[ad_1]

The following is a guest article from Vincent Maliepaard, Marketing Director at IntoTheBlock.

As Bitcoin surpassed its all-time high earlier this year, driven by institutional interest, many expected a similar surge in the decentralized finance (DeFi) space. With DeFi surpassing $100 billion in total value locked (TVL), it was the perfect time for institutions to jump on board. However, the anticipated flood of institutional capital into DeFi has been slower than predicted. In this article, we’ll explore the key challenges hindering institutional DeFi adoption.

Regulatory Hurdles

Regulatory uncertainty is perhaps the most significant roadblock for institutions. In major markets like the U.S. and the EU, the unclear classification of crypto assets—especially stablecoins—complicates compliance. This ambiguity drives up costs and deters institutional involvement. Some jurisdictions, such as Switzerland, Singapore, and the UAE, have embraced clearer regulatory frameworks, which has attracted early movers. However, the lack of global regulatory consistency complicates cross-border capital allocation, making institutions hesitant to enter the DeFi space with confidence.

Moreover, regulatory frameworks like Basel III impose stringent capital requirements on financial institutions that hold crypto assets, further disincentivizing direct participation. Many institutions are opting for indirect exposure through subsidiaries or specialized investment vehicles to sidestep these regulatory constraints.

However, Trump’s office is expected to prioritize innovation over restrictions, potentially reshaping U.S. DeFi regulations. Clearer guidelines could lower compliance barriers, attract institutional capital, and position the U.S. as a leader in the space.

Structural Barriers Beyond Compliance

While regulatory issues often dominate the conversation, other structural barriers also prevent institutional DeFi adoption.

One prominent issue is the lack of suitable wallet infrastructure. Retail users are well-served by wallets like MetaMask, but institutions require secure and compliant solutions, such as Fireblocks, to ensure proper custody and governance. Additionally, the need for seamless on-and-off ramps between traditional finance and DeFi is critical for reducing friction in capital flow. Without robust infrastructure, institutions struggle to navigate between these two financial ecosystems efficiently.

DeFi infrastructure requires developers with a highly specific skillset. The skillset required often differs from traditional finance software development and can also vary blockchain by blockchain. Institutions that are only looking to deploy in the most liquid strategies, will likely have to deploy into multiple blockchains which can increase overhead and complexity.

Liquidity Fragmentation

Liquidity remains one of DeFi’s most persistent issues. Fragmented liquidity across various decentralized exchanges (DEXs) and borrowing platforms poses risks such as slippage and bad debt. For institutions, executing large transactions without significantly affecting market prices is vital, and shallow liquidity makes this difficult.

This can create situations where institutions have to execute transactions over multiple blockchains to perform one trade, adding to complexity and increasing risk vectors on the strategy. To attract institutional capital, DeFi protocols must create deep and concentrated liquidity pools capable of supporting very large trades.

