayden Adams published a post on Sunday, Sept. 21, boasting about the platform’s metrics and saying “Always funny to see people bear post Uniswap,” adding further that the protocol’s volumes “are at all time high” exceeding $1 trillion per year for the first time.

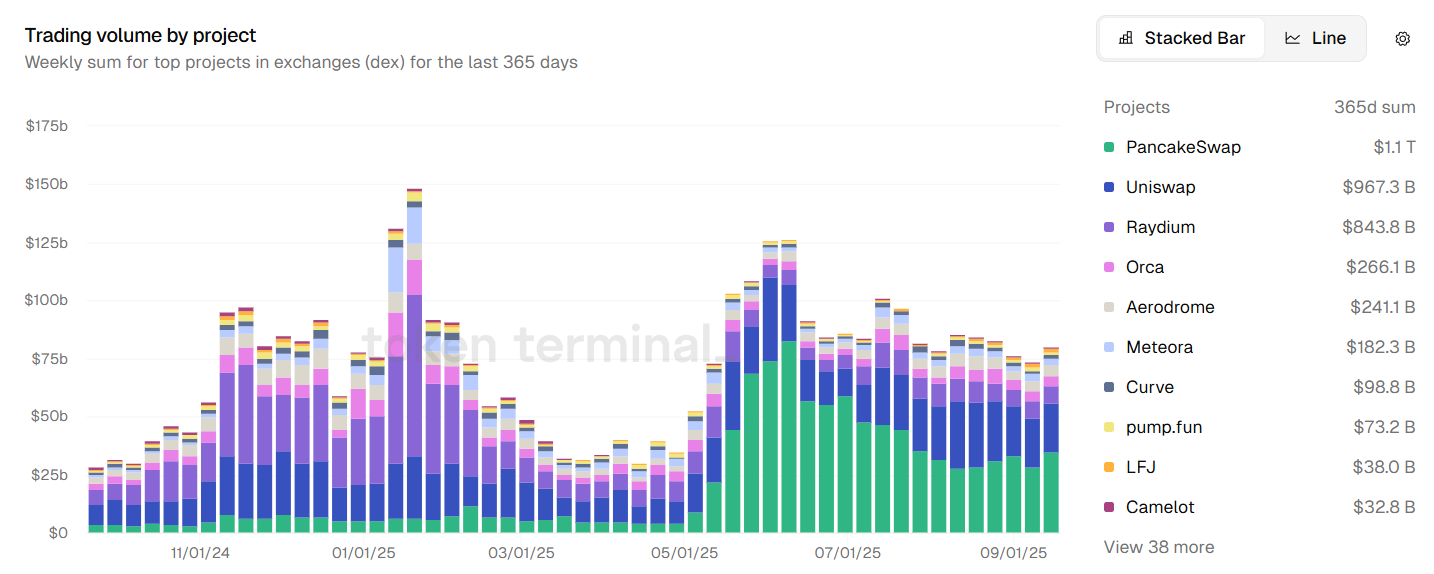

Top DEXs by trading volume. Source: Token Terminal

Data from Token Terminal shows that Uniswap is nearing the $1 trillion mark for yearly volume, next only to PancakeSwap, which has already surpassed $1.1 trillion in the past year.

Adams’ post sparked an immediate reaction in the crypto community, which wasn’t pleased with how things are unfolding for UNI holders. Arca chief investment officer Jeff Dorman fired back at the Uniswap founder, saying in an X post that UNI has become a “complete nonsense token in today’s market & changing regulatory environment.”

“Everything you and your VCs stand for is irrelevant. Turn on revenues & buybacks, or don’t bother having a token,” Dorman added in the X post.

Crypto investor Mike Dudas also responded to Adams’ post yesterday, saying “reasonable to ask why there is no value accrual to the UNI token 5 years post-TGE[.] nearly every other major defi primitive has figured this out by now[.]”

