In order to diversify the basket of systematic trading strategies, this article will attempt to evaluate whether it is possible to approach trading on Ethereum (ETH) with a “mean reverting” strategy based on false breakouts. Like most cryptocurrencies, Ethereum has historically shown a predominantly “trend following” behavior, therefore seeking trend reversals might seem like a counterproductive choice.

With the recent evolution of the crypto market, it might be useful to consider incorporating a strategy into your portfolio that takes advantage of the “mean reverting” trend, which seems to be increasingly present in this market as well, fueled by growing liquidity.

To do this, an attempt will be made to define a trading system that can take advantage of false breakouts at the previous session’s low levels, which increasingly often result in rebounds rather than downward trend extensions. Upon breaking the previous day’s low, the condition will be met to enter long if the price returns to the just-broken low level.

Structure and initial results of the mean reverting trading system on Ethereum (ETH)

The strategy, which will be built only on the long side, assumes entering after bearish market movements with the idea that breaking the previous day’s low could lead to a rebound.

The session is calculated using the exchange’s time (normally Greenwich Mean Time, GMT) from midnight to 11:59 PM, considering a historical data series from 2016 to today (May 2024). A fixed amount of $10,000 per trade is set, with an initial stop loss of $3,000.

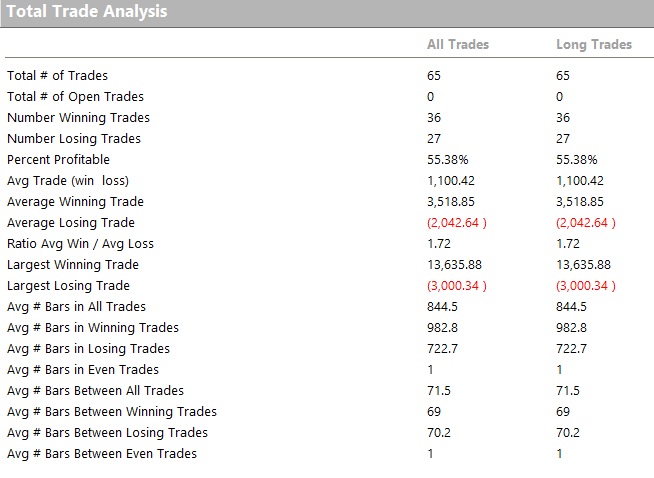

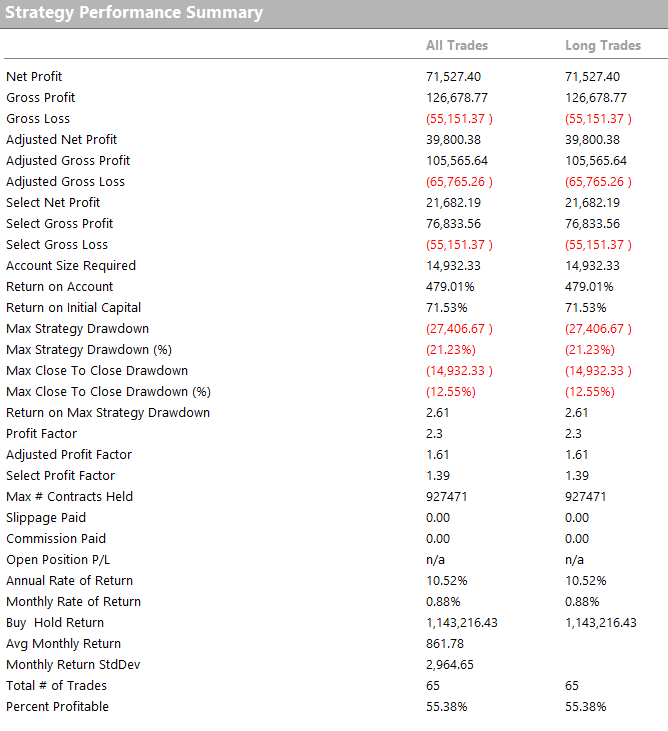

Positive results are obtained right from the start, with a growing equity line. In the following figures, it can be seen how the total profit of the system exceeds $71,000 in just 75 trades, with an average trade of $1,100. These results might seem overly positive, but in reality, they indicate a still rough strategy, given the few very long-duration trades, as confirmed by the high value of the average trade.

