Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debates about its impact on Ethereum, Solana, and other existing payment-focused chains.

While many experts view this as an opportunity to expand user adoption and strengthen cross-chain infrastructure, others remain skeptical about its claimed “neutrality” and Stripe’s true motives. Tempo could become a significant catalyst for the stablecoin market, but it also risks reshaping the competitive landscape of crypto.

Tempo as Libra v2?

Stripe and Paradigm drew significant market attention by announcing the concept of a payments-first blockchain called Tempo. This announcement immediately triggered discussions around the “payments-first” model — a design that prioritizes stablecoin transfers and payment experiences rather than focusing on multipurpose smart contracts like Ethereum.

On a macro level, a payments-first blockchain provides a direct path for new users (merchants and Stripe’s customer base) to access stablecoins and on-chain payments without necessarily going through multiple bridges or complex Layer-2 (L2) solutions. This could explain why fintech giants often favor Layer-1 (L1) over L2.

Interestingly, many have compared Tempo to Libra, the ill-fated project once spearheaded by Meta (formerly Facebook). However, Tempo might have better odds, as crypto now enjoys greater political and institutional support.

“Tempo chain by Stripe is Libra v2 but with a political climate that won’t strangle it in the crib,” noted Ryan Adams from Bankless.

That said, Tempo’s real value depends on whether it can attract meaningful payment volume or become just “another chain” in the ecosystem.

Many Doubts

Although Tempo has been labeled “Libra v2,” some argue its technical foundations may not align with the current state of the market, given that other platforms already deliver much more than what Tempo proposes.

“There might be business reasons for a Stripe L1, but IMO the cited technical motives are a bit sus in 2025,” commented the CEO/CTO of Mysten Labs.

Other experts have raised concerns about the project’s claims of “neutrality” regarding stablecoins and gas tokens within the Tempo ecosystem. Regulatory risks remain, as stablecoin issuers may face conflicts of interest or lack confidence in the chain’s framework.

“There is a reason why successful L1s only accept their own native token for gas. The counterparty risk of doing it any other way is high and only grows if the chain succeeds…” one X user shared.

Tempo’s Impact on the Crypto Market

Some perspectives highlight that “fragmentation of chains” could benefit cross-chain interoperability protocols, as demand for bridges and /or oracles increases. Consequently, infrastructure players such as bridges, oracle providers like Chainlink (LINK), and on-chain payment service providers could gain the most, as their services become essential for value transfer across ecosystems.

However, while the growth of stablecoins is generally a positive signal for crypto, and new Stripe users can still tap into Ethereum DeFi, analyst Ignas cautioned that it’s difficult to interpret this as a bullish signal for ETH.

