[ad_1]

If 2023–2024 saw tokenized Treasuries play the role of a “first stage,” then 2025 marks a clear shift, with capital gradually flowing into Private Credit and other higher-yield products.

In 2025, on-chain capital is no longer just about stablecoins and staking. A new asset class — Real World Assets (RWA) — has taken center stage, as crypto investors seek yield from traditional financial instruments “wrapped” in token form.

RWA 2025: The Big Picture

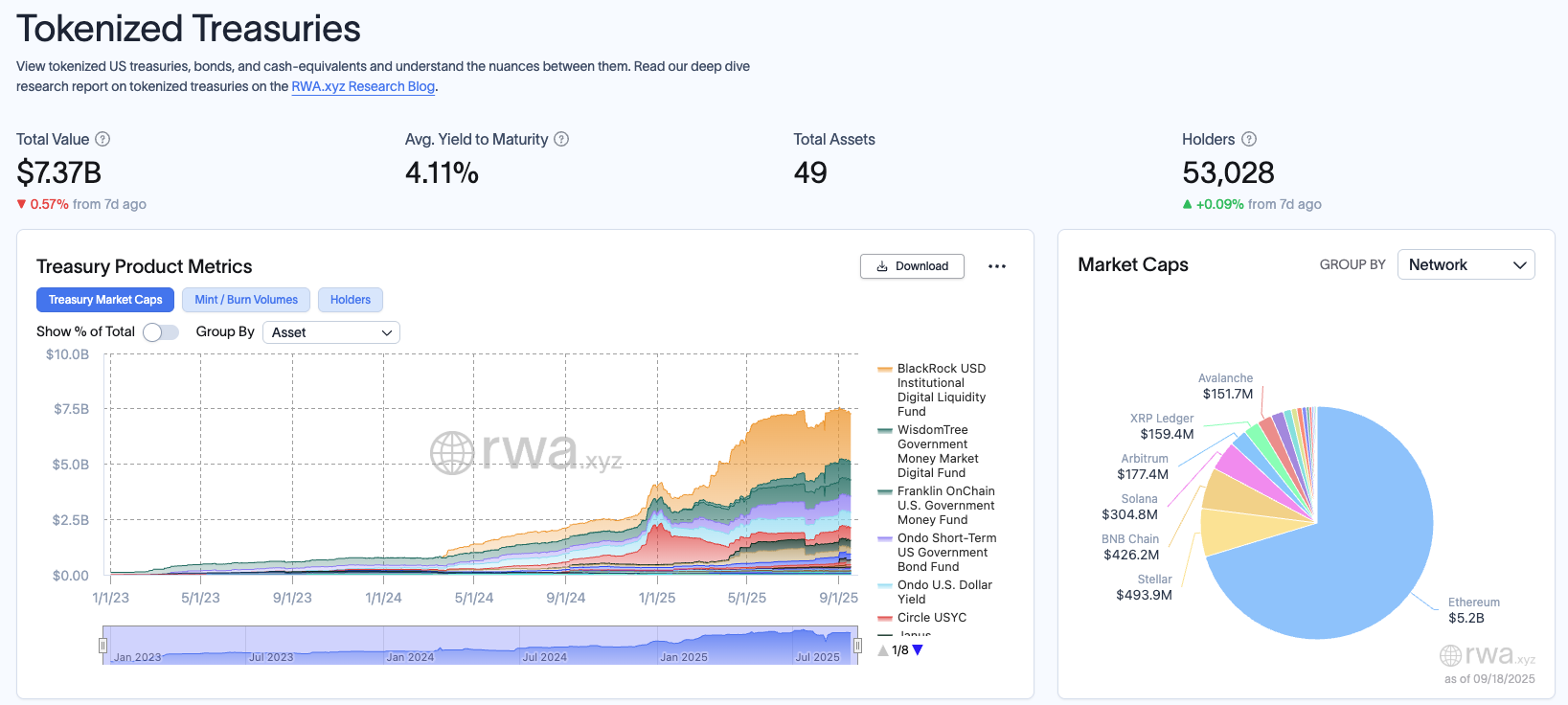

According to the Dune x RWA 2025 report, the total value of tokenized assets continues to grow strongly, reaching approximately USD 30.26 billion. Among these, U.S. Treasuries are the fastest-growing segment, with a market size of about USD 7.3 billion, led by products such as BlackRock (BUIDL) and Franklin (BENJI). This is considered “market proof” that tokenization is truly working.

Tokenized U.S. Treasuries Value. Source: RWA.xyz

At the same time, Private Credit is emerging as the next key piece, with a total value of around USD 15.9 billion, far outpacing Treasuries. Platforms like Maple Finance and Centrifuge lead the charge, bringing off-chain credit into DeFi via permissionless or semi-permissioned pools.

The report also highlights that RWAs are becoming increasingly composable in DeFi: from being used as collateral on Aave (AAVE) to being integrated into AMMs or structured vaults. This turns RWAs from mere digital replicas into actual building blocks for DeFi.

“RWA adoption is moving beyond vanity TVL figures concentrated in a few wallets. The real progress comes from active users holding and using assets onchain — making them liquid, composable, and part of DeFi.” — Chris Yin, CEO and Co-Founder, Plume Network, shared in the report.

Capital Flow: From Safety to Risk

The most interesting aspect of the RWA landscape is that capital is steadily climbing the yield curve. This journey has three key stages:

Stage 1: Treasuries. This is when crypto investors turn to tokenized Treasuries for their safety, delivering “risk-adjusted yield with institutional credibility” (around 4–5%) and stable liquidity.

Stage 2: Private Credit. After getting comfortable with Treasury yields, capital flows into private credit pools. Instead of yields of just 4–5% like before, this segment can deliver returns as high as 10–16%. However, it comes with risks such as defaults, counterparty concentration, and regulatory exposure.

Stage 3: Structured Credit and Equities. This is the “next frontier,” with tokenized funds, repo vaults, and even tokenized equities. Although still small in scale, these products open the door to bringing the entire traditional capital market on-chain, turning DeFi into a launchpad for all types of yield.

“We started with Treasuries as the safe haven. Then came CLOs, offering higher yield with an acceptable risk profile. Talking to investors, what we hear is clear: they demand higher yield from real-world asset products, and we are responding to that.” Jürgen Blumberg, COO at Centrifuge.

Opportunities and Risks

With the current pace of development, DeFi is gaining a source of real yield, diversifying beyond crypto-native assets. RWAs enable crypto to connect directly with global capital flows while paving the way for major financial institutions to join on-chain.

The market also has many risks, such as the fact that not all RWA products can be redeemed for cash or USDC immediately, which creates liquidity risk. The market also has many different RWA products, each with its own legal structure, which shows complexity and potential legal risks, especially the risk of default.

In 2025, RWAs will no longer be a side segment — they will become the new backbone of DeFi yield. If stablecoins once unlock on-chain liquidity, RWAs — especially Treasuries and Private Credit — are now unlocking the entire traditional capital market. The story of “climbing the yield curve” does not stop at Treasury bills but will continue expanding into structured credit, equities, and beyond.

The post RWA Capital in 2025: The Shift From Safe Treasuries to High-Yield Private Credit appeared first on BeInCrypto.

[ad_2]