Although it provides interesting metrics, the low number of operations makes the statistic not very robust, in addition to being not very applicable in real trading given the long duration of many trades.

It is therefore appropriate to limit the duration of the trades, perhaps finding a compromise between average trade and number of operations through an optimization of the parameters used.

Optimization to determine the ideal duration of trades

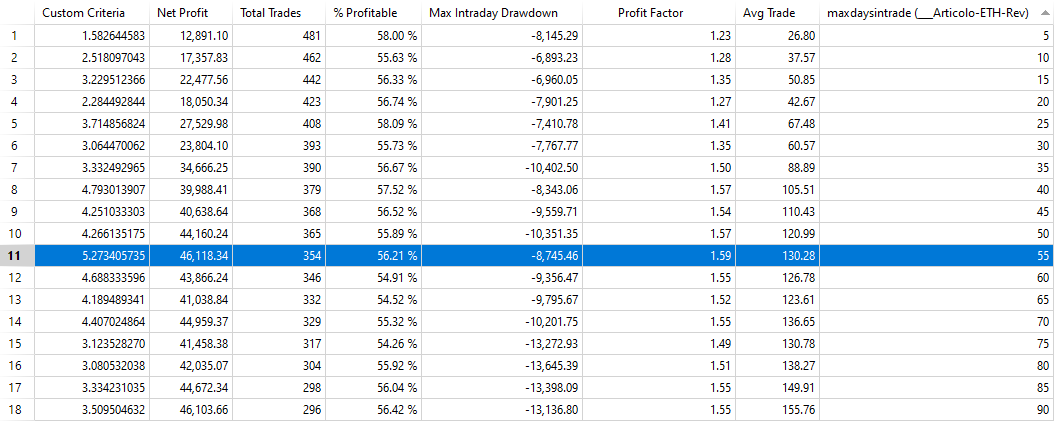

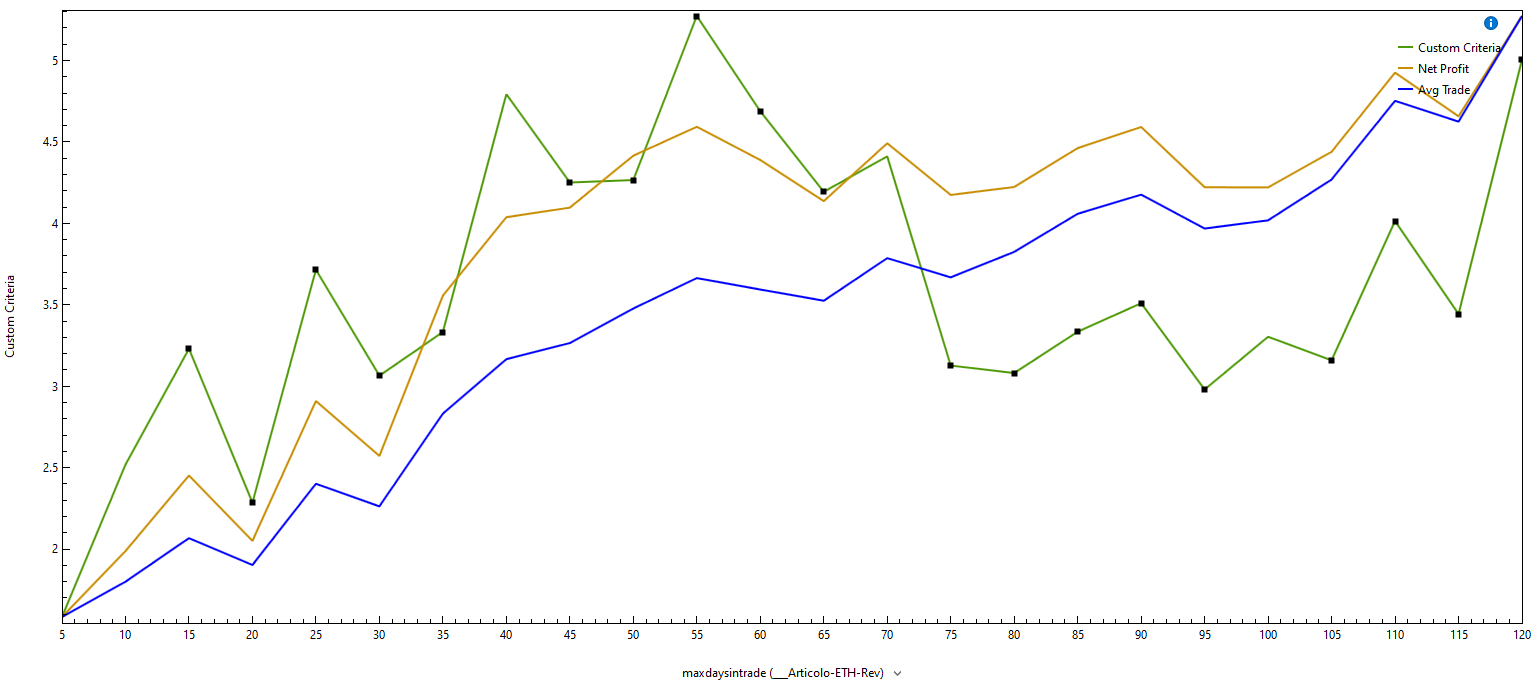

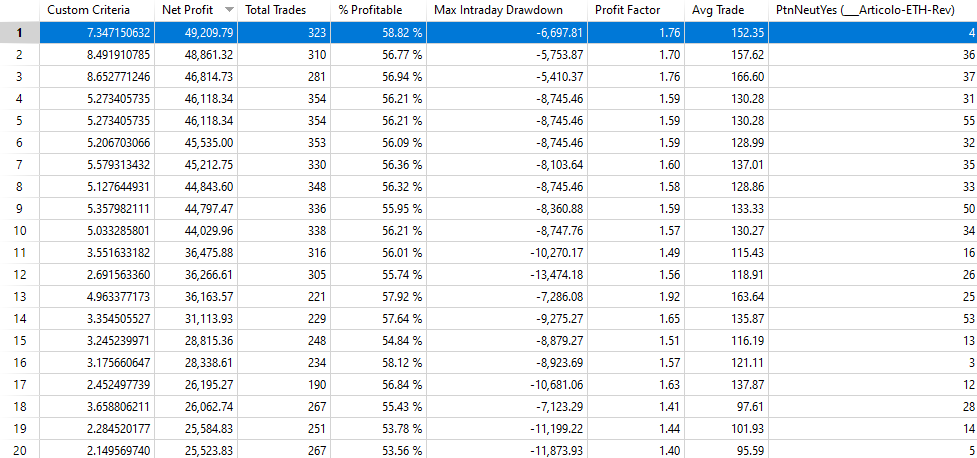

As a first step, we will try to limit the duration of the trades by imposing closure after a certain number of days. By optimizing between 5 and 120 days, the values in figure 4 are found. As noted from the graph in figure 5, around 55 days there is an area with good values of average trade and net profit on drawdown. This is still a rather long duration compared to the event that generates the market entry (false breakout of the previous lows), but the optimization shows that it is not possible to achieve noteworthy results with shorter duration trades. Therefore, as an example, we will choose to close the trades at most after 55 days.

The total profit of the system has dropped to about $46,000 with an average trade of $130, values lower than the previous ones, but definitely more realistic considering that they are obtained in 354 operations, a number that makes the statistics more robust and the trade time horizon more sustainable. However, there might still be room to improve the metrics and get closer to a strategy that can be considered for live trading. For example, one could filter the entries with price patterns, trying to operate only when there are ideal conditions.

Analysis of price patterns to improve the results of the mean reverting trading system on Ethereum

In this regard, a proprietary list will be used that brings together many price combinations, different from each other, which will serve to understand in which situations Ethereum (ETH) seems to work best with the logic of false break out being tested.

The case “PtnNeutYes=4” (figure 6) identifies the days following a session with little conviction. These are days in which the “body” of the daily candle (open-close) was not greater than 75% of the total range of the daily candle (high-low). Therefore, one would want to avoid those situations where the “body” is greater than 75% of the total range of the session.

