Tron’s latest entrant in decentralized derivatives, Sunperp, has opened for traders, adding a new venue to a field crowded by perp players like Hyperliquid, Avantis, Aster, Dydx, GMX, and Jupiter.

Sunperp Opens on Tron; Traders Eye Fees, Slippage, and Funding

Positioned as a perpetuals-focused decentralized exchange (DEX) on Tron, Sunperp outlines design choices aimed at cost and execution reliability: aggregated liquidity across networks, off-chain matching with onchain settlement to support gas-free trades, and multi-source price oracles that compute a “mark price” for profit-and-loss and liquidation logic.

The project docs describe millisecond-level matching, post-trade settlement onchain, and a tiered maker-taker fee schedule linked to recent trading volume. It also details multi-layer risk parameters published per market pair for transparency to users.

The venue supports common order types—market, limit (with FOK, GTC, and IOC time-in-force), post-only, plan orders, trailing strategies, and time-weighted average price (TWAP)—and uses tether ( USDT) as primary collateral with P&L calculated in the stablecoin USDT.

Source: sunperp.com

Sunperp’s risk tools include an insurance fund and auto-deleveraging (ADL) that can reduce opposing positions during stress when reserves decline quickly; users see an on-screen indicator ranking their ADL risk. The platform also emphasizes price-deviation protection that executes against oracle prices rather than order-book prints during volatile moves.

Sunperp’s documentation further states that the core contracts are non-upgradable and that the system remains in testing, with smart-contract, market-maker, liquidity, and network-congestion risks disclosed.

Sunperp’s liquidations trigger when the mark price—computed from a composite of major spot venues and funding-rate inputs—reaches a position’s threshold; smaller positions are more likely to be fully liquidated, while larger positions may be handled in tiers.

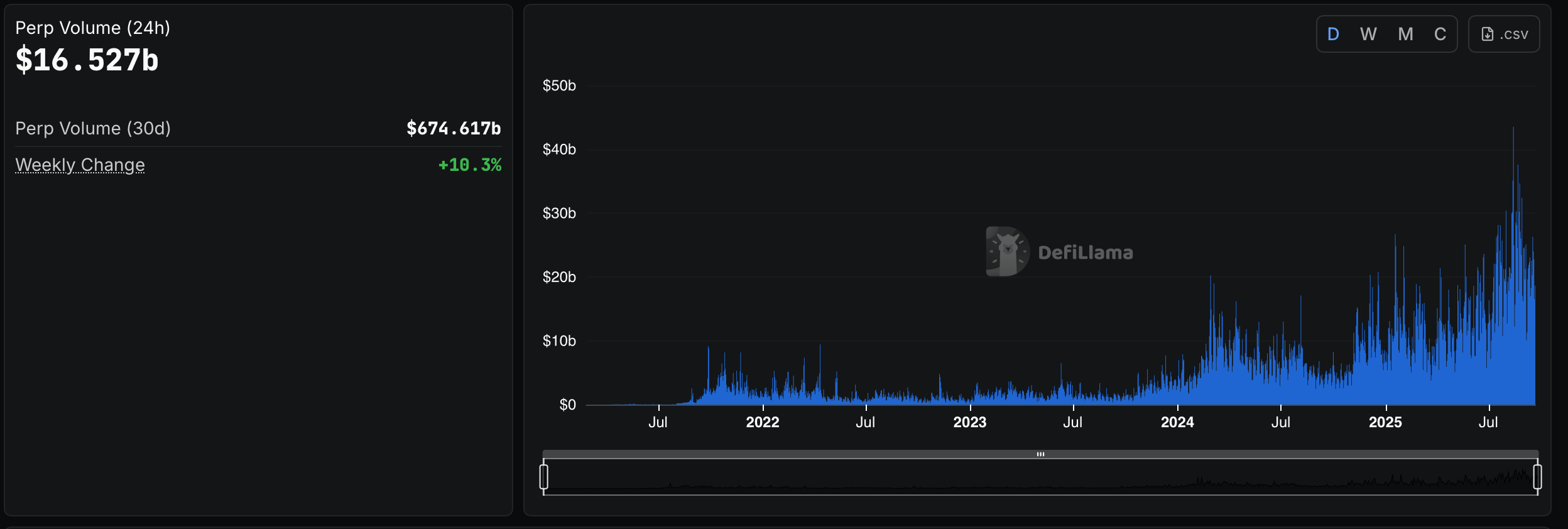

While the feature set is extensive, Sunperp enters a thickly competitive segment. Onchain perpetuals have seen rising activity from rivals ranging from general-purpose layer twos (L2s) to straight-up app-chains like Hyperliquid, and incumbents already advertise deep liquidity, rebates, points or airdrops.

24-hour perp volume according to defillama.com. Hyperliquid has dominated by raking in 31.48% of the day’s volume.

Traders will likely compare effective fees, realized spreads, and funding outcomes before shifting flow from established alternatives. Tron founder Justin Sun promoted the launch several times on X, saying, “Sunperp’s got three big perks: deposit paybacks, lowest fees, and airdrop hype.”

The Tron executive added:

“Jump in and try the cheapest Perp DEX on Tron — do the math!”

As with any decentralized exchange (DEX), user outcomes hinge on slippage, settlement latency, oracle robustness, and funding mechanics during volatility. For now, Sunperp presents a detailed rulebook—covering order types, margin, liquidation, and ADL—and a public invitation to test its approach against well-capitalized competitors in practice.