At 9:45 a.m. Eastern time, bitcoin is holding steady with a price of $93,810 on April 27, 2025, commanding a market capitalization of $1.86 trillion, with a 24-hour trade volume of $15.71 billion. Trading within an intraday range of $93,780 to $95,115, bitcoin’s price action on Sunday showcases a tightly contested battle between bulls and bears, setting the stage for its next major move.

Bitcoin

On the daily chart, bitcoin (BTC) exhibits a strong bullish trend after breaking free from a prolonged downtrend, finding significant support near the $74,434 level. Volume activity has increased notably since mid-April, indicating renewed buying interest as the price propelled upward. Immediate resistance looms at $95,857, a point that, if surpassed with strong volume, could catalyze an accelerated rally. Conversely, support zones near $88,000 to $90,000 present critical levels for bulls to defend.

BTC/USD 1D chart on April 27, 2025.

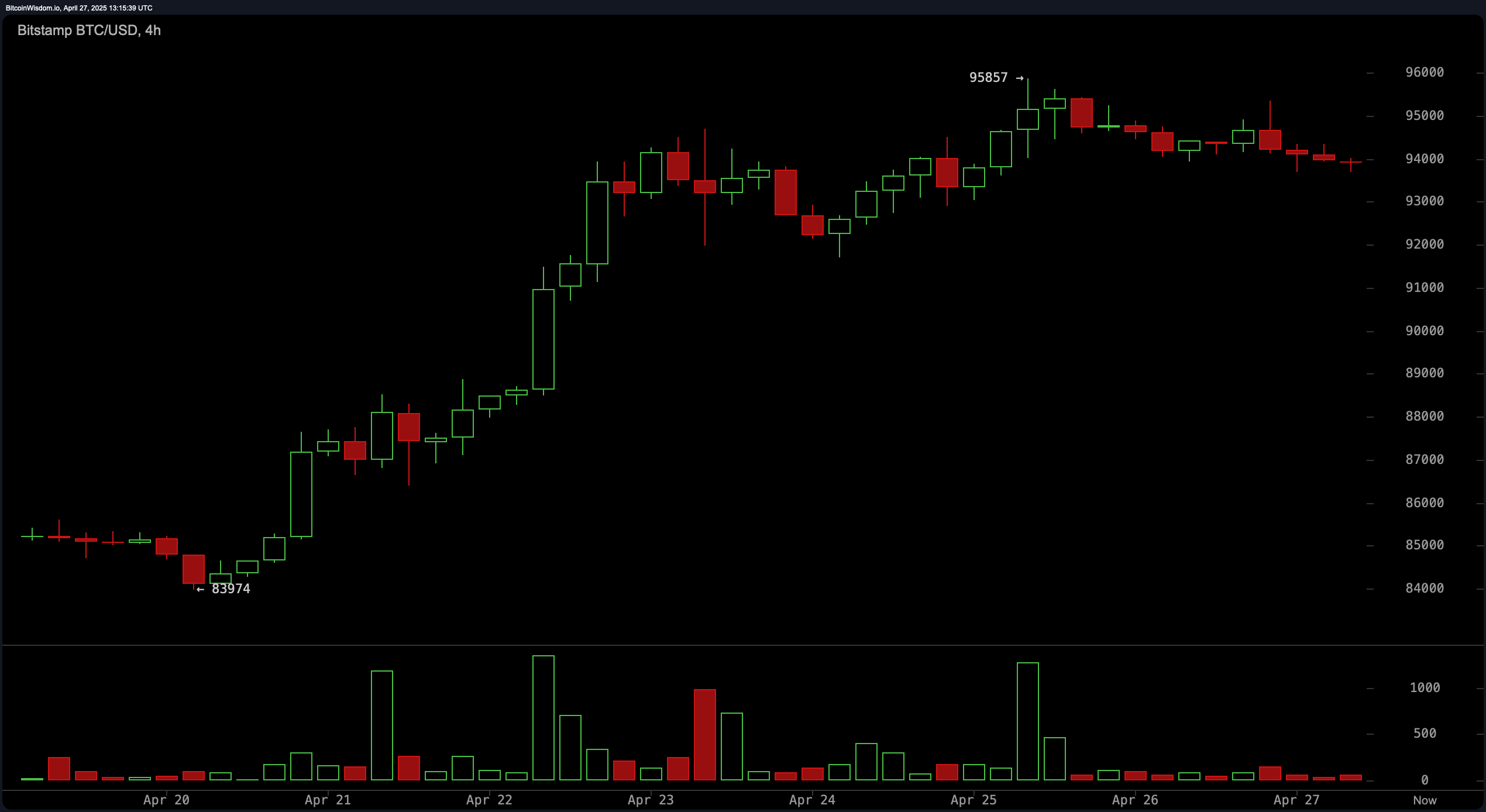

Shifting focus to the 4-hour chart, bitcoin is currently navigating a consolidation phase following its ascent to $95,857, marked by decreasing volume—a potential signal of waning momentum. A rounding top pattern is subtly emerging, which could suggest the start of a corrective move if support fails. Maintaining the $94,000–$94,200 area is key; a successful defense here could spark short-term bullish opportunities. Should the price dip below $93,500, however, it would indicate weakness likely leading to a retest of lower support around $92,000.

BTC/USD 4H chart on April 27, 2025.

The 1-hour chart reflects a neutral-to-bearish bias, with very low volume underscoring a lack of conviction among market participants. Bitcoin found short-term support at $93,685, but fresh long entries are discouraged unless the price closes decisively above $94,500 accompanied by meaningful volume. A breakdown below $93,500 could trigger accelerated selling pressure.

BTC/USD 1H chart on April 27, 2025.