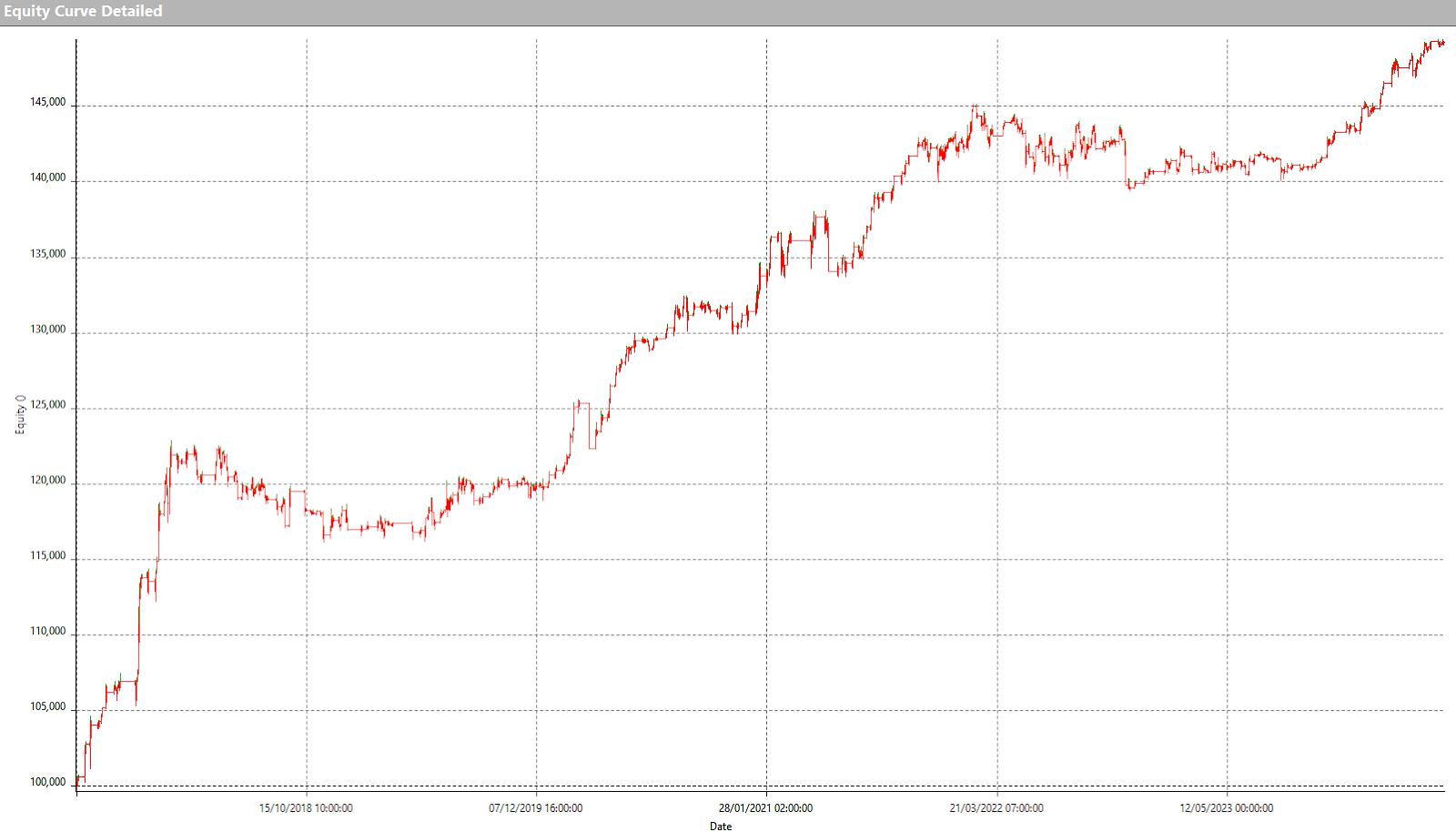

It is noted how in fact MyPtn number 4 manages to increase the average trade (152$) and the net profit (49,209$). The drawdown also decreases and stands at -6,697$. A good improvement, also visible from the shape of the equity which is decidedly more regular (figure 7).

