[ad_1]

The U.S. House of Representatives is poised to vote in favor of a crypto market structure bill for the first time, in a symbolic effort to radically reshape the country’s digital asset regulatory landscape.

The Financial Innovation and Technology for the 21st Century Act, sponsored by members of the House Financial Services and House Agriculture Committees, will begin seeing votes Wednesday afternoon, where it is expected to pass with a bipartisan majority.

The bill, dubbed FIT21, would grant the U.S. Commodity Futures Trading Commission (CFTC) greater spot-market authority over digital assets deemed to be commodities, while also creating new jurisdictional lines for the Securities and Exchange Commission (SEC). Crypto companies and digital asset issuers would have a framework for determining whether and how their assets are securities under the terms defined by the bill, which in turn would let them know who their primary regulator could be.

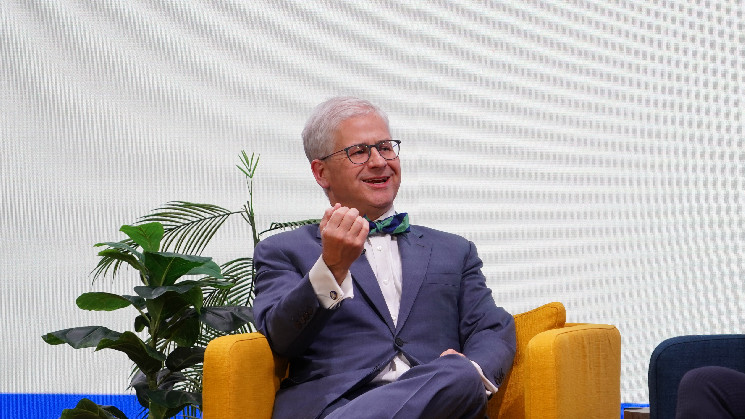

Rep. Patrick McHenry (R-N.C.), who chairs the Financial Services Committee, told reporters on Tuesday that he hoped for “a substantial vote” in favor of the legislation to demonstrate that there is real momentum for digital asset legislation, a week after the Senate voted in favor of a House resolution that overturned SEC accounting guidance.

The bill is expected to pass, with a handful of Democrats joining a majority of Republicans in voting in favor of the bill. The bill’s path through the Senate is less clear, and the White House earlier Wednesday said it opposed the legislation, though President Joe Biden did not threaten a veto.

For and against

The bill has been the subject of a large amount of discussion in recent days.

Rep. Jim Himes (D-Conn.), one of at least nine Democrat lawmakers who said they would support the bill, said he “look[ed] forward to working with my colleagues on the Financial Services Committee on our continued oversight of this issue.”

“FIT21 is an important step forward in the regulation of the cryptocurrency industry and a meaningful improvement on the status quo,” he said in a statement.

Rep. Ro Khanna (D-Calif.) announced he would vote in favor of the bill shortly before the vote on Wednesday, saying “we need blockchain innovation here in America.”

Rep. French Hill (R-Ark.) told reporters on Tuesday that the bill creates a “5-step test on whether something is a decentralized blockchain or not,” and includes a roadmap for the regulator to utilize.

In comments to the House Rules Committee, he said the lawmakers who developed the bill had engaged with regulators – including the SEC – for more than a year, incorporating their feedback to the legislation.

“We included provisions to mitigate conflicts of interest. We impose capital and other necessary requirements on intermediaries. And we impose higher standards for custody,” he said.

There’s an interim process as well, where companies need to file a “notice of intent to register” with the agencies, he said.

Read more: Democrat House Leadership Says Crypto Bill Vote Won’t Be Whipped

Opposition to the bill, however, starts within the House Financial Services Committee itself.

Rep. Maxine Waters (D-Calif.), the ranking member on the committee, dubbed the bill the “not fit for purpose act” and told the House Rules Committee on Tuesday that it “is perhaps the worst, most harmful deregulatory proposal I have seen in a long time,” likening it to the Commodity Futures Modernization Act. The CFMA, Waters charged, deregulated certain derivatives products which later “blew up our economy when AIG collapsed.”

FIT21 does not give the CFTC greater authority to target fraud or other crimes, despite directing the agency to oversee digital commodities, she said. The bill also sunsets disclosure requirements after 180 days, meaning the regulator cannot force companies it’s supposed to regulate to provide audited financial statements past that deadline.

“What is even more problematic is the bill’s definition of quote ‘investment contract assets,'” she said. “Securities that meet this definition would be transferred into a regulatory void, with no primary regulator and virtually no laws and regulations to speak of. Importantly, the definition of investment contract asset is not limited to crypto, and it would be fairly easy for both crypto and traditional securities to be formatted to meet this definition.”

Interest groups weigh in

A group of unions, consumer protection organizations, academics and others sent a public letter to House Speaker Michael Johnson (R-La.) and Minority Leader Hakeem Jeffries (D-N.Y.) asking them to vote against the bill and laying out a list of concerns similar to Gensler’s.

The letter took aim at the industry more broadly, saying crypto “still struggles to demonstrate viable use cases outside of speculative investment” and referencing the various ongoing bankruptcies and civil and criminal litigation.

“The industry has superficially recovered this year, in part due to controversial approval of spot BTC ETPs by the Securities Exchange Commission,” the letter said. “Yet, the scams, hacks, theft, instability, reckless promotional activities, and regulatory evasion that were present during the last crypto bull market remain endemic in the industry today.”

The letter was signed by organizations including the AFL-CIO, Americans for Financial Reform, Revolving Door Project, the National Consumer Law Center and over 30 others as well as 10 individuals.

Echoing Gensler, the groups said they are concerned the bill would weaken existing securities laws to the point where even non-crypto companies could “evade more rigorous oversight” by tying themselves to a decentralized network (or at least claiming they were tied to a decentralized network). While the bill gives the CFTC greater authority, the letter said this authority “is vague,” to the point it could undermine other agencies like the Consumer Financial Protection Bureau.

“All told, we believe this bill as written introduces a policy ‘cure’ that would be far worse than the disease and create significant harm within and far beyond the crypto industry,” the letter said.

Advocates for the bill argue that legislation is needed to support companies’ efforts to “build a better financial services system and better internet.”

“Since the inception of the Bitcoin network in 2009, the blockchain and digital asset industry has existed without targeted market regulation,” a letter filed by the Blockchain Association, a lobby group, said. “The absence of clear rules leads to confusion in the marketplace for companies – and leaves users and consumers unprotected.”

Read more: Crypto Industry Rallies Behind House Bill as It Heads Toward Final Vote

The letter, signed by groups including stablecoin issuer Circle, Ethereum incubator ConsenSys, venture capital firm Digital Currency Group, exchanges such as Kraken and 50 other companies in the sector, went on to argue that the “lack of clarity” risked putting the U.S. behind in “the global technology race.”

SEC Chair Gary Gensler published a statement on Wednesday opposing the legislation. In it, he raised the specter of crypto’s various collapses and frauds, suggesting the bill might allow even traditional pump and dumpers or penny stock pushers to escape oversight by branding themselves as using decentralized networks.

“We should make the policy choice to protect the investing public over facilitating business models of noncompliant firms,” he said.

[ad_2]