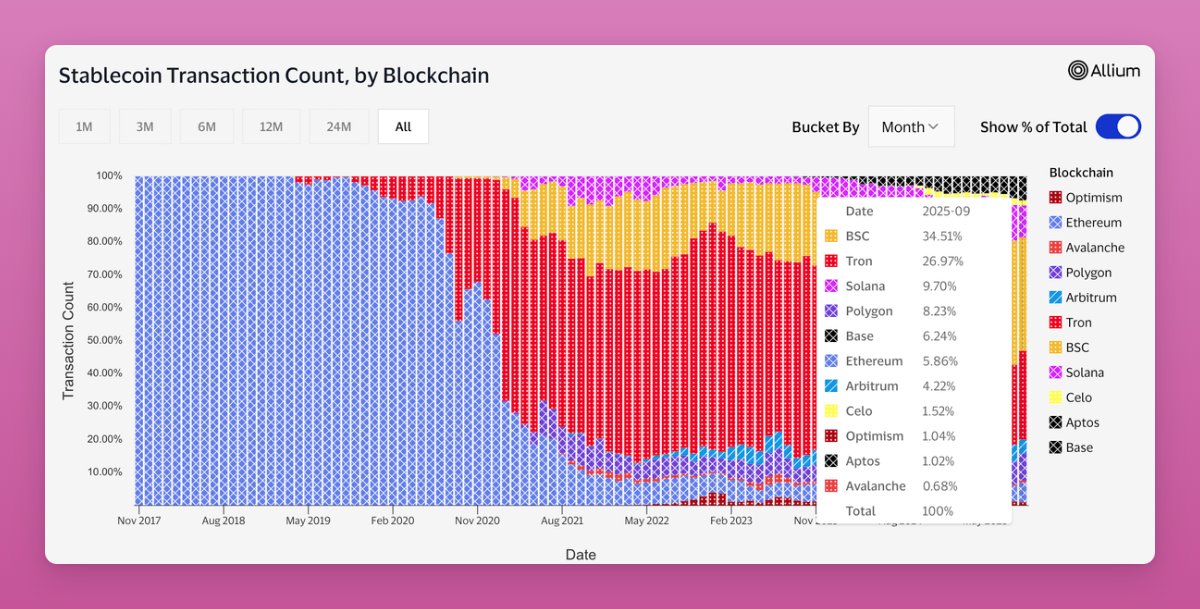

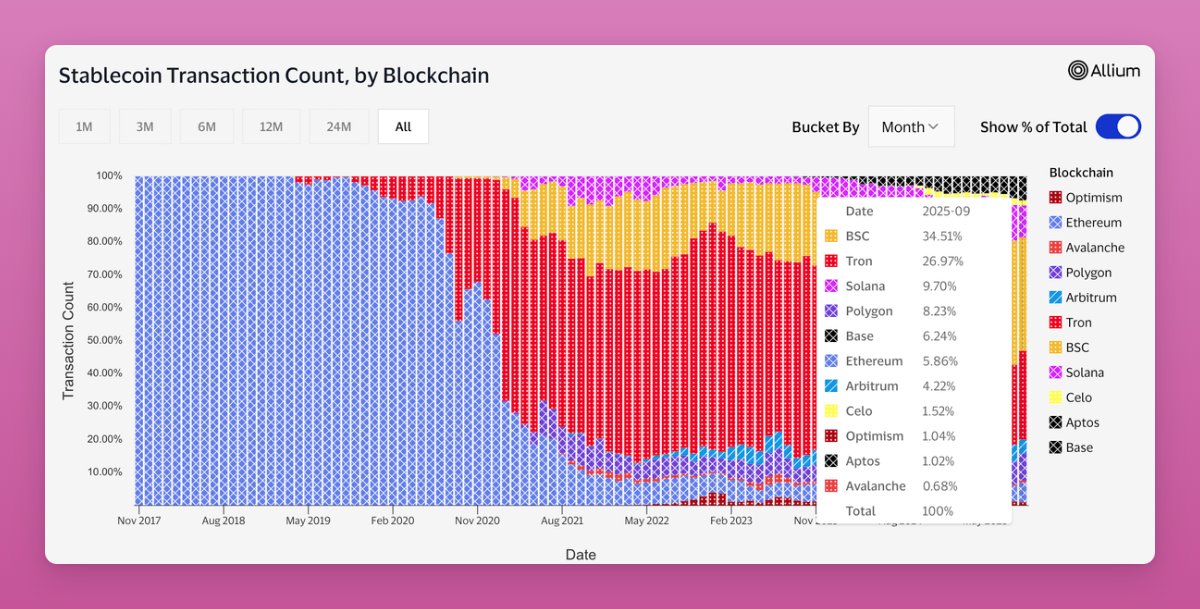

Most stablecoin transactions occur on Tron, Solana, Polygon, and L2 networks. Tempo’s entry could directly compete with these ecosystems. Still, experts predict Ethereum will be a big winner in the new stablecoin economy.

Stablecoin transactions by blockchain. Source: Ignas on X

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo could become a serious competitor to Tether, Circle, Ethereum, and Solana in the payments niche. If Tempo successfully captures liquidity and merchant adoption, stablecoin flows could be significantly redirected.

Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debates about its impact on Ethereum, Solana, and other existing payment-focused chains.

While many experts view this as an opportunity to expand user adoption and strengthen cross-chain infrastructure, others remain skeptical about its claimed “neutrality” and Stripe’s true motives. Tempo could become a significant catalyst for the stablecoin market, but it also risks reshaping the competitive landscape of crypto.

Tempo as Libra v2?

Stripe and Paradigm drew significant market attention by announcing the concept of a payments-first blockchain called Tempo. This announcement immediately triggered discussions around the “payments-first” model — a design that prioritizes stablecoin transfers and payment experiences rather than focusing on multipurpose smart contracts like Ethereum.

On a macro level, a payments-first blockchain provides a direct path for new users (merchants and Stripe’s customer base) to access stablecoins and on-chain payments without necessarily going through multiple bridges or complex Layer-2 (L2) solutions. This could explain why fintech giants often favor Layer-1 (L1) over L2.

Interestingly, many have compared Tempo to Libra, the ill-fated project once spearheaded by Meta (formerly Facebook). However, Tempo might have better odds, as crypto now enjoys greater political and institutional support.

“Tempo chain by Stripe is Libra v2 but with a political climate that won’t strangle it in the crib,” noted Ryan Adams from Bankless.

That said, Tempo’s real value depends on whether it can attract meaningful payment volume or become just “another chain” in the ecosystem.

Many Doubts

Although Tempo has been labeled “Libra v2,” some argue its technical foundations may not align with the current state of the market, given that other platforms already deliver much more than what Tempo proposes.