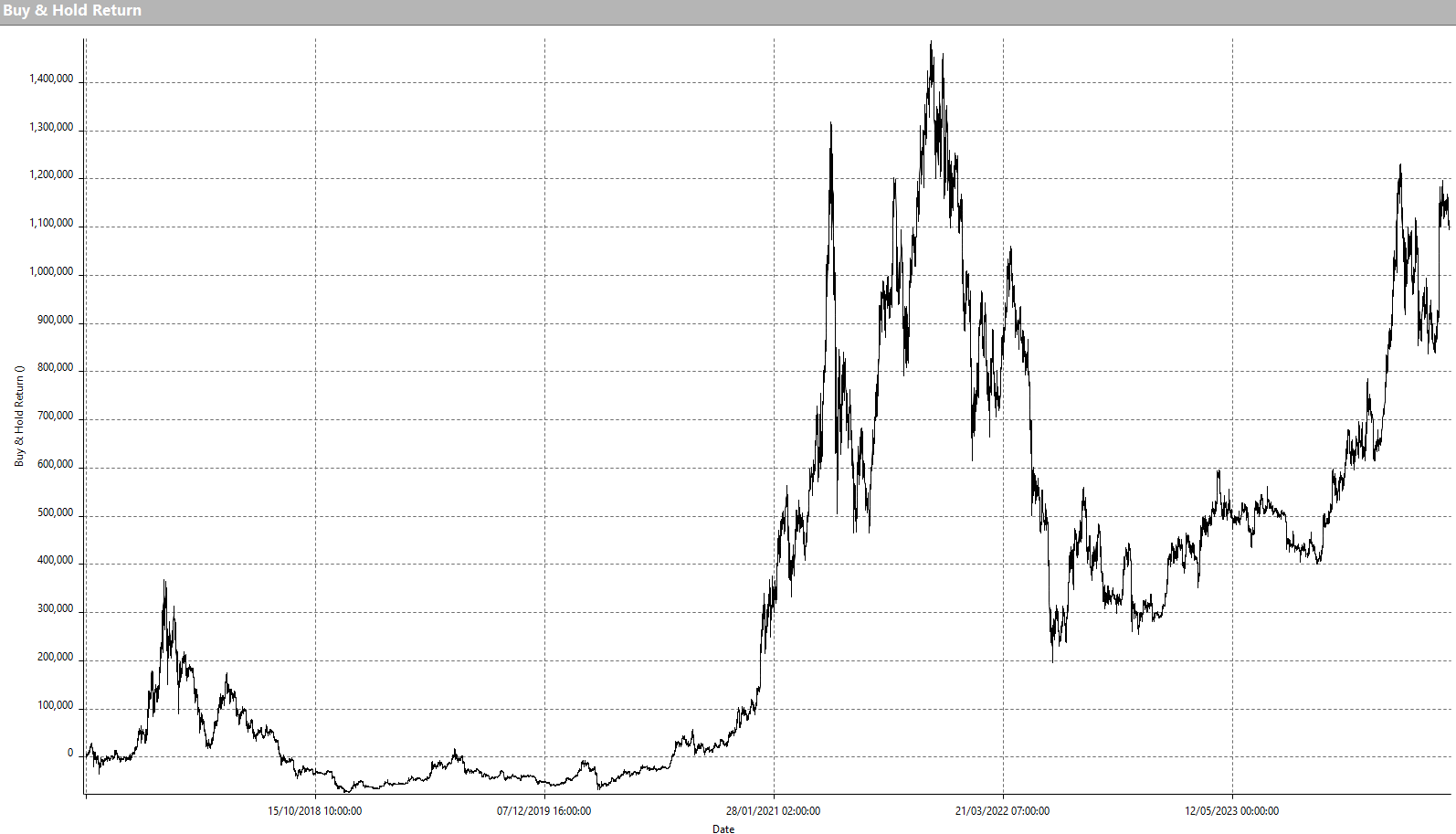

These good results are certainly far from those that would have been achieved with the simple “buy & hold” of Ethereum (ETH) from 2016 to today (figure 9) in terms of absolute profits. But it must be considered that the fluctuations of the “buy & hold” are not comparable to those experienced by the trading system, making the former a definitely less sustainable approach. In addition to this, it should be noted that the trading system uses a fixed size, while applying the “buy & hold” is like reinvesting the profits obtained.

Final considerations on the mean reverting trading system on Ethereum

In conclusion, it has been shown how it is possible to operate with a mean reverting approach even on an instrument like Ethereum, typically trend following, which with the general growth of the mercato crypto presents more and more opportunities for reversal. The trading system developed in this article is certainly not ready for live trading, but the reader is left with the task of further experimenting and optimizing this idea to refine it and transform it into a real operational strategy.

See you next time and happy trading!