[ad_1]

As Bitcoin breached the $52,000 mark, a notable shift in investor sentiment has been observed, with an increased interest in call options for Bitcoin at ‘ambitious’ strike prices. This trend, primarily focusing on strikes above $60,000, signals a ‘robust’ confidence among traders in Bitcoin’s potential for further gains.

QCP Capital, a renowned crypto asset trading firm, explained this phenomenon in its latest report, emphasizing the concentrated buying activity in these high-strike call options with various expiry dates.

Related Reading: $52,000 And Climbing: Bitcoin Eyes New Highs This March, Predicts Top Firm

A Surge In High-Strike Call Options

Call options are financial contracts that give the buyer the right, but not the obligation, to buy an asset at a predetermined price within a specified timeframe.

In the context of Bitcoin, this surge in call option buying at higher strike prices suggests a bullish outlook from investors, betting on Bitcoin’s price to climb significantly higher than its current levels.

This optimism is not just a speculative bubble but is backed by substantial financial commitments, with QCP Capital highlighting close to “$10 million spent on premiums for $60,000 and $80,000” strike options alone.

According to the detailed analysis by QCP Capital, there’s been a significant uptick in the purchase of Bitcoin call options, with strike prices towering above $60,000. This activity is spread from April to December expiries, indicating a long-term bullish sentiment among investors.

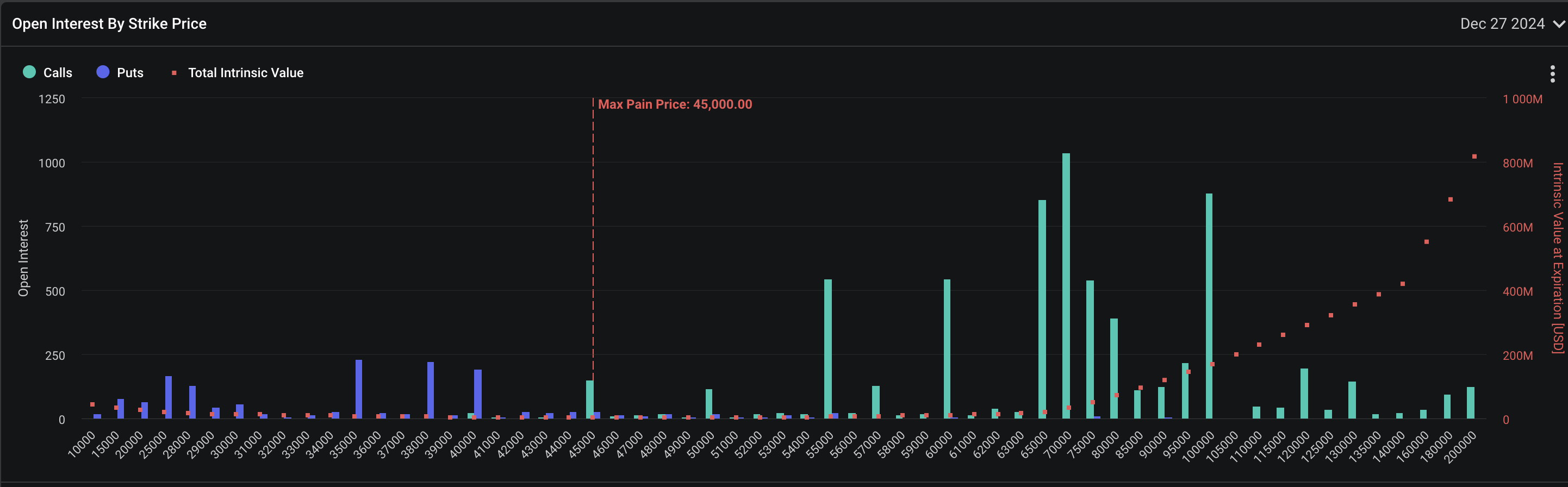

Deribit, the leading crypto derivatives exchange, corroborates this trend, reporting a substantial concentration of open call options at $65,000 and higher.

The December expiry call option cluster targets a $100,000 strike price, showcasing some traders’ ultra-bullish expectations for Bitcoin’s year-end valuation.

The end of March sees the largest volume of Bitcoin options calls at a $60,000 strike, revealing the immediacy of some traders’ bullish outlooks. With over 1,273 contracts set for the March 29 expiry, the notional value of these bets exceeds $67 million, highlighting the significant capital being placed on these optimistic market predictions.

Bitcoin Market Sentiment And Predictions

This enthusiastic options trading activity occurs amid bullish Bitcoin price forecasts. Matt Dines, Chief Investment Officer at Build Asset Management, identifies a ‘Cup and Handle’ pattern on the Bitcoin price chart, suggesting a potential rally to $75,000.

Cup and handle #Bitcoin #sendit pic.twitter.com/DmYAVwmLfj

— Matt Dines (@BuildCIO) February 13, 2024

Similarly, QCP Capital analysts see Bitcoin reaching new all-time highs, projecting a significant surge before the end of March 2024.

This collective optimism is also mirrored in the Ethereum market, where there’s a notable accumulation of call options around the $4,000 strike price for mid-year expiries, indicating a broader positive sentiment across major cryptocurrencies.

Related Reading: Betting Big On Ethereum: Options Traders Target $4,000 Mark Amid Market Optimism

Meanwhile, Bitcoin continues to make significant moves, crossing the $52,000 threshold with a nearly 20% increase in the past week, indicating that the market’s bullish sentiment is palpable.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]