Oscillators offer a mixed sentiment, with the relative strength index (RSI) at 66 and the Stochastic at 89, both suggesting neutrality. However, the commodity channel index (CCI) at 121 and momentum indicators at 8,895 signal bearish pressures developing. On the positive side, the moving average convergence divergence (MACD) level is at 2,794, issuing a positive signal, which aligns with the broader bullish narrative on higher timeframes. These conflicting signals warrant a cautious approach, balancing bullish bias with the reality of shorter-term vulnerabilities.

Moving averages (MAs) overwhelmingly favor the bulls, with all key averages flashing optimistic signals across the board. The exponential moving average (EMA) and simple moving average (SMA) across 10, 20, 30, 50, 100, and 200 periods all affirm positive momentum, reinforcing the broader bullish case. Notably, the exponential moving average (10) and simple moving average (10) sit at $91,334 and $90,669, respectively, comfortably below the current market price, indicating strong underlying support. This technical backdrop suggests that while bitcoin faces short-term volatility risks, the overarching trend remains solidly in favor of the bulls.

Bull Verdict:

Bitcoin remains in a strong uptrend on the daily chart, supported by consistent buy signals across all major moving averages and a bullish moving average convergence divergence (MACD) reading. If $93,000 support holds and momentum reignites, bitcoin could reclaim $95,857 and push toward new highs. Dip-buying strategies around $90,000–$92,000 remain favorable for bullish participants.

Bear Verdict:

Despite the broader bullish structure, weakening momentum on the 4-hour and 1-hour charts, combined with neutral oscillators, highlights near-term downside risks. A failure to defend $93,000 could open the door for a deeper pullback toward the $92,000 level or lower below the $90,000 zone. Caution is warranted, especially without confirmation of renewed volume strength.

Final Verdict:

Bitcoin’s medium- to long-term outlook remains bullish, but short-term traders should be prepared for volatility and possible retracements. While the trend favors higher prices, confirmation above $94,500 with strong volume is critical for fresh upside momentum. Until then, disciplined trading and risk management are essential.