[ad_1]

Bitcoin and altcoins started the new week with a sharp decline despite the Fed’s interest rate cut decision last week.

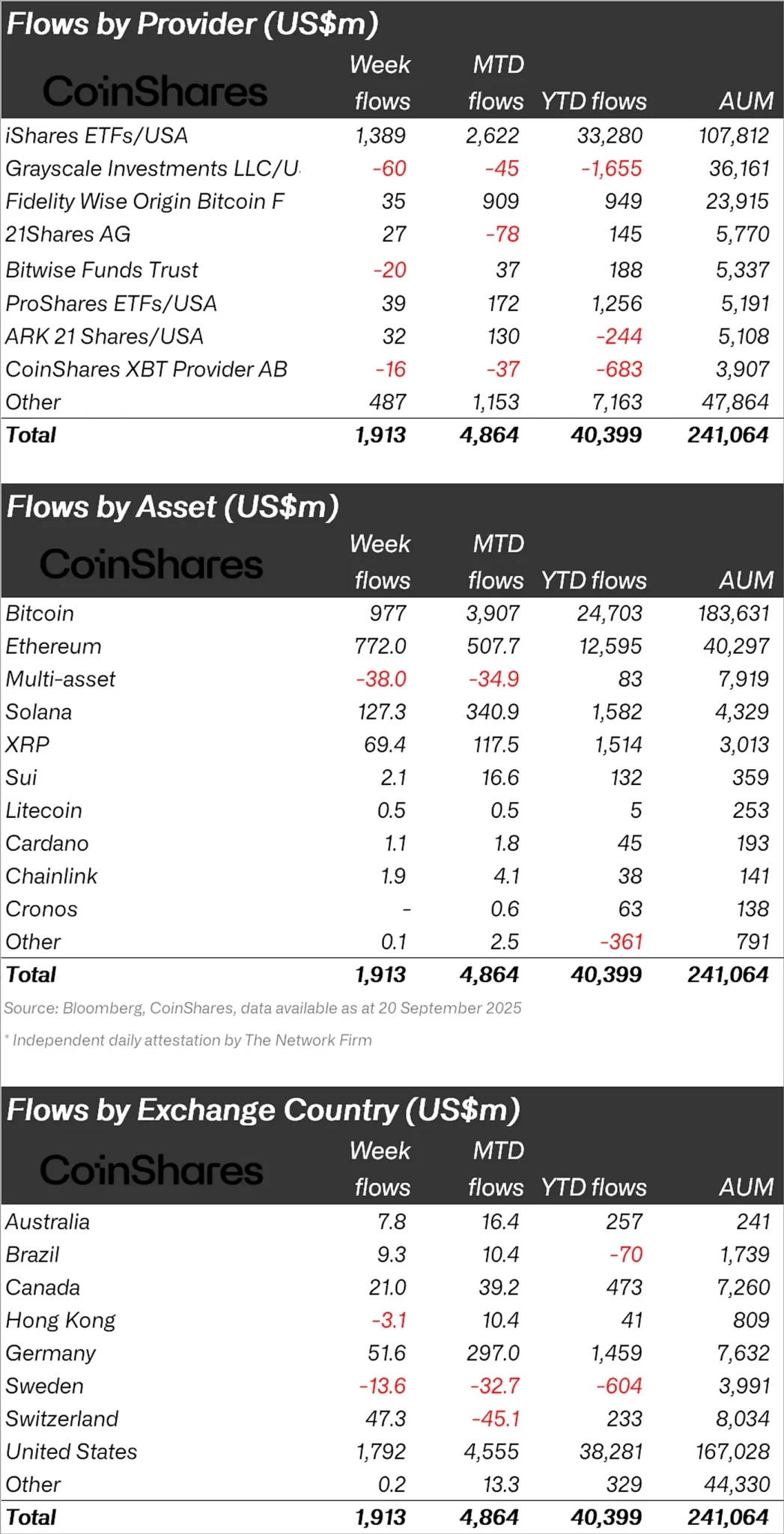

With the decline, Bitcoin and altcoins fell below pre-FOMC levels, while CoinShares published its weekly cryptocurrency report and said that there was an inflow of $1.9 billion last week.

“Cryptocurrency investment products saw $1.9 billion in inflows last week, a positive response to the Fed’s ‘hawkish rate cut’ last week.”

Bitcoin and Ethereum Go Neck and Neck!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While Bitcoin experienced an inflow of $977 billion, Ethereum (ETH) experienced an inflow of $772 million.

Looking at other altcoins, Solana (SOL) saw an inflow of $127 million, XRP $69.4 million, Sui (SUI) $2.1 million, and Chainlink (LINK) $1.9 million.

“Bitcoin received the largest inflow share last week with $977 million.

Ethereum also benefited, with $772 million in inflows. Year-to-date inflows reached a record $12.6 billion, and total assets under management reached an all-time high of $40.3 billion.

Other significant inflows came from Solana ($127.3 million) and XRP ($69.4 million).

When looking at regional fund inflows and outflows, the USA ranked first with an inflow of $1.79 billion.

Following the USA, Germany had an inflow of $51.6 million and Switzerland $47.3 million.

Against these inflows, Sweden experienced an outflow of $13.6 million and Hong Kong $3.1 million.

*This is not investment advice.

[ad_2]