The crypto market shifts to tokenized securities during the periods right after a market top. After the bullish rally, investors switch to demand for passive income.

Tokenized securities have been growing in the past two months, following Bitcoin (BTC) record prices. Research by Messari shows a shift toward tokenized securities, which grow their supply following a market peak. Tokenized bonds are the most reliable basis for tokenization, while stocks lag due to regulatory doubts and general market fluctuations.

Tokenized treasuries serve as risk-off assets, offering low but secure passive income. Messari’s data shows that the crypto market is currently in the expansion stage for tokenized securities.

Tokenized treasuries tend to rise after crypto market tops, indicating a shift to yield-bearing assets when sentiment dips.

In contrast, stablecoins align closely with market prices, acting as a proxy for liquidity demand, while tokenized treasuries indicate a move towards… pic.twitter.com/0OixaHLS2O

— Messari (@MessariCrypto) March 27, 2025

The most common type of tokenized security is US treasury debt, which is used within RWA protocols in addition to stablecoins. Tokenized debt grows independent of the supply of stablecoins, which expands and contracts based on general market cycles.

The growth of tokenization happened despite the slowdown of Ethereum (ETH) and the fall of BTC from a top above $109,000. Demand for tokenized treasuries comes from protocols that are shifting their volatile crypto earnings into more secure holdings.

Tokenized US treasuries lead the way

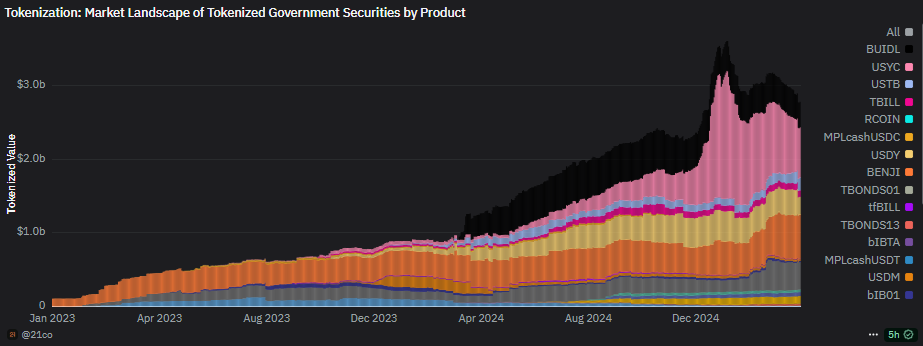

Tokenized US treasuries are the fastest-growing type of RWA after private debt. In the past months, tokenized treasuries expanded to $4.6B, based on data by RWA.xyz. Messari’s approach estimates a higher number, up to $4.8B in tokenized treasuries.

Tokenized government bonds or T-bills were the fastest-growing tokenization category after private debt. | Source: RWA.xyz

The sector has grown about 20% in the first quarter of 2024, marked by a drawdown for all other crypto assets. According to Ondo Finance, the growth of tokenized securities is even faster than the initial expansion of stablecoins. The current supply was achieved in just two years, while stablecoins took more than four years to grow to that level during the early stages of the crypto market.

On-chain data shows there are a total of 23 government security products, most of which serve as a bridge between traditional finance and crypto tokens.

Most of the issuance of tokenized US treasuries is linked to six entities, with BlackRock’s BUIDL among the most prominent token offerings. Other top issuers include Hashnote, Franklin Templeton, Ondo Finance, Securitize, Superstate, and Spiko. The top 5 issuers carry more than 78% of all bond-backed tokens.

The tokenization market has also grown more diverse in the past few quarters. At the initial stage, most of the market was covered by BlackRock and Franklin Templeton. Recently, new tokenization inflows came from Securitize and Hashnote. The landscape of tokenized US treasuries is shifting based on demand. Even BlackRock’s BUIDL decreased its supply to around 370M tokens, spread among 37 holders, after lowered demand. At the same time, other issuers expanded their products.

The tokenized bonds product landscape became more diverse in the past quarter. | Source: Dune Analytics

Those large-scale issuers use yield-bearing stablecoins to wrap their security offerings, achieving risk-free fixed income. The yield-bearing stablecoins are not widely used for crypto tasks, payments or DeFi, but are instead a part of the portfolio for other projects and funds.

Additionally, a handful of smaller startups have tokenized around $200M in US and international debt. Tokenized debt has still not reached retail buyers and is mostly used by whales and protocols to support other assets or as a strategic reserve.

Currently, BENJI by Franklin Templeton is the only fund available for US-based retail buyers. On-chain data shows products are often used at the protocol level to back up new types of stablecoins for DeFi lending or other tasks.

The availability of tokenized US T-bills allows protocols to park their earnings from bull markets into a secure cash-like asset with additional passive income. The tokenization of reliable securities also legitimizes the crypto market and on-chain assets.

Tokenized security issuers mostly use Ethereum for their tokenization as a legacy network with sufficient users and liquidity. Franklin Templeton uses the most diverse set of chains, including Arbitrum, Avalanche, Polygon, and Stellar. Recently, BlackRock’s BUIDL also added Solana as the next tokenization platform.