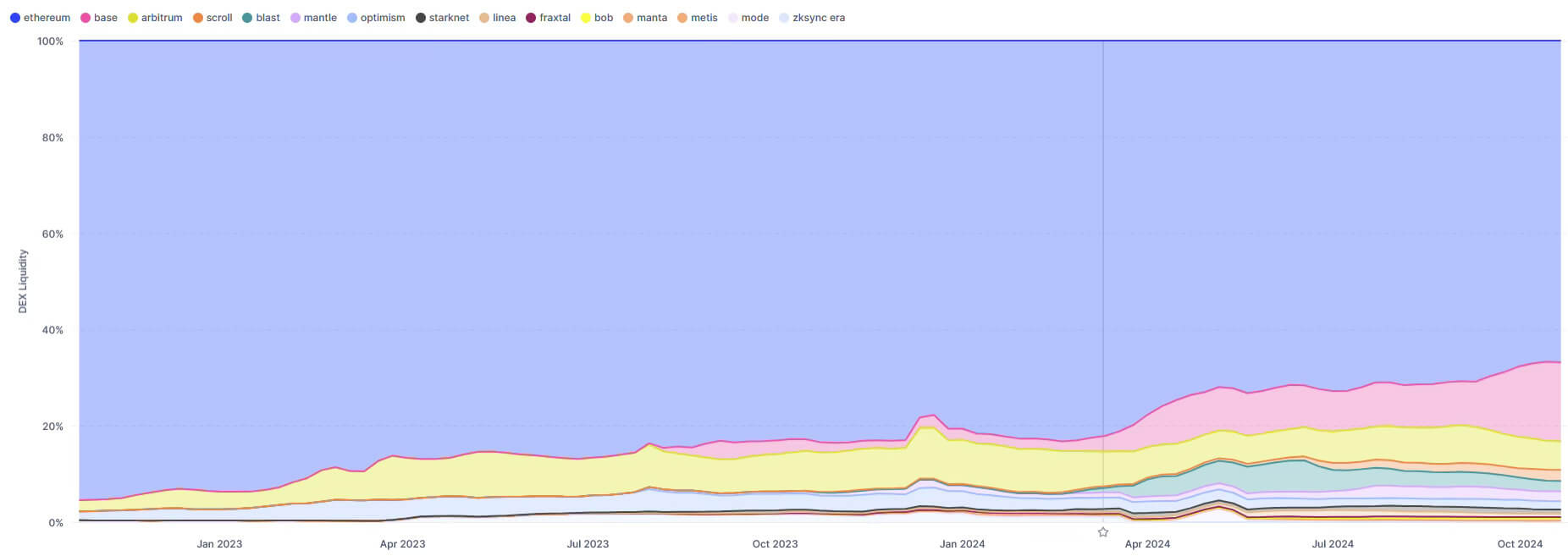

A good example of liquidity fragmentation can be seen with the evolution of the Layer 2 (L2) blockchain landscape. As it becomes cheaper to build and transact on L2 blockchains, liquidity has migrated away from Ethereum mainnet. This has reduced liquidity on mainnet for certain assets and trades, therefore reducing the size of deployment that institutions can make.

While technologies and infrastructure improvements are in development to resolve many liquidity fragmentation issues, this has been a key blocker for institutional deployment. This is especially true for deployments onto L2s where liquidity and infrastructure issues are more pronounced than on mainnet.

Risk Management

Risk management is paramount for institutions, especially when engaging with a nascent sector like DeFi. Beyond technical security, which mitigates hacks and exploits, institutions need to understand the economic risks inherent in DeFi protocols. Protocol vulnerabilities, whether in governance or tokenomics, can expose institutions to significant risks.

To compound these complexities, the lack of insurance options at institutional size to cover large loss events like a protocol exploit, often means that only the assets earmarked for high R/R get allocated to DeFi. This means that lower risk funds that might be open to BTC exposure are not deploying into DeFi. Furthermore, liquidity constraints—such as the inability to exit positions without triggering major market impacts—make it challenging for institutions to manage exposure effectively.

Institutions also need sophisticated tools to assess liquidity risks, including stress testing and modeling. Without these, DeFi will remain too risky for institutional portfolios, which prioritize stability and the ability to deploy or unwind large capital positions with minimal exposure to volatility.

The Path Forward: Building Institutional-Grade DeFi

To attract institutional capital, DeFi must evolve to meet institutional standards. This means developing institutional-grade wallets, creating seamless capital on-and-off ramps, offering structured incentive programs, and implementing comprehensive risk management solutions. Addressing these areas will pave the way for DeFi to mature into a parallel financial system, one capable of supporting the scale and sophistication required by large financial players.

By building the right infrastructure and aligning with institutional needs, DeFi has the potential to transform traditional finance. As these improvements are made, DeFi will not only attract more institutional capital but also establish itself as a foundational component of the global financial ecosystem, ushering in a new era of financial innovation.

This article is based on IntoTheBlock’s latest research paper about the future of institutional DeFi.

[ad_2]