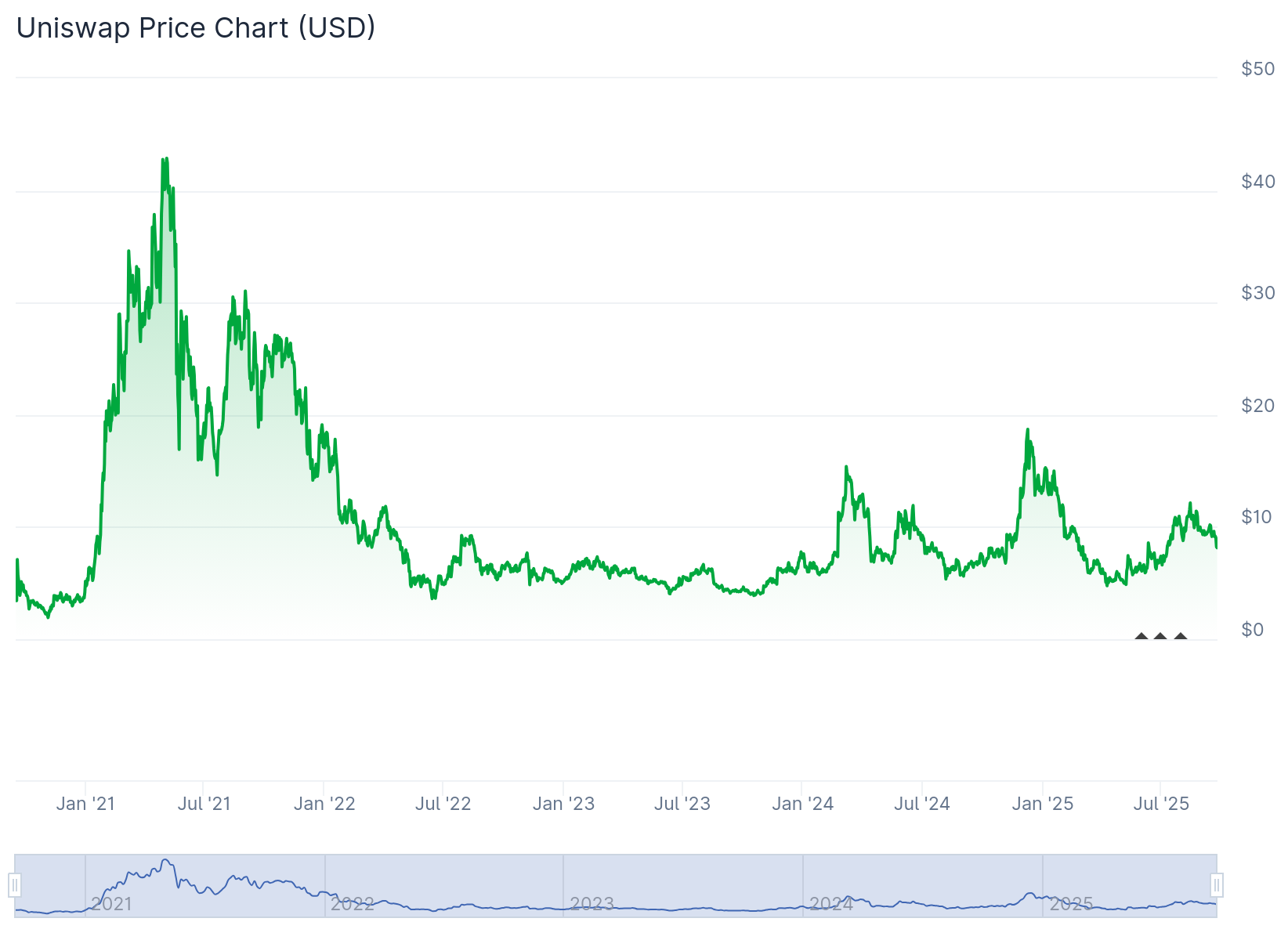

As of press time, Uniswap (UNI) is trading at $8.13, down 81.7% from May 2021, when it reached an all-time high at $44.92, according to The Defiant’s price tracking page.

UNI all-time price chart. Source: CoinGecko

While the argument that the DEX’s high volumes and revenue don’t directly benefit UNI holders was repeated by several prominent commentators, some also pointed out issues with the volumes themselves.

Pseudonymous DeFi analyst jpn memelord wrote in a Monday X post that roughly 5% of Q3’s $270 billion in trading volume on Uniswap’s version for Base came from a “honeypot network,” or a malicious smart contract that creates tokens that are unsellable.

“The bots don’t even pay the front end fee to Uniswap Labs, this is just volume for volume’s sake (or potentially money laundering),” the analyst added.

Third Parties Get It All

Launched in September 2020, the UNI token mainly functions as a governance tool, letting holders vote on fee structures, but so far none of those mechanisms have delivered real economic gains to token holders.

