As of Dec. 7, 2024, at 3:25 p.m. EDT, bitcoin (BTC) is trading at $100,297 per coin, making it the seventh-largest asset globally by market capitalization, with a total valuation of $1.98 trillion. Before stepping into 2025, here’s an in-depth look at the top ten entities holding bitcoin and their stakes.

$294 Billion in Bitcoin: Exploring the Key Players Shaping the Market

Bitcoin etched its name in the history books this week, crossing the $100,000 mark for the first time and hitting a peak of $103,647 on Dec. 4. While it briefly dipped below six figures, by Saturday afternoon, just after 3 p.m., bitcoin had climbed back above the $100,000 threshold. At block height 873,693, there are currently around 19,792,573.94 BTC circulating in the market. Over the past year, the introduction of spot bitcoin exchange-traded funds (ETFs) in the U.S. has stirred up ownership dynamics.

Based on data from timechainindex.com, Coinbase ranks as the largest single holder of bitcoin (BTC). It’s important to mention that this analysis excludes the unspent block rewards from early years—2009 (including Satoshi’s holdings), 2010, 2011, 2012, and beyond. As it stands, the San Fransico exchange and custodian Coinbase (Nasdaq: COIN) holds 1,123,520.49 BTC, valued at more than $112 billion, according to visible onchain data from timechainindex.com. Coming in second is Binance, the centralized crypto exchange, which, as of Dec. 7, holds 686,997.40 BTC, worth a staggering $68.9 billion.

Next on the list, according to blockchain parser data, is Blackrock. The firm’s ETF, dubbed IBIT, secures third place with 520,861 BTC, valued at $52.2 billion at today’s rates. In fourth is the publicly traded company Microstrategy (Nasdaq: MSTR), holding 402,099.99 BTC, worth $40.3 billion. Following closely is the centralized crypto exchange Bitfinex, which rounds out the top five with 350,262.05 BTC, commanding an estimated $35.04 billion.