“There might be business reasons for a Stripe L1, but IMO the cited technical motives are a bit sus in 2025,” commented the CEO/CTO of Mysten Labs.

Other experts have raised concerns about the project’s claims of “neutrality” regarding stablecoins and gas tokens within the Tempo ecosystem. Regulatory risks remain, as stablecoin issuers may face conflicts of interest or lack confidence in the chain’s framework.

“There is a reason why successful L1s only accept their own native token for gas. The counterparty risk of doing it any other way is high and only grows if the chain succeeds…” one X user shared.

Tempo’s Impact on the Crypto Market

Some perspectives highlight that “fragmentation of chains” could benefit cross-chain interoperability protocols, as demand for bridges and /or oracles increases. Consequently, infrastructure players such as bridges, oracle providers like Chainlink (LINK), and on-chain payment service providers could gain the most, as their services become essential for value transfer across ecosystems.

However, while the growth of stablecoins is generally a positive signal for crypto, and new Stripe users can still tap into Ethereum DeFi, analyst Ignas cautioned that it’s difficult to interpret this as a bullish signal for ETH.

Most stablecoin transactions occur on Tron, Solana, Polygon, and L2 networks. Tempo’s entry could directly compete with these ecosystems. Still, experts predict Ethereum will be a big winner in the new stablecoin economy.

Stablecoin transactions by blockchain. Source: Ignas on X

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo could become a serious competitor to Tether, Circle, Ethereum, and Solana in the payments niche. If Tempo successfully captures liquidity and merchant adoption, stablecoin flows could be significantly redirected.

Stripe and Paradigm have launched Tempo, a “payments-first” blockchain designed to optimize stablecoin transactions. This has sparked heated debates about its impact on Ethereum, Solana, and other existing payment-focused chains.

While many experts view this as an opportunity to expand user adoption and strengthen cross-chain infrastructure, others remain skeptical about its claimed “neutrality” and Stripe’s true motives. Tempo could become a significant catalyst for the stablecoin market, but it also risks reshaping the competitive landscape of crypto.

Tempo as Libra v2?

Stripe and Paradigm drew significant market attention by announcing the concept of a payments-first blockchain called Tempo. This announcement immediately triggered discussions around the “payments-first” model — a design that prioritizes stablecoin transfers and payment experiences rather than focusing on multipurpose smart contracts like Ethereum.

On a macro level, a payments-first blockchain provides a direct path for new users (merchants and Stripe’s customer base) to access stablecoins and on-chain payments without necessarily going through multiple bridges or complex Layer-2 (L2) solutions. This could explain why fintech giants often favor Layer-1 (L1) over L2.

Interestingly, many have compared Tempo to Libra, the ill-fated project once spearheaded by Meta (formerly Facebook). However, Tempo might have better odds, as crypto now enjoys greater political and institutional support.

“Tempo chain by Stripe is Libra v2 but with a political climate that won’t strangle it in the crib,” noted Ryan Adams from Bankless.

That said, Tempo’s real value depends on whether it can attract meaningful payment volume or become just “another chain” in the ecosystem.

Many Doubts

Although Tempo has been labeled “Libra v2,” some argue its technical foundations may not align with the current state of the market, given that other platforms already deliver much more than what Tempo proposes.

“There might be business reasons for a Stripe L1, but IMO the cited technical motives are a bit sus in 2025,” commented the CEO/CTO of Mysten Labs.

Other experts have raised concerns about the project’s claims of “neutrality” regarding stablecoins and gas tokens within the Tempo ecosystem. Regulatory risks remain, as stablecoin issuers may face conflicts of interest or lack confidence in the chain’s framework.

“There is a reason why successful L1s only accept their own native token for gas. The counterparty risk of doing it any other way is high and only grows if the chain succeeds…” one X user shared.

Tempo’s Impact on the Crypto Market

Some perspectives highlight that “fragmentation of chains” could benefit cross-chain interoperability protocols, as demand for bridges and /or oracles increases. Consequently, infrastructure players such as bridges, oracle providers like Chainlink (LINK), and on-chain payment service providers could gain the most, as their services become essential for value transfer across ecosystems.

However, while the growth of stablecoins is generally a positive signal for crypto, and new Stripe users can still tap into Ethereum DeFi, analyst Ignas cautioned that it’s difficult to interpret this as a bullish signal for ETH.

Most stablecoin transactions occur on Tron, Solana, Polygon, and L2 networks. Tempo’s entry could directly compete with these ecosystems. Still, experts predict Ethereum will be a big winner in the new stablecoin economy.

Stablecoin transactions by blockchain. Source: Ignas on X

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo could become a serious competitor to Tether, Circle, Ethereum, and Solana in the payments niche. If Tempo successfully captures liquidity and merchant adoption, stablecoin flows could be significantly redirected.