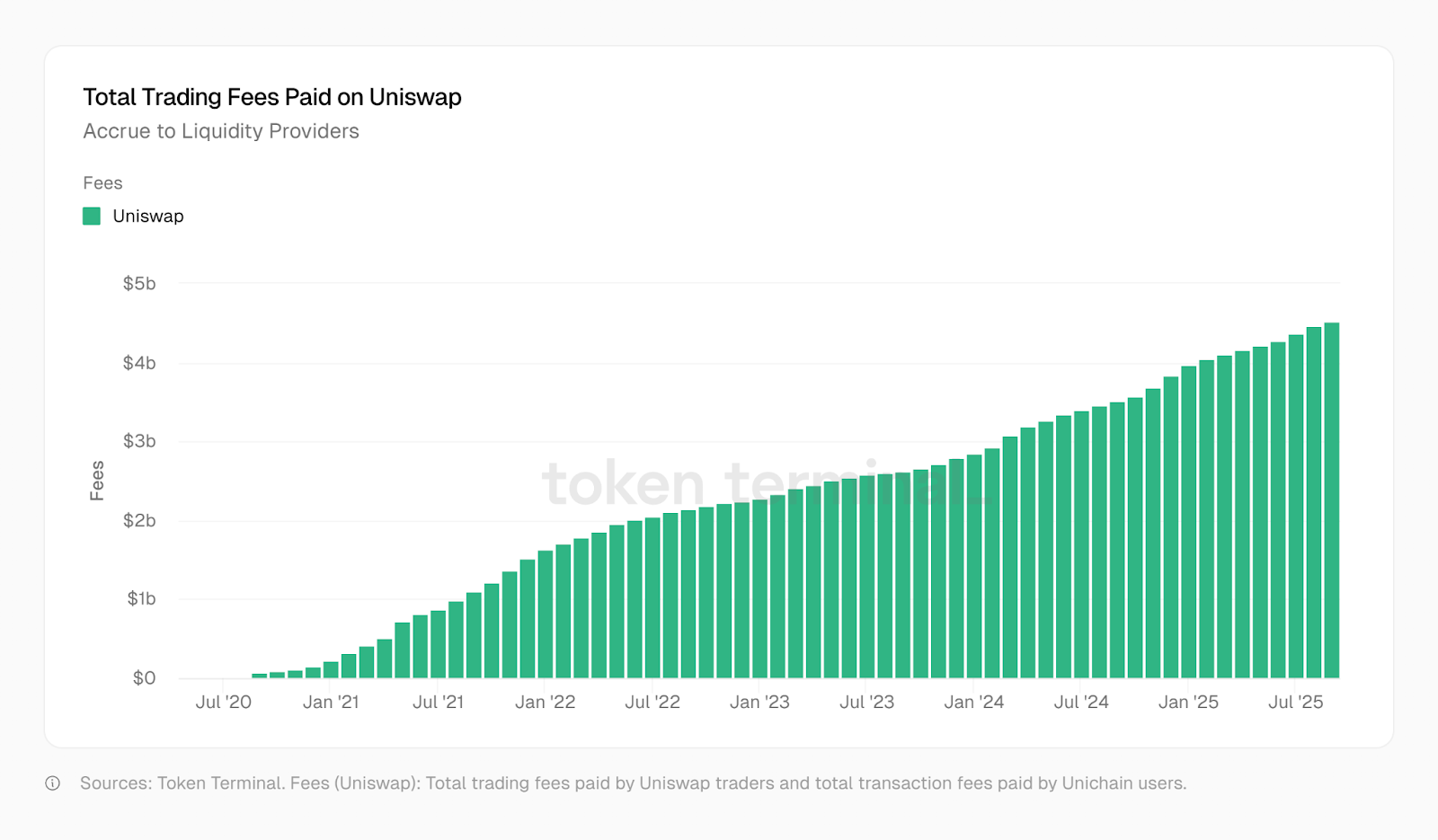

Analysts from The DeFi Report pointed out in a research note earlier this year that over 99% of the value created by Uniswap has gone to third parties like liquidity providers, MEV bots, and Ethereum validators. Since May 2020, Uniswap has paid over $4.5 billion in trading fees to liquidity providers, Token Terminal data shows.