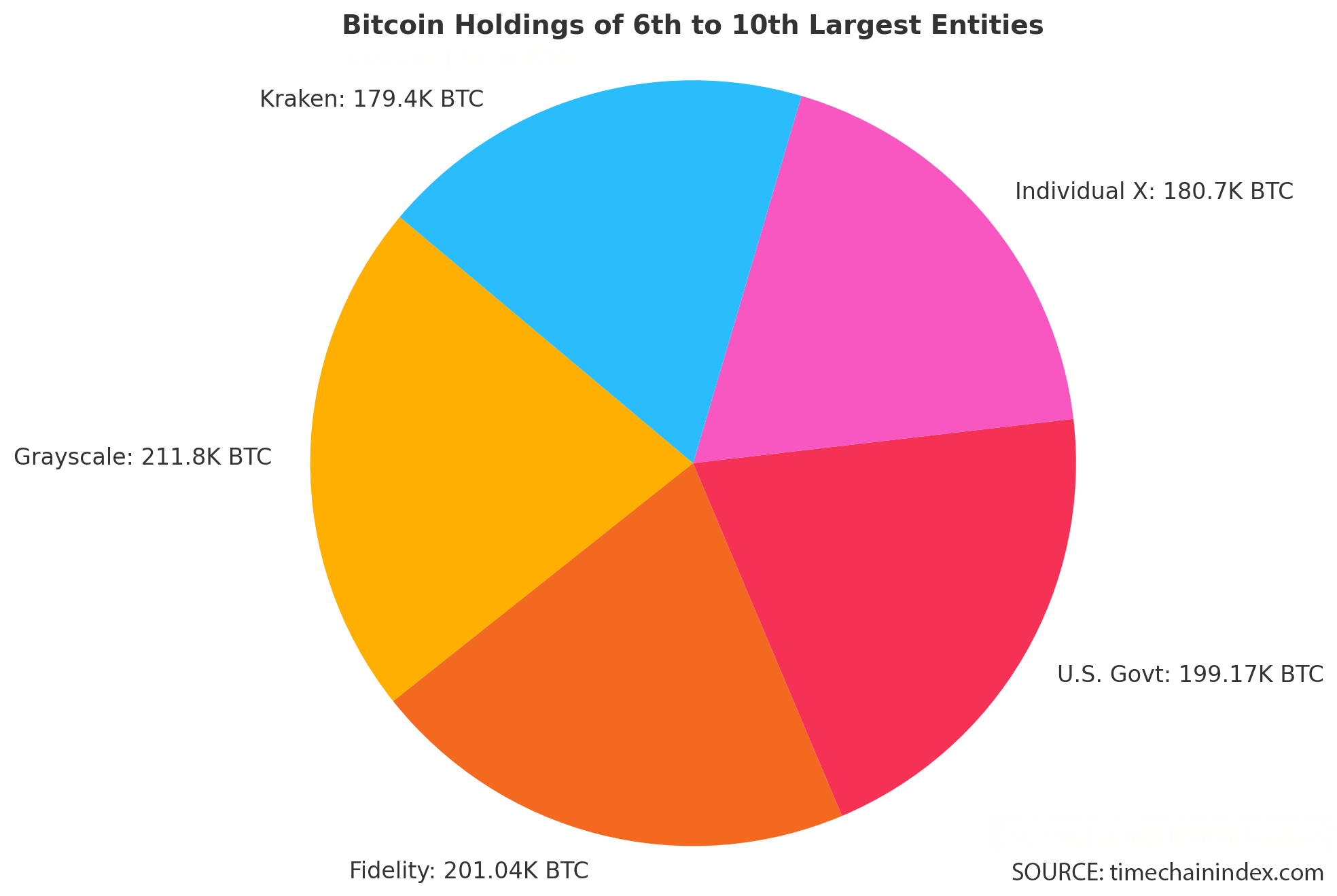

Altogether, these five entities control a staggering 1,960,220.44 BTC, valued at $196.59 billion. This combined stake represents about 9.9% of the entire circulating bitcoin supply. Grayscale takes the sixth spot, with verified onchain holdings of 211,799.39 BTC, valued at roughly $21.19 billion this weekend. Fidelity follows in seventh place, managing 201,043.88 BTC, worth an estimated $20.11 billion.

In eighth place is the U.S. government, which has amassed 199,172.73 BTC through seized assets, valued at $19.92 billion. If the government holds onto these bitcoins, it will likely stay among the world’s top ten BTC holders, excluding unspent coinbase rewards and Satoshi Nakamoto’s holdings. Next up is an enigmatic figure flagged as “Individual X” by timechainindex.com. This mysterious entity holds 180,701.87 BTC, which could fetch just over $18 billion. Rounding out the top ten is the centralized crypto exchange Kraken, with onchain holdings of 179,409.90 BTC, valued at $17.94 billion.

The 6th through 10th largest bitcoin holders together command a total of 972,127.77 BTC, valued at $97.4 billion. Altogether, the top ten entities control 2,932,348.21 BTC, worth an impressive $294 billion based on today’s rates. This group collectively holds about 14.82% of the total circulating bitcoin supply. It’s worth mentioning that these bitcoins are spread across thousands of addresses tracked by platforms like timechainindex.com and intel.arkm.com when they follow entities, rather than the misconception of the funds being consolidated into single wallets.

Bitcoin’s ascent into the six-figure territory showcases its growing stature as a global financial asset, highlighting the increasing concentration of ownership among prominent players. As these key holders continue to amass wealth in bitcoin, their influence on BTC’s market dynamics may intensify, raising questions about decentralization and the evolving power structures within the bitcoin ecosystem.

Despite the theoretical, a detailed snapshot of bitcoin’s largest holders offers a glimpse into the interplay between today’s institutional adoption and individual participation. As the leading cryptocurrency advances, its distribution pattern may shape future narratives around ownership equity and market control. With 2025 on the horizon, these dynamics could signal pivotal shifts for bitcoin’s role in the broader financial landscape.

While the top holders collectively command significant amounts of bitcoin, it’s crucial to conclude in this snapshot that most entities (80%), such as Coinbase, Binance, and Grayscale, do not officially “own” these assets—they secure them on behalf of investors, customers, and shareholders (Microstrategy). Exceptions include the U.S. government, which could assert ownership over seized assets, and the enigmatic Individual X, whose holdings remain personal or unknown.