[ad_1]

TURBO rallied over 30%, hitting a new all-time high of $0.0143 on Dec. 12 following a recent listing on Coinbase, the largest crypto exchange in the U.S.

Turbo (TURBO), the toad-themed meme coin on Ethereum, was up 16.1% over the past day at press time, trading at $0.01283. Its market cap stood at $893 million, just $107 million shy of reaching the $1 billion milestone.

The altcoin’s rally came in a high-volume environment. According to crypto.news data TURBO’s daily trading volume jumped 62.9%, hovering over $956 million.

TURBO saw a significant rally after its listing on Coinbase, a tier-1 cryptocurrency exchange with a daily trading volume exceeding $9.1 billion, according to data from CoinGecko.

Hours later, the meme coin was also listed on Coinbase Advanced, the exchange’s platform designed for more experienced traders. The renewed interest from traders subsequently propelled the meme coin to trend on Google.

Turbo’s recent rally was also fueled by its listing on other popular exchanges, including X-change and Biconomy. The altcoin’s price also gained momentum amid a broader rally among meme coins, with the meme coin market gaining 8.7% over the past day standing at $138.5 billion when writing.

You might also like: Three reasons SUI could target $7.66 by 2025

According to data from Coinglass, the Open Interest in TURBO futures across exchanges increased from $56.93 million on Wednesday to $104.97 million on Thursday, continuing its steady rise since late November. A growing Open Interest indicates fresh capital entering the market and new buying activity, suggesting a potential rally in TURBO’s price.

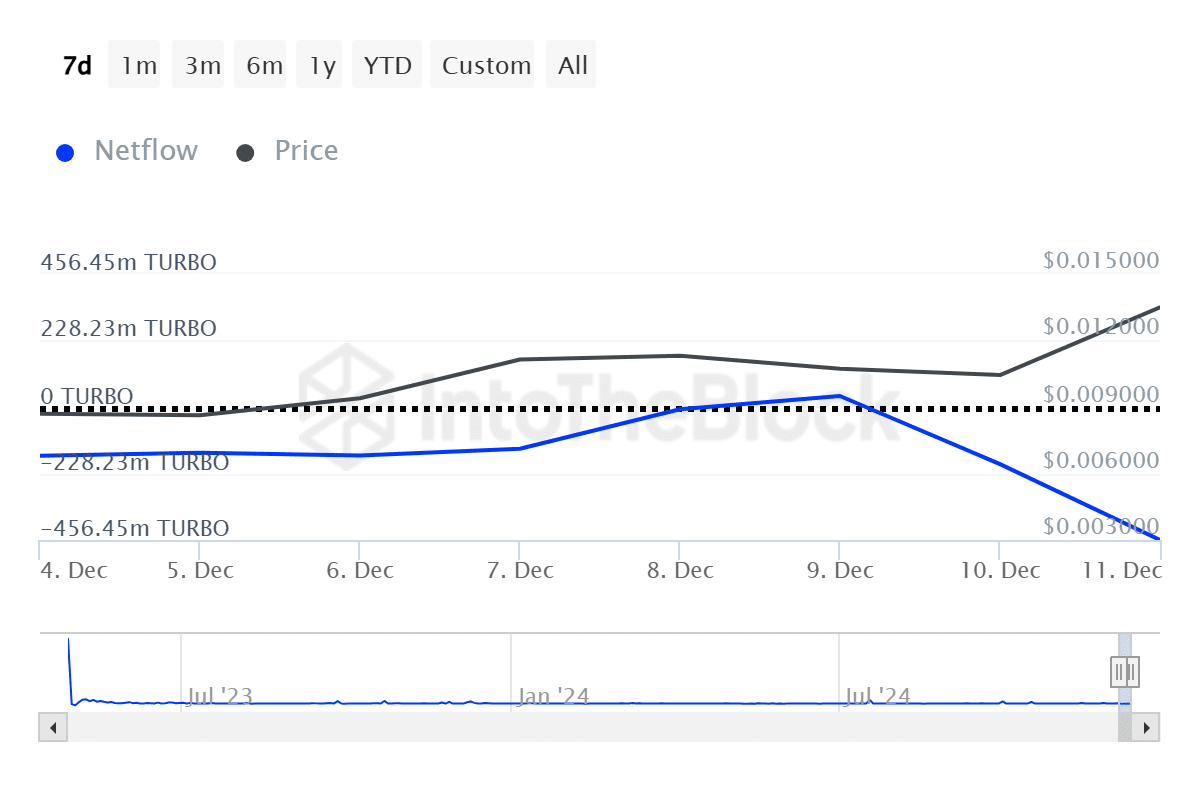

Despite Turbo’s recent gains, the meme coin faces a potential risk that could hinder its current rally. According to data from IntoTheBlock, whales have started selling the asset, as indicated by the whale holder netflow, which has shifted from an inflow of $403,000 on Dec. 9 to an outflow exceeding $6.1 million on Dec. 11.

TURBO price and large holders net flows – Dec. 11 | Source: IntoTheBlock

Whale sell-offs often indicate periods of panic or profit-taking, which can frequently lead to price drops. As previously reported by crypto.news, these large investor sell-offs drove AAVE, the native token of crypto lending platform Aave Protocol to fall by 14% over five consecutive days after hitting a local high at the end of October.

Read more: 4 reasons behind Aave’s rally to 40-month highs

[ad_2]