Total trading fees paid on Uniswap. Source: Token Terminal

However, Uniswap Labs, the developer of the Uniswap protocol, wasn’t left behind. The DeFi Report notes that the team activated a fee for users trading on Uniswap via the web interface

The report states that the interface fee generated Uniswap Labs $50 million in the first six months of its activation.

In total, all-time fees captured by Uniswap Labs have surpassed $127 million by press time, Token Terminal data shows. The DeFi Report analysts also note that UNI holders and investors “have not received any fee revenue to date.”

Uniswap did not immediately reply to The Defiant’s request for comments on the platform’s plans for UNI’s tokenomics.

Focus on Unichain

Technically, the Uniswap Foundation tried to address this issue in early 2024 by letting UNI holders stake their tokens to earn a share of protocol fees.

A Snapshot vote in March showed support, but the plan was put on hold after the U.S. Securities and Exchange Commission (SEC) issued a Wells Notice to Uniswap Labs, alleging it operated as an unregistered securities exchange and that UNI might be considered an unregistered security. Even though the SEC dropped its charges in February of this year, the regulatory uncertainty left the initiative stalled.

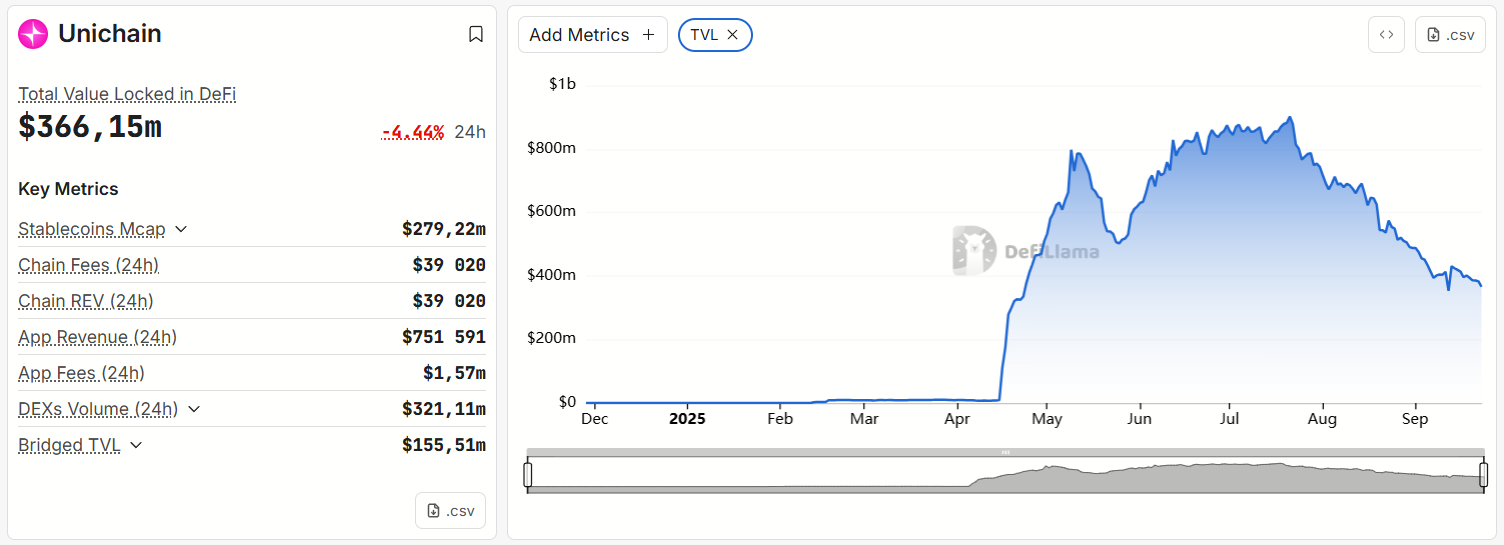

The DeFi Report analysts suggested that Uniswap’s launch of Unichain, a Layer 2 protocol on the Optimism Superchain, could eventually allow UNI holders to capture some of the protocol’s economic upside by staking tokens with validators to earn settlement fees and MEV revenue, without taking fees from liquidity providers.

Unichain TVL. Source: DefiLlama

But, as of press time, that potential hasn’t materialized, with data from DefiLlama showing total value locked (TVL) in Unichain has steadily fallen since late July and now sits around April levels of around $360 million.

[ad_2]