We are standing on the cusp of a new era when digital and traditional finance converge to create social and economic transformation. Where barriers to entry once stood, technological advancements are making it possible for anyone to access wealth-creation opportunities that were once the domain of the elite few. At the forefront of this transformation is the emergence of tokens, specifically those that represent real-world assets, such as stocks, bonds, real estate and others.

By reimagining ownership and trading of assets, tokenization is unlocking doors to financial opportunities previously out of reach to many. This shift is not just altering market dynamics, it’s laying the foundation for a more equitable and accessible financial future when empowerment and freedom aren’t just ideals but tangible realities.

The ability to invest capital into assets, instead of holding cash, is not a luxury but a necessity for every household looking to survive and thrive. Holding cash, often perceived as a safe bet, is a silent thief eroded by the relentless march of inflation. Consider this, $100 in 2004, sitting idly, would have the purchasing power of merely $60 today. Contrast this, with the dynamism of the stock market the same amount invested in the S&P 500 over the same period would have quintupled to an impressive $470.

Yet, the landscape of stock ownership reveals a stark imbalance. The wealthiest 10% in the US control an overwhelming 93% of stocks, illustrating a deep-seated inequality in financial opportunity and access. This inequality is magnified when looking at sectors like private equity and private credit, where doors often remain closed to everyday investors.

Enter Tokenization, the Great Equalizer

While a distinctly counter-culture ethos characterized the early days of blockchain, it wasn’t long before traditional financial institutions sought to leverage this technology to improve existing financial pipelines. Thus began the race to tokenize the world and empower traditional assets like stock, bonds, and real estate with the benefits of blockchain, such as 24/7/365 trading, fractional ownership, transparency, and programmability.

“The most important first step is to get in there and start to engage in the ecosystem”—Sandy Kaul of @FTI_Global.

How banks and asset managers can get started with tokenization ⬇️ pic.twitter.com/kG2MdNrUdv

— Chainlink (@chainlink) April 17, 2024

Yet, perhaps the greatest advantage of the tokenization of traditional asset classes is the ability to encourage retail participation. Take the Republic Note, for example, a digital asset representing the Republic’s private equity portfolio of over 600 companies, including SpaceX, Maven, and Gumroad. All retail investors have to do to gain exposure to the portfolio is sign up for INX.One, the trading platform where the Republic Note trades 24/7/365. Such a privilege was unthinkable in the pre-tokenization era.

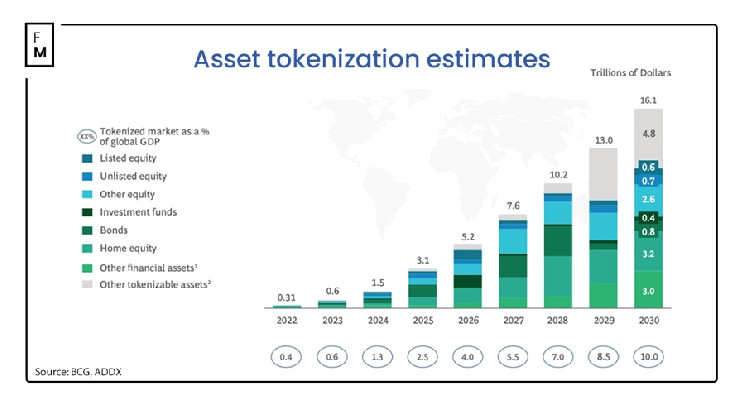

The Tokenization Market Is Huge

The total addressable market for tokenization is huge, with hundreds of trillions of dollars worth of real-world assets waiting to come on chain. According to Boston Consulting Group, the tokenized asset market is projected to grow to a staggering $16 trillion by 2030. We are still in the early stages of this transformation, with only about 0.03% of the total market size currently captured. At this low level of market penetration, a golden opportunity presents itself to innovative asset managers, institutions, and investors who wish to position themselves on the cusp of a new financial era.

#HSBC to Expand Tokenized Asset Offerings — CEO Says He’s ‘Very Comfortable’ With #Tokenization https://t.co/mjFwfPN7Fw

— Bitcoin.com News (@BTCTN) April 16, 2024

However, navigating this evolving landscape is not without its challenges. Regulatory frameworks vary significantly across the globe, creating a complex mosaic of compliance requirements for asset managers and investors. This inconsistency in regulations poses a considerable hurdle, as entities must adapt and comply with diverse legal standards in different jurisdictions.

Despite these challenges, the opportunity presented in the tokenization of real-world assets is too significant to ignore. Innovative asset managers, institutions, and investors looking to capitalize on this shift should collaborate with tokenization leaders to capitalize on this rare chance to be at the forefront of a financial revolution.

Towards a Holistic Tokenized Future

Tokenzied real-world assets are not growing in a vacuum. Indeed, no single type of digital asset will monopolize this new financial dawn. Rather, the true power of digital assets is unleashed when different forms of digital assets interface with one another.

“The Bank for International Settlements (BIS) has teamed up with the central banks of France, Japan, South Korea, Mexico, Switzerland, the United Kingdom, and the United States Federal Reserve Banks to explore asset tokenization.”https://t.co/IfCuWBVWAt

— Securitize (@Securitize) April 17, 2024

Cryptocurrencies like Bitcoin, tokenized real-world assets, and Central Bank Digital Currencies (CBDCs) emerge as the foundational pillars of this modernized financial landscape. Each serves a unique role and can empower its peers to reach further than they can on their own. For example, enabling investors to purchase stocks, bonds, and real estate with crypto opens up entirely new investment avenues for crypto investors to diversify their holdings.

The coexistence is a testament to the fact that financial inclusivity and progress don’t demand the dominance of one over the others, but thrive on their mutual support and integration. As we move forward, this triad of digital assets is poised to redefine not just investment and currency, but the very fabric of economic interaction and empowerment.